ps1_answers

advertisement

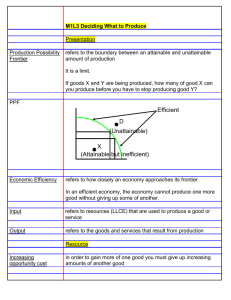

Akos Lada alada@fas.harvard.edu Harvard Kennedy School Summer Program 2014 Problem Set #1 (Due Friday, July 25th) 1. The following is based on the assigned article: Whatever Happened to the Food Crisis, The Economist, July 4, 2009. The following statements have been extracted for you to analyze their impact on the supply and demand of world food prices - specifically agricultural crop prices. For each statement, determine the impact on price and quantity (ceteris paribus) for the crop indicated. Then in the language of an economist communicate what is happening to supply and demand (i.e., was it a change in supply and/or demand and/or a change in quantity of supply and/or demand). a) (Do this problem in regards to the general market for cereal crops) "The European Union shelved a programme that had obliged farmers to leave 10% of their land fallow" ANSWER: New land is now available for cultivation. This is basically equivalent to a decrease in input prices (regulation is thought to add a cost to business). Thus, we will get an increase in supply and a decrease in prices (at least in the short run - if over cultivation exhaust the soil in the long run, supply may eventually decrease). P will decrease and Q will increase. This corresponds to an increase in supply and an increase in the quantity demanded. b) (Do this problem in regards to the general market for soybeans) "Take oil prices, for example: oil (and government subsidies) determines how much maize is planted for ethanol. That in turn influences how much land is planted to soybeans, which for many farmers around the world are interchangeable with maize." (Excerpt has been edited) Extra information: Maize (corn) is used for ethanol, soybeans are not. Assume oil prices are increasing over the time period being discussed. ANSWER: Since we are assuming oil prices are increasing over the time period there will be an increase in demand for ethanol (joint products in production). There will be an increase in land prices for soybeans (an increase in input prices). P of soybeans will increase and Q will decrease. In economic terms, there is a decrease in supply and a decrease in the quantity demanded. c) (Do this problem in regards to the general market for cereal crops) "At the moment, the world’s population is 6.7 billion and 750m people are born each year. Though the rate of increase is declining, inertia means the total will go on rising until 2050, when the population will reach 9 billion. In Ethiopia, for example, 18m children are born every year, rising to 24m a year by 2040. That will double its headcount from 80m to 160m." ANSWER: This is an increase in number of buyers for cereal crops. Akos Lada alada@fas.harvard.edu Harvard Kennedy School Summer Program 2014 P will increase and Q will increase. In economic terms, there is an increase in Demand and an increase in the quantity supplied. PPF 2. In this problem we will be examining the United States' and China's hypothetical production possibility curves (ie. production possibility frontiers). Instead of placing narrow types of goods on the two axes, we will be placing very broadly defined goods on the axes. These good categories will be "consumer goods" and "capital goods" (capital goods are plants/facilities, equipment, technology, etc. - in other words, capital goods are goods that help us make other goods - when countries produce capital goods economist sometimes refer to these production decisions as capital investments). Assume all goods made in either country can be classified as one of these two types of goods. a) Draw a single graph with capital goods and consumer goods on the two axes. Place both the United States' and China's PPF on this graph. To help you do this, here is some information: The United States Nominal GDP: $14.264 trillion The United States GDP (PPP): $14.264 trillion China's Nominal GDP: $4.33 trillion (in dollar denominated terms) China's GDP (PPP): $7.8 trillion ANSWER: Seeing that the US's GDP is about twice that of China's (182% of China's or 83% larger than China's) I would draw the US's PPF about twice as far from the origin. Now, there are some complications. The GDP number only corresponds to one point on the PPF. It does tell us that the US has the ability to make 83% more consumer goods if consumer goods were all they made - or 83% capital goods if capital goods were all they made. So, there is no way to build a PPF which reflects each country's real capacity at all points along their PPF with just a GDP number. BUT, GDP does provide a good reference point (especially if purchasing power parity has been taken into account) - and, I think it's always interesting to note different countries' GDP numbers. Each country's PPF should be concave to the origin (i.e., if the origin was the center of the pie - each PPF would look like a one-quarter slice of the pie (different size pie slices, but nevertheless, both should look basically like a pie slice). Grading Note: Some put dollars on the axes, remember you actually want units on the axes. GDP is measured in monetary units, but it was give just as a reference. The increasing opportunity cost aspect of the PPF is distorted