Reserve Energy Consultation document by Castalia Group

advertisement

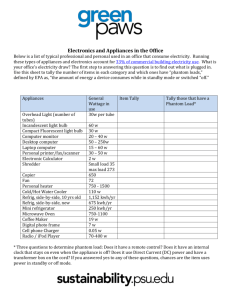

Submission: Reserve Energy Consultation document by Castalia Group Molly Melhuish, 11 April 2007 I fully support the Grey Power submission, and consider that the problem is not whether the status quo mechanism for contracting for reserve energy should be maintained. The problem is that the separation of “reserve energy” from the normal market place prevents an even-handed access to this highly valuable market, from large- and small-scale suppliers and from demand reduction. Questions: What marginal costs should be attributed to energy savings at various levels? The analysis of this referred to a “representative” consumer: this requires us to consider that over a large group of consumers, the aversion to shortage far, far outweighs the preference for a lower average power price. However there will be a group of consumers for whom the marginal cost of saving electricity will be on the order of 15c/kWh – this is taken from Consumer April 2007). These consumers use electric heating for convenience, and use their wood fires for ambience and extra warmth on particularly cold days. At the approach to a dry winter, such consumers could be invited (paid) to lay in a stock of firelogs (desirably, in bulk and therefore discounted from the retail price). They can then go through their winter’s stock of ordinary firewood as quickly as necessary to cut out all but a minimum of space heating. As firewood is replaced by poorly seasoned wood, at typically 5c/kWh, it can be supplemented by the dry firelogs, maintaining efficient burning throughout even a long dry winter. The difficulty of course is of timing: the high spot prices occur now many months before winter bites. Hence the need to contract in advance with domestic consumers. Any dual fuel system of low capital cost will be similarly available for dry year contracts – however domestic heating by LPG is not desirable as it leads to serious indoor air pollution . Bottled gas heating costs approximately 17c/kWh (MFE Warm Homes Technical Report, 2005). A market in dual fuel water heating could be developed, especially for large users including tourist establishments and dairy farms. LPG marginal costs would be similar, wood costs would be on the order of 5c/kWh as the burners would be able to use ordinary firewood (or chipped wood). Dual fuel systems using pellets would be less appropriate as capital costs of pellet burners are higher and pellets are bulkier to store, What are your views on the inferred optimal energy margin of between 12 percent and 17 percent? I support Grey Power’s rationale for calculating such energy margins. Effective contracting for dry year generation or substitution would reduce the overall cost, but would require addressing extremely large barriers which inhibit gentailers from so contracting. 1 Should the security of supply standard be raised to allow for the unpopularity of demand restraints? I agree with Castalia’s assessment: What might appear in advance a prudent balancing of the costs of demand restraints and of reserve energy can easily be perceived as disastrously inadequate service levels and poor planning when a shortage actually occurs—especially with some creative media coverage. Power cuts are very unpopular and may lead to calls for the electricity sector to be restructured (again). Rather than adding a margin of extra conservatism to the security of supply standard, we believe that this perception problem should be addressed head-on through the publicity material that advises the market and the media about security of supply. Pricing Considerations for a Security of Supply Standard? I agree with those who are concerned about high spot prices long in advance of potential shortages. During summer and autumn, the options for switching between fuel and electricity are essentially limited to water heating, and there are very few dual-fuel water heaters around. Yet the high spot prices in 2006 led to a yearly (to November) average of 8.4c/kWh (Haywards), despite the lakes filling and the spot price dropping in May – spot prices averaged over dry years have so far proved to be approximately twice those in normal years. This is not an efficiently functioning market place! The electricity market review needs to focus on mechanisms to link the retail markets – domestic, commercial and industrial alike – with the wholesale market. A half a market is no market at all. 2 NZTF contracts compared to spot price haywards, averaged monthy and yearly 25 2006 1997 5 c/kWh, yearly NZTF index spot prices NZTFyearly spot price yearly Oct-06 Apr-06 Oct-05 Apr-05 Oct-04 Apr-04 Oct-03 Apr-03 Oct-02 Apr-02 Oct-01 Apr-01 Oct-00 -15 Apr-00 0 Oct-99 -10 Apr-99 5 Oct-98 -5 Apr-98 10 Oct-97 0 Apr-97 15 Oct-96 c/kWh, monthly 20 10 Do you agree that there is evidence of some market failure, but insufficient evidence to be able to assess the likely frequency or magnitude of market failure? The evidence of market failure is not as described in the Issues paper. Systematic failure is not simply of “late” investment in reserve or normal generation. It is that the incentives of gentailers are to sell more not less energy, to get closer to shortage rather than leave adequate margin. The graph comparing spot prices with the Tariff and Fuels Index, indicates that