Taxes 101: Five Basic Ideas

advertisement

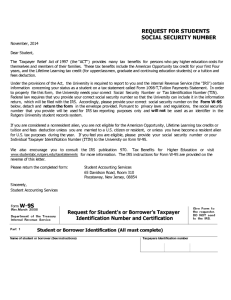

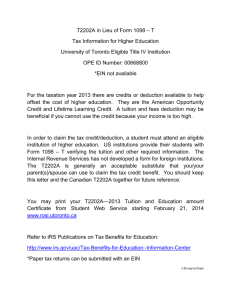

LIFE AFTER AMERICORPS RESOURCE PACKET MARCH 2011 IN THIS ISSUE: TAX INFORMATION & MONEY TIPS AmeriCorps National Civilian Community Corps Pacific Region Campus If you would like information about a specific job or school, or if you know of an opportunity that should be included in next month’s packet, please contact: Amanda Enright, Program Office Support Team Leader: aenright.guest@cns.gov or 916-717-9989 Erin Blobaum, Assistant Program Director/ Training: eblobaum@cns.gov or 916-640-0315 Table of Contents Table of Contents.............................................................................................................. 2 Taxes 101………………………………………………………………………………… 3 Income Tax......................................................................................................................... 4 How to File......................................................................................................................... 5-7 Earned Income Credit…………………………………………………………………… 8 Peer Review Form……………………………………………………………………..... 8 Medical & Dental Expenses.............................................................................................. 9 Educational Expenses....................................................................................................... 10 12 Tips for College Students Filling................................................................................. 11 Sample Support Team Leader Resume………………………………………………… 12-13 Scholarships & Grants...................................................................................................... 13 Hope Scholarship Tax Credit............................................................................................ 14 Tuition Tax Deduction...................................................................................................... 15-16 Taxes & FAFSA................................................................................................................. 16 Taxes & AmeriCorps Education Award………………………………………………. 17 Online Links for Tax Information……………………………………………………… 18-19 Common Mistakes People Make With Money………………………………………… 20-22 Job Postings……………………………………………………………………………… 23-36 2 TAXES 101: FIVE BASIC IDEAS By William Perez http://taxes.about.com/od/taxplanning/a/taxbasics.htm Why do we have taxes at all? The United States has a big budget. We have to pay for things like schools, roads, hospitals, the military, government employees, national parks, and so forth. The only way to pay for these things is for the government to get money from people and companies. People and companies pay a percentage of their income to the government. This is called the income tax. The government taxes our income so it can have enough money to pay for the things we all need. Congress and the President of the United States are responsible for writing and for approving the tax laws. The Internal Revenue Service is responsible for enforcing the tax law, for collecting taxes, for processing tax returns, for issuing tax refunds, and for turning over the money collected to the US Treasury. The Treasury, in turn, is responsible for paying various government expenses. Congress and the President are also responsible for the federal budget. The budget is how much the government plans to spend on various programs and services. When the government spends more money, it must raise more money through taxes. When the government spends less money, it can afford to lower taxes. Five Aspects of the Tax System First of all, every person, organization, company, or non-profit is subject to the income tax. "Subject to income tax" means that people and organizations must report their income and calculate their tax. Some organizations are exempt from tax. But they still have to file a return, and the their tax-exempt status could be revoked if the organization fails to meet certain criteria. Secondly, you are taxed on your income. That's the long and the short of it. Income is any money you earn because you worked for it or invested for it. Income includes wages, interest, dividends, profits on your investments, pensions you receive, and so forth. Income does not include gifts. You are not taxed on gifts you receive, such as inheritances and scholarships. Thirdly, you must pay your taxes throughout the year. This is called "pay as you go." For most people, it means your income taxes are taken out of your paycheck and sent directly to the federal government. At the end of the year, you have paid in a certain amount of taxes. If you paid in more than what you owe, the government refunds the amount over what you owed. This is called a tax refund. If you haven't paid enough to cover what you owe, then you have a balance due. And you must pay this amount due by April 15th of the following year, or the government will charge you interest and penalties on the amount you haven't paid in. Fourthly, the US tax system is progressive. That means that people who make more money have a higher tax rate, and people who make less money have a lower tax rate. Your tax rate will change depending on how much money you made that year. There is a debate over whether our tax rates should be progressive or flat. Politicians who support a flat tax argue that a single tax rate for everybody will greatly simplify people's lives. Politicians who support progressive tax rates argue that it is unfair to ask a person of modest income to pay the same percentage of their income as a wealthier person. This idea of fairness is the motivation for all sorts of tax benefits. For example, you can reduce your total income if you contribute money to retirement account, such as a 401(k) or IRA plan. There are many other types of tax benefits. Tax benefits are how Congress rewards people for making certain types of decisions. The goal of tax planning is to choose which tax benefits make the most sense for you. For more information on taxes and tax resources please visit http://taxes.about.com. 3 INCOME TAX 101 www.fairmark.com/begin/tax101.htm This page provides a quick overview of the U.S. federal income tax. Here's a quick overview of the U.S. federal income tax: Step 1: Total Income Total income includes many kinds of receipts: wages, interest, dividends, business and partnership income, amounts you receive from IRAs and pension plans, alimony, lottery winnings — and the list goes on. Of special interest: it includes your profit from sales of assets such as stock or real property — in other words, capital gain. But some items aren't included. For example, total income doesn't include gifts you receive or life insurance proceeds. Step 2: Deductions Deductions come in four main flavors: Business deductions These deductions are claimed as part of the calculation of business income, so they're actually part of the determination of total income in Step One. But take note: deductions related to your investment activities are not considered business deductions. Adjustments These are deductions you're allowed to claim even if you don't claim itemized deductions (see below). Among the items here are your contributions to an IRA or Keogh plan, and alimony you paid. When you subtract your adjustments from total income, you arrive at an important number called adjusted gross income. Itemized deductions; standard deduction Each year you're allowed to claim itemized deductions or the standard deduction, whichever is larger. Itemized deductions include such items as medical expenses, state and local taxes, mortgage interest — and investment expenses. If those items don't add up to a large enough total, you claim the standard deduction instead. Your standard deduction depends on your filing status and is adjusted each year for inflation. Exemptions You're allowed a deduction just for being you: a personal exemption. You're also allowed an exemption for each person who qualifies as your dependent. Like the standard deduction, the exemption deduction is adjusted each year for inflation. When you've subtracted all of these deductions from your total income, the result is your taxable income. Step 3: Apply the Tax Rates Once you know your taxable income, you apply the tax rates to find out your tax Most people do this quite simply by looking up their taxable income in a table supplied with their tax form. If your income includes long-term capital gain you have to perform a special calculation to obtain the benefit of the lower rate that applies to this type of income. Step 4: Subtract Payments and Credits The tax law allows you to claim certain credits that reduce the amount of tax you owe. For example, if you pay for child care, a portion of that expense may be allowed as a credit. And of course, you get credit for any tax you've already paid — including income tax your employer withheld from your paycheck and any estimated tax payments you made during the year. Subtract your credits and payments from your tax to find out how much you owe. If your payments exceed the tax, you're in luck: you have a refund coming! 