MMC Earnings Exam Procedures

Multistate Mortgage Committee

Earnings

Examination Procedures

Examination Procedures

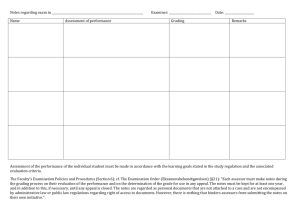

[Document supporting evidence noting determinations and findings made]

1 Are profit, planning, and budget practices adequate?

Examiner Notes:

2 Are internal controls related to earnings adequate?

Examiner Notes:

3 Are the auditor or independent review functions for earnings adequate?

Examiner Notes:

4 Are earnings information communication systems adequate and accurate?

Y

Examiner Notes:

5 Are earnings at a level appropriate for the institut ion’s risk profile?

Examiner Notes:

6 Are earnings sustainable?

Examiner Notes:

7 Do the board and senior management effectively supervise this area?

Examiner Notes:

8 Review previous reports of examination, prior examination workpapers, and file correspondence for an overview of any previously identified earnings concerns.

Examiner Notes:

9 Review the most recent audits and independent reviews and identify deficiencies concerning reliability of information systems that may affect quality and reliability of reported earnings.

Examiner Notes:

N

1 of 6

Multistate Mortgage Committee

Earnings

Examination Procedures

Examination Procedures

[Document supporting evidence noting determinations and findings made]

10 Review management’s remedial actions to correct examination and audit deficiencies related to earnings.

Examiner Notes:

11 Discuss with management any recent or planned changes in strategic objectives and their implications for profit plans.

Examiner Notes:

12 Review board and committee minutes and management reports to determine the level and quality of management information systems related to earnings.

Examiner Notes:

13 Review the recent balance sheets to determine if there have been and significant changes in balance sheet structure that could materially affect earnings performance.

Examiner Notes:

14 Review strategic plans, profit plans and budgets to determine if the underlying assumptions are realistic. Determine the sources of input for profit plans and budgets. Profit plans and budgets should address the following areas with detail appropriate for the size and complexity of the institution:

Anticipated level and volatility of interest rates;

Local and national economic conditions;

Funding Strategies; Asset and liability mix and pricing;

Growth objectives; and

Interest rate and maturity mismatches.

Examiner Notes:

15 Compare earnings performance to budget forecasts. Determine if management compares budgeted performance to actual performance on a periodic basis and modifies projections when interim circumstances change significantly.

Y N

2 of 6

Multistate Mortgage Committee

Earnings

Examination Procedures

Examination Procedures

[Document supporting evidence noting determinations and findings made]

Examiner Notes:

16 Review man agement’s procedures to prevent, detect, and correct earnings errors.

Examiner Notes:

17 Determine if the income and expense posting, reconcilement, and review functions are independent of each other. Consider testing selected income and expense items to observe the operational flow of transactions. Areas commonly selected for review are:

Large Volumes of other income (miscellaneous, service fees, or any other unusual accounts)

Proper treatment of loan origination fees per SFAS 91.

Insider expense accounts.

Management fees or other payments to affiliates.

Significant legal fees.

Examiner Notes:

18 Determine if significant income, expenses, and capital charges are reviewed and authorized.

Examiner Notes:

19 Determine if insider related items are routinely reviewed for authorization and appropriateness.

Examiner Notes:

20 Determine that the audit or independent review program provides sufficient review of earnings relative to the institution’s size, complexity, and risk profile. These activities should:

Recommend corrective action when related to earnings warranted;

Verify implementation and effectiveness of corrective action related to earnings;

Assess separation of duties and internal controls related to

Y N

3 of 6

Multistate Mortgage Committee

Earnings

Examination Procedures

Examination Procedures

[Document supporting evidence noting determinations and findings made] earnings;

Determine compliance with profit planning objectives and accounting standards.

Assess the adequacy, accuracy, and timeliness of earnings reports to senior management and the board;

Include sufficient transaction testing to assure income and expenses are accurately recorded.

Examiner Notes:

21 Determine if managerial earnings reports provide sufficient information relative to the size and risk profile of the institution.

Examiner Notes:

22 Evaluate the accuracy and timeliness of the earnings reports produced for the board and executive management. These may include:

Periodic earnings results;

Budget variance analyses;

Income projections;

Large item reviews;

Insider related transaction disclosures;

Tax planning analyses.

Examiner Notes:

23 Validate the accuracy of Reports of Income where necessary.

Examiner Notes:

24 Assess the level, trend, and sustainability of return on average assets relative to historical performance, peer comparisons, the organization’s risk profile, and local economic conditions. Determine areas needing further investigation.

Examiner Notes:

25 Evaluate the level and stability of the institution’s core earnings.

Examiner Notes:

Y N

4 of 6

Multistate Mortgage Committee

Earnings

Examination Procedures

Examination Procedures

[Document supporting evidence noting determinations and findings made]

26 Evaluate the level and trend of overhead expenses.

Examiner Notes:

27 Evaluate the level, trend, and sources of non-interest income.

Examiner Notes:

28 Review the level and trend of provisions for loan and lease losses and the relationship to actual loan losses to determine the impact of asset quality on earnings.

Examiner Notes:

29 Review the level and trend of non-operating gains and losses and their impact on the earnings.

Examiner Notes:

30 Determine whether there have been any nonrecurring events that have affected earnings performance. Consider adjusting earnings on a tax- equivalent basis for comparison purposes.

Examiner Notes:

31 Evaluate the level and trend of income tax payments recognizing the institution’s basis for filing taxes.

Examiner Notes:

32 Assess the ability of earnings to support capital growth. Review the earnings retention rate in comparison to the intuition’s potential growth rate.

Examiner Notes:

33 Evaluate the earnings impact of activities with affiliated organizations.

Examiner Notes:

Y N

5 of 6

Multistate Mortgage Committee

Earnings

Examination Procedures

Examination Procedures

[Document supporting evidence noting determinations and findings made]

34 Determine if board records document routine attention to institution earnings and timely responses to significant budget deviations.

Examiner Notes:

35 Assess compliance with institution policies, applicable regulations, and governing accounting standards related to earnings.

Examiner Notes:

36 Calculate the applicable ratios under the ratio analysis section and determine the institution’s adequacy relative to those ratios.

Examiner Notes:

Y N

6 of 6