The National Law Journal

October 11, 2010

Insurance coverage goes constitutional

When the duty to cooperate is at odds with Fifth Amendment, the attorney-client privilege may

provide some relief.

Anthony Pacheco, Paul L. Langer, and Alison Haddock

How is it that an insurance coverage issue could invoke a constitutional Catch-22?

Consider the following. An executive is named as a defendant in a civil lawsuit and is simultaneously being

investigated by law enforcement for suspected misconduct. The fees for the executive's legal defense in the

civil lawsuit are being paid by an insurer under an insurance policy. The executive is questioned at a

deposition in the civil matter about acts that the executive and the executive's counsel believe could be

incriminating in the parallel criminal investigation. The executive asserts the Fifth Amendment right against

self-incrimination and refuses to answer the posed questions. Post-deposition, the insurance company

contacts the executive and warns the executive that the assertion of the Fifth Amendment constitutes a

"failure to cooperate" with the insurer's defense of the civil claims, as is required by the insurance policy. If

the executive continues to assert the constitutional Fifth Amendment rights, the insurer will withdraw

insurance coverage.

Federal courts have ruled that a policyholder who "pleads the Fifth" to avoid self-incrimination can be in

breach of an insurance policy's cooperation clause because it constitutes a failure to participate in the

insurer's investigation of the claim. These rulings force policyholders to make a difficult choice: to cooperate

and waive important constitutional rights or forgo insurance coverage and shoulder the high costs of

litigation. All of this before the policyholder has been convicted of a crime, and thus is still presumed to be

innocent.

The Fifth Amendment provides that no person "shall be compelled in any criminal case to be a witness

against himself." This privilege applies not only when an individual is called as a witness in a criminal

prosecution, but also applies to any other proceeding, civil or criminal, formal or informal, when the answers

might tend to incriminate the witness in a future criminal proceeding. McCarthy v. Arndstein, 266 U.S. 34, 40

(1924).

Despite this important and broad protection, a policyholder's failure to provide testimony in an investigation

or civil proceeding on the basis of the Fifth Amendment has been found to be a breach of the policyholder's

duty to cooperate with its insurer. See Aetna Casualty & Surety Co. v. State Farm Mut. Auto. Ins. Co., 771 F.

Supp. 704 (W.D. Pa. 1991). One federal court has held that the "Fifth Amendment privilege against selfincrimination does not trump an insurance policy's duty to cooperate requirement." Bogatin v. Federal Ins.

Co., No. 99-4441, 2000 U.S. Dist. Lexis 8632, at *78 (E.D. Pa. June 21, 2000).

Given this growing body of jurisprudence, what should an executive in this position do?

THE ATTORNEY-CLIENT PRIVILEGE

The attorney-client privilege may provide some relief. Many jurisdictions have afforded some level of

attorney-client privilege to communications between a policyholder and insurer and that privilege could

preclude such information from being used against the policyholder in a criminal proceeding. Different courts

have adopted different views on the scope and breadth of this privilege, but in every case the inquiry is factspecific and turns on the circumstances surrounding the communication between the insured and insurer,

including the purpose of the communication, timing of the communication and other considerations aimed at

determining whether the communication was confidential and made for the purpose of furnishing or

obtaining legal advice or assistance.

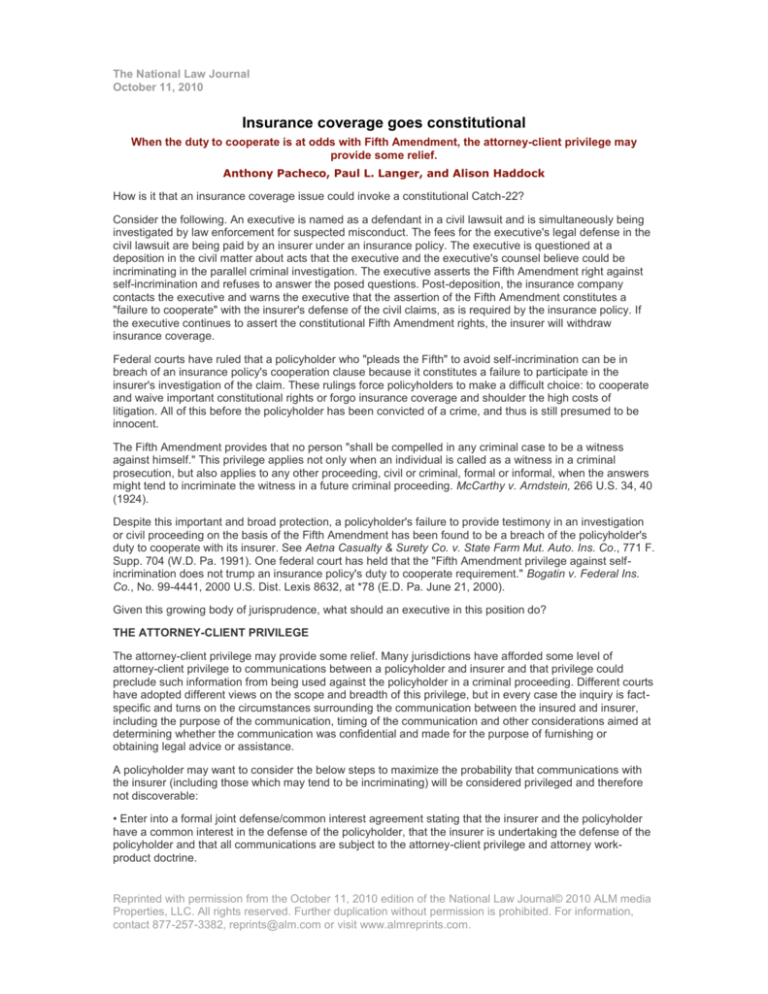

A policyholder may want to consider the below steps to maximize the probability that communications with

the insurer (including those which may tend to be incriminating) will be considered privileged and therefore

not discoverable:

• Enter into a formal joint defense/common interest agreement stating that the insurer and the policyholder

have a common interest in the defense of the policyholder, that the insurer is undertaking the defense of the

policyholder and that all communications are subject to the attorney-client privilege and attorney workproduct doctrine.

