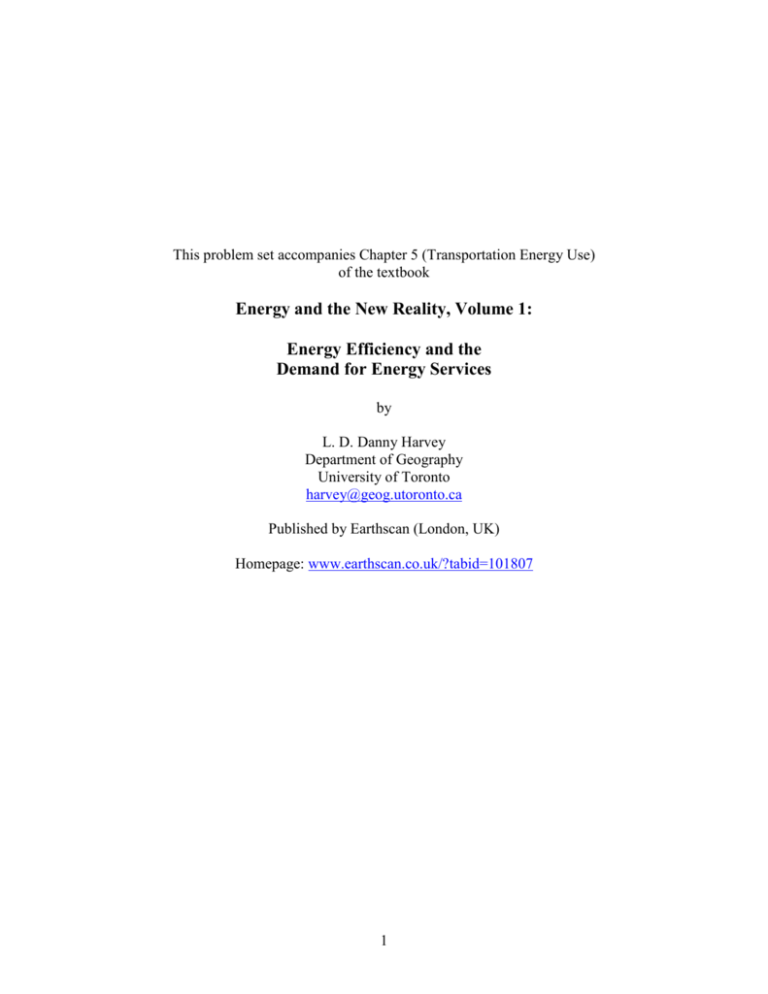

Chapter 5 Problem Set (Transportation)

advertisement

This problem set accompanies Chapter 5 (Transportation Energy Use) of the textbook Energy and the New Reality, Volume 1: Energy Efficiency and the Demand for Energy Services by L. D. Danny Harvey Department of Geography University of Toronto harvey@geog.utoronto.ca Published by Earthscan (London, UK) Homepage: www.earthscan.co.uk/?tabid=101807 1 Problem Set 4 – Transportation Energy Use Assigned: Due: Taken up: In this problem set you will (1) examine the loads on a car, (2) analyze the energy savings and economics of plug-in hybrid electric vehicles compared to conventional vehicles, and (3) examine the prospects for a near-term peaking in the world oil supply. Note: many of the questions may be hard to understand, or to get started on, if you have not already carefully read through Chapter 5. Loads on a car and energy use 1. (a) From the definition of power (watts) as rate of supply or use of energy, the definition of energy as work done, and the definition of work as force times distance, etc., work out the units of power in terms of meters, kg, and seconds (show your work). Then, show that each of the loads given by the formulae in Table 5.8 has the units of power. Finally, show how to convert the expressions for the various loads into energy used per km of distance travelled. (b) Consider a car with a mass of 1500 kg, a frontal area of 2 m2, a rolling resistance coefficient of 0.008, and an aerodynamic drag coefficient of 0.3. Assume that the car is climbing a hill with a 5% slope. Compute the loads due to rolling resistance, aerodynamic drag, and hill climbing as function of speed (from 0 to 150 km/hr), and plot on an excel layer chart (as in Fig. 5.13 of the textbook). (c) A car accelerates from 0 to 100 km/hr in 10 seconds and travels 5 km. What is the average energy use per km travelled caused by the acceleration? (show the steps in your calculation, of course) (d) Suppose that we can improve the efficiency of an automobile engine by 20% and reduce the total amount of work that the engine must do (by reducing the loads) by 30%. What would be the overall savings in energy (assuming no change in driving behaviour)? Net present value 2. (a) On the Excel worksheet for this question, calculate the Net Present Value (NPV) factor of a stream of future income payments (or savings) for discount rates of 5% and 10% for payments over periods of 10 years and 20 years (the formula for NPV factor is given in Appendix D, along with an explanation). The Excel spreadsheet will then give you the ratios of the NPV factors for various combinations of cases. (b) For the case with a discount rate of 5% and 20 years of payments, calculate the present value for each future yearly payment of $100 (where the payment in year 1 is one year from now, and so on), then add up the present value of all the future payments, and confirm that the sum is equal to (NPV factor) x P, where P is the fixed annual payment. Discussion questions: 2 How does doubling the discount rate affect the NPV factor in general? How does having a longer string of payments alter the effect of doubling the discount rate? How does doubling the number of payments affect the NPV factor, and how does this effect depend on the discount rate? Note: to get a deep understanding of the answers to these questions, you’ll need to do a side-by-side comparison of the present value of future payments in different years for different discount rates. Energy use and economics of PHEVs 3. In this question you will investigate the energy and CO2 emissions savings and the economics of plug-in hybrid vehicles (PHEVs) compared to conventional vehicles (CVs). The PHEV operates on batteries that are recharged with electricity from the grid, and when the batteries are low the vehicle switches to operation on gasoline. (a) (b) (c) (d) Compute the fuel energy use, the primary energy use, and the CO2 emission (as gmC) per km travelled for a CV with a fuel consumption of 8 litres/100 km, given a LHV for gasoline of 32.2 MJ/litre and assuming upstream energy use (all as petroleum) for refining and delivery equal to 20% of the energy delivered to the gas station. Compute the same thing for the PHEV when it is operating on gasoline, assuming a gasoline fuel consumption of 5.6 litres/100 km. Compute the primary energy use and CO2 emissions per km travelled when the PHEV is operating on the batteries, assuming an electricity requirement (from the grid) of 0.22 kWh/km, and assuming the electricity to be generated either from coal at 38% efficiency or from natural gas at 55% efficiency, in both cases with 6% loss in transmitting the electricity from the powerplant to where the batteries are recharged. If 75% of the km travelled with a PHEV use grid electricity, compute the percent CO2 emission reduction for the PHEV compared to (i) the conventional vehicle, and (ii) a hybrid electric vehicle (HEV), in which