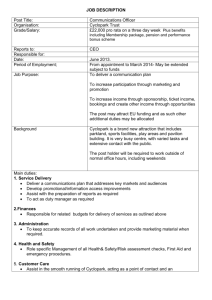

Only the Strong Survive: A Comprehensive Analysis of Sports Radio

Only the Strong Survive:

A Comprehensive Analysis of Sports Radio in a Digital Age

By

Kathleen M. Brown

Master’s Thesis/Capstone Project

Submitted in partial fulfillment of the

Requirements for the degree of

Master of Arts in Sports Administration

Northwestern University

December 2009

Josh Grau, Thesis Advisor/Primary Reader

Amy Pilewski, Secondary Reader

Abstract

Advancements in digital technology have made an enormous impact on the manner in which sports fans gather and consume content. Radio has traditionally been a key source of sports coverage, commentary and analysis; however, shifts in consumer behavior and increased competition among media outlets have negatively impacted the radio industry as a whole.

Although consumers’ time spent with radio has decreased since the advent of television, the media landscape has since become even more fragmented with internet technology. Radio properties are no longer able to rely on terrestrial AM/FM audiences to grow revenues, as audio content is being consumed on the internet, mobile phones and portable audio players. Moreover, sports fans have become more in control and accustomed to on-demand content, which can be consumed at their convenience, rather than on a set schedule. Critics have slammed the radio industry for its failure to adapt to this paradigm shift, and blame radio’s lack of innovation for its massive losses in revenue.

A great deal of research was conducted on the radio medium (and sports radio specifically) to develop an initial research question: Can the sports radio industry survive in a digital age, or will new technology cause its eventual demise? Supporting literature reviewed included industry journals, media research, sports marketing books and interviews with executives in the sports radio industry. After conducting this research and surveying over 400 individuals to learn about their media consumption habits, it was determined that digital advancements provide more opportunity for the industry’s growth, rather than cause a threat.

Sports radio properties that fail to adapt to the needs of fans will continue to experience revenue losses. Conversely, properties that do evolve digitally and offer a multimedia, on-demand and portable experience for sports fans will likely flourish for years to come.

2

Table of Contents

Introduction

Justification

Supporting Literature

Evolution of Sports Media

Analysis, Interpretation, and Findings

Survey Results

Sports Radio’s Current State

Industry Leader: ESPN Audio

Weaknesses

Opportunities

Threats

Case Study: Newspapers in a Digital Age

Conclusion, Recommendation and Implications

References

Appendices

8

17

23

27

29

35

47

52

57

59

66

4

6

3

Introduction

“The future of radio is to be much more than radio. Not simply what's on the radio. The future of radio will be more interactive than passive, more customized than homogenized, more visual and visceral. The future of radio will be an experience, not just a station.”

--Mark Ramsey, President of Mercury Media Research 1

The sports media landscape has been significantly altered by advancements in digital technology. Sports fans now have access to seemingly endless amounts of content, available at any time. Although radio has traditionally been a significant player in sports media, the industry has struggled in recent years. Are fans simply tuning out, or are they finding non-traditional ways to engage with radio properties? This thesis sets out to not only understand radio’s place within the sports media landscape, but also what its weaknesses, opportunities and threats are.

Further, this thesis will determine sports radio’s sustainability in a digital age.

Before the internet, it was standard for media providers to have one content distribution platform. Newspaper content was distributed in print form, radio content was broadcast to terrestrial receivers and television programming was broadcast to TV sets. However, since the internet’s mass-market adoption, it has become necessary for media providers to have multiplatform content distribution through digital means. This thesis will also determine the best distribution platforms for audio content. Further, it will assess how sports radio properties can adjust their traditional revenue structure to be profitable in the current sports media climate.

Perhaps radio properties should not be viewing themselves as simply that, but rather multimedia content providers that specialize in audio. This is an integrative work that applies the concepts, theories and interdisciplinary curriculum in the field, as the evolution of the sports media landscape has dramatically altered not only the way fans interact with content, but also how

1 The future of radio will be an "experience" (2007, July 27). In Hear 2.0

. Weblog post retrieved January 3, 2009, from http://www.hear2.com/2007/07/the-future-of-r.html

4

advertisers—who support the industry—connect with them.

5

Justification

For over 75 years, the radio industry enjoyed a state of prosperity. Despite the advent of television during radio’s early years, the medium persevered, and served as a paramount source of news and entertainment for decades. However, radio’s revenues have diminished in recent years, due in large part to the introduction of the internet. Digital technology has not been universally welcomed by the radio industry. With eight consecutive years of slow to no revenue growth, and the internet surpassing the 87-year old industry in annual revenues, it has become clear that radio is at a crossroads.

2

No longer do radio stations compete with one another for audience shares; rather, they now face competition from a wider variety of media alternatives all vying for consumers’ attention. Further, within this fragmented media environment, audiences have gravitated towards digital content, which is more portable and on-demand in nature.

The industry as a whole has been slow to evolve technologically, and adapt to changes in consumer behavior. The majority of radio listening is done while driving (73%) and the rest is primarily done in the home (30%) or at work (17%).

3

Radio content is not widely available to those on-the-go. Although radio was once widely consumed via the portable audio player, portability is no longer one of the medium’s strong suits. While other mediums have rapidly adapted to changes in consumer behavior by providing multi-platform content distribution—such as televisions’ online streaming platform—radio as a whole has not evolved much in this manner. Within the sports arena, there are numerous media choices that allow fans to stay connected anytime, anywhere. For instance, a live Major League Baseball match-up between the

Chicago White Sox and the Chicago Cubs may be televised locally on WGN and nationally on

2 Prediction: Radio ad spend to drop below internet in ‘08. (2007). Media buyer planner . Retrieved December 5,

2009, from http://www.mediabuyerplanner.com/entry/37415/prediction-radio-ad-spend-to-drop-below-internet-in-

08/

3 “Listening by Location.” Radio Heard Here. (2009). Radio marketing guide . Author.

6

ESPN; broadcast locally on WGN Radio and nationally on ESPN Radio and XM Sirius Satellite

Radio; watched or listened to on MLB.com; and documented widely online with scoring information, simulated game coverage and blog commentary. In this highly competitive environment, it is critical for radio to set itself apart and engage fans with relevant content, available at their disposal. Otherwise, radio’s audience will migrate to other mediums.

Radio is primarily supported by advertising revenue, which is generated by guaranteeing audience numbers. Media buyers have traditionally based their value assessment on terrestrial radio audience ratings. However, listeners have begun to gravitate towards digital content—like live streaming and podcasting—which cannot be evaluated in the same manner. Media budgets formerly allocated to radio are now shifted to digital. Therefore, while terrestrial audience numbers decrease, so does the industry’s traditional revenue structure. Without new, nontraditional revenue streams to engage consumers, the radio industry’s financial position is not likely to improve.

7

Supporting Literature

Evolution of Sports Media

It is important to provide a historical context of sports media in the United States in order to understand radio’s position in the overall landscape. Before radio was introduced to the public in 1922, sports fans turned to newspapers to gather sports information. For about 130 years prior to that, newspapers were the only connection between the sports industry and the American public. Newspapers not only provided coverage of sporting events, but also served as a promotional tool for the sports industry. At the turn of the 20 th

century, professional baseball, boxing and horse racing were the three most popular spectator sports. Understanding little about the rules and goal of each sport, the public sought knowledge through newspapers. The more attention newspapers gave to covering the sports industry, the more popular sports became. As such, the symbiotic relationship between mass media and the sports industry began. In the book

Media, Sports & Society , University of Illinois Communications professor Robert McChesney affirms, “the staggering popularity of sport is due, to no small extent, to the enormous amount of attention provided it by the mass media.” 4

As awareness of sports began to build, newspapers created sections dedicated to covering the growing industry. In 1883, the first U.S. newspaper sports department was formed at New York World , and New York Journal followed suit in 1895.

