CHC2D_Lesson__2__Stock_Market_Crash

advertisement

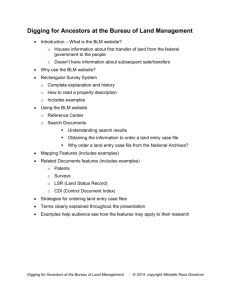

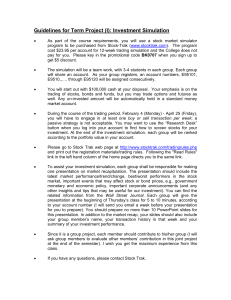

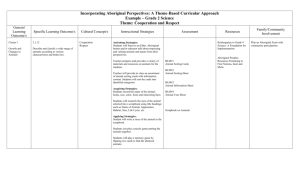

Financial Literacy in CWS and SSH: An OHASSTA-OHHSSCA Collaborative Project Ontario History and Social Sciences Teachers' Association Funding from the Ontario Ministry of Education 2011 Financial Literacy Lesson Plan CHC2D Financial Literacy Lesson Plan 2011 Financial Literacy Lesson Plan CHC2D Connections to Financial Literacy Describe the financial literacy knowledge and skills which will be addressed and assessed in this lesson. Financial literacy knowledge and skills could include, but are not limited to: personal financial planning such as budgeting, saving and investing; understanding the economy; planning for the future. The Roaring 20s and Dirty 30s: The 1929 Stock Market Crash [3 × 75-minute periods = 225 minutes] Grade 10 Academic History/CHC2D Curriculum Expectations Learning Goals Social, Economic, and Political Structures analyse how changing economic and social conditions have affected Canadians since 1914 compare economic conditions of the 1920s and 1930s, and describe the impact of those conditions on Canadians, individually and collectively At the end of this lesson, students will know, understand and/or be able to… Methods of Historical Inquiry and Communication draw conclusions and make reasoned generalizations or appropriate predictions on the basis of relevant and sufficient supporting evidence express ideas, arguments, and conclusions, as appropriate for the audience and purpose, using a variety of styles and forms (e.g., reports, essays, debates, role playing, group presentations) 1. stock market terms; 2. the basics of how a stock market works; 3. that stock prices can experience large fluctuations; 4. the 1929 stock market crash; 5. that confidence plays a key role in financial and economic systems; 6. strategies for avoiding personal debt problems; and 7. improve their critical and creative thinking skills, and their communication skills. Instructional Components and Context Readiness Materials Students should know that the Canadian economy was in recovery in the 1920s after tough economic times that immediately followed World War I. However, this is reviewed at the beginning of the lesson. calculators for students prizes for simulation winners (optional) bell (can do without) suggested Black Line Masters (BLM) #1-14 overhead projector and transparencies, or LCD projector Bristol board (for students who choose the poster option) Terminology economic boom economic recovery stock investor stock market, stock exchange capital gain buying on margin Black Tuesday buying on credit buying on margin buying on credit As written, class will need access to a computer lab for the third of three class periods. Financial Literacy Lesson Plan 2011 Minds On Connections Establishing a positive learning environment Connecting to prior learning and/or experiences Setting the context for learning Explicitly label: Assessment for learning Assessment as learning Assessment of learning Explicitly identify planned differentiation of content, process, or product based on readiness, interest, or learning Whole Class – Review and Stock Market Terms Review Canada’s economic recovery in the 1920s by reading over with the class an overhead transparency copy of Black Line Master (BLM) #1. Then introduce stock market terms by having students fill in the blanks on BLM #2 with an overhead transparency made of BLM #3. Assessment for learning: Review of Canada’s economic prosperity following WW1 allows the teacher to determine student readiness to learn new information. Some of this new information is immediately introduced in the form on a straightforward fill-in-the blank note. Action! Introducing new learning or extending/reinforcing prior learning Providing opportunities for practice and application of learning (guided > independent) Whole Class – Stock Market Simulation Introduction With enthusiasm, rhetorically ask students, “Who wants to get rich?!” Tell them that the class will be doing a stock market simulation where they will be able to buy and sell stocks, and maybe even get rich. Remind students [as was indicated in BLM #1] that the 1920s were a time when ‘playing’ the stock market became more popular. Explain that they will each start with the same amount of money and will be competing to see who has the most money at the end of the simulation. Tell them that they can participate individually, but that they are encouraged to have a partner as the simulation is usually more fun that way. Insist that at least one person in every pairing must have a calculator, and that means they must have their own calculator if they’re going to participate on their own. Allow them time to find partners and to move so that partners are sitting together. Individually or in Partners – Stock Market Simulation Hand out to every team a copy of the Stock Market Simulation sheet. (Note that each team must have six copies of BLM #4 to participate in the simulation, each copy corresponding to a round of stock price changes in the simulation. An 11” × 17” sheet can be used for this