Liquidity Policy - Illinois Credit Union League

advertisement

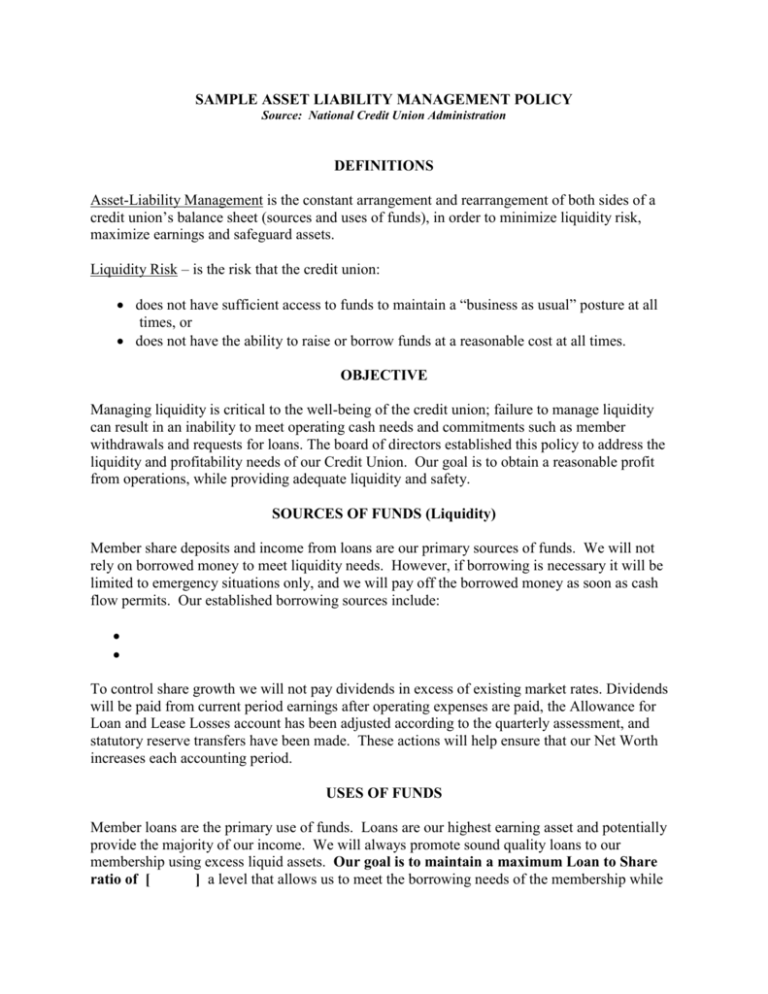

SAMPLE ASSET LIABILITY MANAGEMENT POLICY Source: National Credit Union Administration DEFINITIONS Asset-Liability Management is the constant arrangement and rearrangement of both sides of a credit union’s balance sheet (sources and uses of funds), in order to minimize liquidity risk, maximize earnings and safeguard assets. Liquidity Risk – is the risk that the credit union: does not have sufficient access to funds to maintain a “business as usual” posture at all times, or does not have the ability to raise or borrow funds at a reasonable cost at all times. OBJECTIVE Managing liquidity is critical to the well-being of the credit union; failure to manage liquidity can result in an inability to meet operating cash needs and commitments such as member withdrawals and requests for loans. The board of directors established this policy to address the liquidity and profitability needs of our Credit Union. Our goal is to obtain a reasonable profit from operations, while providing adequate liquidity and safety. SOURCES OF FUNDS (Liquidity) Member share deposits and income from loans are our primary sources of funds. We will not rely on borrowed money to meet liquidity needs. However, if borrowing is necessary it will be limited to emergency situations only, and we will pay off the borrowed money as soon as cash flow permits. Our established borrowing sources include: To control share growth we will not pay dividends in excess of existing market rates. Dividends will be paid from current period earnings after operating expenses are paid, the Allowance for Loan and Lease Losses account has been adjusted according to the quarterly assessment, and statutory reserve transfers have been made. These actions will help ensure that our Net Worth increases each accounting period. USES OF FUNDS Member loans are the primary use of funds. Loans are our highest earning asset and potentially provide the majority of our income. We will always promote sound quality loans to our membership using excess liquid assets. Our goal is to maintain a maximum Loan to Share ratio of [ ] a level that allows us to meet the borrowing needs of the membership while assuring an adequate earnings spread, and sufficient liquidity. As of [ ] our Loan to Share Ratio is [ ] We are implementing plans to increase this ratio in a safe and sound manner. Investments will be made when loan demand has been met or when the level of lendable funds has been reached. Investments will follow the S-L-Y Principle of Safety first, then Liquidity, then Yield. See the board-approved written Investment Policy. Investments in fixed assets (furniture and equipment) will be limited to those necessary to carry out member services. Fixed asset investments will never exceed the legal limit established by our regulator. The checking account and/or change fund will be maintained at a minimum level to reduce loss of earnings but will be sufficient to assure our ability to meet predictable share withdrawal and loan demand. CAPITAL ACCUMULATION GOALS We will maintain a sufficient level of Retained Earnings to meet contingencies and assure continuation of essential services throughout a perpetual existence. Our Net Worth ratio (Regular Reserves + Undivided Earnings + Net Income / Total Assets) is currently [ of [ ] and we are classified as “Well Capitalized” ] as Our goal is to maintain a Net Worth ratio of [ ] % or higher each quarter. The board will review the net worth ratio at every board meeting. If it falls below seven percent we will transfer at least .1% of total assets from Undivided Earnings or Net Income to the Regular Reserve account each accounting period. POLICY CHANGES The board of directors will review this policy and make revisions (if necessary) at least annually, and whenever the credit union experiences a significant change. This policy was last reviewed and approved by the board of directors on _____________________.