Sample Action Plan on Driving with Materials

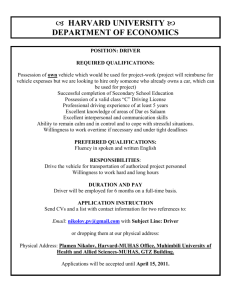

advertisement

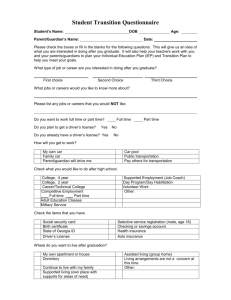

PLAN FOR SELF-ADVOCACY TRAINING Name of self-advocacy group: _______________________________ Topic self-advocacy group is working on: DRIVING IN CALIFORNIA PART 1. KNOWLEDGE SECTION What knowledge (information) did the self-advocacy group members identify that they want to learn about this topic? Group members said they want to find out about how to get a driver’s license, how to get car insurance and ways to get enough money to afford a car and driving expenses. What did the self-advocacy group members say they wanted to do with the information that they learn? The group members said they want to be able to buy and drive a car so that they have more independence and have more reliable transportation to get to work or school. SUB-TOPIC: WHAT TO KNOW AND WHAT TO DO Week 1: HOW TO GET A DRIVER’S LICENSE Method: Reading, discussion Materials: Flipchart/Handout: “How to Get a Driver’s License” Week 2: GETTING BEHIND THE WHEEL Method: Reading, Discussion Materials: Flipchart/Handout: “Preparing for the Driver’s Test” Week 3: GETTING BEHIND THE WHEEL Method: Discussion Materials: “Once you’ve Passed your Driver’s Test” Week 4: COSTS OF DRIVING A CAR Method: Discussion Materials: “Buying a Car - What to Look for When Buying a Car” Week 5: COSTS OF DRIVING A CAR Methods: Discussion Materials: Flipchart/Handout: “Car Insurance and Registration” Week 6: COSTS OF DRIVING A CAR Method: Discussion Materials: Flipchart/Handout: “Affording Gas and Car Maintenance” Week 7: HOW TO AFFORD A CAR Method: Discussion Materials: Flipchart/Handout: “How to Raise Money” and “Advocacy Project Worksheet and Sample Letter – How to Request Donations” *Note: The Group can choose to spend more time with the materials on Requesting Donations if they would like. Week 8: GETTING CAR INSURANCE Method: Discussion Materials: Flipchart/Worksheet: “Insurance Requirements and Shopping Around” Week 9: GETTING CAR INSURANCE Method: Discussion Materials: Flipchart/Worksheet: “How to get Affordable Car Insurance” Week 10: REVIEW AND THINGS TO REMEMBER Method: Discussion Materials: Flipchart/Handout: “Things to Remember While Driving” Week 11: GROUP EVALUATION Method: Discussion Materials: Flipchart/Evaluation Worksheet SO YOU WANT TO DRIVE IN CALIFORNIA? WHAT TO KNOW AND WHAT TO DO I. HOW TO GET A DRIVER’S LICENSE A) Take a Driver’s Education Course 1) 30 hours of instruction 2) Through School, a Certified Private Agency or Online 3) Approximately $70 B) Apply for Learner’s permit 1) Make an appointment at DMV 2) Bring necessary documents – Original Driver’s License application form (Form DL 44), Birth Certificate, Social Security number 3) $29 Application Fee 4) Thumbprint 5) Photo 6) Vision exam C) Study and Take Written Test 1) Must answer at least 39 out of 46 questions correctly 2) If you don’t pass, you can take the test up to 3 times, at least 7 days in-between tests 3) If you don’t pass after 3 tries, you must start the application process over again 4) Receive a DMV-approved certificate D) Driving Test 1) If under 17 ½ years old, must take a DMVapproved Driver’s Training course (6 hours instruction behind the wheel, not more than 2 hours at a time) 2) Practice Driving an additional 50 hours in the next 6 months (10 hours must be at night) with parent or adult over 25 years old E) Provisional Driver’s License 1) After passing the Driver’s Test and driving for 6 months with Learner’s Permit 2) If under 18, you must be accompanied by an adult over 25 while: - Driving between 11pm and 5am (for the first 12 months or until you turn 18) - Driving with any passengers younger than 20 years old (for the first 12 months or until you turn 18) II. COSTS OF DRIVING A CAR A) Buying a Car: 1) New or Used (approximately $2,500-$30,000) 2) Payment: - Down Payment - Monthly Car Loan Payments or One-Time Payment - Warranty or “As Is?” B) Vehicle Registration: 1) How Old is the Car? 2) Gets cheaper every year with same car 2) Estimated Average from $40 – $300 per year C) Car Insurance (Based on Various Factors): 1) Insurance Company 2) Age 3) Driving Record 4) Good Student Grades 5) Multiple Insurance Policies with the Same Company 6) Monthly Payments or every 6 – 12 months at a time D) Affording Gas 1) Plan a Budget and Figure out Expenses - Hard to Budget as Prices continue to Increase - How Far do you Drive? - How much Gas will you need Per Week? Per Month? - Average Miles per Gallon 2) Know Where and When to Get Gas - Know where the Cheaper Gas Stations are - Cash or Credit? - Get Gas in the Mornings or When it’s Cooler - Put the Automatic Filler on Lowest Setting 3) Carpool and Share Gas Costs E) Car Maintenance 1) 2) 3) 4) Regular Maintenance Unexpected Repairs Budget approximately $50 per month Ask around for a Good Mechanic III. HOW TO AFFORD A CAR A) Raising Money: 1) Job and Monthly Savings 2) Small business venture (i.e. recycling, dogwalking or sitting, etc.) 3) If on SSI – get a PASS Plan 4) Fundraiser – Car Wash, Raffles, etc. 5) Write and Send out a Letter Requesting Donations (see materials on “How to Write a Request for Donations Letter”) 6) Car Loan or Other Loan B) Know What You’re Looking For - Price Range - Price Negotiation? - Mileage - Miles per Gallon C) Look for a Good Deal 1) Car Donations from Local Charities 2) Sales at Car Dealers 3) Buy a Used Car: - Pre-owned Vehicle from Dealer (such as CarMax) or Private Owner) - Warranty? - Maintenance History 4) Bring Someone who Knows about Cars IV. GETTING CAR REGISTRATION AND INSURANCE A) Registration 1) Get Pink Slip 2) Go to DMV 3) Pay Registration Fee 4) Make sure to Put Sticker on License Plate 5) Renew each Year B) Car Insurance 1) Minimum California Insurance Requirements (15/30/5) - $15,000 for Injury of Death of One Person - $30,000 for Injury or Death of more than one Person - $5,000 for Damage to Other Person’s Car or Property 2) Look for Different Insurance Companies - Online, Phone Book, Newspaper, etc. - Ask Around - Call Several Different Insurance Companies 3) Get Insurance Quotes - Compare Prices and Coverage - Driver Discounts (Good Grades, Good Driving Record, have Other Insurance Policies, such as Renter’s Insurance, with Same Insurance Company) - Negotiate with Companies V. YOU’RE ON YOUR WAY! A) Always Carry your Driver’s License and a Copy of your Insurance B) Renew your Vehicle Registration Every Year C) Do Regular Car Maintenance D) Budget your Expenses E) Drive Responsibly F) Have Fun! HOW TO GET A DRIVER’S LICENSE To apply for a Provisional Permit, you will need the following: 1. Be at least 15 ½, but under 18 years of age 2. Visit a DMV office (make an appointment for faster service) 3. Complete the application form DL 44 (An original DL 44 form must be submitted. Copies will not be accepted.) 4. Have your parents’ or guardians’ signatures on the application form DL 44 5. Give a thumb print and Have your picture taken 6. Provide your social security number. It will be verified with the Social Security Administration while you are in the office. 7. Verify your birth date and legal presence and full name (bring a copy of your birth certificate) 8. Submit the proper form(s) for driver education and/or driver training classes (See below for details.) 9. Pay the application fee (This fee entitles you to three exams of any type within the 12-month period and pays for both the instruction permit and the driver license. If all requirements are not met within the 12-month period, the application becomes void and all steps must be completed again.) 10. Pass a vision exam 11. Pass a traffic laws and sign test. There are 46 questions on the test. A passing score is at least 39 correct answers. You have three chances to pass the test. If you fail, you must wait 7 days before taking it again. *Note: To allow you sufficient time for testing DMV will not be administering written or audio exams after 4:30 p.m. **Note: If you are over 18 years old, you must go through the same process. Week 2 GETTING BEHIND THE WHEEL 1) PREPARING FOR THE DRIVER’S TEST If you are 15 ½ to 17 ½ years of age, you will need to Provide Proof that you: Completed driver education (Form DL 387 or OL 237) and are taking driver training (DL 392 or OL 392) OR Completed driver education and driver training (DL 387, DL 388, DL 388A, OL 237, or OL 238). OR Are enrolled and participating in an approved integrated driver education/driver training program (DL 400). *Note: If you are over 17 ½ but under 18 years of age, you may get your permit without the driver education and driver training certificates; however, you will not be able to take the driving test until you turn 18. 2) Driver Education and Driver’s Training You may take driver education (classroom training) or driver training (behind-the-wheel) in a public or private high school, or in a state licensed, professional driving school. Driver Education and Driver Training courses must be conducted as prescribed by the Department of Education. Driver Education must consist of at least 30 hours or 2 1/2 semester periods of professional classroom instruction. Driver training must consist of at least six hours of behind-the-wheel professional instruction. Professional schools and instructors in California are licensed by the DMV. Schools must carry liability insurance, be bonded, and maintain complete records for DMV inspection. Their teaching cars are subject to inspection every 6 months. Instructors must pass qualifying examinations every three years, or show proof of continuing education in traffic safety. *Note: If driver education and driver training were taken in a state other than California, DMV will accept either a To Secondary Schools Other Than California Schools form DL 33 completed by the out-of state school, or a letter on the out-of state school’s stationery signed by a school official stating that the courses are equivalent to California’s requirements. Instructional permits issued by another state are not acceptable proof. 