purpose, with three copies of BLM #4 on the front and three on the back.) Tell them to write their names where indicated on the top right hand corner of the sheet, and to write in “#1” for the first round just below that. They should also go ahead and number the rest of the rounds from #2 to #6. Inform students that every team will start with $1,000 and that the winner of the simulation will be the team that ends with the most amount of money. Put up an overhead transparency of BLM #5, “Fake Companies in Which You Can Buy Stock” and read through it with the class. Instruct students that they can buy stock in whichever of the five companies they wish, but it is suggested they only buy shares in 2 to 3 companies in the first couple of rounds until they’re comfortable in understanding how the simulation works and how to make their calculations. Tell them to now write down the names of the companies in which they wish to buy stock in Column [1] on the simulation sheet for round #1, and give them time to do so. Financial Literacy Lesson Plan 2011 Assessment for learning: Movement by the teacher throughout the room during the simulation allows for guidance and feedback. Students may need help in calculating share prices or net worth. The teacher can monitor pairings for indications of positive teamwork. The flexibility of running between three and six rounds of stock trades allows for the teacher to tailor the length of each round to the specific abilities of their students, without losing the overall purpose of the simulation. Next, inform them that they can buy as many shares in each company they have listed up to the total amount of money they can lay their hands on. Students will think in the first round that this is the $1,000 net worth each team starts with. This is the time to remind them that borrowing money became much more widespread in the 1920s, including borrowing money to buy stock, also called buying on margin. The rule for the simulation is that at least 10% of the money investors use to buy stock must be their own money, which means they can borrow the remaining 90%. This means that they can actually invest ten times the amount of their net worth, which at the start means they can invest ten times $1,000, or $10,000. Of course, of that ten thousand dollars, $1,000 would be their own money, and $9,000 would be borrowed and they would have to pay it back. Recommend to them that they don’t borrow to invest at least in the first round because doing so makes the math a little more complicated. Differentiated instruction: The stock market simulation offers benefits to several learning types: Kinesthetic learners will appreciate the ability to move around the room; logical/mathematical learning style students will like the use of simple mathematical calculations implemented throughout the simulation; visual learners will benefit from the overhead transparencies tracking the changes in stock prices; students with strong interpersonal skills will be motivated by working with a partner and conferring on stock choices. Put up an overhead transparency of BLM #6, covering up the bottom half so as to reveal only the “Starting Prices.” Students should copy from the transparency the share prices of the stocks they are buying into column [2]. They next need to decide how many shares of each company they are buying and write the numbers in column [3]. They should then fill in column [4] by doing as the simulation sheet indicates, being sure they calculate a total for column [4]. If they are not investing more than their net worth — which again is $1,000 for all of them at the start of the simulation — they do not need to fill in columns [5] or [6] and will need to wait for the teacher for the next step. If they are investing more than their net worth, they are buying on margin and so must fill in totals for columns [5] and [6], following the directions on the sheet. After doing so, they too will be ready for the teacher for the next step. The teacher should circulate through the class with a calculator in hand to help students fill in their sheets correctly. Once all teams are ready, the teacher should ring a bell or make a loud clanging noise to signal that trading (teams buying stocks) is now done. The teacher should then reveal the bottom half of BLM #6, and have teams copy from the transparency the new stock prices into column [7]. Teams should then calculate the numbers for column [8] following the directions on the sheet. Once this has been completed, they should fill in the bottom table on the sheet, “Calculating Personal Net Worth at End of Round.” When they have completed doing so, they are ready to make their stock purchases for the next round. This same process is repeated for all rounds using the appropriate halves of overhead transparencies made from BLMs #6 to #9. The prices of stocks to start the second round are the prices where the stocks finished at the end of the first round. The prices to start the third round are the prices where the stocks finished at the end of the second round, and so on. (It should be pointed out that the simulation sheet is set up to assume that teams sell off their stock at the end of every round. While