gentailers make a profit first on the spot prices, subsequently on the contract prices. What is called “market failure” is really a regulatory failure, that there are no effective sanctions on gentailers’ management of bids and offers to maximise profits. Options? Do you agree that, given the uncertainty about market failure, the best policy going forward is to adopt a watch dog approach? No: the status quo is allowing massive intramarginal rents to be taken, with generation revenues apparently doubling during dry years. I support the general principle of market augmentation, and agree with the Issues paper that consumers need to be protected by strong sanctions on retailers to acquire sufficient dry year hedges. This however needs to be supported by a comprehensive review of the wholesale and retail electricity markets and price regulation, to enable large and small consumers to actively participate, thus reducing the market power of the gentailers. I repeat that the status quo is not a market mechanism, but an arrangement to cap spot prices supposedly at 20c/kWh (but spot prices went way above that at times in 2006), paid for by all consumers via the electricity levy. 3 Do you agree that the current levy arrangements should remain in place? No: I agree with the comment in the issues paper: In a market reserve energy-design option, where retailers and major entities are required to hedge themselves, there would be no levy . . . . . . We believe the requirement for a review of the levy was included in the GPS prescription for this Review because it was at that time regarded as possible that the Commission would be intervening regularly. If such regular intervention is required, then we would recommend moving away from the current direct procurement process to an energy hedge adequacy requirement. If we move to an energy adequacy hedge requirement, the levy debate will largely fall away. Do you agree with the proposed separation of scope between the Regime and the Policy? Are there better alternative definitions of scope that could be adopted? I agree with the issue paper’s conclusion: . . . an overly prescriptive Regime may not be durable or effective. As the electricity sector evolves, so do the issues related security of supply, and methods for dealing with those issues. An overly prescriptive regime could quickly become outdated and require significant and regular revision. . . . a clear delineation is needed between the respective roles of primary legislation (the Act), regulations (the Regime) and the practical implementation of both (the Policy). . . . The current framework differs from this approach because the Regime, in translating the legislative objective, goes much further than simply defining a quantitative objective and the boundaries of the Commission’s powers. Overview of Current Policy I shall not comment on this. Do you agree that no further compulsory requirements should be imposed for the provision of information to the Commission? No. The Grey Power submission, which I fully support, explains how further market information could be used to determine what reserve margin is appropriate, and to indicate any progressive need of retailers to acquire their own reserve energy. I believe that if such information disclosure is not made compulsory, it will not happen. Unasked question: does the Commission face significant conflicts of interest in both procuring reserve energy and 4 I agree with the issues paper’s statement: The Commission’s degree of independence from Government is defined in the Electricity Act and is outside the scope of this Review. However I disagree with most stakeholders, who gave the following impression: Stakeholder feedback on conflicts of interest protocols indicates that most stakeholders are comfortable that the conflicts arising from the Commission’s role as a regulator and market participant have been managed well by the current Policy. However, a number of stakeholders noted that, in their view, the biggest conflict of interest arises from the Commission’s lack of full independence from the Government. I therefore disagree with most of the recommendations, which are centred around considering marginal improvements to the status quo market intervention. Conclusion New Zealand was an early adopter of physical mechanisms for “price discovery” at each halfhour of the year at each of over 250 grid exit points. It now applies a sledge hammer to this differentiated information, averaging prices over times and locations, further rebundled by retailers, with absolute denial of the consumer sovereignty that was the aim of the original restructuring. Efficient electricity markets working through true price discovery is still the holy grail of electricity restructuring worldwide. New Zealand failed early on to move towards that holy grail, and has moved progressively backwards since then. The Reserve Energy Policy was a milestone in rejection of market mechanisms, in favour of political determination of a security standard, and the charging of all consumers to acquire the necessary mechanisms to achieve it. The result is increasingly high spot prices driven by market power of gentailers. Hopefully the Commission’s electricity market review will address these issues rather than taking the status quo as given, and describing “interventions” as relating only to changes in the status quo. 5