5

When the telegraph introduced the ability to provide timely sports information to the public in the 1920s, sports departments were formed at many other American newspaper companies. The introduction of newspapers’ sports sections clearly enhanced public interest in sport during this

4 McChesney, R. W. (1989). Media made sport. In Media, sports & society . (pp. 49-67). Newbury Park, CA: Sage

Publications. p49.

5 Ibid. p53.

8

era—commonly regarded as “The Golden Age of Sports”—and sport assumed its modern position as a cornerstone of American culture.

6

Sports journalists were not only the major spokespersons and interpreters of the game action, but were also better known than most of the athletes.

7

For a long while, sporting events were inaccessible for many people, especially those living in smaller metropolitan areas.

Professional baseball began to permeate most of the major U.S. cities around the start of the 20 th century; horseracing expanded nationally around 1918 and organized boxing matches moved from saloons to large arenas around the same time. Since only a small fraction of the public were able to attend sporting events, the newspaper medium provided the next best alternative.

Sportswriters like Warren Brown and Grantland Rice were considered legends, as they provided first-hand accounts of sporting events that otherwise went unknown.

Given that newspapers were the primary promotional vehicles for sports during “The

Golden Age,” it was not uncommon for sportswriters to travel with athletes across the country to cover games. Sports promoters and organizations were often willing to underwrite sportswriters’ expenses to gain coverage, as affirmed by McChesney in Media, Sports & Society .

8

The two parties formed a mutually beneficial relationship, as it seemed neither could truly succeed without the other. Perhaps the most historic sporting event of all-time would have never occurred, if it were not for the bond between heavyweight champion boxer Gene Tunney and distinguished sportswriter Warren Brown. As he prepared for his re-match with Jack Dempsey in

Chicago at Soldier Field on September 22, 1927, Tunney received word that a mob-affiliated

6

McChesney, R. W. (1989). Media made sport. In Media, sports & society . (pp. 49-67). Newbury Park, CA: Sage

Publications. p55.

7 Rein, I., Kotler, P., & Shields, B. (2006). The Elusive fan: Reinventing sports in a crowded marketplace . New

York, NY: McGraw-Hill. p33.

8 Ibid.

9

referee would oversee the fight. Fearing that his heavyweight title was at stake, he reached out to

Brown, a sportswriter he had come to know and respect over the years. Tunney requested that

Brown meet with the Illinois State Athletic Commission to ensure the judges and match would be fair. Not wanting to disappoint Tunney or the 145,000 fans with main event tickets, Brown met with the Commission.

9

As a result of their meeting, a new referee, Dave Barry, was assigned to the match.

10

This decision ultimately affected the outcome of one of the most controversial and legendary sporting events of all time.

The print industry expanded to include sport-focused magazines in the 1950’s, and publications such as Sports Illustrated and Sporting News during that time had a combined weekly circulation of several million copies.

11

Sports magazines enjoyed a long period of prosperity due to their ability to provide the public with background stories and extensive commentary and analysis. As the sports industry grew and people converted from passive to avid fans, so did the advertising landscape. Capitalizing on this trend, businesses began to advertise in sports-focused print publications. According to McChesney, this growth in advertising sales largely contributed to the expansion of the print industry, and set a model for the broadcast media industry to follow.

12

It was not until the introduction of terrestrial AM/FM radio in 1922 that sports enthusiasts were truly able to experience a sporting event without actually being there. Radio content was broadcast to those with a receiver, and programming ranged from news and music to commentary and live sports coverage. The American public—and sports fans specifically—

9

Rein, I., Kotler, P., & Shields, B. (2006). The Elusive fan: Reinventing sports in a crowded marketplace . New

York, NY: McGraw-Hill. p27.

10 Tunney, G. (1931, October 28). [Letter to Warren Brown]. Found in 230 Park Avenue, New York, NY.

11 McChesney, R. W. (1989). Media made sport. In Media, sports & society (pp. 49-67). Newbury Park, CA: Sage

Publications. p66.

12 Ibid. p56.

10

enthusiastically embraced radio. According to McChesney, the 1920s was a watershed decade for the sport-mass media relationship because of radio’s emergence. “In 1922, radio was found in only 1 of every 400 homes, but by 1929 fully one-third of American homes had radios…Yet as much as sport contributed to popularizing radio, radio contributed even more to the popularity of sport; it opened up new vistas for millions who had never had access to a major sporting event in the past.” 13

Sporting events were not regularly broadcast initially, but rather ad hoc networks were established for major match-ups. For example, a network was formed to broadcast live coverage of the Tunney versus Dempsey heavyweight title boxing match in 1927, which was heard by an estimated 50 million listeners.

14

The formation of radio networks to broadcast live sports is now ordinary with modern play-by-play broadcasts. In the book The Elusive Fan:

Reinventing Sports in a Crowded Marketplace, the authors Irving Rein, Philip Kotler and Ben

Shields assert, “listeners were glued to radios, using their imagination and the announcer’s description to visualize the epic battle [between Tunney and Dempsey]. And hundreds of journalists stood ready to deliver the fight’s outcome to the readers of the latest editions of their newspapers. It was as if the entire country had paused to focus its attention on this monumental boxing match.” 15

During their first prizefight against one another a year earlier, Tunney—a younger, quicker and fitter boxer—claimed the heavyweight title from the older, slower, yet unanimously revered Dempsey. In his Sports Illustrated article, “The Long Count,” author William Nack explained, “it was the first time in history that the heavyweight title had changed hands on a

13 McChesney, R. W. (1989). Media made sport. In Media, sports & society (pp. 49-67). Newbury Park, CA: Sage

Publications. p59.

14 Nack, W. (1997, September 27). The Long count. Sports illustrated . Retrieved December 30, 2008, from http://sportsillustrated.cnn.com/magazine/features/si50/states/colorado/flashback/

15 Rein, I., Kotler, P., & Shields, B. (2006). The Elusive fan: Reinventing sports in a crowded marketplace . New

York, NY: McGraw-Hill. p27.

11

decision, and the public resented Tunney for dethroning Dempsey in such unworthy fashion.

16

According to reports, the first 30 minutes of their bout carried on the same way it had a year prior. However, after 6 ½ rounds, the fan favorite Dempsey knocked Tunney to the ground.

Pandemonium ensued, as it appeared that the fight was over. Nack recounts, “beyond Soldier

Field, announcer Graham McNamee, speaking to more people at one time than any man ever had, blurted out the news in his cracked, quavering voice: ‘And then Dempsey comes back, and

Tunney is down! Tunney is down from a barrage of lefts and rights to the face!’ Nine people died of heart attacks listening to that broadcast, three of them during McNamee’s blow-by-blow of the seventh round.” 17

Instead of immediately counting ten seconds—as was usual protocol for boxing—Dave Barry, the referee newly assigned to the match, followed a recently introduced rule of waiting until Dempsey retreated to a neutral corner, away from Tunney. In his book,

Sports on New York Radio , author David Halberstam recounts, “throughout the American landscape, folks huddled around loudspeakers on the streets or families gathered around the radio, hanging on every one of [McNamee’s] words.”

18

During this dramatic five-second delay,

Tunney was able to regain his strength and ultimately defeated the beloved Dempsey in ten rounds. This controversial outcome naturally disappointed fans inside Soldier Field, but likewise those huddled around the nearest radio listening to the live broadcast. It can certainly be argued that this was one of the most legendary sporting events of all-time, and radio provided the means for millions of fans to take in the experience.