this assumption does simplify running the simulation by making the procedure of buying stocks the same in every round, it unfortunately does not reflect what investors actually do in investing in a real stock market. Of course, should students wish to “hold on” to the stocks they owned in the previous round, they can simply “buy them back” by listing them on their sheet for the current round.) Note that the number of rounds that are run in the simulation can be reduced if class time is running short. To do so, simply skip rounds up to the last round. Be sure to run round #6, “Final Round – The Crash,” as the last round in order to simulate the 1929 Stock Market Crash. It is recommended that at a minimum of three rounds be run in total. When the final round has been completed, ask teams to share with the rest of the class what their net worth ended up being and how they found the Financial Literacy Lesson Plan 2011 Assessment for learning: As the rounds progress, the teacher is advised to note how student behaviour may change. At the outset of the activity, students may be cautious in their stock buying, but as prices make impressive gains in the first three rounds, and students’ confidence in their ability to pick “winners” increases, teams may become more willing to take more risks with their choices and buy on margin. Additionally, students may be motivated by competition with other pairings to improve their overall net worth. The teacher’s observations about student behaviours during the simulation may be shared after the activity, and a discussion may take place about the pitfalls of giving into a “herd mentality.” simulation. Prizes can be awarded to the teams that finished with the highest net worth. Inform students that just as the market crashed in this simulation, so too did stock markets around the world on Black Tuesday — October 29, 1929. Show and discuss with the class the front page of the New York Times the next day by making an overhead transparency of BLM #10. A more readable version of the beginning of the stock market crash article is provided with BLM #11. Assessment for learning: A brief class discussion at the end of the simulation allows for students to consolidate knowledge gained through the activity. Consolidation Providing opportunities for consolidation and reflection Helping students demonstrate what they have learned Individually – 1929 Stock Market Crash Reading and Worksheet Distribute copies of BLM #12 to students and ask them to do it. A visual check may be made of its completion. The sheet should be discussed upon its completion; this may be done with a Think/Pair/Share (TPS) first, followed up with a whole class discussion. Individually – Avoiding a Personal Credit Crisis Assignment (It is suggested that this class take place in a computer lab.) Distribute and explain this assignment using BLM #13 and the peer- and selfassessment checklists that are on BLM #14. Allow students time to work on the assignment, as well as time for peer- and self-assessment. It is recommended that students have the checklists while working on the assignment, and that the peer assessment checklist is filled in before the self-assessment to help students more objectively assess the work. Assessment for learning: This concluding discussion allows the teacher to provide specific feedback about the key understandings of the 1929 stock market crash. This will ensure that students have a solid grasp on this event, and will prepare them for subsequent lessons on the causes of the Great Depression. Differentiated assessment: This assignment provides students with three choices for their final product: a written response, a poster with paragraph explanation, and a comic strip. Students will be able to highlight their individual strengths through their chosen means of communication. Assessment as learning: Using a checklist, students will have their work peer assessed, and then they will self-assess it. This gives students the opportunity to more objectively consider their work, reflect on their learning, and make improvements. By reviewing the work of their peers, students not only help to guide the learning of others, but also gain insight into their own work. Assessment of learning: This assessment allows the teacher to gauge the quality of individual student learning based on specific criteria. Having students explore strategies for avoiding debt allows the teacher to understand how successful each student has been in achieving expectations. Financial Literacy Lesson Plan 2011 BLM #1 The 1920s Economic Boom Recall that following the tough times immediately after WW1, Canada’s economy picked up in the 1920s. Wheat prices were high, helping farmers in the prairies. Pulp and paper became Canada’s 2nd largest industry after agriculture. Hydroelectric power production soared in Ontario and Quebec, making Canada the 2nd largest producer in the world. By the end of the decade, 7 out of every 10 homes in Canada had electricity. In 1924, oil was discovered in Alberta, creating a boom for the province’s economy. Canada became the second largest producer of automobiles in the world, which also gave rise to spin-off industries such as