5.3. Information flow definition – Remittance advice process

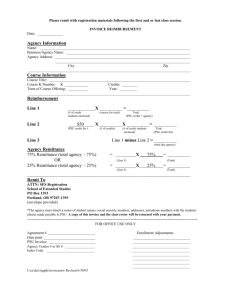

advertisement

UN/CEFACT Simple, Transparent and Effective Processes For Global Commerce BUSINESS REQUIREMENTS SPECIFICATION (BRS) Business domain: Cross industry – Supply chain Business process: Remittance advice process Document identification: Title: Cross Industry Remittance advice Process UN/CEFACT International Trade and Business Processes Group: TBG1 Version: 0.2 Release: 2 Date: 15 February 2005 Document Change History Log Date of change 30.07.2004 Version 0.1 Paragraph changed 15.02.2005 0.2 All 106756888 Page 1 of 31 Summary of changes Approved by eBES/EEG1 Textual changes proposed by Corporate reference group Business Requirements Specification Table of Contents 1. Preamble ..................................................................................................................................... 3 2. References ................................................................................................................................... 4 3. Objective ..................................................................................................................................... 4 4. Scope............................................................................................................................................ 5 5. Business requirements ............................................................................................................... 7 5.1. Business requirements views ............................................................................................. 7 5.2. Business process elaboration - Traditional or suppliers’ initiated invoice ................... 8 5.2.1. Use case: Payment cycle ............................................................................................ 9 5.2.2. Use case: Remittance advice process ...................................................................... 10 5.3. Information flow definition – Remittance advice process ............................................ 12 5.3.1. Activity diagram: Remittance advice process ....................................................... 12 5.3.2. Business collaboration diagram: Remittance advice process .............................. 14 5.4. Information model definition – Remittance advice (Class diagram) .......................... 16 5.5. Business rules.................................................................................................................... 28 5.6. Definition of terms ........................................................................................................... 30 5.6.1 Parties and party roles ............................................................................................. 30 106756888 Page 2 of 31 1. Preamble This document describes the Remittance advice process being a part of the Payment process for the transfer of funds between the customer and the supplier in the Supply chain. The following functions comprise the payment cycle: - the Remittance advice process, being the communication of the Remittance advice between the customer and the supplier, - the Payment order process, being the execution of the payment (transfer of funds) between the customer, customers’ bank, supplier bank and the supplier. The Payment order process is out of the scope of this document, because the information flows involved in this process are financial transactions and should be part of another Business Requirements Specification (BRS) submitted by the UN/CEFACT/TBG 5 – Financial group. Started as an initiative by CEN/ISSS Work shop eBES, the European Expert Group 1 (EEG1) – Supply Chain & e-Procurement developed the Cross Industry Remittance advice in 2004. The Cross Industry Remittance advice has been compiled using the EUROFER ESIDEL version 1.0 as the base, with contributions and submissions from: EUROFER, EAN/UCC, CIDX, EDIFICE, AIAG/ODETTE, SWIFT and the Corporate Reference Group. The first draft of the Business Requirements Specification (BRS) was presented at the September 2004 UN/CEFACT Forum to the TBG1 members for review and comments from the other regions. Based on comments received TBG1 has drafted the final version of the BRS for further processing through the UN/CEFACT Forum process with the goal of developing a UN/CEFACT ebXML standard message. The purpose of this document is to define a globally consistent Remittance advice process between the customer and the supplier for the worldwide supply chains. The UN/CEFACT Modelling Methodology (UMM) approach and Unified Modelling Language is used to describe and detail the business processes and transactions involved. The structure of this document is based on the structure of the UN/CEFACT Business Requirements Specification (BRS) document reference CEFACT/ICG/005. 106756888 Page 3 of 31 2. 