As radio grew in popularity among sports fans, coverage expanded to include not only live broadcasts of events, but commentary surrounding them, and within 65 years of radio’s

16 Nack, W. (1997, September 27). The Long count. Sports illustrated . Retrieved December 30, 2008, from http://sportsillustrated.cnn.com/magazine/features/si50/states/colorado/flashback/

17 Ibid.

18 Halberstam, D. J. (1999). Sports on New York radio . Chicago, IL: Masters Press. p9.

12

introduction, a radio station dedicated entirely to sports was formed: CBS-owned WFAN-AM in

New York City, introduced in 1987. From that time until 2009, 559 other sports radio stations entered the marketplace.

19

Today, sports radio stations provide fans with live event play-by-play, as well as talk programming. Millions of fans tune into sports radio each day to stay current and gain insight into their favorite athletes, teams and opponents. However, radio listening has gradually decreased over the years, due in large part to the introduction of television and the internet.

The television was introduced to the public in 1928 and quickly became a staple in households around America. This technology provided fans with the ability to watch live sporting events at home. Authors of The Elusive Fan describe its rapid adoption: “In its early years, television attracted people to bars, electronics stores, and the homes of neighbors who first bought the sets to witness this new miracle. By 1959, nearly 90% of Americans owned a television set.” 20

Television broadcasts of sporting events now provided the masses with a superior product to play-by-play on the radio, as fans no longer had to imagine the accounts of the game by listening to a radio announcer, and could now watch it for themselves. Television’s introduction presented radio with a significant threat, and was the first major media paradigm shift. In his book The Radio Station , author Michael C. Keith explains: “Not only did radio’s audience begin to migrate to the TV screen, but many of the medium’s entertainers and sponsors jumped ship as well. Profits began to decline, and the radio networks lost their prominence.”

21

At the time, several media observers predicted that television’s effect would be too devastating for radio to overcome. Keith goes on to acknowledge that many U.S. radio station owners sold their

19 Honea, B. (2009, February 2). Radio audience question [E-mail to the author].

20 Rein, I., Kotler, P., & Shields, B. (2006). The Elusive fan: Reinventing sports in a crowded marketplace . New

York, NY: McGraw-Hill. p37.

21 Keith, M.C. (2007). The Radio station: Broadcast, satellite & internet (7 th ed). Burlington, MA: Focal Press. p9.

13

businesses, and some reinvested their money in television.

22

Although the years that followed television’s introduction were unstable for radio, ultimately the industry prevailed and adapted to the new competitive landscape. Due in large part to the massive popularity of sport and the medium’s ability to reach consumers out-of-home, radio was able to maintain its relevancy— even after television’s mass adoption.

As television quickly ascended to become the number one entertainment medium, the symbiotic relationship between media and sports grew stronger. Audiences tuned into sports programming on television with such fervor that networks began producing around-the-clock content dedicated to this type of coverage. The introduction of ESPN, a specialized network dedicated solely to the coverage of sport in 1979, is evidence of this. WFAN-AM, the all-sports radio station in New York City, was first broadcast eight years later. As more people tuned into these broadcasts, the sports themselves became more popular. The Elusive Fan authors contend that in the first few years of television broadcasting, sports made up 60% of all programming.

“Sports were easy to shoot, low budget, and a high-profit programming option for the networks.” 23

Sports leagues and teams no longer paid journalists to attend their games, but rather began to negotiate rights fees with television and radio properties wanting to broadcast their games. During this time, the power structure in the industry shifted and sports properties themselves gained the upper hand. Since television networks made such a large profit on sports programming, they began to compete with each other for broadcast rights. Concurrently, as rights fees for all the major sports increased, specialized sports channels like ESPN were introduced and they expanded programming content and audiences. In Media, Sports & Society ,

McChesney recounts that upon its creation, one ESPN executive remarked that his company

22 Keith, M.C. (2007). The Radio station: Broadcast, satellite & internet (7 th ed). Burlington, MA: Focal Press. p9.

23 Ibid.

14

believed the appetite for sports in America is insatiable.

24

The company’s multi-platform growth from television to radio, print, and most recently the internet, certainly suggests the company’s prediction was correct. Within twenty years of ESPN’s introduction, internet technology became widely adopted, and it has presented both challenges and opportunities for traditional media properties.

Internet technology reached mass-market penetration in the late 1990s, and has dramatically impacted the media landscape ever since. Users of this technology have been given access to unlimited content choices at their disposal, through the computer or mobile phone. In an effort to respond to this paradigm shift, traditional media outlets rapidly developed online destinations to interact with their audiences. However, as internet technology has evolved, it is no longer sufficient for traditional media to simply augment content with website interactivity.

The internet has forced print, radio and television to adapt to an “on-demand” culture, instead of providing the public with content on a set schedule. This has expanded traditional media’s distribution platforms. For instance, instead of reading the newspaper sports section in print, fans can now simply log online to do so—for free. Rather than tuning into the radio or television broadcast of a game, fans can use their computer or mobile phone to stay connected. Consumers have grown accustomed to the luxury of having this content available at their disposal.

The advent of the internet has also created a much more fragmented media landscape.

Fans have many content alternatives to television, radio and print, now presented with online options including sports blogs, team websites, athletes’ Twitter accounts and sports information hubs like ESPN.com. Modern fans have been inundated with content available at their fingertips.

The Elusive Fan authors assert, “these new technological capabilities have widened and

24 McChesney, R. W. (1989). Media made sport. In Media, sports & society (pp. 49-67). Newbury Park, CA: Sage

Publications. p65.

15

multiplied the dimensions of being a fan, thus creating a new fan experience that is unlike any of those in the previous generations.” 25 Digital technology has put fans in control like never before.

With so many media options available, fans have utilized digital technology to obtain sports information at their leisure. Instead of waiting until the morning after a big sporting event, fans can simply log online to gain access to a wide array of media outlets reporting on the outcome.

However, the ability to deliver content through digital means has not provided all media with the same opportunities. Whereas the print industry can expand content distribution online, this shift negatively impacts their subscriber fee revenue model. Since radio and television’s revenue structures do not rely on this, they have the ability to grow their audience via the internet. Sports media outlets that have flourished in the digital age have been those providing fans with unique and engaging content, accessible anytime and anywhere.

25 Rein, I., Kotler, P., & Shields, B. (2006). The Elusive fan: Reinventing sports in a crowded marketplace . New

York, NY: McGraw-Hill. p44.

16

Analysis, Interpretations and Findings

Survey Results

In an effort to learn more about people’s audio consumption habits, a survey was designed and administered in January 2009. The online survey was conducted with Survey

Monkey software, and the link was sent to hundreds of individuals and promoted through word of mouth. As an added incentive to answer all 24 questions, respondents could provide their email address for a chance to win a $25 iTunes gift card. In three weeks, 438 individuals completed the survey, thus providing an adequate sample size for analysis. Of those, 52.3% were male, and 47.7% were female.

26

In order to gauge their proclivity towards digital audio content, respondents were asked which platforms they utilize for its consumption, checking all that apply.

Keeping in line with data reported by Arbitron—the current main source of radio research—

84.2% listen through terrestrial radio, and 24.8% via online streaming. Additionally, 36.6% consume iPod audio, and 20.6% tune into satellite radio. When asked where they most often consume audio content, a large majority responded “in the car” (88.4%), with the second most popular environment “at home” (55.3%), followed by “at work” (35.9%) and “at the gym”

(30.7%). Although these statistics were important in learning where audio is currently consumed most often, it would have been helpful to follow-up by asking where respondents spend most of their time, so as to determine how the medium may better reach them.

