18th July, 1997

advertisement

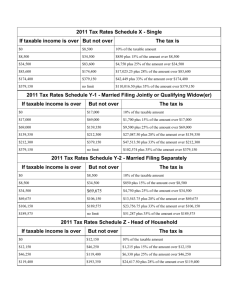

D.R. TIGHE & COMPANY PTY LTD A.B.N: 88 007 082 331 ACCOUNTANTS & TAX AGENTS ANNUAL NEWSLETTER 2009 INCOME TAX RETURN – BUSINESS Yes it is that time of year again! We have prepared a checklist of information required to prepare your 2009 Business Income Tax Return. Please review and complete the checklist below and forward with your paperwork to our office. If WE are preparing your Accounts we need the following: All bank statements for business account’s and loans taken out from 1 July 2008 to 30 June 2009. Cheque books from 1 July 2008 to 30 June 2009. Deposit books from 1 July 2008 to 30 June 2009. List of Debtors invoiced as at 30 June 2009 but not paid. List of Creditors – ie Expenses incurred but not paid as at 30 June. If YOU have prepared your Accounts we need the following: MYOB Data File – if your accounts are processed thru MYOB please forward a back up of your MYOB data file. IMPORTANT - Please include any passwords, version of MYOB you are running and your username. If you have prepared a Cash Book, we need the book. If prepared using excel, you can email the file to us. List of Debtors invoiced as at 30 June 2009 but not paid. List of Creditors – ie Expenses incurred but not paid as at 30 June 2009. GENERAL INFORMATION: (Where applicable) INCOME – Business Income INCOME – Also if applicable, PAYG Payment Summary, Centrelink Statements and Eligible Termination payment documents. INCOME – Interest received, dividends received and details of other investment income earned. This includes interest earnt on term deposits that is rolled back into the account and dividends reinvested rather than received. Dividend details must include value of imputation credits. INCOME - A record of any capital assets or investments sold with details of the original purchase, including date of purchase and costs involved with the purchase. E.g.: Shares, Rental properties, Assets, plant & equipment sold or scrapped, etc. Wages – copies of PAYG Summaries issued to employees together with PAYG payment Summary Statement for yearend. Details of Superannuation paid for each employee. Motor Vehicle Expenses – if you wish to claim motor vehicle expenses then you should have the receipts as above and a log-book verifying business use OR a record of business related kilometers to be claimed up to 5000 kms and the engine capacity of the relevant vehicle (ie. 1.8 Litre engine). If you purchased a new motor vehicle during the year and/or traded your old motor vehicle please forward relevant paperwork. Photocopies of Installment Activity Statements OR Business Activity Statements together with details of payments made to the Australian Taxation Office. Bad Debts – details of any Debts written off prior to 30 June 2009. Details of any loans taken out during the year, including paperwork, bank statements and what the loan was for. Details of personal payments to superannuation funds. You may be eligible for a Government Co-contribution of up to $1500, to match your contributions made if your income is below $28,000. The Government Co-contribution tapers off for those with incomes between $28,000 and $58,000. If you wish to claim your superannuation contributions as a tax deduction, we will need to have a letter from your superfund saying that you will be claiming as a tax deduction. ELECTRONIC LODGEMENT SYSTEM Your 2009 Income Tax Return will be lodged electronically, meaning faster refunds. The Australian Taxation Office claim that 80% of assessments will be issued within 14 days when lodged electronically. We cannot guarantee this however. INDIVIDUAL TAX RATES - 2009 YEAR Taxable Income 1 – 6,000 6,001 – 34,000 34,001 – 80,000 80,001 – 180,000 Over 180,000 Tax Nil Nil plus 15 cents for each $1 over $6,000 $4,200 + 30 cents for each $1 over $34,000 $18,000 + 40 cents for each $1 over $80,000 $58,000 + 45 cents for each $1 over $180,000 COMPANY & SUPERANNUATION TAX RATES – 2009 YEAR Tax Rate 30% 15% Details Company on taxable income (flat rate) Complying Superannuation Fund (flat rate) MEDICARE LEVY Taxable Income 0 – 17,794 17,795 – 20,935 20,936 and above Levy Nil 10% of excess over $17,794 1.5% of Taxable Income MEDICARE LEVY SURCHARGE (Taxpayers with NO private Health Cover) Rate: 1% of taxable income Maximum single and combined incomes you can earn before incurring this surcharge. Taxpayer Status Single, No Dependants Couple, 0 – 1 Dependants Couple, 2 Dependants Couple, 3 Dependants Couple, 4 Dependants Couple, 5 Dependants Income Threshold $70,000 $140,000 $141,500 $143,000 $144,500 $146,000 Medical rebate – Where net medical, hospital, chemist, dental, etc, expenses exceed $1,500, 20% of the excess is allowed as a rebate. PRIVATE HEALTH INSURANCE A 30% rebate of all premiums for 2009 is available to the taxpayer with Private Health Insurance. This does not apply if yo u have already received a reduced premium. SMALL BUSINESS TAX BREAK A bonus deduction of 50% will be available to small business entities (SBE’s) that order an eligible asset between 13 December 2008 and 31 December 2009, and install it ready for use by 31 st December 2010. As long as you have entered into a contact for the purchase of an asset prior to 31 st December 2009, you can get this 50% deduction even if you have not yet received the asset!! Eligible Assets must be new. Secondhand and intangible assets (e.g. Software) do not qualify for the tax break. Eligible assets include business machinery and equipment, cars, leased business machinery and equipment. No matter whether you expect a refund or expect to pay, it is equally important that you provide us with all the relevant information as soon as possible. Please call us to make your appointment, or post/email the necessary information to us and we will telephone you to deal with any matters that require clarification. Telephone: Melbourne (03) 9521 9588 or Sorrento (03) 5984 4499 P O Box 79 Sandringham Vic 3191 Email: 2009@drtighe.com.au