3. References UN/CEFACT Modelling Methodology (CEFACT/TMG/N090R10, November 2001 UN/CEFACT –ebXML Core Components Technical Specifications version 2.01 – ISO 1500-5 UN/CEFACT Business Requirements Specification version 1.5 (CEFACT/ICG/005) UN/EDIFACT – Remittance advice message Unified Modelling Language (UML version 1.4) Objective The objective of this document is to standardize the Business processes, the Business transactions and the Information entities of the Remittance advice used by industry and the trade sector in the supply chain. The business process is the detailed description of the way trading partners intend to play their respective roles, establish business relations and share responsibilities to interact efficiently with the support of their respective information systems. Each Business transaction is realised by an exchange of Business documents (also called messages). The sequence in which these documents are used, composes a particular instance of a scenario and are presented as use cases in the document. The business documents are composed of Business Information Entities (BIE), which are preferably taken from libraries of reusable business information entities. The contents of the business documents and the Business Information Entities are presented using class diagrams. 106756888 Page 4 of 31 4. Scope This section describes the extent and limits of the business process within the supply chain being described in this document. The class diagram of the Remittance advice business transaction is developed in such a way that it specifies the cross industry reusable business information entities. Categories Business process Product Classification Industry Classification Geopolitical Official Constraint Business Process Role Supporting Role System Capabilities Description and Values Remittance advice process in the supply chain All All Global None Private and public procurement None No limitations In the payment cycle the transfer of funds takes place between the customer and the supplier in settlement of the amounts that are due for the supply of goods and services. On a date prior to, or synchronous with, the payment date, information about the transfer of funds is exchanged between the parties involved. This document describes the payment order process and the remittance advice process for the transfer of funds. The following functions comprise the payment cycle: - The generation of the Payment order based on invoices having the status “payable” - The communication of the remittance details between the customer and the supplier either embedded in the payment, or as a separate remittance advice. - The execution of the payment between the customer, customers’ bank, the supplier’s bank and the supplier. - The reconciliation by the paying organisation of the confirmation from the buyer’s bank that the payment has been executed with the “Payments in Transit”. - The reconciliation by the receiving organisation of the remittance details (either the separate Remittance advice or the invoices specified in the bank statement or Credit Advice) with the open invoices in the Accounts Receivable system. The different invoicing procedures are not part of the payment cycle, but are detailed in the invoicing cycle. To simplify the description, the parties involved are limited to the customer, the supplier and their respective banks. In the total trade process each of the parties can play more than one role. For the payment cycle the customer can play the role of consignee, invoicee and payer. The supplier covers the roles of seller, consignor, sales agent or sales company, and payee. 106756888 Page 5 of 31 To ensure that the payment of the invoices are in line with common practice used in industry and trade sectors, only the following three scenarios will be taken into consideration: The remittance advice is sent directly between the customer and the supplier, or The remittance details are embedded within the payment order and the bank generates a separate Remittance advice message, to be delivered to the payee, or The Remittance advice is sent indirectly in a form embedded within the payment order, exchanged through the buyer’s bank to the supplier’s bank and delivered to the payee in the Credit Advice or the Bank statement. 106756888 Page 6 of 31 5. Business requirements 5.1. Business requirements views Cross Industry Businessd ’échange Langage des filières acier Basic Basic information information Ordering Ordering Scheduling Scheduling Shipping Shipping Invoicing Invoicing Remittance & Payment Remittance advice Payment order with Remittance details The Payment cycle is divided in to these processes: - The remittance advice process This process supports the generation and communication of the remittance advice by the customer to the supplier. The remittance advice provides a detailed accounting relative to a payment, or other form of financial settlement, in respect of the provision of goods and, or services provided by the supplier. - The payment order process This process supports the generation of the payment order by the customer to his bank, the exchange of information between banks and the exchange of information between the suppliers’ bank and the supplier about the transfer of funds. The communication of the remittance advice may be included in the payment process, to be developed with the UN/CEFACT TBG 5 - Finance group. 