Since media research studies all seem to vary in their assessment of overall media consumption, respondents were asked to rank the four mediums (television, print, radio and internet) they consume most often. 42.3% of respondents indicated the internet, followed by television (35%), radio (13.3%) and print (9.4%). Granted, these internet usage figures do not

26 Brown, K. M. (2009, January 19). [Individual media consumption habits]. Unpublished raw data.

17

take into account any digital television, radio or print content consumed. However, these statistics do put into perspective just how big a disparity there is between radio consumption, and that of television and the internet. Furthermore, when asked if they listen to radio or audio content more often, less often or the same amount as they did ten years ago, 40% or the majority of respondents answered that they now listen more. Although this data is encouraging, it conflicts with Arbitron research that indicates that overall radio listening has decreased 15% between 1990 and 2005.

27

When asked what they like or enjoy about radio, respondents answered that it is an intimate medium, with content relevant to their interests. Other common answers were that radio is informative, providing detail that other mediums cannot; it is easily accessible in the car; it provides an escape from reality; and it offers an interactive environment to connect with radio hosts and personalities. Throughout the survey, a recurrent theme among responses was the personal connection listeners have with radio hosts. It seems that one of the biggest reasons respondents tune into radio programs is that they enjoy hearing the opinions, insight and advice of on-air personalities.

Radio show hosts are trusted sources of news and information, building listener rapport through consistent, honest dialogue. The medium’s strength of connecting to people on an emotional level gives radio an advantage over other, less personal media.

While many of radio’s positive attributes were proclaimed in survey results, respondents also provided a great deal of negative attributes. When asked to describe what they dislike or do not enjoy about radio, an overwhelming majority (58%) of the 372 responses expressed their aversion to commercial advertising. The general consensus from respondents was that radio plays too many commercials and does not provide enough content. Many responses cited a need

27 Keith, M.C. (2007). The Radio station: Broadcast, satellite & internet (7 th ed). Burlington, MA: Focal Press. p1.

18

for more variety in commercial content, stating that they often hear the same companies running the same messaging. This response is not necessarily a reflection of the medium itself, but rather of radio properties’ advertising sales efforts, and the failure of their clients to produce multiple commercials. A great deal of respondents also noted that, while television offers digital video recording technology, radio has not widely introduced similar capabilities for listeners wishing to bypass commercials, or who are unable to tune-in on a set schedule. Another common response to this question pointed to radio’s need for portability. Respondents stated that, while they listen in the car, radio is not an ideal medium for those on-the-go. Furthermore, many respondents expressed frustration towards radio’s poor reception, especially in large metropolitan areas.

Some answered that radio signals cannot be detected in their homes, or while at work. This issue is a significant one for radio, as listeners will migrate to more technologically savvy mediums that can better serve their entertainment needs.

In an effort to expand on the reasons why listeners tune into radio, respondents were asked what they like about their favorite hosts or deejays. A common theme in these answers was respondents’ attraction to the intimacy and personal connection offered by radio. It was widely reported that respondents felt a connection with radio hosts—more so than other mediums—and when asked whether they could carry on a five-minute conversation with them,

84.8% answered affirmatively. Explanations for liking radio personalities varied, but common responses were that they discussed content relevant to their lives, and were intelligent, humorous, engaging and down-to-earth.

Following up on this question, respondents were asked about the ways in which they actively engage with radio content. When asked how often they visit radio station or program websites—if ever—53.1% answered that they do so regularly or occasionally. The most common

19

reasons cited for visiting the websites were to “look up something heard on-air” (65.7%) and

“stream audio” (51.2%). Radio properties that do not offer listeners a digital platform for engagement are failing to capitalize on a significant revenue stream. This data is evidence that, although listeners may not be accounted for in terrestrial radio ratings, they are engaged in the medium through digital means, which would be reflected in online metrics. Accordingly, listeners will spend more time overall with radio properties that provide a robust and highly engaging digital experience.

Survey respondents further attested to their proclivity to interact with the medium when asked if they have ever called into a radio program. 50.9% indicated that they have called into a radio program “to participate in a promotion, request a song, discuss a topic or give feedback.”

This means that more than half of those surveyed have acted on their desire to contribute to show content, which is a significant statistic. Radio’s ability to do this is something that has historically set it apart from other mediums. Whereas television and print have only recently introduced means of interactivity to its audience, radio offered listeners this capability—through mail and telephone—since its early days.

28

Due to the conversational nature of radio, it would surely benefit the industry to more fully involve its audience with show content.

In order to learn more about respondents’ sports radio consumption, the survey posed a question about whether they listen to the format regularly, occasionally, have listened in the past, or not at all. Of the 353 respondents who proceeded through this section, 69.1% answered that they regularly or occasionally listen to sports talk radio. Considering 423 individuals had previously acknowledged regular radio listening habits, this means that 57.7% of respondents— or the vast majority—are current sports talk listeners. Additionally, 74% of radio listeners

28 Dunning, J. (1998). On the air: The Encyclopedia of old-time radio. New York, NY: Oxford Press. p219.

20

surveyed answered that they regularly or occasionally listen to live sporting events or play-byplay on the radio. In order to learn which platforms are currently utilized to consume sports radio content, respondents were asked to check all that apply. The majority of those surveyed listen on terrestrial radio (95.8%), followed by satellite radio (21.9%) and digital audio streams (18.8%).

This data reveals that sports radio listeners are no more inclined to consume streaming audio or satellite radio content than the broader radio listening group surveyed.

In addition to exploring the manner in which sports radio listeners consume content, respondents were asked about the reasons for doing so. Among the responses, listeners most commonly praised sports radio’s ability to provide extensive commentary and analysis, as well as insider scoop, in a timely manner. Many respondents answered that sports radio content is valuable to them while they are driving, and lack access to media alternatives to stay connected.

This can either be viewed as a strength or weakness for sports radio, as it suggests that—if given an alternative—fans may not find radio as relevant as television, print or the internet.

Furthermore, the majority of sports radio listeners surveyed (58%) do not consider the medium to be integral to their sports information gathering routine, and only 38% feel that it is. In order for radio to maintain its relevance among sports fans, properties need to truly understand their audience. On-air and online content decisions should only be made if, after evaluating sports fans’ needs, it is determined that a more engaging fan environment will be created. By promoting open dialogue with its audience through focus groups, online surveys or e-mail feedback, sports radio will better position itself for a more profitable future.

One of the more surprising conclusions of the survey was that respondents do not consider radio to be nearly as important as previously thought, and yet they still believe themselves to be consuming more audio content now than they did five to ten years ago. Despite

21

industry research that proves otherwise, the survey revealed that audio engagement may have actually increased over the past decade. However, the survey may not have adequately clarified the difference between audio content choices for respondents. For the purpose of this research study, the only audio content in question is derived from radio—inclusive of terrestrial, streaming, satellite and podcast content—so portable music player content should not have been taken into consideration. Perhaps another reason for this puzzling conclusion is that radio’s historical audience figures are based on terrestrial ratings. Respondents may feel they are consuming more audio content because they are doing so via digital platforms. The survey also revealed that listeners are spending more time on-the-go, and many do not feel as though radio has an adequate content distribution platform for this type of lifestyle. It is crucial for radio to evolve in this way in order to surround its audience, wherever they may be. Furthermore, this survey also suggested that individuals are far more disenchanted with radio’s technical capabilities than previously thought. Respondents referred to the medium’s inability to allow listeners to record and playback content at their leisure, as well as the reception issues that occasionally impede on their ability to tune into content. The radio industry ought to be addressing these issues, as these concerns can negatively affect ratings and overall perception of the medium. In this increasingly fragmented media landscape, radio properties need to become more proactive in adjusting their business to better serve listeners. Otherwise, its audience will erode and find more suitable media alternatives.

22

Sports Radio’s Current State

The current American sports radio industry includes 560 “all sports” formatted stations, according to the Radio Advertising Bureau.

29

Many other local radio stations carry sports talk and play-by-play programming, but are formatted otherwise. In terms of audience size, “all sports” ranks 13 th

among all radio formats.

