INTERMEDIATE

ACCOUNTING

Seventh Canadian Edition

KIESO, WEYGANDT, WARFIELD, IRVINE, SILVESTER, YOUNG, WIECEK

Prepared by:

Gabriela H. Schneider, CMA; Northern Alberta Institute of Technology

CHAPTER

3

Appendix 3A

Using Reversing Entries

Learning Objectives

1. Identify adjusting entries that may be

reversed.

Reversing Entries

• Used to reverse two types of adjusting

entries:

– Accrued Revenues

– Accrued Expenses

• Reversing entries are recorded and

posted on the first day of the new fiscal

period

• Reversing entries are an option

Reversing Entry Guidelines

If reversing entries are used:

1. All accrued items should be reversed

2. All prepaid items where cash was

debited or credited on the original

transaction should be reversed

3. Amortization and bad debt

adjustments are not reversed

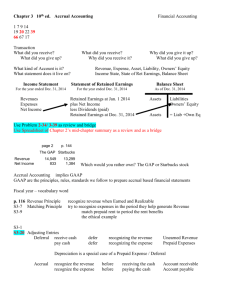

Reversing Entries – Accrual

Example

Given the following original, adjusting and closing entries

Oct. 24

Oct. 31

Oct. 31

Salaries Expense

Cash

Salaries Expense

Salaries Payable

Income Summary

Salaries Expense

4,000

1,200

5,200

4,000

1,200

5,200

On November 8th salaries of $2,500 are paid. $1,200 of

this amount relates to the salary accrual of October 31st

Reversing Entries - Accrual

Example

If no reversing entry were made on November 1st

Nov. 8

Salaries Payable

Salaries Expense

Cash

1,200

1,300

2,500

Salary Expense for November is $1,300; and

Salaries Payable now has a zero balance

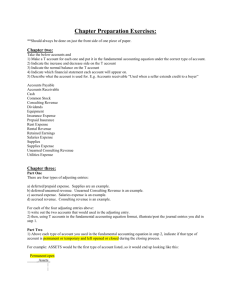

Reversing Entries - Accrual

Example

If reversing entry is made on November 1st

Nov. 1

Salaries Payable

Expense

1,200

Nov. 8

Salaries Expense

Cash

2,500

1,200

2,500

Salary Expense for November is $1,300; and

Salaries Payable now has a zero balance

Reversing Entries –

Prepayment Example

Given the following original, adjusting and closing entries

Dec. 10

Office Supplies

Cash

20,000

20,000

Dec. 31

Office Supplies Expense

Office Supplies

15,000

15,000

Dec. 31

Income Summary

15,000

Office Supplies Expense

15,000

No reversing entry necessary here. Office Supplies

(Inventory) was debited in the original transaction.

Reversing Entries –

Prepayment Example

Given the following original, adjusting and closing entries

Dec. 10

Office Supplies Expense

Cash

20,000

20,000

Dec. 31

Office Supplies

5,000

Office Supplies Expense

5,000

Dec. 31

Income Summary

15,000

Office Supplies Expense

15,000

If reversing entries are used, a reversing entry is made

in order for the expense account balance to equal the

unused supply cost.

Reversing Entries - Accrual

Example

Reversing entry on January 1st:

Jan. 1

Office Supplies Expense 5,000

Office Supplies

5,000

Here, any additional office supply purchases are

debited to the Office Supplies Expense account.

Office Supplies inventory would then be adjusted

During the year-end adjusting process.

COPYRIGHT

Copyright © 2002 John Wiley & Sons Canada, Ltd.

All rights reserved. Reproduction or translation of

this work beyond that permitted by CANCOPY

(Canadian Reprography Collective) is unlawful.

Request for further information should be

addressed to the Permissions Department, John

Wiley & Sons Canada, Ltd. The purchaser may

make back-up copies for his / her own use only and

not for distribution or resale. The author and the

publisher assume no responsibility for errors,

omissions, or damages, caused by the use of these

programs or from the use of the information

contained herein.