Final Assignment

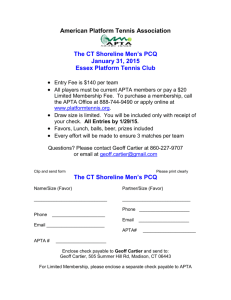

advertisement

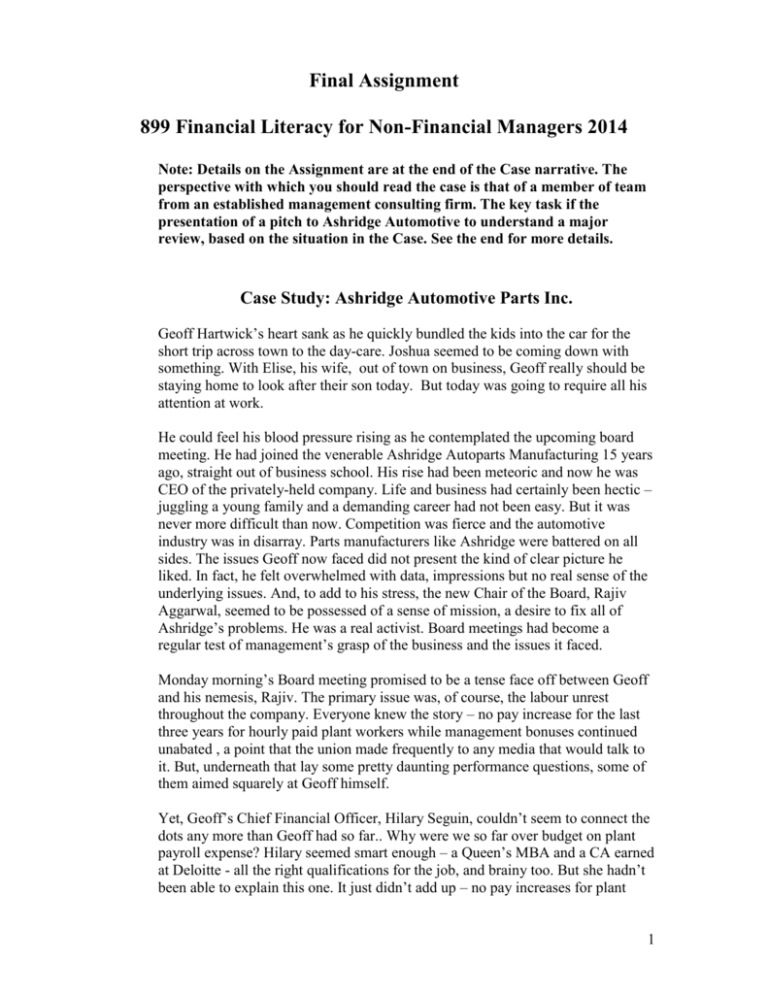

Final Assignment 899 Financial Literacy for Non-Financial Managers 2014 Note: Details on the Assignment are at the end of the Case narrative. The perspective with which you should read the case is that of a member of team from an established management consulting firm. The key task if the presentation of a pitch to Ashridge Automotive to understand a major review, based on the situation in the Case. See the end for more details. Case Study: Ashridge Automotive Parts Inc. Geoff Hartwick’s heart sank as he quickly bundled the kids into the car for the short trip across town to the day-care. Joshua seemed to be coming down with something. With Elise, his wife, out of town on business, Geoff really should be staying home to look after their son today. But today was going to require all his attention at work. He could feel his blood pressure rising as he contemplated the upcoming board meeting. He had joined the venerable Ashridge Autoparts Manufacturing 15 years ago, straight out of business school. His rise had been meteoric and now he was CEO of the privately-held company. Life and business had certainly been hectic – juggling a young family and a demanding career had not been easy. But it was never more difficult than now. Competition was fierce and the automotive industry was in disarray. Parts manufacturers like Ashridge were battered on all sides. The issues Geoff now faced did not present the kind of clear picture he liked. In fact, he felt overwhelmed with data, impressions but no real sense of the underlying issues. And, to add to his stress, the new Chair of the Board, Rajiv Aggarwal, seemed to be possessed of a sense of mission, a desire to fix all of Ashridge’s problems. He was a real activist. Board meetings had become a regular test of management’s grasp of the business and the issues it faced. Monday morning’s Board meeting promised to be a tense face off between Geoff and his nemesis, Rajiv. The primary issue was, of course, the labour unrest throughout the company. Everyone knew the story – no pay increase for the last three years for hourly paid plant workers while management bonuses continued unabated , a point that the union made frequently to any media that would talk to it. But, underneath that lay some pretty daunting performance questions, some of them aimed squarely at Geoff himself. Yet, Geoff’s Chief Financial Officer, Hilary Seguin, couldn’t seem to connect the dots any more than Geoff had so far.. Why were we so far over budget on plant payroll expense? Hilary seemed smart enough – a Queen’s MBA and a CA earned at Deloitte - all the right qualifications for the job, and brainy too. But she hadn’t been able to explain this one. It just didn’t add up – no pay increases for plant 1 Final Assignment 899 Financial Literacy for Non-Financial Managers 2014 workers, falling demand for our product and yet the plant payroll expense was way over budget. Hilary had embarked on a cost containment exercise and had eliminated or frozen all non-essential expenditures. Gone was the free coffee, executives had to travel economy class and all media and advertising was stopped. But that still wasn’t enough to offset the labour cost issue. Geoff wondered whether Hilary was really worth that bonus cheque she just received; it just didn’t seem right that the company missed its objectives and yet senior management staff received a fixed percentage of their salary as bonus (the percentage increased with each year of service as the Ashridge family valued loyalty above all else), with no linkage to performance. Rajiv was similarly anxious as he drove into the office, anticipating yet another tangled encounter with management. He was a person who always tried for clrity, especially when running a company or on its board. Here he felt he had fallen into a swamp. He needed a strong coffee, and his usual Starbucks brew gave him the required lift. But he always resented the time spent in line waiting for the unreasonably chirpy “And how are you doing this morning?” Still, it was a business formula that seemed to work for Starbucks, everyone on their team seemed really engaged. Rajiv always found it interesting to compare the Starbucks experience to that offered by Tim Hortons – there was something about their business model that seemed to justify the premium price; it was more than just the coffee. He had been asked to take on the role of Chairman by the Ashridge family who controlled the company. His mandate was to get management on track and to ensure the company dealt with the full range of issues it faced. The family could see that something was wrong, but was reluctant to point fingers as they viewed their senior people – and all their staff – as family themselves. Rajiv’s first few months in the role had convinced him that the Board and management needed to get a better understanding the risks they were now facing and get better control over the business. The elusive key to success seems to be to get people on side, to buy-in and commit to the strategy, but this was not happening so are. Geoff seemed so defensive whenever legitimate questions were asked of him. And Rajiv could not understand a word that Hilary said; “Typical accountant!” he thought, “All jargon. She should get to the point.”