4 WHEN, WHERE, AND HOW TO FILE www.irs.gov/taxtopics/tc301.html April 15 each year is the due date for filing your Federal individual income tax return, if your tax year ends December 31st. Your return is considered filed timely if the envelope is properly addressed and postmarked no later than April 15. If the due date falls on a Saturday, Sunday, or legal holiday, the due date is delayed until the next business day (i.e., Tax Year 2006 is due April 17, 2007). If you cannot file by the due date of your return, then you can request an extension of time to file. However, an extension of time to file is not an extension of time to pay. You will owe interest on any past–due tax and you may be subject to a late–payment penalty if payment is not made timely. To receive an automatic 6– month extension of time to file your return, you can file Form 4868 by the due date of your return. For more information, refer to the Form 4868 Instructions. Be sure to use your social security number as it is appears on your social security card. If you have changed your name you should notify the Social Security Administration or call 1–800–772–1213 before you file your return. If a joint return is filed, both husband and wife must sign the return Be sure to attach the Form W-2 and the Form 1099-R that show Federal income tax withheld to the front of the return. If you are filing Form 1040, be sure to attach all related schedules and forms behind your return in order of the sequence number located in the upper right hand corner of the schedule or form. If you owe tax, make your check or money order payable to the United States Treasury, and enclose it with your return. On the front of your check or money order, please show your name, address, social security number, daytime phone number, the tax year and type of form you are filing (for example, "2005 Form 1040"). Do not mail cash with your return. You can also use a credit card to pay the tax due by calling 1– 800–2paytax (1–800–272–9829) or Link2Gov (1–800–729–1040). Refer to your form instructions for more information. Mail your return to the address given in the tax form instructions for the area where you live. If possible, use the pre–addressed envelope that came with your booklet. If you are mailing payment or owe tax, follow additional instructions in your tax package. You may want to file electronically! When you file electronically, you usually receive your refund within 3 weeks after the IRS has received your return, even faster if you have it directly deposited into your checking or savings account. Many professional tax return preparers offer electronic filing of tax returns in addition to their return preparation services. A fee may be charged. For more information on electronic filing, click on the e-file logo on the home page of www.irs.gov. 5 DEPENDENTS www.irs.gov/taxtopics/tc354.html Generally, you may claim a dependency exemption for a qualifying child or a qualifying relative. You may not claim a dependency exemption for an individual, however, if you are a dependent of another taxpayer. To claim a dependency exemption for a qualifying child or a qualifying relative, the citizen, national, or resident test and joint return test must be met. To meet the citizen, national or resident test, an individual must be a citizen or national of the United States, a resident of the United States, or a resident of Canada or Mexico. An exception may apply for an adopted child who is not a citizen, national or resident of the United States. To meet the joint return test, an individual generally must not have filed a joint return with the individual's spouse. An exception applies if the joint return is files as a claim for refund, neither the individual nor the individual's spouse is required to file a return, and no liability would have existed for either the individual or the individual's spouse if each had file a separate return. You must include a valid social security number, individual tax payer identification number (ITIN), or adoption taxpayer identification number (ATIN) for each dependent claimed on your tax return or the exemption will be disallowed. For more information on dependents, refer to www.irs.gov/taxtopics/tc354.html. IRS FREE FILE PROGRAM www.irs.gov/efile/article/0,,id=118986,00.html The Free File program is a free federal tax preparation and electronic filing program for eligible taxpayers developed through a partnership between the Internal Revenue Service (IRS) and the Free File Alliance LLC, a group of private sector tax software companies. Since Free File’s debut in 2003, more than 15.4 million returns have been prepared and e-filed through the program. Free File allows taxpayers with an Adjusted Gross Income (AGI) of $52,000 or less in 2006 to e-file their federal tax returns for free. That means 70 percent of all taxpayers – 95 million taxpayers – can take advantage of the Free File program. Some Important Changes for the Free File Program: Free File is a free service offered by companies for taxpayers with an Adjusted Gross Income (AGI) of $52,000 or less. Before selecting a company link, review the tax software company’s criteria to confirm that you meet their eligibility for preparing and e-filing your federal return for free. Fees for state tax returns may apply. Some companies offer free state tax return preparation and e-filing. Check company websites for more details. Some companies offer extensions for free. Some companies offer free e-filing of the Form 1040EZ-T, Telephone Excise Tax Refund, for those who want to claim the refund credit and are not required to file a federal income tax return. You are under no obligation to buy any of the company’s other products or services. 