3) Before being eligible to take your driving test you must: Be 16 years old AND Have held your permit for a minimum of six months AND Have completed driver education AND Have completed 6 hours of professional driver training AND Have completed 50 hours of practice with an adult 25 years or older. The adult must have a valid California driver license and certify to the 50 hours of practice. At least 10 of the 50 hours must have been done at night. It is illegal for you to drive alone at any time. *Note: If you are over 18 years old, the adult who rides with you only needs to be over 18 years old. 4) To take your driving test, you will need to: Make a driving test appointment. (Driving tests are not given without an appointment.) You may also call 1-800777-0133 between the hours of 8 a.m. and 5 p.m. Monday-Friday, to make a driving test appointment. *Note: If you fail your driving test, you must wait two weeks before you can take the test again. You have three chances to pass. Provide proof of financial responsibility *Note: When parents or guardians sign for a minor to get a driver license, they are stating that they will accept financial responsibility for that minor. Week 3 GETTING BEHIND THE WHEEL 1) ONCE YOU PASSED THE DRIVER’S TEST After you pass your driving test, you can get an Interim License: A minor’s application for a driver license must have the signatures of: - Both parents, if the parents are California residents and have joint custody, or - Both parents, if divorced, with joint custody, or - One parent, if that parent has custody, or - Guardians of the minor, if neither parent is living or has custody, or - The person(s) having actual full and complete custody, if no legal guardian is appointed. *Note: Nonresident parents cannot sign the application form and cannot accept liability for a minor in California. Nonresident military parents stationed and living in California can sign the application form and accept liability for a minor. Evidence of financial responsibility must be carried at all times in the vehicle. Most Californians maintain financial responsibility through insurance companies, which provide the policy holder with an identification card to be used as evidence of coverage. The card must state the insurance company’s name and address, the period of coverage, and policy number. Financial responsibility in California requires that drivers and vehicle owners carry the following minimum monetary limits: - $15,000 for injury or death of 1 person per accident - $30,000 for injury or death of 2 or more persons per accident - $5,000 for any property damage per accident You will be issued an interim license valid for 60 days until you receive your new photo license in the mail. Check your address before you leave DMV and tell the DMV representative if you have moved or if your address is incorrect. If you have not received your license after 60 days, call 1800-777-0133 to check on the status. Have your interim license with you to provide information when requested. When you turn 18 years of age, the provisional part of your license ends. You may continue to drive as an adult using your photo license, which will expire on your 5th birthday after the date you applied. 2) Provisional Driver License Restrictions Effective January 1, 2006, persons under age 18 must be accompanied by a parent/guardian or other person specified by law when: Transporting passengers under 20 years of age, at any time for the first twelve months. Driving between the hours of 11:00 PM and 5:00 AM for the first twelve months Week 4 COSTS OF DRIVING A CAR I. Buying a Car – What to Look For Buying a car is a big responsibility and a big decision. You may want to do some research and consult the “Consumer Reports” to see what different cars offer in terms of gas mileage, price, accessories, safety, etc. You can usually get a copy at your local library. Some of the things you may want to think about and look for before you buy a car are the following: New or Used? - Do you want to buy a New or Used Car? Buying a used car is usually a lot less expensive and is a wise decision if you don’t have a lot of money. However, used cars may not have all the same safety features that new cars have, so you may want to spend more money for a safer car that you like. - If you buy a new car, usually you will pay a down payment, which is a lump sum you pay at the time you purchase the car. Then you can usually get a car loan to help you pay for the car, depending on your credit. If you get a loan, you will have to pay monthly car payments to keep your car. Private Owner or Car Dealer? - When you buy a new car from a car dealer, you will get a warranty for the car – the warranty is usually good for 5 years or 100,000 miles, whichever comes first. It is very important to have a warranty in case the car doesn’t work well or needs excessive repairs