rubber, glass, and asphalt and encouraged tourism. The 1920s were also a time when ‘playing’ the stock market became more popular. Many people were able to get rich almost overnight, and could afford to buy the new modern conveniences like a radio, washing machine, record player, or even a car. Even if you could not afford these things, you still might be able to attain them by buying on credit, which became much more common in the 1920s. BLM #2 STOCK MARKET GLOSSARY stock — a s in the o . of a business for example, if you bought 100 shares in a business and the business had 1,000 shares in total, you would own % of the business investor — a person who puts m into a business in the hope of making money, for example, someone who buys s in a business stock market (or stock exchange) — a marketplace where stocks are b and s . . capital gain — the profit a shareholder would make by selling stocks for a higher p than she paid for them Buying on margin is borrowing money to buy stocks. For example, if you were buying $1,000 worth of stocks, you could pay with $100 of your own money and borrow $ to pay for the rest. (Of course, you’d have to pay the $900 back later.) If your stocks increased in value, you might well be able to sell them, pay back the money you borrowed, and make (or realize) a big, fat p ! (The more you borrowed, the more stocks you could buy, the greater your p could be!) But, if your stocks decreased in value and you ended up selling them at a lower price than you paid for them, you would have lost some of your own m — and you would still have to p b the money you borrowed. As long as the stock market was doing well, you could make a f buying on margin . . BLM #3 STOCK MARKET GLOSSARY stock — a share in the ownership of a business for example, if you bought 100 shares in a business and the business had 1,000 shares in total, you would own 10 % of the business investor — a person who puts money into a business in the hope of making money, for example, someone who buys stock in a business stock market (or stock exchange) — a marketplace where stocks are bought and sold capital gain — the profit a shareholder would make by selling stocks for a higher price than she paid for them Buying on margin is borrowing money to buy stocks. For example, if you were buying $1,000 worth of stocks, you could pay with $100 of your own money and borrow $ to pay for the rest. (Of course, you’d have to pay the $900 back later.) If your stocks increased in value, you might well be able to sell them, pay back the money you borrowed, and make (or realize) a big, fat profit ! (The more you borrowed, the more stocks you could buy, the greater your profits could be!) But, if your stocks decreased in value and you ended up selling them at a lower price than you paid for them, you would have lost some of your own money — and you would still have to pay back the money you borrowed. As long as the stock market was doing well, you could make a fortune buying on margin. BLM #4 SIMULATION Name(s): ________________________________________________________________ Round Number: _______ [1] Company Name [2] Share Price at Start of Round [3] Number of Shares Buying [4] Total Cost (Share Price x Number of Shares) [5] Cash Used if Buying on Margin with 10% down (Total Cost x 0.10) [2] x [3] [4] x 0.10 [6] Money Borrowed if Buying on Margin (Total Cost x 0.90) [7] Share Price at End of Round [4] x 0.90 If buying on margin, just work out your Total Cash Used by multiplying your Total Cost by 0.10 If buying on margin, just work out your Total Money Borrowed by multiplying your Total Cost by 0.90 Totals: Calculating Personal Net Worth at End of Round: Cash Leftover After Stock Purchases* Add Total Value of Stocks at End of Round Subtract Money Borrowed Net Worth: * Equals Net Worth at Start of Round subtract Cash Invested (If you did not buy on the margin, Cash Invested = Total Cost [4]; if you did buy on the margin, Cash Invested = Cash Used [5].) [8] Value of Stocks at End of Round [3] x [7] BLM #5 Radio Company of Canada (RCC) Stock analysts are saying the future is bright for this company. As radio’s popularity continues to grow — radio programming now going as late as midnight in the big cities — so should the fortunes of this company and its stockholders. Real McCoy Automobiles Stock analysts have been excited by the company’s spiffy new model, but hope it will be better named than the company’s previous flop, the Windbreaker. The new model’s designers are bragging about the smoothness of its manual crank starter, which the marketing department is saying will make the cars great struggle buggies! Papier Pulp and Paper A darling of Bay Street, investors have been keen to buy stock in this company as newspaper circulation continues to increase. People can’t seem to get over the convenience of getting their news daily, especially during hockey season since American teams have joined the NHL. Ritzy Glitzy Movie Theatres Stock analysts are predicting that film fans will appreciate the swanky lobbies and plush seating of this expanding cinema chain. With the company’s promise to provide top rate musical accompaniment for Hollywood’s latest releases, investors have been