6 CONTRIBUTIONS www.irs.gov/taxtopics/tc506.html Charitable contributions are deductible only if you itemize deductions on Form 1040, Schedule A. To be deductible, charitable contributions must be made to qualified organizations. Qualified organizations include, but are not limited to, Federal, state, and local governments and organizations organized and operated only for charitable, religious, educational, scientific, or literary purposes, or for the prevention of cruelty to children or animals. Organizations can tell you if they are qualified and if donations to them are deductible. If your contribution entitles you to merchandise, goods, or services, including admission to a charity ball, banquet, theatrical performance, or sporting event, you can deduct only the amount that exceeds the fair market value of the benefit received. For a contribution of $250 or more, you can claim a deduction only if you obtain a written acknowledgment from the qualified organization. You generally can deduct your cash contributions as well as the fair market value of any property you donate to qualified organizations. The fair market value of most household or personal items is generally much less than the price paid when new. You should claim only what the item would sell for at a garage sale, a flea market, or a second hand or thrift store. You must fill out Form 8283 Section A, if your total deduction for all non-cash contributions is more than $500. If you make a contribution of non-cash property worth more than $5,000, generally an appraisal must be done. In that case, you must also fill out Form 8283 Section B and attach it to your return. Generally, if property you contribute increased in value while you owned it, you may not be able to deduct its full value. You may have to make an additional computation which includes the property's cost to determine the deductible amount of your contribution. Contributions you cannot deduct at all include contributions made to specific individuals, political organizations and candidates, the value of your time or services and the cost of raffles, bingo, or other games of chance. You cannot deduct contributions that you give to qualified organizations if, as a result, you receive or expect to receive a financial or economic benefit equal to the contribution. Although you cannot deduct the value of your time or services, you can deduct the expenses you incur while donating your services to a qualified organization. If the expenses are for travel, which may include transportation and meals and lodging while away from home, they may be deducted only if there is no significant element of personal pleasure, recreation, or vacation in the travel. Actual costs of gas and oil can be deducted, or you can choose to take 14 cents per mile for using your own car. Deductions for contributions in excess of 20% of your adjusted gross income may be limited depending on the type of property or the type of organization the donation is contributed to. For more information, refer to www.irs.gov/taxtopics/tc506.html. 7 EARNED INCOME TAX CREDIT From the IRS website and http://about.taxes.com The Earned Income Tax Credit (EITC) sometimes called the Earned Income Credit (EIC), is a refundable federal income tax credit for low-income working individuals and families. Congress originally approved the tax credit legislation in 1975 in part to offset the burden of social security taxes and to provide an incentive to work. When the EITC exceeds the amount of taxes owed, it results in a tax refund to those who claim and qualify for the credit. To qualify, taxpayers must meet certain requirements and file a tax return, even if they did not earn enough money to be obligated to file a tax return. The EITC has no effect on certain welfare benefits. In most cases, EITC payments will not be used to determine eligibility for Medicaid, Supplemental Security Income (SSI), food stamps, low-income housing or most Temporary Assistance for Needy Families (TANF) payments. You may be eligible to claim the Earned Income Credit if: Your Adjusted Gross Income on Form 1040 Line 36 is less than $11,490 (for Single people) or less than $12,490 (for Married people) and you have no dependents. Your Adjusted Gross Income on Form 1040 Line 36 is less than $34,458 (for Head of Household) or less than $35,458 (for Married people) and you have qualifying dependents. You and your spouse (if married) cannot be claimed as a dependent by someone else. You and your spouse (if married) are between the ages of 25 and 64. If you want the IRS to calculate your Earned Income Credit for you, enter the word "EIC" on Form 1040 Line 65a. Otherwise, use your "earned income" figure to look up your tax credit amount on the EIC table , or use the new IRS EIC calculator. CHANGE OF ADDRESS – HOW TO NOTIFY IRS www.irs.gov/taxtopics/tc157.html If you have moved or your address has changed, you need to notify the IRS to ensure you receive any IRS refund or correspondence. You may provide your new address in a variety of ways. You may correct the address legibly on the mailing label from your tax package or write the new address on your return when you file. When your return is processed, we will update your records. If you change your address after filing your return, you should notify your post office that services your old address. This ensures your mail will be forwarded (not all post offices forward government checks). Complete a Form 8822, Address Change Request, to change your address with the IRS. Form 8822 may be downloaded from the IRS website (www.irs.gov). If you correspond to inform us of your address change, we need your full name, old and new addresses, and your Social Security Number or Employer Identification Number and your signature. If you filed a joint return, you should provide the same information and signatures for both spouses. Send your address change information to the campus where you filed your last return and provide your new address. The campus addresses are listed in the instructions to the tax forms. If you filed a joint return and you and/or your spouse establish separate residences, you both should notify the IRS of your new address. 8 MEDICAL AND DENTAL EXPENSES www.irs.gov/taxtopics/tc502.html If you itemize your deductions on Form 1040, Schedule A, you may be able to deduct expenses you paid that year for medical care (including dental) for yourself, your spouse, and your dependents. A deduction is allowed only for expenses paid for the prevention or alleviation of a physical or mental defect or illness. Medical care expenses include payments for the diagnosis, cure, mitigation, treatment, or prevention of disease, or treatment affecting any structure or function of the body. The cost of drugs is deductible only for drugs that require a prescription, except for insulin. Medical expenses include fees paid to doctors, dentists, surgeons, chiropractors, psychiatrists, psychologists, and Christian Science practitioners. Also included are payments for hospital services, qualified long–term care services, nursing services, and laboratory fees. Payments for acupuncture treatments or inpatient treatment at a center for alcohol or drug addiction are also deductible medical expenses. You may include amounts you paid for participating in a smoking–cessation program and for drugs prescribed to alleviate nicotine withdrawal. However, you may not deduct amounts paid for nicotine gum and nicotine patches, which do not require a prescription. You may deduct the cost of participating in a weight-loss program for a specific disease or diseases, including obesity, diagnosed by a physician. You may not deduct the cost of purchasing diet food items. In addition, you may include expenses for admission and transportation to a medical conference relating to the chronic disease of yourself, your spouse, or your dependent (if the costs are primarily for and essential to the medical care). However, you may not deduct the costs for meals and lodging while attending the medical conference. The cost of items such as false teeth, prescription eyeglasses or contact lenses, laser eye surgery, hearing aids, crutches, wheelchairs, and guide dogs for the blind or deaf are deductible medical expenses. You may not deduct funeral or burial expenses, health club dues, over–the–counter medicines, toothpaste, toiletries, cosmetics, a trip or program for the general improvement of your health, or most cosmetic surgery. Transportation costs primarily for and essential to medical care qualify as medical expenses. The actual fare for a taxi, bus, train, or ambulance can be deducted. If you use your car for medical transportation, you can deduct actual out–of–pocket expenses such as gas and oil, or you can deduct the standard mileage rate for medical expenses. With either method you may include tolls and parking fees. You may include in medical expenses the incidental cost of meals and lodging charged by the hospital or similar institution if your main reason for being there is to receive medical care. You can only include the medical expenses you paid during the year, regardless of when the services were provided. Your total medical expenses for the year must be reduced by any reimbursement. It makes no difference if you receive the reimbursement or if it is paid directly to the doctor or hospital. You may include qualified medical expenses you pay for yourself, your spouse, and your dependents, including a person you claim as a dependent under a multiple support agreement. If either parent claims a child as a dependent under the rules for divorced or separated parents, each parent may deduct the medical expenses he or she actually pays for the child. You can also deduct medical expenses you paid for someone who would have qualified as your dependent except that the person didn't meet the gross income or joint return test. You may deduct only the amount by which your total medical care expenses for the year exceed 7.5% of your adjusted gross income. You do this calculation on Form 1040 Schedule A in computing the amount deductible. 