a little with dollar amounts on the axes - especially if you have the PPF intersecting the axes as $14 trillion for US and $7.8 trillion for China. Note: These GDP numbers are given simply to give you an idea of each country's production capacity. You don't have to be exact by any means. Use the PPP GDP numbers as your reference when constructing the PPFs. They are more reflective of the true production capacity of the two countries. A little information about purchasing power parity (this is not required material - read at your leisure): Akos Lada alada@fas.harvard.edu Harvard Kennedy School Summer Program 2014 Purchasing power parity: a theory of exchange rates whereby a unit of any given currency should be able to buy the same quantity of goods in all countries. Explanation: Assume $1 can purchase a 12 oz. can of coke. Also assume $1 can be exchanged for 8.2 Yuan (the Chinese currency). Then it would be assumed a 12 oz. can of coke cost 8.2 Yuan. However, this is often not the case. Instead, it may only cost 3.9 Yuan to purchase a 12 oz. can of coke. Therefore, a United States citizen would truly get more for his money when he goes to China. Thus, in this example, we want to use the PPP numbers to determine the size of each countries' PPF. Note: For more, see page 707. b) The PPFs for the two countries should have bowed-out shapes. What does the changing slope of each country’s PPF mean in economic terms? ANSWER: In absolute value terms (disregarding the negative value of the slope) the slope of the PPF is increasing as we move from left to right. Assume good X is on the x-axis and good Y is on the y-axis. As we move from left to right along the PPF we are making more of good X and less of good Y. The rate at which we give up good Y to get good X is increasing. Conversely, when we move from right to left along the PPF we are increasing our production of good Y and decreasing our production of good X. In this situation the graphical slope (in ∆x/∆y) is decreasing, but the rate at which we give up X to get Y is increasing. Thus, either direction we move along the PPF shows us that the opportunity cost increases as we increase production of a particular good. Therefore, the shape of the PPF communicates the realities of increasing opportunity cost. Note: You are NOT expected to do outside research for this question in regards to China and United States. The following questions should just represent your current knowledge. The goal of these questions is to get deeper understanding of the PPF model, not to know all about the US's and China's production realities. c) Assuming countries' who invest in capital goods at a higher rate than consumer goods grow at a faster rate, place a dot on each country's PPF which reflects the amount of capital and consumer goods each country has chosen to produce. Assume that each country is producing efficiently - it's a big stretch, I know. Next to each dot write US09 and China09. Remember, you're only using your current knowledge about China and the United States. ANSWER: First of all, there is no right answer (your knowledge of the US's growth rate and China's growth rate is not the point of the question). But given that China has been growing at a significantly faster rate than the US over the last 2 decades (approximately 8-10% to approximately 2-4% respectively) it does make some sense to argue that China is producing more capital goods relative to consumer goods as compared to the US. However, China increasing production capacity might be related to other factors of production - i.e., land, labor, and entrepreneurial ability and/or technology. I would argue that China is probably investing in capital a little more than the US (in relative terms) - especially when you expand capital to not only private investments but also to include public investments (like ports, roads, energy plants, etc.). But, I would also associate China's increased production capacity to investments in human resources and targeted loosing of some regulated markets to increase risk taking (i.e., entrepreneurial Akos Lada alada@fas.harvard.edu Harvard Kennedy School Summer Program 2014 activities). Finally, convergence between the US and China comes from China's relatively efficient adoption of technologies from more developed economies and their larger marginal gain from capital investments (i.e., the marginal gain from capital is greater for less developed economies than more developed economies). So, wherever you placed each country's dot (representing where they are at the present) is fine with me - as long as you thought it through. The idea was simply to make you think through an application of the PPF. d) Based on your answer in (c), what percentage of each country's production capacity has gone to producing capital goods (just estimate)? What percentage of each country's production capacity has gone to producing consumer goods (just estimate)? In absolute terms, which country is producing more capital goods? ANSWER: Remember, you're just estimating in this problem. The trick to this problem is to look at where you placed a country's dot and then draw a horizontal line to the y-axis and a vertical line to the x-axis. Now, look at those two distances (the distance