. It wouldn’t have been so difficult if they had an accountant on the Audit Committee. Come to think of it, the Audit Committee hadn’t met in over a year - that needed attention, but Rajiv just had so many priorities. Beyond the concerns of meeting the current year’s budget and what that meant in terms of risk exposure and future business plans, Rajiv was particularly troubled by the company’s inability to attract and retain sufficient young engineering 2 Final Assignment 899 Financial Literacy for Non-Financial Managers 2014 talent. His long-term vision for the company – one that he held dearly but had not managed to get the owners and management, let along the rest of the Board on side on - entailed shifting away from the price-sensitive business of component stamping and getting into a higher value-added product mix that would differentiate the company from its competition and allow for better margins. But that vision depended on the company’s ability to innovate, which in turn required young engineers. Two to three early career recruits were brought on annually, usually poached from other auto parts manufacturers with the offer of growth opportunities. Engineer attrition was inexplicably high, with most leaving within a year or two of being recruited. No exit interviews were performed, but Rajiv suspected that the company simply didn’t know how to engage Millennials. However, there was no full analysis of the situation coming from HR, when was swamped in constantly recruiting. No exit interviews. On-boarding, as we will see, was more like sink or swim than joining in. Meanwhile, the company’s growth strategy was failing miserably. This strategy stressed leveraging the expertise and good service of the firm in its traditional product areas. Production was down and sales were down even more. No one on the shop floor seemed concerned “It’s management’s problem” being the standard response to inquiries about falling productivity. Caroline Brown was in charge of production. She faced increasing quality problems with her key performance measure of “ppm (parts per million) defective” steadily and uncontrollably increasing. In her darkest moments, she even wondered if plant staff were deliberately sabotaging quality. Yesterday, she had bumped into a recent new-hire from Frobishers – Daniel Smith - who had complained that the Quality Control process was still manual – at Frobishers, apparently, QC is facilitated by automated scanning equipment resulting in faster through-put and fewer missed defects. Ashridge still relied on visual inspection by a team of dedicated QC Inspectors. Visual inspection had been a bit of a bottleneck and so Caroline had compensated by keeping finished parts inventory levels higher than would otherwise be required – just so she could deliver to their customers on a rush basis without having to deal with delays in QC. It seemed to work and she had not thought that QC required any further management attention. However, it was a work-around a problem, not the solution to it. Maybe QC needed some QC. Daniel Smith had indeed just joined from Frobishers. He thought he needed a change but had no idea what lay in store for him at Ashridge. It’s been four weeks already and still no induction program. No-one seems to know what’s expected of them, morale is low and he’s never once heard anything about the company’s goals and business plans. Quite a change from Frobishers. He did mention to that 3 Final Assignment 899 Financial Literacy for Non-Financial Managers 2014 woman, Caroline Brown, that he thought a little investment in automation was long overdue at the plant – but wished he’d never mentioned it as clearly she didn’t appreciate any feedback from mere plant workers. Daniel worked for foreman Sammy Medora. A nice guy but fairly high-strung. Sammy had hired Daniel for a production job even though, clearly, there was insufficient work to do. Sammy said he had to maintain headcount and even had them working overtime on Saturdays (make-work projects, thought Daniel, producing stampings for inventory – why bother producing inventory without a specific customer order?). Sammy said if he didn’t maintain the headcount and hours in his department, he’d have his budget cut; then what would happen to Sammy’s job, how would he afford his wife’s frequent visits to her stylist, his kids’ tuition? As a new Canadian, Sammy was particularly proud to tell his family back in the Philippines that his two kids were attending Queen’s University, a Canadian Ivy League school! But wow, the tuition was expensive. Sure, Sammy said, things were slow, but they’d pick up soon. Management had a growth strategy, whatever that was, so surely things would be growing soon. And once that growth started, they’d be able to use up all that finished goods inventory currently sitting in rented