9 Medical expenses include insurance premiums paid for accident and health or qualified long-term care insurance. You may not deduct insurance premiums for life insurance, for policies providing for loss of wages because of illness or injury, or policies that pay you a guaranteed amount each week for a sickness. In addition, the deduction for a qualified long–term care insurance policy's premium is limited. You may not deduct insurance premiums paid by an employer–sponsored health insurance plan (cafeteria plan) unless the premiums are included in Box 1 of your Form W-2. If you are self–employed and have a net profit for the year, or if you are a partner in a partnership or a shareholder in an S corporation, you may be able to deduct, as an adjustment to income, 100% of the amount you pay for medical insurance for yourself and your spouse and dependents. You can include the remaining premiums with your other medical expenses as an itemized deduction. You cannot take the special 100% deduction for any month in which you are eligible to participate in any subsidized health plan maintained by your employer or your spouse's employer. TAXES & YOUR EDUCATION EXPENESES EDUCATIONAL EXPENSES www.irs.gov/taxtopics/tc513.html You may be able to deduct work–related educational expenses paid during the year as an itemized deduction on Form 1040, Schedule A. To be deductible, your expenses must be for education that: Maintains or improves skills required in your present job; or, Serves a business purpose of your employer and is required by your employer, or by law or regulations, to keep your present salary, status, or job. Your expenses are not deductible if the education is required to meet the minimum educational requirements of your job, or is part of a program of study that can lead to qualifying you in a new trade or business. Although the education must relate to your present work, educational expenses incurred during temporary absence from your job may be deductible. However, after your temporary absence, you must return to the same kind of work. Usually, absence from work for one year or less is considered temporary. Educational expenses include amounts spent for tuition, books, supplies, laboratory fees, and similar items. They also include the cost of research and typing when writing a paper as part of an educational program. Transportation and travel expenses to attend qualified educational activities may also be deductible. If you take a deduction for these educational expenses on your tax return, you cannot take other educational credits for these same expenses. If you are an employee, you generally must complete Form 2106 or Form 2106-EZ. Educational expenses are deducted as miscellaneous itemized deductions on Form 1040 Schedule A; they are subject to the 2% of adjusted gross income limit. You can also exclude from income a certain amount of employer–provided educational benefits received under a qualified educational assistance program. The payments do not have to be for work–related courses, but generally cannot be for courses involving sports, games, or hobbies. Courses that began after December 31, 2003 can be courses leading to an advanced academic or professional degree. Your employer may report the educational assistance payments on your Form W-2 in the appropriate box under "other". Taxable reimbursements will be reported by your employer as income to you in the appropriate box of Form W–2. For more information on educational expenses or Education Tax Credits, refer to: www.irs.gov/taxtopics/tc513.html. 10 12 TIPS FOR COLLEGE STUDENTS FILING TAXES www.bankrate.com/brm/itax/news/20040130a1.asp If you're in college, doing your taxes feels like one more final exam. But there's one big difference. This grade is measured in cash. With a little research and time, you can ace this test and maybe even earn a nice check in the process. Here are 12 tips to help you over the rough spots and make this tax exam a little easier. 1. File Sure, you might make too little money to file, but if you've had money withheld from paychecks, you've got a refund coming. "The most common error is that people don't realize 'it could make a lot of sense for me to file even if I don't have to,'" says Mark Oleson, director of the Financial Counseling Clinic at Iowa State University. 2. Start early Even if you haven't received your W-2s, your final pay stub will have the pertinent tax information, such as your income and how much was withheld. You also can go online and download state and federal forms you'll need. Taking an advance look at your tax situation will help you know which issues might apply to your return. Think you might need a little help? It's probably closer than you think and possibly free. Most college accounting departments have students offering free tax help so they can get some practice with real-life returns. If you haven't seen ads around campus, contact the accounting or business department and find out how you can get some advice. The Internal Revenue Service also offers in many communities Volunteer Income Tax Assistance sites where you can go to get help from IRS volunteers, says Oleson. Remember, though, the closer you get to April 15, the longer the wait for help. "The sooner you start, the better off you'll be," advises Oleson. "If you have a tight spring schedule and can't talk to someone for three weeks, saying that on Feb. 1 is a lot different than saying that in April." 3. Give yourself a weekend No, filling out your forms won't take that long. But if you allow a weekend, you'll have time to take a few breaks when you get tired and still be able to double check the numbers before you mail that return. Oleson recommends you take a leisurely weekend to do your returns. Then take the next week to seek any outside help and ask more questions. Next weekend, check your numbers again and send it. 4. Practice on paper Even if you're filing electronically, many students find it's more efficient to fill out the paper forms and work out the bugs before they go online to file, says Oleson. 5. Take extra credit These days, college students (or parents paying college tuition) are getting a little help from the government in the form of credits and deductions. While there are three major ones, students (or their parents) get to select only one per student. And whoever claims the student as a dependent is the one who is eligible for the credit. Pick the one that best suits your family and situation: Hope Scholarship Credit - Gives you a tax credit for up to 100 percent of your first $1,000 in tuition and fees and up to 50 percent for the second $1,000. The maximum credit is $1,500 and it applies to the first two years of college only. Lifetime Learning Credit - Gives you a tax credit equal to 20 percent of your tuition and certain related expenses up to $10,000. The credit maximum is $2,000. 