30

That audience, according to Arbitron—the company that compiles research for the majority of the industry—is defined by 84% males and 16% females, with an average age between 35-45.

31 Based on audience figures, ESPN Radio is the main player in the industry, followed by Clear Channel Communications and CBS Radio. ESPN

Radio owns five major market sports radio stations and additionally syndicates 24/7 network programming to 725 radio stations nationwide. Clear Channel owns 38 sports radio stations and its network radio division, Premiere Radio Networks, syndicates The FOX Sports Radio

Network, The Jim Rome Show and The Dan Patrick Radio Show, which are popular sports talk programs. CBS owns 12 sports radio stations, and its network sales division Westwood One syndicates NFL, along with NCAA men’s basketball and football play-by-play programming.

There are several other popular syndicated sports radio properties, including Sporting News

Radio, a 24/7 network heard on over 185 affiliates nationwide.

32

Sports radio stations not owned by the four major players are largely independently owned, and broadcast a mixture of local and nationally syndicated programming from those providers.

It should be noted that network radio operates by allowing local radio station affiliates to syndicate national programming to supplement their local line-up. In exchange for affiliation

29 Honea, B. (2009, February 2). Radio audience question [E-mail to the author].

30 Ibid.

31 Arbitron. (1999, June 24). America's top stations: A Format profile . Retrieved April 5, 2009.

32 Sporting News Radio. (2009). Media kit . Scottsdale, AZ: Author. Retrieved March 16, 2009, from http://www.sportingnews.com/mediakit/

23

rights, the stations allow the network advertising sales division to sell an allotment of commercial time. For instance, instead of employing talent to fill in an entire 24/7 programming schedule, stations will broadcast a mixture of local and national programming. This allows stations to save money on talent and production salaries to produce local programming. The transition between local and national content is seamless to the listener.

The current sports radio financial situation—similar to the rest of the radio industry—is in dire straits. According to TNS Media Intelligence, radio industry advertising revenues fell

24.6% from the first half of 2008 to the first half of 2009, which was the largest decline for any medium.

33

Internet advertising spending, according to their report, was the only area that experienced growth. A great deal of advertising spending declines can be attributed to the global economic recession. However, another major factor contributing to the radio industry’s financial problems is its overall inability to adapt to advancements in digital technology. The newspaper industry has had similar problems. Whereas consumers have found other media expanding their content distribution platforms (e.g. television), it’s obvious that the radio industry has been lagging behind.

As a result, consumers are migrating towards advanced media platforms, which is negatively impacting advertising revenues.

Digital technology has completely altered the sports media landscape, yet the radio industry as a whole has not done much to evolve their content distribution platforms. A 2009

University of Southern California “Digital Future” research project determined that 80% of

Americans use the internet, for an average 17 hours per week.

34

With statistics like these, it is no longer an option for radio companies to go without a website if they seek profitability. However

33 Taylor, T. (2009). Radio keeps up with newspaper. Taylor on radio . Retrieved September 17, 2009, from http://www.radio-info.com/newsletters/3-taylor-on-radio-info/

34 Digital Future Project . (2009.) Pasadena, CA: University of Southern California.

24

many sports radio stations—mainly concentrated in smaller markets—have not yet built websites. This unfortunate discovery was made through research done on the four main players, while attempting to visit their local station websites. Astoundingly, many of the sites that have been created are not user-friendly and lack sufficient means of engagement for listeners.

A great example of a sports radio property with a highly interactive website is WEEI-AM in Boston and its online home WEEI.com. Upon visiting the site’s main page, users will find a vast array of options to choose from in a sleek, organized design. In the top right corner there are options to listen live or on-demand, and below it is an abbreviated program lineup and real-time updates from each show. Additionally, users will find videos, breaking news stories, journalists’ sports columns, Twitter updates and blogs dedicated to Boston sports news, and more. The website is very user-friendly and seamlessly integrates WEEI audio content with other media to provide Boston sports fans with a highly engaging and entertaining environment. This is just one example of a property that has evolved its business to provide sports fans with unique and engaging content through the internet. Perhaps if all sports radio properties took advantage of the opportunities afforded by the internet, the industry would be in a better financial situation.

The main source of radio revenue is generated from advertising, and audience ratings are the key factor in generating those dollars. In terms of its overall audience, in 2008 radio reached more than 235 million weekly listeners, versus 232 million in 2007, which is an increase of about

1.2%.

35

However, the same study revealed that while more people are listening to radio, they are consuming fewer than 19 hours a week—versus 20.4 hours—or 7% less than they did three years prior in 2005.

36

It is important to note that these numbers do not factor in online or satellite radio

35 Arbitron. RADAR 98 . (2008). New York, NY: Arbitron.

36 Clifford, S. (2008, November 25). Radio’s revenue falls even as audience grows. The New York Times. Retrieved

November 26, 2008, from http://www.nytimes.com/2008/11/26/business/media/26adco.html

25

listening. The two most significant factors to consider when evaluating radio’s strength is audience size and time spent with the medium. If radio is reaching more people, but those people are listening less, engagement in the medium does not necessarily increase. Furthermore, radio listening has become less concentrated and disseminated among more properties than in years past. New terrestrial audience measurement technology has revealed that total radio listening has increased, but the time spent listening to each individual station has decreased. This trend has been problematic for many stations that historically dominated audience rating reports, and has spread out revenues accordingly. Further contributing to the industry’s troubles: as people spend less time listening to terrestrial radio content and more time listening online, it complicates the industry’s current advertising revenue structure.

26

Industry Leader: ESPN Audio

The biggest player in the sports radio industry is ESPN Audio. The company’s audio division syndicates national radio programming, and distributes these assets through several digital platforms. Despite only owning and operating five local ESPN Radio stations—in New

York City, Los Angeles, Chicago, Dallas and Pittsburgh—its programming is syndicated on 725 radio stations nationwide, thanks to the quality of the content and its ability to generate ratings for its affiliates.

37 Further, according to BIA Research, of all sports formatted stations, 63% are

ESPN Radio affiliates.

38

The company has a 24-hour, seven day-a-week radio network which broadcasts both talk and play-by-play programming. Produced at the company’s headquarters in

Bristol, Connecticut, these programs are distributed to affiliates nationwide. Depending on their need, local radio stations can choose from a variety of ESPN Radio programming.

The company’s sports talk radio lineup includes shows like “Mike and Mike in the

Morning,” “The Herd with Colin Cowherd,” and “The Scott Van Pelt Show.” The hosts encourage interactivity with their listeners by providing them with a variety of ways to join the conversation, either by phone, email or text message. “MLB on ESPN Radio” and “NBA on

ESPN Radio” are included in ESPN Audio’s play-by-play programming portfolio, along with other properties that augment the 250 live sporting events nationally broadcast each year.

39

Listeners of these programs—as well as about 30 others the company syndicates—are regularly directed to ESPNRadio.com to stream live audio and video programming, download podcasts and participate in promotions. In 2009, the site reached a streaming milestone, becoming the

37 ESPN Audio. (2008). Media kit . New York, NY.

38 Ibid.

39 ESPN Audio: Quick little update . (2008). New York, NY: ESPN Audio.

27

single most listened-to online stream of any terrestrial broadcaster in the world.

40

This achievement is evidence of ESPN Audio’s ability to sustain listener engagement by continuously driving listeners to their website.