storage. Besides, no one in management seemed to be tracking his work levels and output relative to sales or targets. In fact, Sammy, who really is the linchpin in that link, was not aware of sales targets or sales performance. He built the product. He didn’t sell it. Pay was not Daniel’s primary motivation. Just as well. No bonus plan. And, as he’d discovered, no pay raises for 3 years. Some of the plant workers were quite agitated about that and frequently asked why they should care about the success of the company when clearly the company didn’t care about them. On his way into the office, Geoff’s cell phone rang. He pulled over to take the call and could see it was Hilary calling. Joshua did not look well at all and this added an additional anxiety to Geoff’s voice. “What’s up Hilary? Everything OK for this morning’s Board meeting?” Hilary advised that the bank was anxious about the company’s poor current ratio and had been asking for it to be rectified for a couple of months now. Today, the bank had called to say that it was cutting the line of credit from $1 million to $750,000 and unless the current ratio was improved from 0.9 to 1.25, would be looking to cut the line to $500,000 next month. “The banks are always concerned about their own hides” she said (demonstrating a little too much detachment for Geoff’s taste – he just wished she’d bring a little more enthusiasm and drive to her role). So, this was going to be the crisis this week, thought Geoff. What on earth will Rajiv say when he hears that? And Joshua clearly has a fever, what kind of a father am I turning out to be? 4 Final Assignment 899 Financial Literacy for Non-Financial Managers 2014 Having arrived early for the board meeting, Rajiv’s attention was caught by a stack of old publications in the reception area. One dated three years prior, was an Ashridge Staff Newsletter proudly proclaiming details of the business plan for that year. Intrigued, Rajiv asked Jessie, the receptionist for a copy of a more current edition. “Oh, that was stopped three years ago Mr. Aggarwal. We’re very cost conscious, always looking for ways to cut costs here you know”. Just then, Geoff arrived, having hastily dropped Joshua and his sister at the day care and feeling drained already. The assembled members of management and the Board walked along the hall to the boardroom. The Board meeting followed the usual agenda, with a review of results to date and outlook for the balance of the year. Given the rise in labour costs and reduction in sales, one Board member commented, “This is a formula for a major problem. What is happening to turn it around?” “Good question,” chimed in Rajiv. Geoff’s response centered on sales efforts and the state of the market. “There is not a lot we can do in these economic times. It is a storm to be weathered.” This time Rajiv’s blood pressure shot up. As expected, much discussion was given over to labour unrest at the plant, with concerns expressed about low employee morale and high labour costs. Heated discussion followed over the company’s banking woes. The Board was blind-sided on this, never having had it identified as a risk factor in the past, or one that needed to be mitigated. Both Geoff and Hillary said that they had had no prior warning, nor had they sat down with the bank to review their current pressures. With considerable vitriol directed at the bankers “who just do not understand our business”, the management team felt that the Board should exert some pressure. Under “Other business” Rajiv invited management to share competitive insights gained since the last meeting and it was then that the Board learned of Frobisher’s latest innovation, which entailed the off-shoring of their engineering function to India. Rajiv wondered if this had merit for Ashridges and asked Geoff to develop a decision support framework that would allow the Board to evaluate future offshoring proposals. Rajiv asked if there was anything else on the horizon that they should be aware of. Geoff said that with the complex situation in the plant, it was difficult to get any outside perspective. Rajiv wondered is this was something the Board could and perhaps should help with. Geoff left the meeting feeling more anxious than ever. The Company continues to miss growth targets, is unable to recruit and retain the talent it needs to innovate and is being assailed by competitors who are better at cost reduction. No one, Geoff felt, had yet seen the big picture. In truth, Geoff had to count himself in 5 Final Assignment 899 Financial Literacy for Non-Financial Managers 2014 here too. Was he at the end of good run? If so, what could he possibly do to shift gears here. Something fundamental is wrong, but what is it? At this point, Geoff decided to take the lead here and try to pull things together. Otherwise, Rajiv would simply keep at him until he found the hook to dump him and find his own CEO. Geoff could count on the loyalty of the Ashridges, but he was fool. There was even a limit there. It was called the bottom line. As he was still in the building, Geoff found Rajiv and asked if he could