from the origin to your line's intersection with the y-axis and the distance from the origin to your line's intersection with the x-axis). Partition each axis with standardized units. For example, maybe your production point corresponds to 3 units on the y-axis and 7 units on the x-axis. Therefore, this country would be allocating 30% of the production capacity to the good associated y-axis good and 70% of its production capacity to the x-axis good. Note: This is still playing a little fast and loose with the numbers. For this to really work out, the standardized units on each axis would need to correspond to resource expenditures for each of the respective goods. Many of you had very different percentages (one country producing over 70% of one good and the other country producing over 70% of the other good). I would say in the US we would expect about 15 to 20% going to capital goods and not a whole lot more going to capital goods in China. It would be quite rare for a country to devote over 30% of production capacity to capital goods. e) Name 3 public policies that may expand a country's PPF over time. (To answer this, think about what expands a county's PPF - not what they need to do to be on their PPF, but how do they actually expand it outward.) ANSWER: I would say the following are pretty arguable answers: Investments in education Investments in job training Investments in healthcare (a more healthy workforce is more efficient) Investments in physical infrastructure - roads, mass transit, docks, canals, bridges, etc. Tax breaks for businesses engaging in capital expenditures Adoption of technologies which have proven to increase efficiency Attract Foreign Direct Investment Attract Foreign Portfolio Investment Some more controversial answers - but still could be argued: Better enforcement of property rights (this is definitely true for some countries) Increasing democratic governance Public policy to ensure merit based hiring instead of political patronage Privatization of some industries (e.g., steel) Akos Lada alada@fas.harvard.edu Harvard Kennedy School Summer Program 2014 Increased regulation of other industries to ensure stability and thus more investment due to decrease in risks Decrease trade barriers (however China and the US are fairly open right now) Changes in immigration laws - specifically ones that favor high skilled laborers (however, increases in immigration regardless of job skill should increase the PPF). So, this is a question for the ages. I'm certain you don't completely agree with my list (I'm not sure if I do), but these are all things that are argued to increase economic growth rates. f) Wherever you placed your dot on the US's PPF, we would assume if you aggregated all of the capital goods produced in the US and all of the consumer goods produced in the US, the market value of those goods would be $14.246 trillion. Knowing what you know about the PPF, if the United States decided to switch all their production capacity to the production of consumer goods, would the total market value of those consumer goods equal $14.246 trillion? Explain why or why not. ANSWER: No. Although GDP is an attempt to figure out how many goods and services a country is making, GDP still gives more weight to goods that are valued more by society (ie., have a higher price). The units on the x and y-axes are actually units of those goods. If the US produced only consumer goods they would be increasing supply of consumer goods and therefore the market value of those goods would go down. Also, if the US switched production to consumer goods it would mean major changes in production facilities - hence they would follow the line of their PPF - ie., the opportunity cost would continue to increase as they moved resources that were good at producing capital goods and bad at producing consumer goods to the production of consumer goods. So, no, 100% production of consumer goods would not yield a GDP of $14.246 trillion. Trade Note: All numbers in this question are fictitious. 3. Germany and Vietnam are considering entering into a trade agreement regarding textile goods and automobiles. Currently, Germany has the production capacity to produce 50,000 units of textiles per week or 10,000 automobiles per week – or some combination of the two. Vietnam on the other hand has the production capacity to produce 10,000 units of textiles per week or 1,000 automobiles per week – or some combination of the two. Assume both countries face constant trade-offs (ie constant opportunity costs) as they switch production from one good to the other. a) Draw two graphs representing each country's production capacity in relation to these two goods. ANSWER: You should have drawn to PPF curves. The PPF line should have been linear. The y-axis intercept should correspond with one of the amounts in the problem set-up and the x-axis intercept should correspond to the other amount in the problem set-up. The linear line represents the constant trade-off as we switch production from one good to the other. b) Which country has the absolute advantage in the production of each good? ANSWER: Germany has the absolute advantage for both goods. Akos Lada alada@fas.harvard.edu Harvard Kennedy School Summer Program 