106756888 Page 7 of 31 5.2. Business process elaboration - Traditional or suppliers’ initiated invoice Scope The remittance advice process will be used to allow the customer to inform the supplier of detailed information relative to a payment, or other form of financial settlement for the provision of goods and/or services provided by the supplier. The remittance advice will give an overview of the invoices, credit notes and debit notes that are taken in account in the payment order given by the customer to his bank for the transfer of funds to the supplier. It also specifies the identification and the requested execution date of the Payment Order. Definition The remittance advice process is the mechanism by which the customer provides the supplier with the underlying details of the transfer of funds. This process should relate to the process of transfer of funds between the parties and the respective banks specified in the payment order process. Electronic transmission of the Remittance Advice message from customer to supplier is the basic scenario. An "electronic work environment (Electronic market place)" may be used as an intermediary to distribute the remittance advice. To support the remittance advice process the following messages have been developed: - Remittance advice - Remittance advice embedded in a payment transaction. Principles The customer has the obligation to provide the details of the payment order to the supplier, allowing the supplier to automatically reconcile incoming payments. Any deviation from the original invoice amount must be specified in the remittance advice. The supplier has the obligation to reconcile the remittance advice against the outstanding invoices, credit notes and debit notes. The supplier should report to the customer any inaccuracy in transfer of funds by reconciling the invoices with the details in the remittance advice. 106756888 Page 8 of 31 5.2.1. Use case: Payment cycle The use case for the payment cycle shows which business collaboration use cases are used to compose the process: - The treatment of the remittance advice process - The treatment of the payment order process A description of each business collaboration use case is provided in this chapter. Use case diagram – payment cycle Payment cycle Customer/ Customer/payer payer Supplier/ Supplier/payee payee payee Payment cycle Remittance advice process Customer/ payer Supplier/ payee Payment order process Suppliers/ payee’s bank Customers/ payer’s bank Figure 1. Use Case Diagram – Payment cycle 106756888 Page 9 of 31 5.2.2. Use case: Remittance advice process The use case for the Remittance advice process has the following business transaction: - Provide a remittance advice. Remittance advice process Supplier Customer Remittance advice process Provide a remittance advice Customer Supplier Figure 2. Use Case Diagram – Remittance advice process 106756888 Page 10 of 31 Use case description – Remittance advice process Business process name Identifier Actors Description Pre-condition Postconditions Scenario Remittance advice Cross industry Remittance advice process Customer, Supplier (Optional, additional roles – Payer, Payee) The customer provides to the supplier for the settlement of the invoices, credit notes and debit notes a detailed statement relating to the funds (to be) transferred (remittance advice) The supplier reconciles the remittance advice with the outstanding invoices, credit notes and debit notes. The Remittance Advice may be sent in advance to allow the supplier’s Accounts Receivable department to match and close open invoices. Though the Remittance Advice is not “a promise to pay”, it is common practice that the payment is actually executed at the date indicated in the Remittance Advice, so the supplier can use this advanced information for cash planning purposes. The supplier has provided goods and/ or services according to the conditions set in the contract and/or order. The customer has received the goods and/or services, and the payment is authorised for execution at the date determined by invoice date and payment terms. The supplier is adequately informed about the invoices being settled by the payment instruction referred to in the Remittance Advice. For an inaccurate remittance advice the supplier will inform the customer. Based on the agreed payment conditions between the parties, the customer will generate the remittance advice when the payment order is given to his bank for the transfer of funds to the supplier. Once the remittance advice is received the supplier reconciles the remittance advice with the outstanding invoices, credit notes and debit notes. If there is any discrepancy found, the supplier shall inform the customer. Remarks 106756888 Page 11 of 31 5.3. Information flow definition – Remittance advice process For the use cases mentioned in chapter 5.2. the corresponding activity diagrams are presented. 