during that time. - If the car is from a car dealer and is pre-owned or used, you can usually still get a limited warranty, so ask the salesperson. This is one advantage to buying a used car from a dealer. - If you buy a used car from a private owner, you will probably not get a warranty, and the car will be sold to you “as is.” You may be able to shop around and find a better deal. But you also want to make sure the car is in good working order, so it’s important to have a good mechanic or someone you know take a good look at the car. Looking for a Good Deal - Look for charities to see if they might donate a car to someone like you who needs one. - Look for sales at car dealers for special discounts - Buy a used car if it’s in good shape Preparing to Buy - Know what your Price Range is before you go to purchase the car - Plan a strategy for negotiation. If you don’t know how to do this, ask a friend or family member who knows how to negotiate and how the process works. - If you want to avoid the negotiation process, go to a car dealer, like CarMax, that sets their prices so that there is not any price negotiation, and you’ll know what to expect and what you’ll spend. - If you’re buying a used car, ask about the car’s maintenance history and how much mileage is on the car. Cars with a lot of mileage should be less expensive, but then you risk that the car will not last as long. - Bring someone with you whom you trust and who knows about cars to help you. Week 5 COSTS OF DRIVING A CAR I. VEHICLE REGISTRATION Whenever you own a car, you have to get it registered with the Department of Motor Vehicles. You can make an appointment to go to the DMV to fill out a form and pay the vehicle registration fee Once you have paid, you will receive a temporary registration until you get the permanent one in the mail. Along with the registration card, you will receive a sticker with the month and year that you got the car registered. Remember to put the stickers on your rear license plate. You will need to renew your vehicle registration every year. In general, older cars tend to have less expensive registration fees. So, as you renew your registration each year with the same car, your registration fees will go down. Make sure to carry your proof of registration with you and place the registration tags on your license plate. If you don’t, you could get a ticket from a law enforcement officer that will require you to pay a penalty. II. CAR INSURANCE The cost of insurance will vary depending on various factors: Insurance Company – Different insurance companies will offer different rates, so that’s why it’s important to shop around and compare costs and coverage Age – Usually, drivers under 25 years old will have to pay more for their insurance Driving Record - If you establish a good driving record without any tickets for moving violations or speeding, then you will usually get a discount on your insurance rates Good Student Grades - People who are students can get better rates if they have good grades Monthly Payments versus every 6 – 12 months at a time – If you pay your insurance every 6-12 months instead of monthly, you can avoid extra charges Multiple Insurance Policies with the Same Company – If you happen to have other insurance policies with the same company, such as renter’s or home-owners insurance, then they will often offer a better rate Week 6 COSTS OF DRIVING A CAR I. AFFORDING GAS A) Plan a Budget With the cost of gas continuing to rise, it is difficult to know how much money you will need for gas and how to get the best deals. It will be important to plan a budget and figure out your expenses. How often do you drive? How far do you usually drive? What’s the average gas mileage of your car? Figure out how much gas you’ll need per week or per month B) How to Save on Gas Expenses Know When and Where to get the most gas for your money - Where are the cheaper gas stations? - Pay cash instead of credit - Get gas in the mornings when it’s cooler - Put the automatic filler on the lowest setting II. CAR MAINTENANCE Make sure to do regular maintenance on your car. This usually means an oil change every 5,000 miles and a major tune-up every 30,000 miles. This will increase the reliability and dependability of your car. Be prepared for unexpected repairs. Accidents can happen, and cars break down, so make sure you’ve budgeted and set some money aside for repairs when you need them. It’s suggested that you budget approximately $50 per month for car maintenance. Make sure to find a good mechanic. You can ask your friends or family for a good referral. Week 7 HOW TO RAISE MONEY TO BUY A CAR There are many different ways to get money to buy and drive a car. Some of these include the following: Get a part-time or full-time job and save some money Start a small business (i.e. recycling, dog-walking, etc.) If you’re on SSI, get a PASS Plan (Plan to Achieve Self Support). A PASS plan is for someone who has a specific goal, such as going