Reprinted with permission from the October 11, 2010 edition of the National Law Journal© 2010 ALM media

Properties, LLC. All rights reserved. Further duplication without permission is prohibited. For information,

contact 877-257-3382, reprints@alm.com or visit www.almreprints.com.

• Label all communications between the policyholder and the insurer as attorney-client privileged, commoninterest privilege (if applicable) and confidential.

• Ensure that all communications between the policyholder and the insurer are made through the attorney

representing the policyholder on the one hand and, if possible, an in-house attorney at the insurance

company on the other.

Although no guarantee that a court in the criminal proceeding will rule such communications to be subject to

the attorney-client privilege, these three steps may increase the possibility of a ruling in favor of the

policyholder.

COORDINATION WITH THE INSURANCE COMPANY

In addition to diligence in preserving and protecting privilege, the policyholder, the policyholder's criminal

defense counsel and insurance coverage counsel can work together to understand what the policyholder

must do to cooperate sufficiently with the insurer. Criminal defense counsel can evaluate whether some

information can be shared with the insurance company short of waiving important Fifth Amendment rights.

Although a difficult tightrope to walk, such efforts can ensure that sufficient information is provided to the

insurance company, thus inhibiting the insurer's efforts to claim a failure to cooperate.

As a general matter, the well-established "Garrity rule" could potentially be expanded to provide courts with

a mechanism to ensure that a policyholder's Fifth Amendment rights are protected and that policyholders do

not end up squeezed by these competing constitutional and financial interests.

Garrity v. New Jersey, 385 U.S. 493, 496-500 (1967), held that when an individual invokes Fifth Amendment

rights but then makes statements as a result of economic coercion, the statements are inadmissible in any

subsequent criminal case. Garrity was recently evoked by the U.S. Court of Appeals for the D.C. Circuit to

dismiss manslaughter indictments against Blackwater security guards, as the court found that the

government utilized coerced statements from the security guards in its prosecution. U.S. v. Slough, 677 F.

Supp. 2d 112 (D.D.C. 2009). "Coercion" sufficient to bar the use of a witness' statements in subsequent

criminal proceeding includes economic pressure like threats of loss of employment or business contracts.

Id.; see also Lefkowitz v. Turley, 414 U.S. 70, 84-5 (1973). The Garrity rule generally applies only when a

state actor, i.e. the federal or state government, applies the coercion, but statements coerced by private

companies acting on the state's behalf, such as when a company receives significant encouragement to

assist the government in an investigation, may also invoke the rule.

"Coercion" in the modern corporate context can arise in relation to U.S. Department of Justice

investigations. In these investigations, federal prosecutors will sometimes defer prosecution if a business will

cooperate with an investigation or prosecution of current or former employees. In a key case addressing the

issue, an employer's conditioning of payment of legal fees on witnesses' waiver of their Fifth Amendment

rights amounted to coercion. See U.S. v. Stein, 440 F. Supp. 2d 315, 330-32 (S.D.N.Y. 2006). In that case,

although KPMG, a private employer, made the economic threat, the Garrity state-action requirement was

met because the government "quite deliberately coerced, and in any case significantly encouraged, KPMG

to pressure its employees to surrender their Fifth Amendment rights" and thus KPMG's actions were "fairly

attributable" to the United States. Id. at 337.

Because the threat to revoke insurance coverage is arguably economic coercion, Garrity could apply to our

executive's quandary if the coercion by the insurer was in some way attributable to the government as in the

KPMG case, if, for example, the government pressures an employer and the insurance company providing

the employer's executive policy to cooperate with its investigation.

Even if an insurance company's actions are not "fairly attributable" to a state actor, courts may want to

consider extending Garrity protections more broadly to coercion exerted by private parties — like insurance

companies — in order to preserve the important Fifth Amendment right. The concerns present in Garrity are

equally applicable to situations in which private companies such as insurers are acting as a "stalking horse"

for the government's investigation, such as when the insurance company conducts an initial investigation

and ultimately provides ammunition for a later government action by providing the government with

discovery. However, given the present state of the law, the executive in our scenario should consider the

measures we suggest above when a duty to cooperate with an insurance company may be in conflict with

the executive's constitutional right against self-incrimination.

Anthony Pacheco, a partner in Proskauer Rose's Los Angeles office, is the deputy chief of the firm's

corporate defense and investigations group and can be reached at apacheco@proskauer.com. Paul L.

Langer, a partner in the Chicago office, is a member of the firm's insurance recovery and counseling group

and can be reached at planger@proskauer.com. Alison Haddock, an associate in the New York office, is

Reprinted with permission from the October 11, 2010 edition of the National Law Journal© 2010 ALM media

Properties, LLC. All rights reserved. Further duplication without permission is prohibited. For information,

contact 877-257-3382, reprints@alm.com or visit www.almreprints.com.

a member of the firm's litigation and dispute resolution department and can be reached at

ahaddock@proskauer.com.

Reprinted with permission from the October 11, 2010 edition of the National Law Journal© 2010 ALM media

Properties, LLC. All rights reserved. Further duplication without permission is prohibited. For information,

contact 877-257-3382, reprints@alm.com or visit www.almreprints.com.

![[Date] [Policyholder Name] [Policyholder address] Re: [XYZ](http://s3.studylib.net/store/data/008312458_1-644e3a63f85b8da415bf082babcf4126-300x300.png)