5.3.1. Activity diagram: Remittance advice process Customer Supplier From invoicepayment system Issue remittance advice Receive remittance advice Remittance advice Reconciliation Check against outstanding invoices, credit notes and debit notes Not ok Ok Initiate the necessary information to the customer end Figure 3. Activity Diagram – Remittance advice process 106756888 Page 12 of 31 Activity diagram description – Remittance advice process Based on the conditions agreed between the customer and supplier, the customer shall select payable invoices and initiate the remittance advice in combination with the transfer of funds specified in the payment order process. The customer sends the remittance advice to the supplier directly or embedded in a Payment order. When the supplier receives the remittance advice, he reconciles the contents of the remittance advice against the outstanding invoices, credit notes and debit notes, closing the matched invoices and booking the total amount of the Remittance Advice as “Remittance in Transit”. Note: this is called “operational reconciliation”. The supplier checks the payment amount mentioned in the remittance advice with the amount received from his bank (see details in the payment order process). Note: this is called “financial reconciliation”. If there is any discrepancy detected by supplier, the supplier should inform the customer so that he is able to correct the payment. 106756888 Page 13 of 31 5.3.2. Business collaboration diagram: Remittance advice process Business Collaboration Identifier EEG1: Remittance advice Description The customer raises and sends a remittance advice to the supplier. When the supplier receives the remittance advice, he checks the remittance advice against the outstanding invoices, credit notes and debit notes and against the amount received. If there is any discrepancy detected the supplier shall inform the customer. Partner Types Customer Supplier Customer (Payer) Supplier (Payee) Authorized Roles Legal Steps/Requirements None Economic Consequences None Initial/Terminal Events Initial: the customer sends the remittance advice Terminal: the supplier receives the remittance advice. Scope To inform about the transfer of funds and the related invoices, credit notes and debit notes. Boundary Not defined yet Constraints The customer shall have full traceability of his remittance advice to make sure it has been received. Failing this technical acknowledgement, the customer shall re-issue his remittance advice message 106756888 Page 14 of 31 Customer Supplier START Generates a remittance advice [CONTROLFAIL] [SUCCESS] Process the remittance advice Remittance advice END Figure 4. Business transaction activity graph – Remittance advice 106756888 Page 15 of 31 Information model definition – Remittance advice (Class diagram) 5.4. cd Remittance adv ice Remittance adv ice + Schema Version: string Remittance Adv ice Header 1 1..* Remittance Adv ice Line Figure 1: Remittance advice Remittance advice Description: A message providing accounting details relative to a payment for the provision of goods and, or services that have been ordered or received or consumed. Mult. 1 1 Business term Schema version Remittance advice header Rel. Att. Ass. Type String Remittance advice header 1..* Remittance advice line Ass. Remittance advice line 106756888 BIE name Description Business document version number. The entity contains the general information about a remittance advice, such as the number, date and the relevant monetary amounts. The entity contains the details of the commercial transactions covered by the remittance advice. The entity specifies the document number, document date, amount due, amount remitted and the payment references. Page 16 of 31 cd Remittance adv ice Header Remittance Adv ice Header + + + + + + + + + + + + Party. Details Remittance Advice. Identifier: Identifier. Type Remittance Advice. Issue Date Time: Date Time. Type Remittance Advice. Payment Date Time: Date Time. Type Remittance Advice. Copy Indicator: Indicator. Type [0..1] Remittance Advice. Payment_ Currency. Code: Code. Type [0..1] Payment Order. Payer_ Identifier: Identifier. Type [0..1] Payment. Payer_ Identifier: Identifier. Type [0..1] Payment. Invoicing Party_ Identifier: Identifier. Type [0..1] Remittance Advice. Total_ Amount: Amount. Type Remittance Advice. Total Remitted_ Amount: Amount. Type Remittance Advice. Total Discount_ Amount: Amount. Type [0..1] Remittance Advice. Text: Text. Type [0..1] +Payer 1 +Payee 1 +Customer 0..1 +Supplier 0..1 0..1 Financial_ Account. Details Payment Instructions + + + +Payee Financial Account + + + 0..1 + + +Payer Financial Account + 0..1 + Payment Instructions. Payment_ Condition. Code: Code. Type [0..1] Payment Instructions. Payment Guarantee. Code: Code. Type [0..1] Payment Instructions. Payment Means. Code: Code. Type [0..1] Financial_ Financial_ Financial_ Financial_ Financial_ Financial_ Financial_ Account. Account. Account. Account. Account. Account. Account. IBAN_ Identifier: Identifier. Type [0..1] Identifier: Identifier. Type [0..1] Holder_ Name. Text: Text. Type [0..1] Institution Branch_ Name. Text: Text. Type [0..1] Institution_ Name. Text: Text. Type [0..1] Institution Swift_ Identifier: Identifier. Type [0..1] Institution Alternative_ Identifier: Identifier. Type [0..1] +Payment Currency Exchange 0..1 Currency Exchange. Details + + + + + + Currency Exchange. Currency Exchange. Currency Exchange. Currency Exchange. Currency Exchange. Currency Exchange. Source_ Currency; Code: Code. Type Source_ Unit Base. Numeric: Numeric. Type [0..1] Target_ Currency. Code: Code. Type Target_ Unit Base. Numeric: Numeric. Type [0..1] Rate. Numeric: Numeric. Type Date Time: Date Time. Type [0..1] Figure 2: Remittance advice header 106756888 Page 17 of 31 Remittance advice header Description: The entity contains the general information about a remittance advice, such as the number, date and the relevant monetary amounts. Mult. 1 Business term Remittance