11 Higher education expenses deduction - This deduction could be as much as $4,000 for families that meet earning guidelines. If you make too much (in the IRS's eyes), you'll get a reduced deduction. The downside: Deductions usually give you less bang for your buck than credits. You get to subtract a credit amount from the actual tax you owe, whereas a deduction reduces the income you pay tax on. So in this case, even if you have $4,000 in expenses you can claim on your tax return (at the bottom of page 1 of your Form 1040), in reality this deduction would at most produce a $1,000 reduction in your tax bill if you're in the 25 percent tax bracket. 6. Understand your family's financial situation Talking to mom and dad about money can be difficult. But you need to know a little about their financial picture to plan who should claim you as a dependent and possibly use your education credit or deduction. If your parents are paying more than 50 percent of your expenses, they are entitled to list you as a dependent on their taxes. 7. Don't automatically take the EZ route File a 1040EZ and the form automatically assumes you will claim yourself as a dependent. But if your parents make the same claim, both of you will get letters from the IRS. If you've already filed when you learn your parents plan to claim both you and your education credits, file a corrected return. 8. Determine where you live Sounds obvious, right? Not when it comes to taxes. If you're going to college in one state and spending summers at home in another, you could have two states vying for your tax dollars. The qualifications for residency "depend on the state," says CPA Barry Picker, author of "Barry Picker's Guide to Retirement Distribution Planning." But in some situations, you could be considered a full-time resident in two places and be required to pay both, he says. 9. Nail down your tuition money's origin It could make a difference in your taxes. For instance, if any of your tuition bill was paid with money from a 529 account or Coverdell education savings account, you can't count those expenses in your total education debt when you try to recoup an education credit or deduction. Since Coverdell and 529 money accumulates tax-free, the government has already given you a tax break on those funds. If your tuition is coming from unsubsidized loans, you can deduct up to $2,500 in interest, says Oleson. And while most financial planners will tell you that grant and loan money is tax-free, there are always exceptions. "A grant that includes room and board is technically taxable," says Stives. Read the fine print carefully for any money you take so you're prepared come tax time. 10. Watch your income If you rely on need-based grants or loans, keep an eye on your income throughout the year. It's smart to leverage your funds so that you can qualify for every tax advantage. But you don't want to outfox yourself and lose tuition money, either. Best bet: Check with your financial aid office before you do anything, such as taking a summer job or putting stocks in your name, that might affect your scholarship standing. Also be wary of claiming yourself as a dependent if you want to stay on your parents' insurance. While the two things seem unrelated, an insurance company could use your independent status as justification to deny your health claims, he says. 11. Be careful with work-study arrangements These programs are taxable. Many colleges and universities issue students checks and take the proper withholdings. If you're not getting a check, make sure that you're putting some money aside for April 15. And if your school simply gives you a break on tuition in exchange for your work, your "income" is taxable. Talk to the director of the program for details. 12 12. Don't mail your return the moment you finish it Come back the next day to double check your math, make sure you've included, and signed, all the forms and made a copy for your records. Says Stives, "You always let it cool off overnight, at least, before you lick that envelope." Final Thoughts Also keep in mind that the available education tax credits will wipe out taxes that you owe, but they won't generate a refund. If you're not making a lot of money and don't owe any taxes, these credits can't help you. And the value of a deduction (for example, the higher education expenses deduction) increases with your tax load, making it much more valuable to someone in the 35 percent bracket (your folks) than someone in the 15 percent bracket (you). So unless you expect to owe a bundle, chances are your parents will get more out of a credit or deduction than you will. SCHOLARSHIP AND FELLOWSHIP GRANTS www.irs.gov/taxtopics/tc421.html If you receive a scholarship or fellowship grant, all or part of the amounts you receive may be tax–free. Qualified scholarship and fellowship grants are treated as tax–free amounts if all the following conditions are met: You are a candidate for a degree at an educational institution that maintains a regular faculty and curriculum and normally has a regular enrolled body of students in attendance at the place where it carries on its educational activities; Amounts you receive as a scholarship or fellowship are used for tuition and fees required for enrollment or attendance at the educational institution, or for books, supplies, and equipment required for courses of instruction; and, The amounts received are not a payment for your services. However, if you receive a scholarship award under the National Health Service Corps Scholarship Program or the Armed Forces Health Professions Scholarship and Financial Assistance Program, the amount received is tax free without regard to any services you are obligated to perform. You must include in gross income amounts used for incidental expenses, such as room and board, travel, and optional equipment, as well as amounts received as payments for teaching, research, or other services required as a condition for receiving the scholarship or fellowship grant. If any part of your scholarship or fellowship grant is taxable, you may have to make estimated tax payments. For more information refer to www.irs.gov/taxtopics/tc421.html. 13 UNDERSTANDING THE HOPE SCHOLARSHIP TAX CREDIT From NASFAA (National Association of Student Financial Aid Administrators) www.nasfaa.org/AnnualPubs/TaxBenefitsGuide.html What Is It? The Hope Scholarship is a tax credit, not a scholarship. Tax credits are subtracted directly from the tax a family owes, instead of being subtracted from taxable income like a tax deduction. A family must file a federal tax return and owe taxes to get this tax credit. A family cannot get a refund for the Hope credit if it does not pay taxes. A family that owes less tax than the maximum amount of the Hope tax credit for which it is eligible can only take a credit up to the amount of taxes owed For the 2006 tax year, a family may claim a tax credit up to $1,650 for each eligible dependent for up to two tax years (100% of the first $1,100 and 50% of the second $1,100 paid for qualified expenses). The Hope credit is available only until each student's first two years of postsecondary education are complete. Gulf Opportunity Zone students may claim up to $3,300 (100% of the first $2,200 and 50% of the second $2,200) for the 2006 tax year. The exact amount of the Hope credit also depends on a family's income, the amount of qualified tuition and fees paid, and the amount of certain scholarships and allowances subtracted from tuition. The total credit is also based on how many eligible dependents are in the family, rather than a maximum dollar amount for the family as with the Lifetime Learning tax credit. Who Qualifies? The Taxpayer: An eligible taxpayer must file a federal tax return and owe taxes to claim the Hope credit. In addition, the taxpayer must claim an eligible student as a dependent on the tax return, unless the credit is for the taxpayer or the taxpayer's spouse. This means the eligible taxpayer may also be the eligible student. In 2006, taxpayers cannot claim a Hope