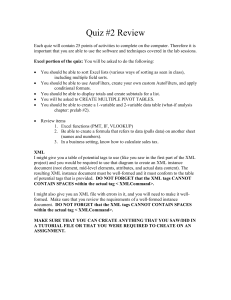

First Quiz Review Sheet

Final Exam Review Sheet

The final exam for this course is Wednesday December 18 at 11:50am

Don’t forget there is a take-home portion of the final exam. You can access a description of the take-home portion of the final on the class web page.

In general, you might want to review your old quiz results, making sure that you are able to do (or still able to do) tasks that we saw/did earlier this semester.

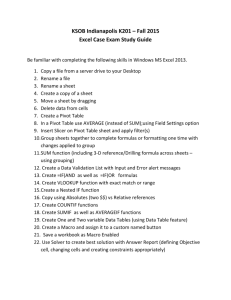

Computer Skills

Use an external data connection to get the price quote for a single stock/fund AND a groups of stocks/funds. Make sure that this will automatically refresh every minute.

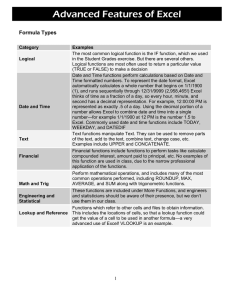

Be able to correctly use the following Excel functions

The various Excel counting functions, MEDIAN, MONTH, DAY, CONCATENATE,

VLOOKUP, IF, PMT, PV, FV, NPER, RATE, IRR, NPV.

Be able to find the 2 nd

lowest value, 3 rd

lowest value, etc. in a range of data (using the

SMALL function). Be able to find the 2 nd

highest value, 3 rd

highest value, etc. in a range of data (using the LARGE function).

Be able to calculate the percentage gained or lost from one period of time to another period

General Form of Formula: (TimePeriod#2-TimePeriod#1)/TimePeriod#1

Be able to create an amortization schedule (where the schedule zeros out)

Be able to calculate portfolio allocation weightings (like we have done during class).

This could be a simple stock/bond/real estate weighting, or it could be something more complex like market cap weightings. You may also have to deal with complicated weightings where a fund is split between stock and bond, and within the stock allocation, it is split between US and foreign, and within the US allocation, it is split between large cap, mid cap and small cap.)

Using financial data, be able to create a pivot table. You should be able to make a pivot table that: o Contains a row, a column and a data area. o Contains a row or column (but not the other) and a data area o Can show different mathematical operations (average, max, min, sum, etc) o Has a report filter/page field that is used to filter the data. o Is formatted according to specified directions

Be able to use Excel to retrieve data from a web site using a web query.

Be able bind cells in an Excel spreadsheet to a data map and load data in Excel into an

XML instance document.

Be able to use Vlookup and Hlookup. What is the difference between each?

When using the Vlookup, how should the items in the first column be arranged?

Be able to create a raw instance document in Notepad.

Be able to create screenshots and insert them into other files.

What is the BDH function and what can you use it for?

The BDH function requires 4 arguments (Security, Fields, Start, End)

What goes into each of the arguments?

Be prepared to write out the function and explain its components.

What was the purpose of the model portfolio project?

What is the difference between optimization and satisficing? How did we practice optimization in Excel? How did we practice satisficing in Excel?

What is the difference between a decision support system and artificial intelligence?

Know examples of where someone might use an expert system.

What is the purpose of an amortization schedule?

What is “what-if” analysis?

How are XML instance documents and schemas different? What does XML allow you to do?

When you create a pivot table, what are you specifying?

Be able to distinguish between an XML instance document, a schema, a stylesheet and a data map. What is the basic purpose of each one? What is binding in terms of Excel and

XML?

What are the steps that you would follow to populate an instance document with data already found in Excel?

When creating a pivot table, what is a report filter (page field)? If you create one, what does it allow you to do?

Why would someone create a pivot table? What can you do with a pivot table that you can’t easily do with some other tool?

Think about how we did use the Bloomberg terminals/Bloomberg system. What did we use that for? What types of information were we able to get from there? How does using

Bloomberg compare to using the Internet or other sources that you have seen/used when conducting research? Be able to discuss and provide examples.

You have decided to use the vlookup function. Prior to using this function, you have to create a table containing the values you are searching for, along with the corresponding results/answers that you wish to display after a given item is found. When you make the table used by your vlookup function, how must you arrange the items in the table

(specifically what must occur in the various columns (1,2,3, etc))?

Circuit breakers on the stock market serve what purpose?

What are the risks of automated trading decisions?

What are the benefits of high frequency trading and why should it be allowed?

What are the reasons that high frequency trading should not be allowed?

Our videos mentioned the proximity of computer servers and computer infrastructure to the exchanges. Explain why this is considered important for some?

Why is it important for someone to have data extraction skills? This should be discussed from the perspective of someone who has just downloaded a bunch of raw data from the

Internet or a database.

How is an actively managed fund different from an index fund?

What is depreciation? Why is it calculated? What types of assets are depreciated? If I have purchased an asset, why would I depreciate it (versus not depreciate)?

How is straight-line depreciation different from declining balance depreciation?

What is the time value of money concept?

What are the two rewards for investing?

Computer Concepts

The following will be terms that you will find on a matching section

Depreciation

Concatenate

Instance document

Satisficing

Excel Solver

Dim

Code Module

Firewall

Disconnection

Variable

Packet Sniffer

XML/XBRL

NPV

Amortization

Formulas

Pivot table

Expert system

Web query

Button

Comment

Access Control

Risk Analysis

Backups

Imitation

Wiki

IRR

Data table

Goal Seek

Optimization

Genetic algorithm

Toolbox

Object

String

Jamming

Scenario Manager

Schema

Event-driven

Virtual Private Network

Label

Radio/Option Button

Numeric

Intrusion Detection

User Training

Flooding

Encryption

Social Engineering

Mole Data Modification

Traditional HTML web site

Given the number of shares that you own, a distribution amount and a reinvest price, be able to calculate the number of shares that you will have after reinvesting your

distribution.

XBRL: what is it, how might it be used, what are the benefits of using, why are organizations using it?

How does XBRL help companies deal with “Big Data and what is “Big Data?”

XBRL: What is the difference between the bolt-in and built-in approach?

Be prepared to discuss the use of high-speed computers in the investment industry? How are they being used and what are are some of the problems associated with using them.

Think about the presentation that you made before the class, as well as the presentations made by fellow students.

Be prepared for questions created by students in the class over their own XBRL presentations.

The class wiki has copies of the questions and answers IF A STUDENT DECIDED TO

ENTER THEM INTO THE WIKI. You can also access info related to each student presentation from the class web page.

Be prepared to discuss the CyperProtect Simulation and what you saw and did while working on the simulation. What attacks did you encounter? Where did they come from? What types of tools/controls/methods were most effective in preventing attacks or mitigating the effects of the attacks?

As part of the final, you will also run the CyperProtect simulation and select various tools/controls to protect your network. After placing the tools/controls in the desired spots, the simulation will simulate several attacks. Your grade will be based on the effectiveness of the placement of the tools and the resulting efficiency rating. The points that you will receive will be based on the effectiveness/effiency rating given after a minium of two quarters. A student can run multiple simulations and receive the highest rating attained.

I suggest developing your strategies prior to walking into the exam.