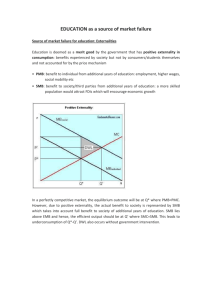

2008 intro + cause of market failure with

advertisement