Topic 2: Income Statement

advertisement

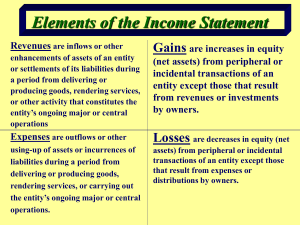

Topic 2: Income Statement Sections: I. Overview II. Individual Items III. Quality of Earnings I. Overview The income statement reports on the performance of the firm and the results of its operating activities during an accounting period. - flow In contrast, balance sheet - stock The matching principle is used for the preparation of the income statement. That is, revenues and related costs should be accounted for during the same accounting period. Example: The cost of the machine is recognized as an expense (depreciation) over the whole range of its estimated useful lifetime rather than as an expense in the period it is purchased. Because net income = revenues – expenses, the income statement has three major elements: 1. Revenues: inflows … of an entity … from delivering or producing goods, rendering services, or other activities that constitute the entity’s ongoing major or central operations (SFAC (Statement of Financial Accounting Concepts) 6). 2. Expenses: outflows …from delivering or producing goods, rendering services, or carrying out other activities that constitute the entity’s ongoing major or central operations (SFAC 6). 3. Net income: accounting earnings (not cash). Non-operating (non-central) inflows and outflows do not enter the above equation. They may include gains and losses from asset sales, lawsuits, and foreign exchange holdings. But, as usual, the classification of events into operating (into the income statement) and non-operating (outside the income statement) can be problematic. For example, a sale of a used car can be nonoperating to Little America Hotel & Resort but central to a car rental company. As mentioned in Topic 1, even more important is the decision on when to recognize (spent) revenues and expenses. This is particularly so for the so-called new economy companies. ----------------------------------------------------------------------------------------------------------Individual Homework: There are two prevailing methods for recognizing revenues in the software industry: perpetual licensing and subscription licensing. When perpetual licensing is used, the software firm records all of the revenue related to the product license upfront, providing that 4 criteria are met: (1) persuasive evidence of an arrangement exists, (2) delivery has occurred, (3) the price is fixed or determinable, and (4) collectability is reasonably assured. In contrast, subscription licensing arrangements recognize revenues over a specified subscription period. Required Tasks: Submit a short (50-150 words), typed report answering the following questions: Holding other factors constant, which method provides more predictable sales? Why? In addition, please do an internet search and find information about how Microsoft recognizes its revenues. For this task, just copy and paste as a 1-page attachment to the report and you do not need to write anything. The report is due in one week (January 31). Then we will discuss it, and you may be asked to talk about it. So be prepared. ----------------------------------------------------------------------------------------------------------II. Individual Items The following income statement is retrieved from Intel’s 2005 10-K: Intel Corporation Consolidated Incomes of Statement Three Years Ended December 25, 2004 (In Millions—Except Per Share Amounts) Net revenue Cost of sales Gross margin 2004 2003 2002 $34,209 $30,141 $26,764 14,463 13,047 13,446 19,746 17,094 13,318 Research and development Marketing, general and administrative Impairment of goodwill Amortization and impairment of acquisition-related intangibles and costs Purchased in-process research and development Operating expenses Operating income 4,778 4,360 4,034 4,659 4,278 4,334 — 617 — 179 301 548 — 5 20 9,616 9,561 8,936 10,130 7,533 4,382 Losses on equity securities, net Interest and other, net (2) 289 Income before taxes Provision for taxes 10,417 2,901 (283) 192 7,442 1,801 (372) 194 4,204 1,087 Net income $ 7,516 $ 5,641 $ 3,117 Basic earnings per common share $ 1.17 $ 0.86 $ 0.47 Diluted earnings per $ 1.16 $ 0.85 $ 0.46 common share Weighted average common shares outstanding 6,400 6,527 6,651 Weighted average common shares outstanding, assuming dilution 6,494 6,621 6,759 Source: Intel’s 2005 10-K This is a multiple-step income statement which usually presents gross profit, operating income, earnings before income and taxes (EBIT), and net income separately. This format is by far the most popular one. Some firms use a single-step income statement which totals revenues and gains (other income) and then deducts total expenses and losses. See Finance 340 textbook, p. 2 for an example of a simplified single-step income statement. Note that many large firms’ statements are “consolidated” for them and their subsidiaries. When the parent and its subsidiaries are in substance one company, given the proportion of control by the parent, the parent reports consolidated accounting numbers. Analysts usually normalize financial statements. A common-size income statement (balance sheet) expresses each item on income statement (balance sheet) as a percentage of net sales (total assets). The following is a partial common-size income statement retrieved from Intel’s 2005 10-K: Net revenue Cost of sales Gross margin Research and development 2 0 0 4 2 0 0 3 2 0 0 2 1 0 0. 0% 4 2. 3% 1 0 0. 0% 4 3. 3% 1 0 0. 0% 5 0. 2% 5 7. 7% 1 4.% 5 6. 7% 1 4.% 4 9. 8% 1 5.% Marketing, general and administrative 0 1 3. 6% Impairment of goodwill — Amortization and impairment of acquisitionrelated intangibles and costs Purchased in-process research and development Operating income Net Sales (Revenues) 5 1 4. 2% 2. 0% 1 1 6. 2% — 0. 1. 2. 5% 0% 0% 0. — — 1% 2 2 1 9. 5. 6. 