swooning for this stock almost as much as moviegoers have been for Canada’s own Mary Pickford. Albertan Oil and Gas Drilling Co. Sure the supply of oil is plentiful, but the demand for it keeps on growing. More and more people are buying cars — they’re not just play things for the rich anymore! And now oil and gas is being used for heating and cooking too. This company’s share price is sure to go sky high with the next gusher they hit. BLM #6 Starting Prices COMPANY RCC Real McCoy Papier Ritzy Glitzy Albertan Oil & Gas LAST ROUND SHARE PRICE CURRENT PRICE ------------------------------------ $70 $14 $11 $21 $27 Round 1 COMPANY RCC Real McCoy Papier Ritzy Glitzy Albertan Oil & Gas LAST ROUND SHARE PRICE CURRENT PRICE $70 $14 $11 $21 $27 $95 $26 $20 $30 $45 BLM #7 Round 2 COMPANY RCC Real McCoy Papier Ritzy Glitzy Albertan Oil & Gas LAST ROUND SHARE PRICE CURRENT PRICE $95 $26 $20 $30 $45 $155 $39 $30 $49 $57 Round 3 COMPANY RCC Real McCoy Papier Ritzy Glitzy Albertan Oil & Gas LAST ROUND SHARE PRICE CURRENT PRICE $155 $39 $30 $49 $57 $280 $51 $52 $82 $116 BLM #8 Round 4 COMPANY RCC Real McCoy Papier Ritzy Glitzy Albertan Oil & Gas LAST ROUND SHARE PRICE CURRENT PRICE $280 $51 $52 $82 $116 $250 $41 $35 $72 $77 Round 5 COMPANY RCC Real McCoy Papier Ritzy Glitzy Albertan Oil & Gas LAST ROUND SHARE PRICE CURRENT PRICE $250 $41 $35 $72 $77 $265 $47 $41 $78 $82 BLM #9 Final Round — The Crash COMPANY RCC Real McCoy Papier Ritzy Glitzy Albertan Oil & Gas LAST ROUND SHARE PRICE CURRENT PRICE $265 $47 $41 $78 $82 $27 $4 $2 $9 $8 BLM #10 source: “October 29.” On This Day. New York Times. 30 Oct. 1929. Web. 1 Aug. 2011. BLM #11 Stocks Collapse In 16,410,030-share Day, But Rally At Close Cheers Brokers; Bankers Optimistic, To Continue Aid CLOSING RALLY VIGOROUS Leading Issues Regain From 4 to 14 Points in 15 Minutes INVESTMENT TRUSTS BUY Large Blocks Thrown on Market at Opening Start Third Break of Week. BIG TRADERS HARDEST HIT Bankers Believe Liquidation Now Has Run Its Course and Advise Purchases Stock prices virtually collapsed yesterday, swept downward with gigantic losses in the most disastrous trading day in the stock market's history. Billions of dollars in open market values were wiped out as prices crumbled under the pressure of liquidation of securities which had to be sold at any price. There was an impressive rally just at the close, which brought many leading stocks back from 4 to 14 points from their lowest points of the day. From every point of view, in the extent of losses sustained, in total turnover, in the number of speculators wiped out, the day was the most disastrous in Wall Street's history. Hysteria swept the country and stocks went overboard for just what they would bring at forced sale. Efforts to estimate yesterday's market losses in dollars are futile because of the vast number of securities quoted over the counter and on out-of-town exchanges on which no calculations are possible. However, it was estimated that 880 issues, on the New York Stock Exchange, lost between $8,000,000,000 and $9,000,000,000 yesterday. Added to that loss is to be reckoned the depreciation on issues on the Curb Market, in the over the counter market and on other exchanges… source: “October 29.” On This Day. New York Times. 30 Oct. 1929. Web. 1 Aug. 2011. BLM #12 Read the article below and fill in the What Report template that follows. Black Tuesday — The Stock Market Crash of 1929 In the late 1920s, Canada’s economy and stock exchanges were booming. From 1921 to the autumn of 1929, the level of stock prices increased more than three times. But these heady days came to a swift end with the stock market crash on Black Tuesday, October 29, 1929, in New York, Toronto, Montreal and other financial centres in the world. Shareholders panicked and sold their stock for whatever they could get. Overnight, individuals and companies were ruined. It was estimated that Canadian stocks lost a total value of $5 billion on paper in 1929. By mid-1930, the value of stocks for the 50 leading Canadian companies had fallen by over 50% from their peaks in 1929. The stock market collapse affected all investors—individuals who had been persuaded to buy shares as well as speculators looking to make a fast dollar… Although the crash was sudden and deep, there were signs that it was coming. Earlier in 1929, stock prices had been volatile. Economic slowdowns in May and June hinted that the booming economy was heading for a recession. Export earnings were declining and the price of wheat plummeted. Economists and historians are still debating what caused the crash... Banks gave out easy and cheap credit, and let people buy stocks on margin: buyers paid only a fraction of the share price and borrowed the rest. Speculation was rampant: bidding drove up the value of stocks as much as 40 times the companies’ annual earnings. Investors seemed to pay less attention to corporate earnings than to how much their shares would appreciate in value. The economy could not sustain its rapid growth and the bubble burst. Investors lost confidence in the market… It is widely felt that the stock market collapse started a chain of events that plunged Canada and the Western world into the decade-long