ESPN Audio is a strong case study for the sports radio industry to follow. Not only has the company attracted a robust following with its talk radio personalities, but it has also evolved digitally unlike any other sports radio property. Traug Keller, ESPN senior vice president of production business divisions, was quoted in a June 2008 Inside Radio newsletter saying that

“utilizing new technologies and new distribution channels is part of [his company’s] overall strategy of serving the sports fan.” 41

The company regularly conducts research studies to understand habits and preferences of its audience. Consequently, the company has invested heavily in digital media. These capabilities currently include the aforementioned website with live audio and video capabilities, podcasts, online promotion pages, viral games, on-demand audio and video, viral games and a mobile platform. To activate their investment in digital media, the company seamlessly incorporates these extensions into its radio programming by repeatedly reminding listeners of online means of engagement. Although most sports radio properties do not have similar resources, the success of ESPN’s audio division provides the industry with a blueprint to follow.

40 ESPNRadio.com most listened to digital audio stream. (2009). Radio business report . Retrieved August 24, 2009, from http://www.rbr.com/media-news/internet/16591.html

41 Sports radio 'gets it right.' (2008). Inside radio . Retrieved June 4, 2008, from www.insideradio.com

28

Sports Radio’s Weaknesses, Opportunities & Threats

In an effort to adequately understand sports radio’s place within the greater sports media landscape, it is necessary to analyze its weaknesses, opportunities and threats. Survey results revealed sports radio’s strengths, and the many reasons why listeners engage with individual properties. However, rather than relying on these, the industry should be aware of its limitations and opportunities for future growth.

Weaknesses

Lack of Portability

As previously mentioned, radio content is most commonly consumed in cars, and through stereo systems and alarm clocks. These outlets were the only accessible listening platforms until

1979 when the Sony “Walkman,” a portable radio device, was introduced. The “Walkman” revolutionized radio, as people had never before had access to audio content while on-the-go. It quickly became the most widely used method of listening to radio while away from home and, according to The Associated Press , sold 385 million devices through 2009.

42

Sony “Walkman” models offered users radio and audio cassette capabilities.

Other manufacturers adopted the portable stereo concept since its introduction, and new audio devices have since entered the marketplace that offer compact disc and MP3 listening capabilities. The most successful of these has been Apple’s iPod, introduced in 2001, which has sold more than 210 million devices in eight years.

43

Although the iPod has also contributed to an increase in portable audio listening, so far only its fifth generation “Nano” device offers a radio component—and it lacks an AM tuner.

42 Kageyama, Y. (2009, July 3). Sony struggling as Walkman hits 30 th anniversary. The Salt Lake Tribune.

Retrieved

November 21, 2009, from http://www.sltrib.com/business/ci_12749568

43 Ibid.

29

There are, however, devices on the market like the Slacker and Sirius Stiletto portable radio players, yet it is extremely rare to see people carrying them around. Mobile streaming providers have emerged in recent years to distribute radio content through cell phone devices, but the platform has not yet been widely adopted. Aforementioned survey results indicate that people are spending more time on-the-go; therefore it would benefit the industry to make their content more widely available via portable audio devices.

Youth Audience

The current youth or teen demographic—aged 12 to 17—grew up with the internet, and the wide array of media options it made available. It can be argued that radio’s lack of digital extensions has not made it an ideal choice for this age group. According to media research firm

Nielsen, only 16% of American teens listen to terrestrial radio daily.

44 Their June 2009 “How

Teens Use Media” study reveals that this demographic spends significantly more time with the internet, television and mobile phones. Teens spend considerably less time with radio than every other age demographic. Arbitron’s 2008 “Radio Today” report reveals that teens spend about nine hours weekly with the medium on average, as opposed to 16-17 hours for persons aged 45-

64.

45 Further evidence of this problem, Arbitron reports that between 1998 and 2007 radio listening among a youth audience dropped 23%, from 11.3 to 8.7 weekly hours.

46

Not only does this age group listen to radio less than the general population, but they are also tuning into FM stations more predominantly than AM stations. According to Arbitron research, only about 50%

44 Nielsen. (2009, June). How teen’s use media: A Nielsen report on the myths and realities of teen media trends.

Chicago, IL: Author.

45 Radio today: How America listens to radio . (2008). New York, NY: Arbitron.

46 Anastasia. (2007, May 23). Is ‘Radio You’ the new model for radio? YPulse . Retrieved November 21, 2009 from http://www.ypulse.com/wordpress/wordpress/is-radio-you-the-new-model-for-radio

30

of radio listening is done on the AM dial—which is extremely problematic given the majority of sports stations are AM affiliates.

47

These statistics are problematic for several reasons. According to Nielsen, this demographic wields tremendous influence—among their peers, their parents and the culture at large. Teens also represent the future generation of listeners. Although it is not easy to convert those who routinely utilize other media over radio, the industry ought to come up with a game plan to protect their future by attracting a younger audience. One HD Radio station in Boston developed a unique concept to do just this. “Radio You Boston” was launched in 2007 to attract young listeners. The campaign—promoted heavily on social media sites—sets out to attract volunteer deejays to host two-hour radio shows once a week.

48

These shows aired on Greater

Media’s HD Radio channel, as well as its online stream. Concepts like this, as well as FM radio affiliations and expanded digital content can better engage the youth audience. One thing is for certain: if radio does not take necessary measures to reverse these trends, its future audience will continue to erode.

Technological Inadequacies

Another major problem for the industry is that, as a whole, radio has not evolved technologically. These inadequacies include lack of digital extensions and listener-friendly innovations that weakens the audio entertainment experience. A considerable number of radio properties do not have website components, thus missing out on incremental advertising and revenue. Although it should be standard to offer online streaming to augment terrestrial

47 Synder, J. (2002, April). Handicapping the ratings: Inside the numbers of America’s top-rated sports stations.

Arbitron . New York, NY: Author.

48 Anastasia. (2007, May 23). Is ‘Radio You’ the new model for radio? YPulse . Retrieved November 21, 2009 from http://www.ypulse.com/wordpress/wordpress/is-radio-you-the-new-model-for-radio

31

broadcasts, many properties with websites lack this feature. Individuals who want to tune-in to a particular station or program, lacking access to a working radio, ought to have the ability to do so online. For sports radio properties specifically, it is absolutely critical to offer digital interactivity to listeners. They should capitalize on this market segment by creating interactive environments online to supplement on-air content.

The majority of individuals surveyed for this project (58%) expressed their disdain for commercial advertising when asked what they do not like about radio. Upon listening to three sports radio stations (WEEI-Boston, WSCR-Chicago and WJFK-Washington, D.C.), it was noted that commercial breaks ranged from eight to twenty-two minutes per hour, which translates into 23% of content on average. Respondents answered that they commonly switch stations when a program goes to commercial break—which negatively impacts a station’s ratings—and wondered why radio does not have technology similar to television’s DVR. This type of technology would not only allow listeners to record audio content to consume at their leisure, but also bypass commercials and maintain engagement with their favorite stations. It would benefit radio to come up with innovative ways to integrate their advertisers into program content and digital extensions, so as to limit its listeners’ perceived commercial annoyance.

These technological innovations can ultimately enhance the audio listening experience.

Poor Reception

Technological advancements in recent years have made it possible for the television industry to upgrade signals and receivers to deliver high-quality programming to viewers. This includes the advancement to digital and high-definition (HD) television. However, with the exception of the small subset of satellite and HD radio users, terrestrial listeners have not been

32

provided with any upgrades in sound quality. Depending on weather conditions or a listener’s distance from a radio satellite tower, they may experience static and interference. It is also common to experience poor reception in populated cities and in tall buildings. Moreover, stations broadcasting on the AM dial are subject to more of these interruptions than stations on the FM dial due to their signal strength. This is especially problematic for sports radio stations, which are predominantly broadcast on the AM dial. Unless a serious commitment is made to improve sound quality for listeners, the radio medium may continue to lose audience to more advanced media.