back to school or getting a job, that will require certain expenses to reach that goal. For example, if you need to have a car to get to school or have a job, you can apply for a PASS plan, and they will allow you to put any money you earn toward your goal of buying a car, without taking any money from your monthly earnings. Have a Fundraiser (Car wash, raffles, etc.) Write and Send a Letter Requesting Donations (see attached materials) Apply for a loan or car loan ADVOCACY PROJECT WORKSHEET HOW TO REQUEST DONATIONS Goal: To obtain donations in the form of ______________ (i.e., money, food, 15 pre-paid cell phones, 5 computers, etc.) for the purpose of: _______________________________________________________ _______________________________________________________ _______________________________________________________ (i.e., purchasing phone cards, being able to go on the Internet, etc.). Plan for achieving this goal: Write and send letters to request donations from companies, organizations or agencies that you have identified who have been known to make charitable contributions. Steps toward achieving this goal: 1. Collect a list of names of people interested in being a part of this project. How many people have signed up? _______ 2. Does the group need a representative? If so, how will we decide on who will be our representative? Who will be the group’s representative? __________________________________________________ 3. Does everyone want to sign the letter, or just the group representative? ________________________________________________ 4. Where and how would you like to be contacted by the companies interested in making a donation? ____________________________________________ 5. Draft a donation letter (see sample donation letter attached). BE SPECIFIC about: The reason you are asking for the donation The amount you would like donated How you plan to use the donation How it will help you 6. Contact companies to find out who to send the letter to (ask for Charitable Contributions Department) Name of Company: _______________________________________________ Contact Person: _______________________________________________ Contact Information: _______________________________________________ 7. Add relevant names and fax #’s to each donation letter 8. Fax and/or mail the letters to the companies Follow-up plan: 1. How and when will we contact the companies? _____________________________________________________ _____________________________________________________ _____________________________________________________ 2. Who will contact them? __________________________________________________ 3. If successful, who will write the thank-you letter? ______________ (see sample “thank you” letter attached) 4. Who will be in charge of distributing or overseeing the donations? _______________________________________ Evaluate project: 1. Did we achieve our goal? __________ 2. What contributed to our success? __________________________________________________ __________________________________________________ __________________________________________________ __________________________________________________ __________________________________________________ 3. What were some obstacles or barriers to achieving this goal? __________________________________________________ __________________________________________________ __________________________________________________ 4. What were the most difficult steps toward achieving this goal? __________________________________________________ __________________________________________________ __________________________________________________ 5. Did the group work well together as a team? ___________ If not, why not? __________________________________________________ __________________________________________________ __________________________________________________ __________________________________________________ 6. Would we use the same strategy again in the future? __________________________________________________ If not, what would we do differently? __________________________________________________ __________________________________________________ __________________________________________________ __________________________________________________ 7. Would we like to further pursue this advocacy project, or start developing another? __________________________________________________ __________________________________________________ __________________________________________________ __________________________________________________ SAMPLE LETTER – Request for Donations Verizon Wireless 1234 First Avenue Los Angeles, CA 90010 May 20, 2008 To Whom it may Concern (or the specific name of the Contact person): [The reason you are asking for the donation] As a group of people with disabilities and/or restricted incomes, one of the main difficulties that we face when trying to find a permanent home or job is that potential landlords and/or employers are not able to contact us