Great Depression… source: “1929 – Stock Market Crash.” Key Economic Events. Government of Canada, 1 May 2002. Web. 21 Jan. 2004. What? (Give the article’s key points of information.) So What? (Identify how the article’s information might be important.) What lessons are to be learned? Are the historical Now What? (events studied similar to more recent events? Explain.) BLM #13 Name: _________________________ Avoiding a Personal Credit Crisis Not only did investors get into debt troubles in the 1920s, so too did many consumers. Borrowing money to pay for goods became much more widespread in the decade, especially with new consumer goods becoming available and their prices becoming more affordable. Radios, washing machines, record players, and even cars could be bought on credit. As the economy seemed to just be getting better and better, many gave little thought to the debt troubles they could get into with such borrowing — troubles that could have serious consequences for both individuals and society as a whole if there was any kind of hiccup in economic growth. This task asks you to think about the risks and dangers of debt. Nine strategies for avoiding a personal credit crisis are provided below. You are to choose ONE of them you believe to be effective, and present this strategy in a present day setting using your critical and creative thinking skills in ONE of the following formats: 1) a newspaper advice column, OR 2) a poster with paragraph explanation, OR 3) a comic strip. Nine Strategies For Avoiding a Personal Credit Crisis 1. Have a budget, and stick to it. 2. Borrow only what you can afford to pay back. 3. Always pay with cash or a debit card — not a credit card. 4. Avoid impulse purchases. 5. Remember that “Don’t Pay a Cent” promotions mean that you’ll have to pay later. 6. Pay yourself first — save a designated amount every paycheque. 7. Have one credit card and pay it monthly. 8. Avoid borrowing from family or friends with no fixed due date. 9. a strategy of your own choosing, with teacher approval Criteria Thinking Critical and Creative Thinking Communication Clarity and persuasiveness of expression, including proper use of language conventions and clear message Level R (<50%) Level 1 (50-59%) Level 2 (60-69%) Thinking My assignment My assignment My assignment demonstrates demonstrates demonstrates insufficient limited some effectiveness in effectiveness in effectiveness in using critical using critical using critical and creative and creative and creative thinking in thinking in thinking in presenting a presenting a presenting a strategy for strategy for strategy for personal personal personal financial financial financial management. management. management. Communication I communicated I communicated I communicated my ideas with my ideas with my ideas with insufficient limited clarity some clarity and clarity and and persuasiveness persuasiveness. persuasiveness about the about the dangers of debt. dangers of debt. Level 3 (70-79%) Level 4 (80-100%) My assignment demonstrates considerable effectiveness in using critical and creative thinking in presenting a strategy for personal financial management. My assignment demonstrates insightful effectiveness in using critical and creative thinking in presenting a strategy for personal financial management. I communicated my ideas with considerable clarity and persuasiveness about the dangers of debt. I communicated my ideas with a high degree of clarity and persuasiveness about the dangers of debt. BLM #14 Peer Assessment Checklist Peer Reviewer: __________________________ YES NO 1. The strategy presented is one from the assignment list. 2. The strategy is presented in the setting of the world today. 3. The assignment format is one of the three provided on the assignment sheet. 4. The assignment makes a clear link been between the strategy and avoiding a personal credit crisis. 5. The strategy is presented in a way that makes sense to me. 6. I have found none/few/some/many spelling and grammar errors, and those I have found I have circled for correction. 7. How well does the assignment explain the strategy? Is any example given to help with the explanation? 8. Identify one way the strategy has been presented creatively (e.g., use of colour, humour, drawing, phrasing). 9. Are there any other suggestions you can make to improve the final product? Self-Assessment Checklist Name: __________________________ YES NO 1. The strategy presented is one from the assignment list. 2. The strategy is presented in the setting of the world today. 3. The assignment format is one of the three provided on the assignment sheet. 4. The assignment makes a clear link been between the strategy and avoiding a personal credit crisis. 5. The strategy is presented in a way that makes sense to me. 6. I have found none/few/some/many spelling and grammar errors, and those I have found I have circled for correction. 7. How well does the assignment explain the strategy? Is any example given to help with the explanation? 8. Identify one way the strategy has been presented creatively (e.g., use of colour, humour, drawing, phrasing). 9. Are there any other suggestions you can make to improve the final product?