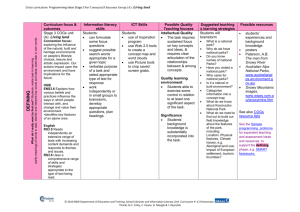

BP-3 Assignment 7

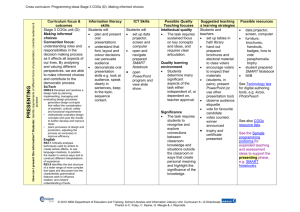

advertisement

RENAISSANCE ENTREPRENEURSHIP CENTER The Business Planning Class ASSIGNMENT SEVEN A Simple Annual Projection By Paul Terry Name: ________________________________ Due: See Assignment Schedule The following are examples of how to calculate an annual sales projection for your start-up or expanding business by simply starting with what you want to make in the next year. The first example is for a service business The second example is for a product business. Pick the one most appropriate for you. (Note: We have not included taxes or investment needed as start-up or expansion cost.) Example One: A Service Business 1. 2. 3. 4. 5. In my first or next year, I want to make Estimated annual overhead (e.g., $1500/month x 12 months) Total estimated sales needed for first/next year (#1 + #2) Average amount per month (#3 divided by 12) Estimated rate is $40 per hour. (You would research appropriate billable rate) 30,000 18,000 48,000 4,000 Calculations: 6. At $40 per hour, the number of billable hours needed per month is 100 hours. (This is step #4 divided by step #5 or $4,000/$40 = 100 hours) 7. If we estimate 20 business days per month, then the number of billable hours needed per day is 5. (100 hours divided by 20 days) Comment: To make the above projection work, this business must bill an average of 5 hours per work day to generate $48,000 in sales. Can this be done? Your Service Business: (YOU DO THIS ONE IF YOU ARE A SERVICE BUSINESS.) 1. 2. 3. 4. 5. In my first or next year, I want to make Estimated annual overhead (e.g.,$ __________x 12) Total estimated sales for first/next year (Line#1 + Line #2) Average amount per month (Line #3 divided by 12) My estimated hourly rate is _______. (Your choice to estimate) __________ __________ __________ __________ Calculations: 6. At $____/hour (see amount chosen for line 5 above), average number of billable hours needed per month will equal ______ hours. (#4 divided by #5) 7. At _____ days/mo, average number of billable hours needed/day will equal ___________ (#6 divided by # of days) Question: Can your business bill _____ hours per work day? If not, what alternatives do you have in changing the billable rates or number of hours, lowering the overhead or reducing draw and increasing sales? Response: ______________________________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ 1 of 3 Example Two: A Product Business Step One: 1. First, you need to calculate your estimated gross profit (or gross profit margin) A. You estimate you want to make a net profit (available for draw) of: $ 36,000 B. You estimate an annual overhead: (estimate $2,000/mo x 12 mo) 24,000 C. Therefore, estimated gross profit is: (add #1 + #2): $ 60,000 Step Two: 2. Next, choose an estimated cost of goods sold (COGS) for your business. Cost of goods sold is estimated by owner based on experience, competition or industry standards. For example, here we assumed COGS of 40%. A. Choose the COGS %: (For example, based on our research and experience, we chose 40%) B. Calculate Gross Profit %: (To review, 100% - COGS % = Gross Profit %). So 100% - 40% =60% or 60/100 or .60 (converted to a decimal). C. Determine COGS in dollars as follows: COGS% divided by GP% x GP in dollars = COGS in $ (For example: .40/.60 x $60,000 =$40,000). Therefore the COGS in dollars is $ 40,000 Step Three: 3. Finally, calculate annual sales in dollars: To determine Annual Sales required: Gross Profit$ + COGS$ = Annual Sales in dollars. So, ($60,000 + $40,000 = $100,000). Total Sales is $100,000 4. Average amount of sales per month (#3 divided by 12) = $ 8,300 5. We set the unit price at $5/unit; then the number of units needed per month is $8,300/$5 = 1660 units. 6. In 20 workdays/month, estimated number of units needed per day is 1660 units/20 days = 84 units Question: Can you sell 84 units per day at an average price of $5 per unit? If not, you need to recalculate and change estimated profit, overhead or cost of goods sold percentage estimate to make your business profitable (based on the above assumptions). You may also need to change the price of the units of sale. 2 of 3 Your Product Business: (YOU DO THIS IF YOU ARE A PRODUCT BUSINESS) Step One: 1. You need to calculate your gross profit A. In my first or next year, I want to make a net profit of: B. Estimate for annual overhead (e.g.,$ __________/month x 12) C. Total estimate needed for gross profit (add Line #1 + Line #2) _________ _________ _________ Step Two: 2. Next, is to estimate for COGS. A. Your research estimates COGS at ____% . (Fill in your guess or industry average here.) B. Therefore, we can calculate your GP% by subtracting COGS% from Total Sales (TS% - COGS% = GP%) For example, 100% - 30% = 70% C. Now you can determine COGS in dollars: COGS%/GP% x GP in dollars = COGS in $. (.30/.70 x GP$ = COGS in dollars) Cost of Goods Sold in Dollars (as estimated above) __________ Step Three: 3. To calculate Annual sales required, add the amount of gross profit to the amount for cost of goods sold. This should equal Total Sales in dollars. Total Sales in Dollars __________ 4. To get average amount of sales per month, divide by 12. __________ 5. At your estimate $___ per unit, the number of units needed per month is = __________ (sales/month divided by $ per unit) 6. At _____ days per month, number of units needed per day = __________ Question: Can you sell _____ units per day? If not, you need to recalculate and change estimated net profit, overhead or cost of goods sold percentage estimate. Response: __________________________________________________________________________________ __________________________________________________________________________________ __________________________________________________________________________________ 3 of 3

![[Name of Business]](http://s2.studylib.net/store/data/005439490_1-eb485795b6ab94ac46e88cc0426770e1-300x300.png)