advice number Rel. Att. Type Identifier 1 1 Remittance advice date time Payment date Att. Att. Date Time Date Time 0..1 Copy indicator Att. Indicator 0..1 Payment currency Att. Code 0..1 Payment order number Att. Identifier 0..1 Payer payment reference number Att. Identifier 0..1 Invoicing party payment reference number Att. Identifier 1 Total amount subject to payment discount Att. Amount 1 0..1 0..1 Total amount remitted Total payment discount amount Remittance advice note Att. Att. Att. Amount Amount Text 0..1 Payment currency exchange Ass. Currency Exchange. Details 1 1 0..1 0..1 0..1 Payer Payee Customer Supplier Payee financial institution Ass. Ass. Ass. Ass. Ass. Party. Details Party. Details Party. Details Party. Details Financial Account. Details 0..1 Payer financial institution Ass. Financial Account. Details 0..1 Payment instructions Ass. Payment Instructions 106756888 BIE Name Description The unique number given by the issuer to identify a remittance advice. The date/time when the remittance advice was issued. The date on which an amount due is made available to the creditor, in accordance witch the terms of payment. The indicator that the remittance advice is a copy of an original remittance advice. The coded identifier of the monetary unit to be used for the payment of an invoice. The number given by the payer to the payment order sent to the payers’ financial institution. The reference number assigned by the payer for the identification of the payment of an accounting document (invoice). The invoice issuer reference number to be mentioned at the payment of a commercial transaction. This reference number is provided on the invoice, credit note or debit note. The total amount of the remittance advice, being the sum of total remittance advice line amount subject to payment discount. The total amount of the remittance advice paid or to be paid. The total amount of the payment discount. The free text information related to the complete remittance advice. The exchange rate used for the conversion of the payment currency from a source currency. The entity contains the details of the payer. The entity contains the details of the payee. The entity contains the details of the customer. The entity contains the details of the supplier. The entity contains the details of the financial institution and the account holder name and account number of the payee. The entity contains the details of the financial institution and the account holder name and account number of the payer. The entity contains the information describing the conditions and guarantee under which the payments will be made. Page 18 of 31 cd Remittance Adv ice Line Remittance Adv ice Line + + + + + + + + + + Remittance Advice Line. Line Number. Identifier: Identifier. Type [0..1] Invoice. Type. Code: Code. Type [0..1] Invoice. Identifier: Identifier. Type Invoice. Issue Date Time: Date Time. Type Invoice. Total Invoice_ Amount: Amount. Type Remittance Advice Line. Due_ Amount: Amount. Type [0..1] Remittance Advice Line. Remitted_ Amount: Amount. Type Payment. Payer_ Identifier: Identifier. Type [0..1] Payment. Invoicing Party_ Identifier: Identifier. Type [0..1] Remittance Advice Line. Text: Text. Type [0..1] +Customer Order Document Reference. Details +Supplier Order 0..1 +Consignee Order 0..1 + + + + 0..1 + + + + Document Document Document Document Document Document Document Document Reference. Reference. Reference. Reference. Reference. Reference. Reference. Reference. Identifier: Identifier. Type Status. Code: Code. Type [0..1] URI. Text: Identifier. Type [0..1] Global Unique_ Identifer: Identifier. Type [0..1] Copy Indicator: Indicator. Type [0..1] Issue Date Time: Date Time. Type [0..1] Item Identifier: Identifier. Type [0..1] Item Status. Code: Code. Type [0..1] Currency Exchange. Details +Payment Currency Exchange +Payment Adjustment 0..* Adj ustment Details + + + Adjustment. Reason. Code: Code. Type Adjustment. Text: Text. Type [0..1] Adjustment. Amount: Amount. Type + + 0..1 + + + + Currency Exchange. Currency Exchange. Currency Exchange. Currency Exchange. Currency Exchange. Currency Exchange. Source_ Currency; Code: Code. Type Source_ Unit Base. Numeric: Numeric. Type [0..1] Target_ Currency. Code: Code. Type Target_ Unit Base. Numeric: Numeric. Type [0..1] Rate. Numeric: Numeric. Type Date Time: Date Time. Type [0..1] 0..1 Adj ustment Document. Details + + + Document. Type. Code: Code. Type Document. Identifier: Identifier. Type Document Issue Date Time: Date Time. Type [0..1] Figure 3: Remittance advice line 106756888 Page 19 of 31 Remittance advice line Description: The entity contains the details of the commercial transactions covered by the remittance advice. The entity specifies the document number, document date, amount due, amount remitted and the payment references. Mult. 0..1 Business term Remittance advice line number Rel. Att. Type Identifier 0..1 Invoice type code Att. Code 1 Invoice number Att. Identifier 1 1 Invoice date time Total invoice amount Att. Att. Date Time Amount 0..1 Amount due Att. Amount 0..1 0..1 Amount remitted Payer payment reference number Att. Att. Amount Identifier 0..1 Invoicing party payment reference number Att. Identifier 0..1 0..1 Remittance advice line note Customer order reference Att. Ass. Text Document Reference. Details 0..1 Supplier order reference Ass. Document Reference. Details 0..1 Consignee order reference Ass. Document Reference. Details 0..1 Payment currency exchange Ass. Currency Exchange. Details 0..