credit if their Modified Adjusted Gross Income (MAGI) is $55,000 or more for a single taxpayer, or $110,000 or more for married taxpayers filing a joint return. MAGI limits were increased by $2,000 for single taxpayers by $3,000 for married taxpayers filing jointly in the 2006 tax year. The Student: An eligible student must be enrolled at least half-time for at least one academic period beginning in 2006 at an eligible program leading to a degree or certificate at an eligible school and can not have completed the first two years of undergraduate study. You may claim the credit yourself if you are not claimed as a dependent by another taxpayer. Once again, this means that the eligible student may also be the eligible taxpayer. Students convicted of a federal or state drug felony before the end of 2006 are not eligible for the Hope credit. How Do You Get It? To apply for the credit, taxpayers must report the amount of tuition and fees paid as well as the amount of certain scholarships, grants, and untaxed income used to pay the tuition and fees. Schools are required to send this information by Jan. 31, 2007 in the form of a 1098-T statement to each taxpayer and to the IRS. Taxpayers use this information and their own records about tuition and fees paid when they fill out IRS form 8863 to claim the tax credit. The statement sent by the school will also include contact information for someone at the school who can answer questions about the information on the form. A taxpayer may wish to talk to a tax advisor for help in calculating the amount of the credit. When Is It Available? Generally, the credit is allowed for qualified education expenses paid in 2006 for an academic period that begins in 2006 or during the first three months of 2007 (e.g., paying in December 2006 for an academic period beginning in the first three months of 2007). 14 UNDERSTANDING THE TUITION AND FEES TAX DEDUCTION From NASFAA (National Association of Student Financial Aid Administrators) www.nasfaa.org/AnnualPubs/TaxBenefitsGuide.html What Is It? The Tuition and Fees Tax Deduction can reduce taxable income by as much as $4,000 in 2006. This deduction is taken as an adjustment to income, which means you can claim this deduction even if they do not itemize deductions on Schedule A of Form 1040. This deduction may benefit taxpayers who do not qualify for either the Hope or Lifetime Learning Education Tax Credits. Up to $4,000 may be deducted from tuition and fees required for enrollment or attendance at an eligible postsecondary institution. Personal living and family expenses, including room and board, insurance, medical and transportation, are not deductible expenses. The exact amount of the Tuition and Fees Tax Deduction depends on the amount of qualified tuition and related expenses paid for one's self, spouse, or dependent for whom the taxpayer can claim an exemption. Who Qualifies? The Taxpayer: An eligible taxpayer must file a federal tax return to claim the Tuition and Fees Tax Deduction. The taxpayer must also claim an eligible student (an individual enrolled in one or more courses at an eligible educational institution) as a dependent on the tax return. The deduction may also be for the taxpayer or the taxpayer's spouse. The amount of qualified education expenses that can be deducted through the Tuition and Fees Deduction remained level for the 2006 tax year at $4,000 for taxpayers with a Modified Adjusted Gross Income (MAGI) of $65,000 or less. The maximum Tuition and Fees Deduction is $2,000 for taxpayers with a MAGI greater than $65,000, but not greater than $80,000. Taxpayers with a MAGI greater than $80,000 are not eligible for this deduction. The Student: An eligible student must be enrolled in one or more courses at an eligible educational institution. An eligible educational institution is any college, university, vocational school, or other postsecondary educational institution eligible to participate in a student aid program administered by the U.S. Department of Education. According to the IRS, "it includes virtually all accredited, public, nonprofit, and proprietary postsecondary institutions." Colleges can provide information on whether they meet this requirement. Students may claim this deduction for themselves if they are not claimed as a dependent by another taxpayer. How Do You Get It? Because Congress passed last-minute legislation to extend the Tuition and Fees Tax Deduction, the IRS urges taxpayers to use IRS e-file because software will be updated so taxpayers can easily claim this deduction. The paper form used to claim this deduction was created before the extension was passed so people using a paper 1040 must take several special steps. Taxpayers must use existing lines on the current Form 1040 and other tax documents to claim this deduction. Instructions on the paper forms contain a cautionary note to taxpayers that the legislation was pending at the time of printing. People using a paper 1040 and claiming the Tuition and Fees Tax Deduction should follow these steps: Taxpayers must file Form 1040 to take this deduction for up to $4,000 of tuition and fees paid to a postsecondary institution. It cannot be claimed on Form 1040A. The deduction for tuition and fees will be claimed on Form 1040, line 35, "Domestic production activities deduction." Enter "T" on the blank space to the left of that line entry if claiming the tuition and fees deduction, or "B" if claiming both a deduction for domestic production activities and the deduction for 15 tuition and fees. For those entering "B," taxpayers must attach a breakdown showing the amounts claimed for each deduction. An eligible institution that received payment for tuition and fees in the 2006 tax year generally must issue IRS Form 1098-T (the Tuition Statement) to each student by January 31, 2007. The information on that form will help taxpayers determine whether they can claim a deduction for 2006. When Is It Available? Generally, the deduction is allowed for qualified tuition and expenses paid in 2006 in connection with enrollment at an institution of higher education during 2006 or for an academic period beginning in 2006 or in the first three months of 2007. For instance, if you paid $1,500 in December 2006 for qualified tuition for a spring 2007 semester that begins in January 2007, that $1,500 can be used to figure the 2006 deduction. Can A Family Claim Multiple Benefits? Taxpayers may claim this deduction along with a Hope credit, a Lifetime Learning credit, and an exclusion from gross income for certain distributions from qualified state tuition programs or education IRAs, if a different student is used for each deduction, credit, or exclusion AND the family does not exceed the Lifetime Learning maximum per family. Taxpayers cannot take the Tuition and Fees Tax Deduction if they deduct tuition and fees expenses under any other provision of the law (for example, as a business expense). This deduction cannot be claimed if the tuition and fees were paid with tax-free scholarships, grants (including Federal Pell Grants), or other educational assistance including employer-provided education assistance and other non-taxable benefits received to pay for education expenses. Taxes and FASFA www.nelliemae.com/finman/taxes_a.html Most student financial aid is distributed on a first-come-first-served basis, so early filing of your FAFSA and your taxes may mean a better financial aid package. Don't put off filing your FAFSA because your 2006 taxes and your family's aren't ready. The FAFSA allows you to estimate those taxes, then update your application online. With W-2 forms arriving in late January, filing your taxes early supports your FAFSA and any other financial aid requirements your school may have, such as the College Scholarship Service (CSS) Profile Form. Fortunately, student taxpayers have more convenient tax-filing options than ever. 16 TAXES & THE AMERICORPS EDUCATION AWARD www.americorps.gov/for_individuals/benefits/benefits_ed_award_taxes.asp