HD Radio

The radio industry’s introduction of HD radio technology was primarily rolled out to combat signal strength issues. As explained in Arbitron’s “Infinite Dial” 2009 report, “[it] enables AM and FM radio stations to broadcast their signals digitally, providing listeners with vastly improved audio quality. In addition, HD Radio features new radio formats that may not be currently available on regular AM/FM radio, and also allows for a digital display with song information, weather reports and traffic alerts.” 49

Since HD radio was introduced several years ago, it has had very little traction among the American public. This is due in large part to the industry’s ineffective marketing strategy. Marci Ryvicker, an industry analyst at Wachovia

Capital Markets, was quoted in a November 2008 New York Times article saying, “it’s been a horribly marketed product that’s not going to save the radio industry. HD radio is pretty much going to be nonexistent, because [the industry] can’t figure out how to get the auto guys to include that as an option, and the auto guys that do include HD don’t let the consumers know

49 Arbitron. (2009). The Infinite Dial 2009: Radio’s digital platforms, AM/FM, online, satellite, HD Radio and podcasting.

New York, NY: Author.

33

about it.” 50

In comparison to television’s successful 2009 switch to all-digital broadcasts, HD radio has failed miserably. On June 12, 2009, the Federal Communications Commission (FCC) mandated that all U.S. based television signals must be transmitted digitally. The great majority of U.S. households (97.5%) were prepared for the digital transition in the week prior to the power turn-off.

51

Television’s transition to digital broadcasting was smoother mainly because analog viewers did not have an option for watching television after the transition date if they did not purchase a converter or a new TV set. HD Radio is simply an alternative platform for listening, and there is no perceived “power-off” threat to those listening on their terrestrial receivers.

Radio broadcasters have invested a great deal of capital to upgrade their signals from analog to digital. However, the majority of Americans have not received adequate education on the new technology. “The Infinite Dial” 2009 report further revealed that only 29% of adults over the age of 12 are aware of technology.

52

Despite a third of the population having awareness of HD radio, a separate study conducted by Bridge Ratings in 2007 reported that a mere seven percent of this demographic were interested in owning one.

53

Although there is definite potential for HD radio technology to improve quality and content for listeners, the industry needs to determine a more effective way to convey its value proposition to the public.

50 Clifford, S. (2008, November 25). Radio’s revenue falls even as audience grows. The New York times. Retrieved

November 26, 2008, from http://www.nytimes.com/2008/11/26/business/media/26adco.html

51 Nielsen. (2009, November 2). The switch from analog to digital TV.

Retrieved November 21, 2009, from http://blog.nielsen.com/nielsenwire/media_entertainment/the-switch-from-analog-to-digital-tv/

52 Arbitron. (2009). The Infinite Dial 2009: Radio’s digital platforms, AM/FM, online, satellite, HD Radio and podcasting.

New York, NY: Author.

53 HD radio vs. internet radio - which is radio's future?

(2007, August 8). Retrieved September 27, 2009, from

Bridge Ratings website: http://www.bridgeratings.com/press_08.08.07.HDvsinternet.htm

34

Opportunities

Audio and video streaming

The introduction of audio and video streaming technology has revolutionized the radio industry. With the advent of this new technology, listeners no longer have to be within a station’s broadcast zone, having access to content now through digital means. The most common way to stream a station’s content is to log-on to their website, and listen or watch a show live. It is also possible to listen to audio streams via mobile phone. Radio properties that offer this technology have the ability to dramatically increase their listener base. For those who have moved away from a geographic area with a favorite station, program or team, they can now tune-in through digital means. Furthermore, online streaming allows sports fans to easily tune-in to the station in an opponent’s city for inside scoop or trade talk. According to Arbitron, approximately 69 million adults over age 12 listen to online radio each month.

54 Based on the same research, online radio listening has not decreased the terrestrial audience, as a 2009 Arbitron study shows streaming users spend more time with radio overall each day.

55

Not all radio properties have augmented their terrestrial broadcasts with online streaming, and certain efforts have been more robust than others.

In 2007, ESPN Radio re-launched their streaming audio player—which carries local and national podcasts, audio and videos streams—desiring to become a multimedia hub for sports information and to broaden its audience. In an April 2007 Chicago Tribune article, Marc Horine,

ESPN’s vice president of digital partnerships and sales development for ESPN, said of the player, “The new design is much sleeker for us. It puts all ESPN audio in one application and

54 Arbitron. (2009). The Infinite Dial 2009: Radio's digital platforms, AM/FM, online, satellite, HD Radio and podcasting.

New York, NY.

55 Ibid.

35

allows us to distribute local content to a national audience.”

56

Accessed from ESPNRadio.com, the player has a national audio and video feed, 13 local station broadcasts, as well as more than

50 local and national podcasts. In August 2009, ESPNRadio.com averaged over 420,000 monthly unique streaming users, with 1.9 million monthly listening sessions averaging 2.5 hours each.

57

These statistics are impressive for any radio property, and demonstrate the popularity of audio content to sports fans.

In addition to broadcasting audio content online, radio stations can simulcast a video feed of their programs. Video streaming technology gives the medium a visual component, which it has historically lacked. This platform gives listeners an opportunity to watch radio hosts interact in the studio, interview guests and conduct stunts. A 2007 experiment with the latter gave ESPN

Audio valuable insight as to the strength of Colin Cowherd’s popularity with listeners. Cowherd, the host of nationally syndicated “The Herd,” challenged his producer to a 40-yard dash with the loser having to get tattooed on-air. Although terrestrial and audio streaming listeners could hear the action, they were also able to visit ESPNRadio.com to watch it live. Eddie Lucaire, ESPN

Audio’s manager of new media sales, reflects on the stunt’s success: “Colin’s 40-yard dash and subsequent tattooing stunt was so popular with listeners that it nearly crashed ESPNRadio.com.

Over 2.4 million streaming sessions and video podcasts were consumed, which set a site record.” 58

This stunt also demonstrated ESPN Radio listeners’ desire to be in on the action and experience online content.

56 Benderoff, E. (2007, April 1). ESPN turns up audio focus on web site to match public interest. The Chicago

Tribune . Retrieved March 14, 2009, from http://www.highbeam.com/doc/1G1-161352839.html

57 ESPNRadio.com most listened to digital audio stream. (2009). Radio business report . Retrieved August 24, 2009, from http://www.rbr.com/media-news/internet/16591.html

58 Lucaire, E. (2009, January 4). ESPN Audio digital history [Telephone interview].

36

Mobile Audio Streaming

In addition to streaming audio online through the computer, it is now possible to do so via mobile phone. Mobile phone users can download audio streaming applications or visit stations’ websites directly to access content. There are a number of companies currently inhabiting the mobile audio software space, including Pandora, IHeartRadio, Radiolicious and

Rogue Amoeba. Rogue Amoeba is a software development company that developed Radioshift

Touch to allow Apple iPhone and iPod Touch users to listen to internet radio anytime and anywhere they desire. According to their website, software users can browse from thousands of streams, searching by keyword, genre, location, or call letters.

59

According to the Wireless

Association, in June 2009 there were over 276 million mobile phone subscribers in the United

States, which amounts to 89% of the total population.

60

Since the vast majority of the U.S. population owns a mobile phone, this technology has the ability to transform the radio medium.

Advertising Age writer Steve Rubel proclaimed in a June 2008 column, “[Mobile audio streaming] will change the radio landscape by not only establishing a two-way modality but by ushering in new models for advertising that are mapped to people’s [audio] tastes and that are perhaps locally relevant as well, thanks to GPS. This may be one of the most promising mobile ad formats and is a space to watch.” 61

In order to capitalize on this opportunity, ESPN Audio launched an iPhone application in

September 2009. This application allows users to stream live local and national broadcasts, as well as podcasts, and live college football games from stations around the country. Rick Broida,

59 Radioshift touch: Listen anywhere via iPhone and iPod touch. (2008). Retrieved December 29, 2008, from http://rogueamoeba.com/radioshifttouch/

60 The Wireless Association. (2009, June). Wireless quick facts . Retrieved November 22, 2009, from http://www.ctia.org/advocacy/research/index.cfm/AID/10323

61 Rubel, S. (2008). New generation of phones is game-changer for radio. Advertising age . Retrieved July 21, 2008, from www.adage.com

37

a technology writer for cNet.com, reviewed the application and concluded, “The [ESPN Audio] app is absolutely terrific, and is well worth the $2.99 price of admission. It is sports radio done right.” 62

Thousands of sports fans seem to agree with Broida. According to Eddie Lucaire, within three months the paid application was downloaded by over 150,000 listeners, who access it roughly 50,000 times per day.