all the driving is done with gasoline with the same gasoline consumption (litres/100 km) as for the gasoline portion of the PHEV driving. Calculate the savings assuming all of the electricity to come from the coal powerplant, from the natural gas powerpoint, or from Cfree sources. For the above, use the following CO2 emission factors (as given in the worksheet): coal, 25 kgC/GJ, petroleum, 20 kgC/GJ, natural gas, 15 kgC/GJ. (e) Assuming that gasoline costs $1.80/litre and electricity 5 cents/kWh (which would be the case if the PHEV is recharged at night, when electricity is less costly in many jurisdictions), and assuming that both the CV and PHEV are driven 20,000 km/yr and that ¾ of the km driven come from electricity in the case of the PHEV, work out the annual cost of energy for driving the two cars. Next, assuming that future savings are discounted at a rate of 10%/yr, and that the cars are owned for 10 years, calculate the NPV of total energy cost savings. Finally, assume that the PHEV costs $10,000 more than the CV, and subtract the 3 extra purchase cost of the PHEV from the NPV of the total savings to get the discounted net savings (we are neglecting any difference in the resale value of the cars after 10 years, or in annual maintenance costs, which are expected to be slightly smaller for PHEVs than for CVs). (f) Electricity from wind could indeed be sold at a discounted cost of 5 cents/kWh or even less when there is excess wind energy that would otherwise be wasted, but energy from PV panels – the other major C-free and renewable energy option for electricity – would be available only at times of peak demand (i.e., in the middle of the day), and so would never be sold at a discounted price. It will also be more costly than wind-based electricity, but by the time PV electricity is deployed on a large scale, the cost of batteries and hence PHEVs should have fallen further. Thus, it is interesting to compute the discounted net cost savings for the following case: electricity at 30 cents/kWh (a reasonable cost for solar electricity in southern Canada in 10 years or so), and an extra cost for the PHEV of $5000. Do this by copying the worksheet used in (e) and then changing these two parameters. (g) Next, let’s look at the implications for [your country’s or region’s] electricity demand of everyone running out and buying a PHEV as soon as they become available (starting in 2010). The worksheet contains cells where data (or estimates) on population, number of vehicles per 1000 people, and per capita distance travelled per year in light-duty vehicles (LDVs – cars and light trucks) for your country or region can be inserted. For these, work out the vehicle population and the average distance travelled per vehicle (rather than per person) for your country or region (use the deduced annual distance travelled per vehicle in the following calculations, rather than the standard 20,000 km/year assumed in parts (e) and (f)). We are interested in two things – the annual energy use, and the rate at which power would be drawn from the grid if everyone were recharging their cars at the same time, assuming that the annual driving is done equally over each day of the year and that batteries are fully recharged each day over a period of 8 hours. Discussion questions: Comment on your results from (c) to (f). Play around with different settings for the number of km travelled per year, the discount rate, and the cost of gasoline, and comment on what you find. In (g), does the calculated additional electricity energy use, or peak power demand, seem to be large? Peak Oil 4. In this question we will use the logistic function to represent the rise, peaking and subsequent decline in the worldwide supply of oil. Letting C represent the cumulative extraction and consumption of oil since the beginning of the oil age, then the rate of supply of oil is equal to the rate at which the cumulative consumption is increasing. The rate of supply is expected to initially grow exponentially, but eventually reaches a peak and then gradually declines to zero as the resource is used up (this obviously ignores 4 perturbations such as wars, major price shocks, and economic cycles). The logistic function is a function that gives this kind of behaviour. It is given by dC C rC 1 dt K (1) Here, r is the initial rate of exponential growth in C and K is the ultimate total consumption. It can be readily seen that when C is small compared to K, we have dC rC dt (2) which is the equation for exponential growth (the larger C gets, the larger the rate of growth). It can also be seen from Eq. (1) that when C=K, dC/dt=0, that is, there is no further consumption. Thus, you should be able to see that dC/dt approaches zero as C approaches K. The solution to Eq. (1) is C (t ) KC0e r (t t o ) K C0 (e r (t t o ) 1) (3) where Co is an initial value of C, at time to, and C(t) is the value of C at time t (measured in years, so t-to is the number of years from Co to C). In the worksheet for this question, you will find data on estimated CO2 emissions from the use of liquids (i.e., oil) from 1870 to 2004, as obtained from the Carbon Dioxide Analysis and Information Center website (http://cdiac.esd.ornl.gov/trends/emis). Do the following: 1. 