The Segal AmeriCorps Education Award, unlike most other forms of scholarships and fellowships, is subject to federal tax in the year the Trust pays the voucher. Living allowances you received during your term of service and any interest the Trust paid on qualified student loans are also subject to income taxes in the years they were paid. When and how much of the education award you redeem may have an impact on your overall income tax responsibility. If the Trust makes a payment on qualified student loans to your school or lender for the entire amount of a full-time education award in one calendar year, you will be responsible for any income taxes owed in that calendar year on that $5,350. If you redeem only a portion of your education award in one calendar year, you will be responsible for any taxes owed on that portion. The interest payments made on postponed qualified student loans are subject to income taxes in the calendar year in which the Trust makes the payments to the lender. The Trust does not deduct taxes from your education award or interest payments. After the calendar year in which we paid your education award or interest payments, we send you a Form 1099 to be used in preparing your income tax return. The total sum of interest payments and the Segal AmeriCorps Education Award are listed together on the 1099 form. For more information on the 1099, go to AmeriCorps website page on tax information. Living Allowance You are responsible for any income taxes owed on any AmeriCorps living allowances you receive. The living allowance amount received in a calendar year is subject to income taxes for that calendar year. For example, if you receive half of your $10,000 living allowance in 2006 and half in year 2007, the $5,000 received in 2002 is subject to 2002 income taxes, and the $5,000 received in 2003 is subject to 2003 income taxes. After the calendar year in which you earned any living allowance, your AmeriCorps project will send you a W-2 form indicating the amount of the allowance you earned in that year. Most AmeriCorps*VISTA and AmeriCorps*NCCC members receive their W-2 forms from the Corporation. Tax relief While you are responsible for taxes on your education award and other AmeriCorps benefits, you may be eligible for other tax relief through the Taxpayer Relief Act of 1997. Issues about income taxes are very complicated. The important point to remember is that you should consider the tax consequences of any decisions you make about when and how to use your education award. Contact a tax professional or the Internal Revenue Service for details. *For questions concerning your Segal AmeriCorps Education Award, please visit the Segal Award Tutorial website: http://encorps.nationalserviceresources.org/edaward/index.shtml or contact the National Service toll-free at 1-888-507-5962. Operators are available Monday through Friday from 8:00 a.m. - 6:00 p.m. (EST). For duplicate vouchers and to report a change of address, please e-mail edawardvoucher@cns.gov. 17 Online Links for Tax Information IRS – www.irs.gov Everything you would need to know about your taxes. Part of the United States Treasury. IRS Refund Status - https://sa2.www4.irs.gov/irfof/lang/en/irfofgetstatus.jsp Website to check out your refund status with the IRS. IRS Free File Program - www.irs.gov/efile/article/0,,id=118986,00.html Homepage for the IRS Free File program. Your link to free federal online filing. IRS Forms & Publications - www.irs.gov/formspubs/index.html The official source of IRS tax products. Webpage provides methods to access and acquire both electronic and paper forms and publications. Volunteer Income Tax Assistance Program - www.irs.gov/individuals/article/0,,id=107626,00.html IRS webpage with information on free tax help for people with low to moderate income levels (less than $39,000). The Beehive - www.thebeehive.org Website for free online tax filing! Turbo Tax Intuit® Freedom Project - http://turbotax.intuit.com/taxfreedom The Project offers free online tax preparation to hard-working Americans and their families, who meet annual eligibility requirements announced at the beginning of each tax season. Taxnet® Tax Preparation - www.taxnet.com Taxnet™ was created to provide taxpayers with a simple and intelligent tax preparation experience …and to do it at a fraction of the cost of other products. H&R Block - www.hrblock.com Complete tax service and online resource. Jackson Hewitt – www.jacksonhewitt.com Tax preparer and resource. Tax Resources – http://taxtopics.net Excellent source for tax resources on the web by subject and category. Tax Calculator - www.taxfilingweb.com Online tax preparation & e-filing. Receive tax refund money in 2 days. Tax Deduction - www.tax-deduction-guides.info Looking to find tax deduction? Visit our tax deduction guide. Free Tax Return - www.onlinerefundfree.com Online service that is free. Prepare, print, & e-file taxes free. eSmart Tax - www.esmarttax.com Online tax filing software including Federal & State tax preparation, free e-file & printing and isIRS tested and approved. 18 eSmart Tax Links - www.esmarttax.com/taxlinks.asp Collection of some of the most useful web links to help in your federal and state tax preparation. Essential Tax Links - www.el.com/elinks/taxes Webpage that provides important online tax resources by category. Federation of Tax Administrators State Tax Forms - www.taxadmin.org/fta/link/forms.html Website that houses all state tax forms and state internet filing sites. 1040.com - www.1040.com 1040.com is an online tax resource dedicated to helping you find the information, news, and forms you need to complete your taxes. Search, download, and print any tax form you need, visit links to the IRS website, find the answers to your tax questions, and get the latest news and information, all in one location. 1040.com is your one-stop tax source! Tax Benefits for Higher Education - www.irs.gov/pub/irs-pdf/p970.pdf A supplemental guide from the IRS on tax benefits for your education expenses. Hope Scholarship and Lifelong Learning Credit Forms - www.irs.gov/pub/irs-pdf/f8863.pdf The online official form from the IRS in applying for the Hope Scholarship or Lifelong Learning Credit. Taxes and your Education FAQs - www.irs.gov/faqs/faq-kw52.html Website dedicated to frequently asked questions about education tax credits. 19 “Common Mistakes Adults Make with Money and How to Avoid Them” www.fdic.gov/consumers/consumer/news/cnspr05/cvrstry.html Everybody makes mistakes with their money. The important thing is to keep them to a minimum. And one of the best ways to accomplish that is to learn from the mistakes of others. Here is our list of the top mistakes young people (and even many not-so-young people) make with their money, and what you can do to avoid these mistakes in the first place. 1. Buying items you don't need...and paying extra for them in interest. Every time you have an urge to do a little "impulse buying" and you use your credit card but you don't pay in full by the due date, you could be paying interest on that purchase for months or years to come. Spending money for something you really don't need can be a big waste of your money. But you can make the matter worse, a lot worse, by putting the purchase on a credit card and paying monthly interest charges. There are good reasons to pay for major purchases with a credit card, such as extra protections if you have problems with the items. But if you charge a purchase with a credit card instead of paying by cash, check or debit card, be smart about how you repay. For example, take advantage of offers of "zero-percent interest" on credit card purchases for a certain number of months (but understand when and how interest charges could begin). 