63

All sports radio properties have the ability to grow their audience in the same manner, and ought to be tapping into the mobile audio streaming space.

Podcasting

Another form of technology that allows radio properties to distribute content over the internet to portable media players and personal computers is the podcast. Though the same content may also be made available by direct download or streaming, a podcast is distinguished from other digital media formats by its ability to be syndicated, subscribed to, and downloaded automatically when new content is added.

64

Radio stations have the ability to produce show podcasts or create custom content for user download. This content can be consumed by listeners who regularly follow the program and may have missed a broadcast, or want to listen to show content again at their computers or on-the-go. The popularity of this content is evidenced by data, which revealed over one billion podcasts were downloaded in 2008 alone.

65 Podcasting is another way for radio properties to extend their brand to digital-savvy and on-the-go consumers.

ESPN Audio provides sports fans with specially produced content for popular sports and events, such as their “Baseball Today” podcast which averages 500,000 weekly downloads during the

62 Broida, R. (2009, September 21). ESPN Radio for iPhone gets your game on.” Cnet.com. Retrieved December 5,

2009, from http://reviews.cnet.com/8301-19512_7-10357795-233.html

63

Lucaire, E. (2009, November 26). ESPN Audio iphone application. [Telephone interview].

64 Wikipedia. (2009). “Podcast.” Retrieved January 2, 2009, from www.wikipedia.org

65 Wizzard Media. (2009) About us . Retrieved November 22, 2009, from http://www.wizzard.tv/about/

38

MLB season.

66

The podcasting platform connects audiences with audio content in a personal, portable manner, and provides a huge growth opportunity for the industry.

Satellite Radio

The satellite radio platform was launched in 1992, and provides subscribers with hundreds of content choices, on commercial-free channels. Its content is broadcast through a digital signal, which differs from terrestrial AM/FM radio. Satellite radio is also not monitored by Arbitron or any accredited ratings service. Instead, the industry relies on the number of subscribers who own a satellite radio device, and therefore it is difficult to determine actual audience figures for each channel. The main player in the industry is Sirius XM, which boasted

19 million total subscribers in December 2008.

67

According to their website, Sirius XM offers nine sports specific channels to listeners, including ESPN Radio, ESPN Deportes, Mad Dog

Radio and six channels dedicated to various league coverage.

68

The company also makes this same content available through their website, as well as on certain mobile phone models. Content is not freely available, as the companies revenue model is based on subscriber fees and income generated from sales of their device. The company also limits commercial advertising, which is considered a benefit to its listeners. Overall, the platform has a unique value proposition, delivering more diverse audio programming options to consumers.

66 Lucaire, E. (2009, January 4). ESPN Audio digital statistics [Telephone interview].

67 Saghir, R. (2009, March 11). Sirius XM subscribers: Only 83,000 subscribers added in Q4. Retrieved September

27, 2009, from http://www.orbitcast.com/archives/sirius-xm-subscribers-only-83000-subscribers-added-in-q4.html

68 Sirius XM Satellite Radio. (2009). Retrieved September 28, 2009, from www.siriusxm.com

39

Radio recording software

Advancements in television technology have allowed viewers to record programming to watch at their leisure. The radio industry historically has not offered listeners this capability until

Rogue Amoeba, creators of Radioshift Touch, developed Radioshift software, which allows people to listen to and record internet and terrestrial radio from around the world on-demand.

69

After downloading the software, users of Radioshift can view a program guide or search by station, program or genre. If the desired program is not broadcasting live, users can set a recording. Similarly to a DVR, users can decide to record a specific date, time or set a series recording. The software is free to consumers and provides them with over 10,000 programming options. Although the financial gains from Radioshift are unclear for its creator and broadcast partners, the software is certainly a step in the right direction for advancing radio’s technological capabilities to create a more listener-friendly, on-demand entertainment option.

Viral gaming

Building off of the popularity of ESPN Radio’s popular morning show duo Mike Golic and Mike Greenberg, the company developed several personality-based viral games, available on

ESPNRadio.com. These games are promoted both on-air—in-program and via commercial—and online via audio streaming and display ads. “MikeMan” was created in a similar design to the popular 1980s game “PacMan” and challenges users—playing as a Golic inspired character—to navigate through a course of obstacles while avoiding capture by the assumed villain Greenberg.

Pizza Hut signed on to sponsor the game in 2008 and ESPN Audio tailored the game’s design accordingly. Users were introduced to the restaurant’s new cheesy crust pizza while playing, and

69 Radioshift: Radio on your schedule. (2008). In Rogue Amoeba. Retrieved January 3, 2009, from www.rogueamoeba.com

40

bonus points were awarded when users digitally consumed the item. “MikeMan” users were also enticed with a special promotion for playing and could instantly place an online order by clicking a button on the game portal. In six weeks, the game attracted 118,000 unique users with a three minute and 30 seconds average play and was, by all accounts, a tremendous success for both parties.

70

By developing new, engaging platforms for listeners, radio properties have an opportunity to add to the time consumers spend with their brand. This will ultimately add to their bottom line and grow their audience base for the future.

Digital Host Interaction

The recent expansion of media options has put consumers in control. Instead of simply serving as an ear for broadcasters and advertisers, radio listeners have demonstrated that they enjoy participating in and contributing to program dialogue. Historically, listeners have had the ability to call or mail in feedback, submit contest entries, request songs or participate in show discussion. Digital advancements have now made it possible for them to participate in these activities through station websites and mobile phones. As previously mentioned, over 53% of those surveyed for this project indicated that they regularly or occasionally visit radio station websites, and over 50% have called-in for one reason or another.

71 The ability to involve listeners in show dialogue is what sets radio apart from the competition. Listeners’ contributions are invaluable to radio stations. In his Making Waves: Radio on the Verge interview, media futurist Douglas Rushkoff says, “I think what we’re starting to realize is that consumers are not just targets to be manipulated but they are really members of [a] company’s culture. And they’re going to want to sign on to a company that can actually accept their contributions and

70 Lucaire, E. (2009, January 4). ESPN Audio digital history [Telephone interview].

71 Brown, K. M. (2009, January 19). [Individual media consumption habits]. Unpublished raw data. Q17.

41

participation in some sort of real way.” 72

Radio properties that provide listeners with platforms for participation will likely be more successful than those who do not.

Nate Bukaty, co-host of a sports radio morning show “The Border Patrol” on WHB-AM in

Kansas City, believes the station’s success can be attributed to the relationship it has formed with listeners. Bukaty explains, “Our station has made itself the most relevant sports outlet in the city…the sports fans in this town feel partial ownership in our station.” 73

The station has empowered listeners to feel this way by providing them with ample opportunity to express themselves during live broadcasts, via phone, text and e-mail. WHB-AM regularly involves callers and references listener feedback in show content. By creating two-way dialogue, listeners have their feelings validated by the station.

At a June 2008 Sports Radio Business Seminar, “Mike and Mike in the Morning” co-host

Mike Golic expressed his listeners’ desire to contribute to on-air dialogue: “Sports radio needs to continue to allow fans to be interactive and vent on the air because they want to be involved.”

74