Document

advertisement

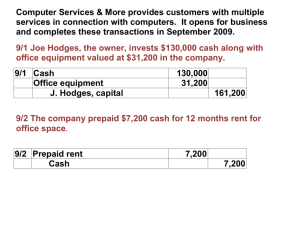

Ok. So what’s the scoop. The first steps of the accounting cycle reflect the ways that accountants go about the recording and accumulating of data. Once that data is captured, the financial accountant goes on to prepare financial statements for issuance to external users. Management may have different informational needs and the accumulated accounting information may be viewed and massaged from a different perspective. The basic example we have been looking at reflects a minimum number of transactions that impact each of the major accounts that we want to make sure we understand at this point: assets, liabilities, owners’ equity (owner investments and owner withdrawals), revenues, and expenses. Plus the example presents two of the basic financial statements: the income statement and balance sheet. Although all the steps of the accounting cycle are presented, we have focused on the initial data capture stage – recording transactions. In fact, we have gone through a number of iterations simply to get to the preferred format – recording transaction in the general journal by means of a general journal entry. At this point, you should have a clear understanding of the material presented in the four PowerPoint presentations concerning the accounting cycle. I want to go back now and address a gap that we had in this example – that is – the preparation of financial statements from the trial balance. Just think, the trial balance represents every financial item we have been keeping track of the entire accounting period and the ending dollar amount to be reported for the item. In some cases (assets, liabilities, capital), the account balance represents the amount the company should report each it as of the end of the year. (How much cash the company has on Dec 31, the amount of debts it owes on Dec 31, and the net worth of the owner.) Some accounts (revenues and expenses) report the dollar amount of something for the entire years. (The total revenues from fees earned for the year or the total amount of utilities expense for the year.) An even though the accountant has recorded every transaction exactly right – the right account title and the correct dollar amount – it is very possible/probable that the amounts reported in the trial balance need to be adjusted (updated) prior to begin reported on the financial statements. Consider the following examples. (I think it may facilitate your understanding if you always look at a transaction from the perspective of being the owner of the business who does his/her own accounting work.) On January 1, your company pays $2,400 to rent a building for the next two years to store your equipment. From an accounting perspective, what just happened? A transaction occurred that results in an impact on at least two accounts. In this case, your company now has the right to use this building for the next two years and also now has less cash. Because assets are defined as “all rights and properties owned by the business” or “probable future economic benefits”, you now have an asset that you could appropriately call “the right to use the building,” “building rights,” or any other title that conveys the economic item that you are keeping track of – in this case we usually call it something like PREPAID RENT. And, obviously your company has less assets in the form of cash. The entry to record the transaction would be: Debit Credit Prepaid Rent Cash $2,400 $2,400 Remember – accounts increase on the side in which they appear in the accounting equation. A = L + C. Therefore assets increase on the left or debit side of the account and logically would decrease on the other side of the account – the right or credit side. If you posted this transaction to the accounts in the ledger, prepaid rent would be increased by $2,400 (debit) and cash would decrease by that amount (credit), and this is exactly right. The company does have the right to use the building for 2 years and the monetary value assigned to this right is the cost of $2,400. And again, if you spent some cash, the cash account should certainly be decreased by the amount of cash that is gone. PERFECT. Perfect that is on Jan 1 when the building was rented, the money was paid, and the transaction was recorded. But what about on Dec 31, the last day of the accounting period when the company is getting ready to prepare financial statements to report the results of transactions for the year? Because the ledger contains a debit of $2,400 to prepaid rent – the trial balance would also show prepaid rent at $2,400 (the monetary value that was assigned to a two year right to use the building even though now on Dec 31, the right to use the building is only one more year? Is it now correct to report Prepaid Rent of $2,400? On Dec 31, and the end of year one – as of this point in time – the company now only has the right to use the building for 1 more year, which logically should report a monetary value of one half the two year right, or $1200. So what do we need to do? Prior to preparing the financial statements we need to adjust the numbers so that we report two things that have happened to the business. WE HAVE USED UP THE RIGHT TO USE THE BUILDING FOR THE ONE YEAR THAT JUST PASSED. First, we need to reduce the dollar amount reported for prepaid rent so that it reflects the monetary right assigned to using the building for the next one year, or $1,200. And with double entry bookkeeping, at least two accounts have to change when a transaction is being recorded. So what else changed? Think about the accounting equation: an asset “prepaid rent” is being decreased. What else changes in the financial position? Did any other assets change? That is, does the company have any other right that increased because of the decrease in building use for one year? Or did it have any other decreases in any other assets because of this? I can’t think of any. So, what about Liabilities? Does using a building increase the amount you owe the bank or anyone else? I don’t see how. So what’s left? Owner’s equity. If you decrease assets and you need to adjust owner’s equity, it must have decreases also to keep the equation equal. And why does owner’s equity decrease? Basically two ways, the owner takes money out of the business for personal use or an expense. This certainly isn’t an owner’s withdrawal, so it must an expense. The definition of an expense is basically the using up of the company’s assets to operate the business. THEREFORE, rent expense for the period has increased and prepaid rent has decreased. Rent Expense decreases owner’s equity which decreases as a debit. Prepaid rent (an asset) decreases as a credit. So the adjusting entry is Rent Expense Prepaid Rent 1,200 1,200 It we posted that entry and balanced the accounts, where would we be? Prepaid rent would now have a debit balance of $1,200 (the monetary value appropriate for the right to use the building for one more year) and rent expense would report a debit balance of $1,200 (the value of the asset “Prepaid Rent” that the company used up this year). Prepaid Rent (+$2,400 - $1,200 = $1,200) Rent Expense (+$1,200 = $1,200) Cash (-$2,400) Is this right? Did the company decrease cash by $2,400? Yes. Does $1,200 of this amount go for rent expense for the first year? Yes. And does $1,200 still represent the right to use the building for one more year – an asset? Yes. This is just an example of one type of adjustment that may be required. The accountant probably needs to make an adjusting entry in six different cases. That is, if any of the following types of accounts/transactions exist in the unadjusted trial balance, there is a distinct possibility that an adjusting entry is necessary. Deferred Expenses (Prepaid Expenses) Deferred Revenues (Unearned Revenues) Accrued Expenses Accrued Revenues Valuation Accounts Income Tax Expense