File

advertisement

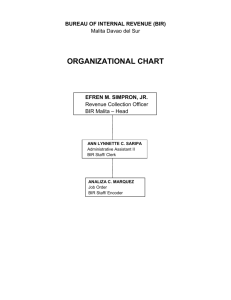

Bureau of Internal Revenue The Bureau of Internal Revenue is mandated by law to assess and collect all national internal revenue taxes, fees and charges, and to enforce all forfeitures, penalties and fines connected therewith, including the execution of judgments in all cases decided in its favor by the Court of Tax Appeals and the ordinary courts (Sec. 2 of the National Internal Revenue Code of 1997). MISSION The BIR shall collect internal revenue taxes for the government. VISION The BIR is an institution of service excellence manned by people with integrity and professionalism. GUIDING PRINCIPLE "Service Excellence with Integrity and Professionalism" VALUES God-fearing Consistency Competency Innovativeness Accountability Synergy Respect Fairness Transparency BIR Management Committee Sixto S. Esquivias IV Commissioner of Internal Revenue Room 501/511 BIR National Office Bldg. Diliman, Quezon City sixto.esquivias@bir.gov.ph 926-5771/922-9345 Loc. 7123,7121,7120 Joel L. Tan-Torres Senior Deputy Commissioner Rm.405, BIR National Office Building, BIR Road Diliman, Quezon City joel.tan-torres@bir.gov.ph 924-2915 Loc. 7382 Nelson M. Aspe Deputy CommissionerOperations Group Room 407, BIR NOB, Diliman, Quezon City nelson.aspe@bir.gov.ph 926-5425/924-3242 Loc. 7310,7314 Lilia C. Guillermo Atty. Gregorio V. Cabantac Deputy CommissionerDeputy Commissioner-Legal Information Systems Group and Inspection Group Room 409, BIR NOB. Diliman, Room 403, BIR NOB, Diliman, Quezon City Quezon City lilia.guillermo@bir.gov.ph gregorio.cabantac@bir.gov.ph 922-4817/924-7309 926-5697 Loc. 7010 Celia C. King Deputy CommissionerResource Management Group Room 410, BIR NOB Diliman, Quezon City celia.king@bir.gov.ph 928-7946 Loc. 7310 Marietta U. Lorenzo OIC-Deputy CommissionerTax Reforms Administration Group Room 401,BIR NOB, Diliman, Quezon City Lucita G. Rodriguez Deputy Commissioner-Special Concerns Group Room 301, BIR NOB, Diliman, Quezon City lucita.rodriguez@bir.gov.ph 920-7506 marietta.lorenzo@bir.gov.ph 981-7319 Loc. 7309 Learning Junard R. Ocay It that kind of activity, I have learn how to exert more patience if you needed to have the information that you are looking. Because we are the one who needed the information necessary for us to know about Bureau of Internal Revenue procedure in business, we need to wait for the time in order for us to be accommodated. This kind of agency is a busy one because almost everyday you can see a lot of people transacting to their particular concern and with this I appreciate more the value of coming early and being on time because if you are in a particular position, you should have learn to appreciate the value of the effort that the single person transacting there.