2. Getting too deeply in debt. Being able to borrow allows us to buy clothes or computers, take a vacation or purchase a home or a car. But taking on too much debt can be a problem, and each year millions of adults of all ages find themselves struggling to pay their loans, credit cards and other bills. Learn to be a good money manager by following the basic strategies outlined in this special report. Also recognize the warning signs of a serious debt problem. These may include borrowing money to make payments on loans you already have, deliberately paying bills late, and putting off doctor visits or other important activities because you think you don't have enough money. For more guidance on how to get out of debt safely or find a reputable credit counselor, start at the Federal Trade Commission (FTC) Web site at www.ftc.gov/bcp/ conline/edcams/credit/coninfo_debt. 3. Paying bills late or otherwise tarnishing your reputation. Companies called credit bureaus prepare credit reports for use by lenders, employers, insurance companies, landlords and others who need to know someone's financial reliability, based largely on each person's track record paying bills and debts. Credit bureaus, lenders and other companies also produce "credit scores" that attempt to summarize and evaluate a person's credit record using a point system. While one or two late payments on your loans or other regular commitments (such as rent or phone bills) over a long period may not seriously damage your credit record, making a habit of it will count against you. Over time you could be charged a higher interest rate on your credit card or a loan that you really want and need. You could be turned down for a job or an apartment. 20 For information about your rights to obtain free copies of your credit report and have errors corrected, see the FTC's fact sheet Your Access to Free Credit Reports online at www.ftc.gov/bcp/ conline/pubs/credit/freereports. 4. Having too many credit cards. Two to four cards (including any from department stores, oil companies and other retailers) are the right number for most adults. Why not more cards? The more credit cards you carry, the more inclined you may be to use them for costly impulse buying. In addition, each card you own — even the ones you don't use — represents money that you could borrow up to the card's spending limit. If you apply for new credit you will be seen as someone who, in theory, could get much deeper in debt and you may only qualify for a smaller or costlier loan. Also be aware that card companies aggressively market their products on college campuses, at concerts, ball games or other events often attended by young adults. Their offers may seem tempting and even harmless — perhaps a free T-shirt or Frisbee, or 10 percent off your first purchase if you just fill out an application for a new card — but you've got to consider the possible consequences we've just described. 5. Not watching your expenses. It's very easy to overspend in some areas and take away from other priorities, including your long-term savings. Our suggestion is to try any system — ranging from a computer-based budget program to handwritten notes — that will help you keep track of your spending each month and enable you to set and stick to limits you consider appropriate. "A budget doesn't have to be complicated, intimidating or painful — just something that works for you in getting a handle on your spending," said Kincaid. Want some specific ideas for ways to cut back on spending? A good place to start is the Web site for the "66 Ways to Save" campaign (www.66ways.org). 6. Not saving for your future. Start by "paying yourself first." That means even before you pay your bills each month you should put money into savings for your future. Often the simplest way is to arrange with your bank or employer to automatically transfer a certain amount each month to a savings account or to purchase a U.S. Savings Bond or an investment, such as a mutual fund that buys stocks and bonds. Banking institutions pay interest on savings accounts that they offer. However, bank deposits aren't the only way to make your money grow. "Investments, which include stocks, bonds and mutual funds, can be attractive alternatives to bank deposits because they often provide a higher rate of return over long periods, but remember that there is the potential for a temporary or permanent loss in value," said James Williams, an FDIC Consumer Affairs Specialist. 7. Paying too much in fees. Whenever possible, use your own financial institution's ATMs owned by financial institutions that don't charge fees to non-customers. You can pay $1 to $4 in fees if you get cash from an ATM that isn't owned by your financial institution or isn't part of an ATM "network" that your bank belongs to. For more about how to save on ATM fees, see the tips from FDIC Consumer News online at: www.fdic.gov/consumers/consumer/news/cnspr04/simple.html. 21 Try not to "bounce" checks — that is, writing checks for more money than you have in your account, which can trigger fees from your financial institution and from merchants. The best precaution is to keep your checkbook up to date and closely monitor your balance, which is easier to do with online and telephone banking. Remember to record your debit card transactions from ATMs and merchants so that you will be sure to have enough money in your account when those withdrawals are processed by you bank. 8. Not taking responsibility for your finances. Do a little comparison shopping to find accounts that match your needs at the right cost. Be sure to review your bills and bank statements as soon as possible after they arrive or monitor your accounts periodically online or by telephone. You want to make sure there are no errors, unauthorized charges or indications that a thief is using your identity to commit fraud. Keep copies of any contracts or other documents that describe your bank accounts, so you can refer to them in a dispute. Also remember that the quickest way to fix a problem usually is to work directly with your bank or other service provider. "Many young people don't take the time to check their receipts or make the necessary phone calls or write letters to correct a problem," one banker told FDIC Consumer News. "Resolving these issues can be time consuming and exhausting but doing so can add up to hundreds of dollars." Final Thoughts Even if you are fortunate enough to have parents or other loved ones you can turn to for help or advice as you start handling money on your own, it's really up to you to take charge of your finances. Doing so can be intimidating for anyone. It's easy to become overwhelmed or frustrated. And everyone makes mistakes. The important thing is to take action. Start small if you need to. Stretch to pay an extra $50 a month on your credit card bill or other debts. Find two or three ways to cut your spending. Put an extra $50 a month into a savings account. Even little changes can add up to big savings over time. Also remember that being financially independent doesn't mean you're entirely on your own. There are always government agencies, including the FDIC and the other organizations listed on For more information that can help with your questions or problems, check out www.fdic.gov/consumers/consumer/news/cnspr05/info.html. Online Links for Financial Planning and other Money Saving Resources www.fdic.gov/consumers/privacy/index.html - Understand financial privacy and how to protect yourself. www.ed.gov/offices/OSFAP/DirectLoan/calc.html - Student Financial Calculator. www.smartmoney.com - Daily stock and mutual fund recommendations, hourly market updates, personal finance investing research tools and advice. www.fpanet.org – Financial Planning Association website. www.mymoney.gov - MyMoney.gov is the U.S. government's website dedicated to teaching all Americans the basics about financial education. Whether you are planning to buy a home, balancing your checkbook, or investing in your 401k, the resources on MyMoney.gov can help you do it better. www.betterbudgeting.com – Free money saving tips newsletter. www.fool.com/foolu/askfoolu/2003/askfoolu030304.htm - Money Saving Tips Galore! 22 23