2014 c) Which country has the comparative advantage in the production of each good? ANSWER: Germany has the comparative advantage for automobiles. Germany gives up 5 units of textiles when they make a car - Vietnam gives up 10 units of textiles when they make a car. Therefore, Vietnam has the comparative advantage for textiles. Vietnam gives up 0.1 cars when they make 1 unit of textiles and Germany gives up 0.2 cars when they make a unit of textiles. d) Which country should produce/sell textiles? ANSWER: Vietnam. What price would they find acceptable for textiles? ANSWER: They would need to receive more than 0.1 cars for a unit of textiles to make trade advantageous to them. e) Which country should produce/sell automobiles? ANSWER: Germany. What price would they find acceptable for automobiles? ANSWER: Germany would need to receive more than 5 units of textiles to make trade advantageous to them. f) State the range of trade terms which would benefit each country for textiles. ANSWER: For textiles it would be between 0.1 cars (what Vietnam would require) and 0.2 cars (what Germany would require). For cars, it would be between 5 textiles (what Germany would require) and 10 textiles (what Vietnam would require). g) State the range of trade terms which would benefit each country for automobiles. ANSWER: For cars it would be between 5 textiles and 10 textiles. h) State a possible negotiated terms of trade Germany and Vietnam might reach. Express this terms of trade in terms of each good. ANSWER: A suitable answer would be 1 unit of textiles for 0.15 cars; and thus, 1 car for 6.67 units of textiles. i) Using the graphs you used in problem 2.a, draw a linear line representing each country's consumption possibility frontier (assuming 100% specialization and a willingness to buy all of either good). ANSWER: Let's look at Germany. Germany has the comparative advantage in car production. So let's first assume they produce nothing but cars - thus producing 10,000 of them (this is the only point on both their PPF and CPF). Now, assume they were willing to sell enough cars to get all the textiles Vietnam made. They would need to sell 1,500 cars to get all of Vietnams 10,000 textiles. This gives us another point - 8,500 cars and 10,000 textiles. This point is beyond their PPF. So connect this point to the first point (the point which corresponds to Germany making 10,000 cars and not trading any of them). Now, Germany (assuming they don't trade with any other country) will have to make their own textiles if they want more of them. Therefore, their cost will now be their opportunity cost based on internal production - no longer the negotiated trade terms. Thus, We now draw a line from the point corresponding to 8,500 cars and 10,000 textiles toward the axis corresponding to textile goods parallel to Akos Lada alada@fas.harvard.edu Harvard Kennedy School Summer Program 2014 their PPF curve (not on their PPF curve, but parallel to it - representing the same opportunity cost). Thus, they will intercept the textile axis at 52,500 units of textiles. Thus, they could make 42,500 textiles and 1,500 cars and then trade the 1,500 cars for 10,000 textiles. OK, with that explanation for Germany, I will leave it up to you to do Vietnam. 4. Represent the changes presented in each problem graphically by showing both the dollar market and the Yen market. State whether each currency is appreciating or depreciating. When graphing a problem, be sure to label everything – it should help you. Determinants of Exchange Rates: Tastes related to imports and exports Relative incomes Relative price levels Relative real interest rates Speculation about future currency values *Political Stability a) The US economy takes a sharp upswing; and therefore, our per capita national income increases. ANSWER: If the US’s per capita national income goes up they will supply more dollars and demand more yen to the exchange market. The dollar will depreciate relative to the yen. b) The US Treasury Department increases interest rates on their treasury notes (the bonds they’re selling). ANSWER: The US bonds are now more attractive. There will be an increase in demand for the dollar to buy the US treasury bonds. The price of the dollar will appreciate relative to the yen. c) Economic forecasters predict that inflation will be a problem in the latter half of the year (i.e., prices of US goods and services are going up). How will this affect the dollar and Yen markets today? ANSWER: This one is a tough one. On one hand they expect the dollar to depreciate so they won’t demand the dollar causing the dollar to depreciate. However, another way to look at this problem is that if they expect prices of US goods and services to be going up in the future, they will demand more today thus demand dollars to buy those goods and services causing the dollar to appreciate today (and the prices of US goods and services to go up today). The problem with this answer is that exchange markets are quite efficient. If the US really experienced inflation the dollar would depreciate in turn, thus Japan could get US goods for the same amount of Yen even with the inflation. Therefore, I would say the first answer is slightly more economically sound than the second.