because we do not have a phone number or address where we can be reached. [The reason you are asking for this specific type of donation] Although there are other services available to help people with limited income and housing opportunities, most of them only provide temporary solutions to a problem that is persistent and difficult to change for the simple reason that potential employers and/or property managers have no way to contact us regarding housing and job opportunities that are available. [The amount you would like donated] While the opportunity to own a cell phone is not possible given our limited financial resources, we would like to ask if you would be willing to help us by contributing 15 pre-paid cell phones with 500 minutes of talk time that would provide us with a reasonable period of time to find housing and employment. [How you plan to use the donation] With the limited amount of talk time, we would be responsible for monitoring our own use of the cell phone. Also, with the option to purchase additional minutes, this would provide us an opportunity to maintain our financial independence once we get back on our feet so that we can become self-sufficient and active members in our communities. [How it will help you and others] We feel that your donation would be a great contribution toward resolving the serious problems of unemployment and homelessness by providing an important tool to help us successfully obtain permanent homes and jobs. We would really appreciate your consideration of our request. If you would like more information, or if you have any questions, please feel free to contact us at The Ventura Adult and Wellness Center, at (805) 653-5045, and ask for Peter L or Mary F. Sincerely, Representatives of the Advisory Board and Membership Council The Ventura Adult Wellness and Recovery Center Week 8 GETTING CAR INSURANCE I. CALIFORNIA CAR INSURANCE REQUIREMENTS A) Required Coverage The minimum liability insurance required in California for private passenger is: $15,000 for injury or death of one person $30,000 for injury or death of more than one person $5,000 for damage to property This is the absolute minimum you can get and still drive your car, and most people buy more coverage than this. Your insurer may recommend coverage in the range of 100/300/100. B) Proof of Coverage Proof of liability insurance must be in the vehicle at all times. If you're pulled over, the officer will ask to see your insurance card, and you'll be cited and fined if you can't produce it. The fines for not carrying proof of insurance can be steep―not less than $500 and possible court costs―and your vehicle could be impounded. II. Auto Insurance Coverages Explained An auto insurance policy actually consists of several different coverages. Required in most states, it is something all drivers must posses. Liability Insurance This coverage is the basis of all auto insurance policies, and the minimum required in most states. If you're found at fault in an accident, liability insurance pays for the injury and property damage expenses of the third party involved in the accident. Property damage pays for the replacement or repair of anything that was damaged. Bodily injury expenses cover lost wages and medical bills. If you cause a major accident, your current or potential coverage may not cover you sufficiently. It is a safe bet to buy more than the minimum required by your state. Collision If you're found at fault in an accident, collision coverage will cover expenses needed to repair your vehicle. Collision coverage is usually the most expensive component of an auto insurance policy, although it isn't required. Insurance companies might proclaim your car a “total loss” if the repairs exceed the market value of the car. When this occurs, the insurance company will pay you the actual cash value, minus the deductable. From there your car is off to an auction where it will be sold for parts or scrap. Replacement Cost The amount required to replace your car or repair damages without considering depreciation. Depreciation Decrease in value because of age/wear on vehicle. Actual Cash Value (ACV) The value of your car when it is damaged or destroyed. Insurance companies figure the ACV by subtracting the depreciation from the replacement cost. Tip In most cases, it’s better to choose replacement cost coverage. Although higher in price, the protection may be worth it. Comprehensive Comprehensive coverage will pay for damages to your vehicle that were not caused by an accident. This includes fire, vandalism, theft, natural disaster, and even animals. Depending on the damage, the insurance company will pay the cars worth right before the incident. This is also optional coverage. Week 9 GETTING CAR INSURANCE I. How to Get Affordable Auto Insurance ‘If it isn't broken, don't fix it' is a maxim that can make insurance companies a lot of money. Although everybody would like cheap car insurance, people tend to stick to the company that they