6% 0% 4% Source: Intel’s 2005 10-K Sales represent revenue from goods or services sold to customers. Sales are usually shown net of any discounts, returns, and allowances. Sales drive the other accounts in income statement. The trend of this figure is THE key element in performance measurement. You would want to know whether the variation in sales is a result of variations in price, volume, or both, and whether the underlying driving forces are increasing or decreasing. These driving forces are usually discussed in the Management Discussion and Analysis section of the 10-K. Cost of Goods Sold, COGS (or Cost of Sales) For a retailing firm, COGS = beginning inventory + purchases – ending inventory. For a manufacturing firm, COGS = beginning inventory + the cost of goods manufactured – ending inventory. For a service firm, this component is called cost of services. COGS is affected by the cost flow assumption. In general, there are three inventory accounting methods: FIFO (first in, first out), LIFO (last in, first out), and average cost. The FIFO (LIFO) assumes that the first (last) units purchased or manufactured are the first units sold during an accounting period. Example: Suppose that a new start-up retailing firm purchases 4 products for sale in its first year of operation. The purchasing costs are increasing over time due to inflation. Item #1 #2 #3 #4 Cost $5 $6 $7 $8 The firm sells three products during this accounting period: FIFO LIFO Average Cost COGS (Income Statement) $18 (#1 + #2 + #3) $21 (#4 + #3 + #2) $19.5 (Total Cost*3/4) Inventory (Balance Sheet) $8 (#4) $5 (#1) $6.5 (Total Cost*1/4) When purchasing or manufacturing costs are increasing, the LIFO method produces the highest COGS and the lowest inventory. Note that a firm is usually allowed to use one accounting method for tax purposes and another method for reporting purposes. But this is not the case for treating inventory. ----------------------------------------------------------------------------------------------------------Questions: 1. According to a survey, slightly more than half of publicly traded corporations used the LIFO method during 1990s. Why was this method so popular? 2. Casual observations show a recent trend for increasing use of the FIFO method. Why? ----------------------------------------------------------------------------------------------------------The account of COGS needs to be carefully examined because this is usually the single largest outflow. As a result, analysts usually pay attention to the following ratio. Gross Profit Margin Gross Profit margin = (net sales – COGS)/net sales = gross profit/net sales = gross margin/net sales ----------------------------------------------------------------------------------------------------------Questions: Is there a trend in Intel’s gross profit margins during 2002-2004? What might cause this? ----------------------------------------------------------------------------------------------------------Operating Expenses Operating expenses consist of two types: selling and administrative. They include salaries, rent, insurance, utilities, advertising expense, and sometimes depreciation. Depreciation and/or Amortization and/or Depletion Depreciation is used to allocate the cost of tangible fixed assets such as buildings, machinery, equipment, furniture, and vehicles, etc. Amortization is the cost write-off process for capital leases (leasing arrangements that is, in substance, a purchase by the lessees), leasehold improvements, and the cost expiration of intangible assets such as patents, copyrights and trademarks, etc. Depletion is used to allocate the cost of acquiring and developing natural resources such as oil and gas, timber, and minerals. Operating Income (Operating Profit, EBIT) This provides a basis for assessing the success of a firm apart from its financing and investing activities and separate from tax considerations. The operating profit margin = operating income/net sales ----------------------------------------------------------------------------------------------------------Question: Is there a trend in Intel’s operating profit margins during 2002-2004? What might drive this? ----------------------------------------------------------------------------------------------------------Other Income (Expense) This includes revenues and costs other than those from operations, such as dividend and interest income, interest expense, gains and losses from sale of assets, and equity earnings or losses. Equity Earnings (Losses) Equity earnings (losses) are the investor’s proportionate share of the investee’s earnings (losses). There are two accounting methods, cost or equity, that can be used to account for investments in the voting stock of other companies. The equity method is used when the investor can exercise “significant” influence over the investee’s operating and financing decisions. Under this method, the account of equity earnings (losses) is used by the investor to recognize the investor’s proportionate share of the investee’s earnings (losses). On the other hand, if the cost method is used, the investor recognizes dividends received and records the amount under the account of other income. Example: Suppose that firm A acquires 20% of the common shares of firm B for $500,000. Firm B reports $200,000 earnings for the year and pay $100,000 in dividends. This impacts firm A’s income statement and balance sheet as follows: Cost Method Equity Method Income Statement $20,000 $40,000 Investment (.2*$100,000) (.2*$200,000) Income (Other Income or Equity Earnings) Balance Sheet $500,000 $520,000 Investment ($500,000+$40,000- Account .2*$100,000)^ ^Under the equity method, investment account = investment at cost + investment income – dividends received Special Items This includes equity earnings, unusual or infrequent items disclosed separately, discontinued operations, extraordinary gains (losses), cumulative effect of change in accounting principle, and minority share of earnings (losses). Please see FIN 340 textbook, pp. 4-13. Net Income (Net Earnings) Net income is the profit after consideration of all revenues and expenses. Earnings per Common Share (EPS) EPS = net income/number of shares outstanding There could be 2 calculations of EPS: basic and diluted. Diluted EPS uses all potentially dilutive securities (convertible bonds, options, warrants, etc.) in the number of shares outstanding. As a result, diluted EPS <=basic EPS. Comprehensive Income The prevailing accounting concept is that income should include all revenues, expenses, gains and losses, regardless of whether they are results of operations. As a result, other comprehensive income includes foreign currency translation adjustments, unrealized holding gains and losses on available-for-sale marketable securities, additional pension liabilities, and cash flow hedges. See FIN 340 textbook, pp. 15-16. III. Quality of Earnings Earnings are the bottom line. One needs to carefully examine the quality of earnings in at least three dimensions: (1) Are reported earnings repeatable? (2) Are reported earnings subject to accounting manipulation? (The “when” question.) (3) Are reported earnings temporarily boosted by a decrease in necessary expenditures, such as R&D.