* Payment adjustment Ass. Adjustment. Details 106756888 BIE Name Description The unique reference given by the issuer to identify a remittance advice line within a remittance advice The code specifying the invoice type (e.g. invoice, debit note, credit note). The unique number assigned by the issuer to identify an invoice. The date/time when the invoice is issued. The total amount of the invoice, being the sum of total invoice line amount, total invoice additional amount and total tax fee amount. The actual amount of the invoice in function of the payment conditions of the invoice. The actual amount paid, or to be paid. The reference number assigned by the payer for the identification of the payment of an accounting document (invoice). The invoice issuer reference number to be mentioned at the payment of a commercial transaction. This reference number is provided on the invoice, credit note or debit note. The free text information related to the remittance advice line. The unique identifier of the order assigned by the customer to an order and the issuing date. The unique identifier of the order assigned by the supplier to an order and the issuing date. The unique identifier of the order assigned by the consignee to an order and the issuing date. The exchange rate used for the conversion of the payment currency from a source currency. The entity to identify the adjustment reason of the difference between the amount due and the amount remitted of a commercial trade transaction. Page 20 of 31 Business Information Entities Address Description: The entity contains the details of a geographical location and of a postal communication channel. Mult. 0..1 0..1 Business term Post box Structured address Rel. Ass. Ass. Type Post Box. Details Structured Address. Details 0..1 Unstructured address Ass. Unstructured Address. Details BIE Name Description The entity the details of a box post. The entity contains the details of a specific address in a structured way. The entity contains the details of a specific address in an unstructured way. Adjustment details Description: The entity contains the adjustment reason for the credit note, debit note or invoice. Mult. 1 0..1 1 0..1 Business term Adjustment reason Adjustment text Adjustment amount Adjustment document Rel. Att. Att. Att. Ass. Type Code Text Text Adjustment Document. Details BIE Name Description The code identifying of the adjustment reason. The free text information explaining the adjustment. The amount of the adjustment. The entity contains the identification of the references to documents to justify the adjustment. Adjustment document details Description: The entity contains the identification of the references to documents to justify the adjustment. Mult. 1 1 0..1 Business term Document type code Document number Document date/time 106756888 Rel. Att. Att. Att. Type Code Identifier Date Time BIE Name Description The code identifying the document type. The unique identifier of the document. The issue date or date time of the document. Page 21 of 31 Contact details Description: The entity contains the details of the contact person or department. Mult. 0..1 0..1 0..1 0..1 0..1 0..1 0..1 0..1 0..1 Business term Contact identifier Contact person Contact department Telephone number Direct phone number Mobile phone number Telefax number Telex number E-Mail address Rel. Att. Att. Att. Att. Att. Att. Att. Att. Att. Type Identifier Text Text Text Text Text Text Text Text BIE Name Description The unique identifier of a contact person or department. The name of a contact person. The name of identification of a department. The number of the telephone. The number of the direct telephone. The number of the mobile telephone. The number of the facsimile. The number of the telex. The E-Mail address. Currency exchange details Description: The entity contains the details of the rate of exchange between two currencies. Mult. 1 Business term Source currency Rel. Att. Type Code 0..1 Unit base source currency Att. Numeric 1 Target currency Att. Code 0..1 Unit base target currency Att. Numeric 1 Exchange rate Att. Numeric 0..1 Exchange date time Att. Date Time 106756888 BIE Name Description The code identifying the currency from which the exchange is being made. The unit base of the source currency for currencies with small denominations. The code identifying the currency to which the exchange is being made. The unit base of the target currency for currencies with small denominations. The exchange rate, from the source currency to the target currency. The date of the rate of exchange. Page 22 of 31 Document reference details Description: The entity contains the identification of the references to documents, such as contract, order item, price list. Mult. 1 0..1 0..1 0..1 Business term Reference number Reference status Reference URI Reference GUID Rel. Att. Att. Att. Att. Type Identifier Code Identifier Identifier 0..1 Copy indicator Att. Indicator 0..1 0..1 Reference date Reference item number Att. Att. Date Time Identifier 0..1 Reference number item status Att. Identifier BIE Name Description The unique