are with rather than shop around for the lowest price for auto insurance. This can cost you hundreds of dollars a year. There are a number of ways of getting cheap auto insurance, regardless of your current company and driving status, by doing the following: Shop Around Check for Discounts Select a higher insurance deductible Reduce coverage on older vehicles A) Shop Around Only by shopping around for auto insurance coverage and getting quotes on premiums from several insurance companies will you be able to know for certain you are getting the lowest price for auto insurance. Be sure to compare like with like. Cheap car insurance should not mean little or no insurance, or bad insurance. Ask about how insurance claims are approved and processed, and how quickly they're paid. Look into each insurers' financial stability (there are independent rating services that can help you with this). B) Check for Discounts Insurance companies like market share, and in order to increase or maintain their market share, many companies offer discounts to drivers. You might be eligible for a discount if you have a good driving record or if you have taken a ‘Defensive Driver Training Program'. There may be discounts available for antitheft or other safety devices on the car. Most companies offer low mileage discounts. C) Select a higher insurance deductible When you file a claim, a deductible is the amount you pay first before your insurer pays the remaining balance. Often people select lower deductibles, so when they have to submit a claim, their out-of-pocket expenses are minimal. But the truth is, the higher your collision and comprehensive deductibles the lower your auto insurance premium. The savings by increasing your deductible to say $1,000 from $250 are significant—you can save hundreds of dollars off your insurance premium. D) Reduce coverage on older vehicles If your car is an older model, you may want to think about dropping the collision or comprehensive coverage (or both) on your policy. You need to weigh the cost of the collision and comprehensive against the value of your car and your chosen deductibles. For example, if you had a 10-year-old car that's worth about $1000, and your deductible was $1000, the coverage is not actually going to help you. This is one of the best means of getting cheap auto insurance. No matter how you are now insured or how much your premium costs, there are means of getting the lowest price for auto insurance. Check out you local insurance brokers. They will be able to find cheap car insurance by finding insurance companies that are a match to your strengths. Week 10 Review VI. HOW TO GET A DRIVER’S LICENSE A) Take a Driver’s Education Course B) Apply for Learner’s permit C) Study and Take Written Test D) Driving Test E) Provisional Driver’s License VII. COSTS OF DRIVING A CAR A) Buying a Car B) Vehicle Registration F) Car Insurance (Based on Various Factors) G) Affording Gas 1) Plan a Budget and Figure out Expenses 4) Know Where and When to Get Gas 5) Carpool and Share Gas Costs H) Car Maintenance VIII. HOW TO AFFORD A CAR A) Raising Money B) Know What You’re Looking For C) Look for a Good Deal IX. GETTING CAR REGISTRATION AND INSURANCE A) Look for Different Insurance Companies B) Get Insurance Quotes Things to Remember When Driving Always Carry your Driver’s License and a Copy of your Insurance and Registration Renew your Vehicle Registration Every Year Do Regular Car Maintenance Budget your Expenses Drive Responsibly Have Fun! Week 11 GROUP EVALUATION Did the group members learn what they wanted to learn from this topic? _______________________________________________________ _______________________________________________________ _______________________________________________________ _______________________________________________________ _______________________________________________________ _______________________________________________________ If not, what other information would group members like to have or discuss? _______________________________________________________ _______________________________________________________ _______________________________________________________ _______________________________________________________ _______________________________________________________ _______________________________________________________ What methods of training would the group members prefer? _______________________________________________________ _______________________________________________________ _______________________________________________________ _______________________________________________________ _______________________________________________________ _______________________________________________________ Are there any other suggestions for improving this training? _______________________________________________________________ _______________________________________________________________ _______________________________________________________________ _