talk. “Look, I am getting a strong sense of your frustration with me and my team. Your body language alone speaks volumes. If I were absolutely certain we were on a profitable and sustainable course, I would be more than ready to butt head with you until we found a way to work together. But, I am not. I see issues but I have yet to put it all together. I think you see problems too. I suggest we find a way to break this impasse. Maybe we just need to bring in some help to lend us some perspective and do that analysis we just don’t seem to ever get to. What do you think?” Rajiv thought to himself, “Step one, finally.” The two agreed that they would talk to the Ashridge family together to suggest a major corporate review. They would argue that the expense of brining a top flight firm with its brightest and best would perhaps help restructure the issues and give them a way forward. The Ashridges readily agreed, relieved that they did not have to go down the route of a managerial blood-bath, at least for the present. Your Assignment Each team identified by the instructors represents a leading management consulting firm invited to give a proposal to work with Ashridges (“the company”) to address the needs that have emerged from this case. As this is a proposal, your objective is not present solutions to the problems, but to convince the review panel (made up of Geoff and Rajiv) that you have developed an understanding of the situation, have a plan for review and have the talent and experience to deliver a final set of usable recommendations. The company has specified that the winning proposal must contain the following elements: An executive summary containing your understanding of the company’s needs and a succinct case for appointing your firm. 6 Final Assignment 899 Financial Literacy for Non-Financial Managers 2014 An assessment of the risks the company faces to achieving its goal of sustained growth in its business, and specifically an assessment of the finance and HR issues faced by the company. It is understood that this assessment will be of a preliminary nature and the successful bidder will be required to undertake a comprehensive issues assessment exercise after appointment. The assessment will also determine what further analysis or information not presented above would have to be gathered to make the recommendations useful. A preliminary workplan identifying potential recommendations that the bidder anticipates will most likely address and resolve the issues identified. The preliminary workplan will assign a priority to each issue and related recommendations. In addition to the identification of potential recommendations, the bidder will briefly identify what further work is required to confirm or change the preliminary assessment and recommendations. A staff budget showing level of staff to be assigned, relative roles and anticipated time to be committed to the project. A description of level of effort by team member should accompany the budget. A description of the methodology you will employ in conducting your work. The content element that the company will consider most influential in making its decision to award the contract is the identification of issues and the development of a preliminary work plan. Bidding firms will present their report using PowerPoint on November 26th and will be afforded 20 minutes to present to the selection team, comprising the CEO and Chairman of Ashridges. Time over-runs will not be permitted and material not presented in the 20 minute timeframe will not be considered by the selection team. Each team will present the selection team members (2) with a copy of their presentation as well as forward an electronic copy – in advance – to Len Anderson and Andrew Graham. To facilitate preparation, bidding teams will be afforded the opportunity to ask questions of the selection team on Wednesday November 19th. One week will be allowed for teams to develop a proposal. Marks will be awarded based on the rubric established and attached to the course outline. The decision of the selection team as to contract award is final. 7 Final Assignment 899 Financial Literacy for Non-Financial Managers 2014 In order to avoid competing teams overlapping in the lobby and waiting around to make their presentation, each team will present according to the following timetable. No other class attendance is required that day. Team Deloitte: Presentation Time: 0830-0855 Paul Armelin Mary Theresa Davis Lauren Flewelling Michael LeJeune Laura Pickard Team McKinsey & Company: Presentation Time: 1000-1025 Sean Cavanagh Tristan Difrancesco Nicollette Huang William McMillan Aleksandra Whistle Team KPMG: Presentation Time: 0900-0925 Alissa Bryers Rachel Davis Abbey Goodine Jie Li Christopher Simon Team: PWC: Presentation Time: 0930-0955 Alexander Carroll Daniel DiCroce Theresa Hillis Morgan MacKay Caleb Stennzl Team Boston Consulting Group: Presentation Time: 1030-1055 Michael Cunninghom Marina Eckert Anchel Kumar Ernest Kevin Mistica Team Ernst & Young: Presentation Time: 1100-1125 Morgan Oddie Kaleigh Pinto Daniel Spadafora Apostole Christos 8