identifier of the referenced document. The code giving the status of the referenced document. The Uniform Resource Identifier of the referenced document. The Global unique identifier (GUID) of the reference document. The indicator that the referenced document is a copy of the original document. The issue date or date time of the referenced document. The unique number to identify an item of the referenced document. The code giving the status of the item of the referenced document. Financial account details Description: The entity contains information of the financial institution and the account holder name and number of the payee. Mult. 0..1 Business term IBAN number Rel. Att. Type Identifier 0..1 0..1 0..1 0..1 0..1 Account holder number Account holder name Institution branch name Institution name Bank identification SWIFT Att. Att. Att. Att. Att. Identifier Text Text Text Identifier 0..1 Alternative bank identification Att. Identifier 106756888 BIE Name Description The international bank account number uniquely identifying the account number of the holder of an account. The account number of the holder of an account. The name of the holder of the account. The name of the financial branch. The name of the financial institution. The identification of the financial institution (bank) given by SWIFT. The identification of the financial institution (bank). Page 23 of 31 cd Party. Details Party. Details + + + Party. Identifier: Identifier. Type Party. Additional_ Identifier: Identifier. Type [0..*] Party. Name. Text: Text. Type [0..1] +Contract Contact 0..1 +Technical Contact 0..1 Contact. Details +New Development Contact +Order Processing Contact 0..1 0..1 +Customer Relation Contact 0..1 +Delivery Contact 0..1 0..1 +Goods Receiving Contact 0..1 +Material Control Contact +Information Contact 0..1 +Order Contact 0..1 +Sales Administration Contact 0..1 +Supplier Contact 0..1 +Technical Contact 0..1 +Accounting Contact 0..1 + + + + + + + + + Contact. Identifier: Identifier. Type [0..1] Contact_ Person. Name. Text: Text. Type [0..1] Contact. Department. Text: Text. Type [0..1] Communication. Phone_ Number. Text: Text. Type [0..1] Communication. Direct Phone_ Number. Text: Text. Type [0..1] Communication. Mobile Phone_ Number. text: Text. Type [0..1] Communication. Telefax_ Number. Text: Text. Type [0..1] Communication. Telex_ Number. text: Text. Type [0..1] Communication. Email_ Text: Text. Type [0..1] 0..1 Post Box. Details Address + 0..1 + + + + Post Post Post Post Post Box. Box. Box. Box. Box. Post Office Box. Text: Text. Type Postcode. Text: Text. Type [0..1] City Name. Text: Text. Type [0..1] Country Subdivision Name. Text : Text. Type [0..1] Country. Identifier: Identifier. Type [0..1] 0..1 0..1 Unstructured Address. Details Structured Address. Details + + + + + + + + + Structured_ Structured_ Structured_ Structured_ Structured_ Structured_ Structured_ Structured_ Structured_ Address. Address. Address. Address. Address. Address. Address. Address. Address. Identifier: Identifier. Type [0..1] Building Name. Text: Text. Type [0..1] Street. Text: Text. Type [0..1] Postcode. Text: Text. Type [0..1] City Name. Text: Text. Type [0..1] District Subdivision Name. Text: Text. Content [0..1] District Name. Text: Text. Type [0..1] Country Subdivision Name. Text: Text. Type [0..1] Country. Identifier: Identifier. Type [0..1] + + + + + + + + + Unstructured_ Unstructured_ Unstructured_ Unstructured_ Unstructured_ Unstructured_ Unstructured_ Unstructured_ Unstructured_ Address. Address. Address. Address. Address. Address. Address. Address. Address. Identifier: Identifier. Type [0..1] Line One. Text: Text. Type Line Two. Text: Text. Type [0..1] Line Three. Text: Text. Type [0..1] Line Four. Text: Text. Type [0..1] Line Five. Text: Text. Type [0..1] Postcode. Text: Text. Type [0..1] City Name. Text: Text. Type [0..1] Country Identfier: Identifier. Type [0..1] Figure 4: Party 106756888 Page 24 of 31 Party details Description: The entity contains the name and the prime identification of a party. Mult. 1 0..* Business term Party identification Party additional identification Rel. Att. Att. Type Identifier Identifier 0..1 0..1 Party name Address Att. Ass. Text Address 0..1 Contract contact Ass. Contact. Details 0..1 Technical contact Ass. Contact. Details 0..1 New development contact Ass. Contact. Details 0..1 Order processing contact Ass. Contact. Details 0..1 Customer relations contact Ass. Contact. Details 0..1 0..1 Delivery contact Goods receiving contact Ass. Ass. Contact. Details Contact. Details 0..1 Material control contact Ass. Contact. Details 0..1 Information contact Ass. Contact. Details 0..1 Order contact Ass. Contact. Details 0..1 0..1 0..1 0..1 Sales administration contact Supplier contact Technical documentation contact Accounting contact Ass. Ass. Ass. Ass. Contact. Details Contact. Details Contact. Details Contact. Details 106756888 BIE Name Description The code identifying a party involved in a transaction. The additional identification of a party involved in a transaction. The name of the party involved in a transaction. The collection of information which locates and identifies a specific address. The department or person to contact for matters regarding contracts. The department or person to contact for matters regarding technical