2. 3. 4. 5. 6. In column C, convert the CO2 emissions to EJ/yr using the information in the worksheet. Since most people don’t know what EJ are, convert EJ/yr to Millions of barrels of oil consumed per day in column D using the information in the worksheet. In column E, give the cumulative oil energy use (in EJ) by making the entry for each year (row) of column E equal to the sum of all oil use up to and including that year. In column F, give the annual oil energy use for each year divided by the cumulative oil energy use up to and including that year. Prepare a graph that plots cumulative consumption vs year up to 2004. The data should be as small squares without a line joining them. Prepare another graph that plots the results in column F vs cumulative consumption (a similar graph is seen in Fig. 2.26 with regard to coal). Your yaxis should run from 0.0 to 0.1 only, as the initial very large values of annual/cumulative oil use are not meaningful. From a cumulative consumption of 3000 EJ onward, the data plot along close to a straight line. Extrapolate these data (by drawing straight lines through the data by eye) to the X-axis (at this point there is no further growth in cumulative consumption – so the point where the line intersects the x-axis is an estimate of the ultimate cumulative consumption of oil) (you’ll have to extend the x-axis far beyond the range of the plotted data so as to see where they extrapolate to). There will be some 5 7. 8. 9. 10. 11. 12. 13. 14. uncertainty in how to extrapolate the data, so give a range for the estimated ultimate cumulative extraction of oil. According to this estimation method, what fraction of the oil that humankind will ultimately ever use has already been used? In column G, re-enter the cumulative oil energy use in 1900 (that is, type “=E57” in cell G57). This cell will serve as the Co that appears in Eq (3). In cell G11 and G12, enter an initial guess for the ultimate cumulative extraction and the initial exponential growth rate (parameters K and r in Eq. (3)). Then, in cell G54, type in Eq. (3), with a $ in front of the row numbers for cells that are to be held fixed when you drag the equation down. Next, drag the cell down to year 2004. Then, plot the results in column G on the graph prepared in Step 5, this time as a line. Play around with different values of K and r until you get as close a fit to the data (the squares plotted in step 5) as you can. There will be always be some errors in the fit, but given that you will be extrapolating a simple function from 1900 to 2004, the resulting best-fit will be remarkably good. In column H, starting in 1901, compute the oil use year by year from the cumulative oil use in column G. When, according to your best-fit curve obtained in Step 7, should the peak in oil supply have occurred? What happened in reality to delay the peak? In column I, compute a new logistic cumulative consumption curve, but starting in 2000 instead of 1900. That is, in cell I157 type “=E157” to give as Co that cumulative use at the end of 2000, then type Eq. (3) in cell I158 but with an appropriate adjustment in the year used for to and referring to cells I15 and I16 for K and r. Set K=12000 EJ in cell I15 and find a value of r that gives a close fit to the data from 2000 to 2004. Do the same thing in Column J as in Column I, but setting K=18000 EJ in cell J15. Show how to convert EJ of oil into trillions of barrels of oil. The two estimates of cumulative oil supply, 12000 EJ and 18000 EJ, represent how many trillions of barrels of oil? What is the cumulative consumption up to 2004 (cell E158) equal to in trillions of barrels? So that you can see when the peak oil supply occurs, compute the oil use year by year in columns K and L from the cumulative oil use in columns I and J, respectively. When does the peak in oil use occur for the two cases? How much has an assumed 50% more cumulative available oil delayed the peak in the rate of oil supply? Comment on how large or small the delay in peak oil is, and why. Convert your two peak rates of oil supply from EJ/year to Millions of barrels per day. How much larger (percentage wise) is the peak for the case where K=18000 EJ compared to the case where K=12000 EJ? Finally, in Column M, rows 57-157, enter the data from the corresponding rows in Column C. In column M, rows 158-257, enter the date from Column K. Do the same thing in column N, using data from Columns C and L. The result will be two time series of annual oil supply running from 1900 to 2100, the first half being actual data and the second half being from the logistic supply curve. Plot the two time series on the same graph. What you see should help you in answering the questions in Step 13. 6