issues. The department or person to contact for matters regarding new developments (e.g. construction). The department or person responsible for the processing of purchase orders. The department or person responsible for the customer relations. The department or person responsible for the delivery. The department or person responsible for receiving the goods at the place of delivery. The department or person responsible for the controlling/inspection of goods. The department or person to contact for questions regarding transactions. The department or person to contact for questions regarding the order. Name of the sales administration contact within a corporation. The department or person to be contacted at the supplier. The department or person to receive technical documentation. The department or person to contact for accounting matters. Page 25 of 31 Payment instructions Description: The entity contains the set of information describing the conditions and guarantee under which the payments will be made. Mult. 0..1 Business term Payment conditions code Rel. Att. Type Code 0..1 0..1 Payment guarantee code Payment means code Att. Att. Code Code BIE Name Description The code identifying the method employed or to be employed in order that a payment may be made or regarded as made. The code specifying the means of payment guarantee. The code specifying the means of payment. BIE Name Description The post box identifier. The national postal code (ZIP code) of the address The name of a city The name of a state or province in a country. The country code specified in ISO 3166-1993 (2 alpha positions) Post Box Description: The entity contains the details of the post box address. Mult. 1 0..1 0..1 0..1 0..1 Business term Post office box Postal code City name State or province name Country code Rel. Att. Att. Att. Att. Att. Type Text Text Text Text Identifier Structured address details Description: The entity contains the details of a specific address in a structured way. Mult. 0..1 Business term Location identifier Rel. Att. Type Identifier 0..1 0..1 0..1 0..1 0..1 0..1 0..1 0..1 Building name Street name Postal code City name District sub-division name District name Country sub-division name Country code Att. Att. Att. Att. Att. Att. Att. Att. Text Text Text Text Text Text Text Identifier 106756888 BIE Name Description The unique identification of a location based on the Duns (Duns & Bradstreet) number of the company followed by four numeric digits. The name of a building The name of a street. The national postal code (ZIP code) of the address The name of a city The name of a sub-division of a district of a city The name a district of a city The name of a state or province in a country. The country code specified in ISO 3166-1993 (2 alpha positions) Page 26 of 31 Unstructured address Description: The entity contains the details of a specific address in an unstructured way. Mult. 0..1 Business term Location identifier Rel. Att. Type Identifier 1 0..1 0..1 0..1 0..1 0..1 0..1 0..1 0..1 Address line 1 Address line 2 Address line 3 Address line 4 Address line 5 Postal code City name Country sub-division name Country code Att. Att. Att. Att. Att. Att. Att. Att. Att. Text Text Text Text Text Text Text Text Identifier 106756888 BIE Name Description The unique identification of a location based on the Duns (Duns & Bradstreet) number of the company followed by four numeric digits. The first line of the address. The second line of the address. The third line of the address. The fourth line of the address. The fifth line of the address. The national postal code (ZIP code) of the address The name of a city The name of a state or province in a country. The country code specified in ISO 3166-1993 (2 alpha positions) Page 27 of 31 5.5. Business rules In Trade the Remittance advice (message) is used to provide accounting details relative to a payment for the provision of goods and, or services that have been ordered, received or consumed. The message is sent by the payer (customer) to the payee (supplier). The following principles are valid for the remittance advice: - A remittance advice is a notice of a payment to be made - A remittance advice may cover one or more commercial trade transactions, such as invoices, credit notes and debit notes - A remittance advice may include a reference to a payment order given by the payer to his bank - Each remittance advice shall be calculated in only one currency, even though the covered transactions may be denominated in different currencies. - Each remittance advice shall relate to only one settlement date. 106756888 Page 28 of 31 5.6. 5.6.1 Definition of terms Parties and party roles Terms Customer Payer Supplier Payee Definition The customer is the person or organization who acquires goods or services from a supplier. The following roles can be found in a customer company in this process: payer. The payer is the person or organization acting on behalf of the customer, doing the payment to the supplier of the payable invoice. The supplier is the person or organization who suppliers goods or service to a customer. The following roles can be found in a supplier company in this process: payee. The payee is the person or organization to whom the invoice should be paid on behalf of the supplier. 106756888 Page 30 of 31