Examination for FUNDAMENTAL ACCOUNTING

advertisement

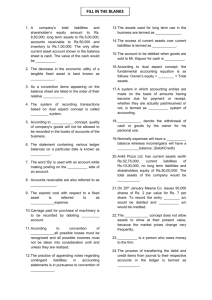

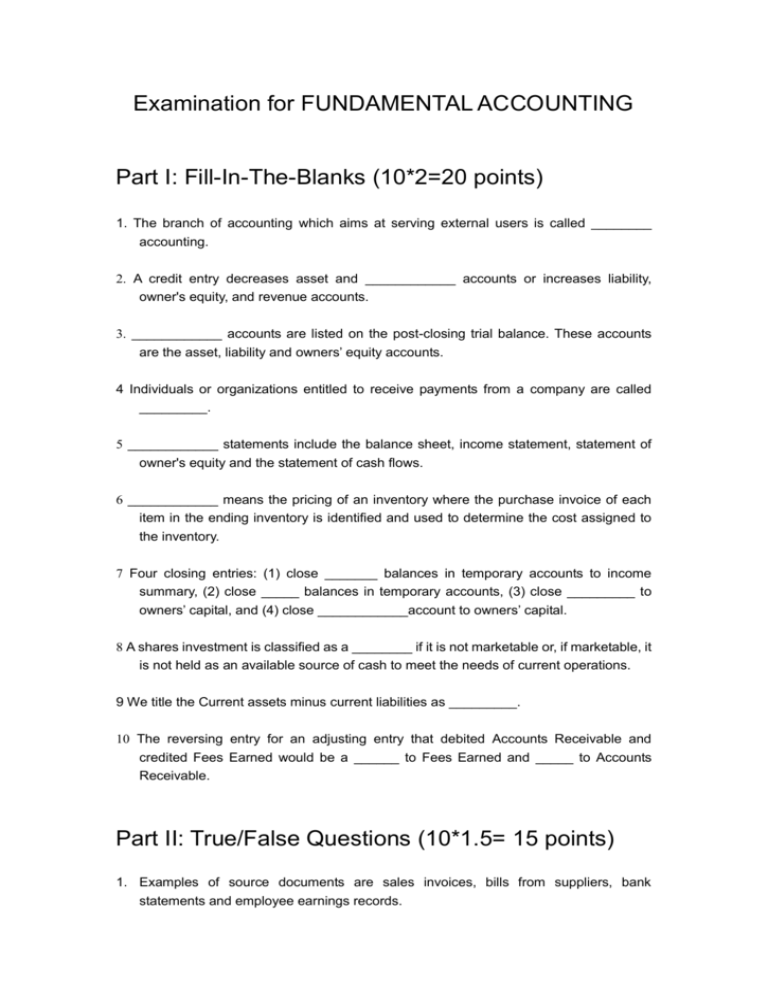

Examination for FUNDAMENTAL ACCOUNTING Part I: Fill-In-The-Blanks (10*2=20 points) 1. The branch of accounting which aims at serving external users is called ________ accounting. 2. A credit entry decreases asset and ____________ accounts or increases liability, owner's equity, and revenue accounts. 3. ____________ accounts are listed on the post-closing trial balance. These accounts are the asset, liability and owners’ equity accounts. 4 Individuals or organizations entitled to receive payments from a company are called _________. 5 ____________ statements include the balance sheet, income statement, statement of owner's equity and the statement of cash flows. 6 ____________ means the pricing of an inventory where the purchase invoice of each item in the ending inventory is identified and used to determine the cost assigned to the inventory. 7 Four closing entries: (1) close _______ balances in temporary accounts to income summary, (2) close _____ balances in temporary accounts, (3) close _________ to owners’ capital, and (4) close ____________account to owners’ capital. 8 A shares investment is classified as a ________ if it is not marketable or, if marketable, it is not held as an available source of cash to meet the needs of current operations. 9 We title the Current assets minus current liabilities as _________. 10 The reversing entry for an adjusting entry that debited Accounts Receivable and credited Fees Earned would be a ______ to Fees Earned and _____ to Accounts Receivable. Part II: True/False Questions (10*1.5= 15 points) 1. Examples of source documents are sales invoices, bills from suppliers, bank statements and employee earnings records. 2. Any transaction, no matter how complex, can be recorded in a general journal under the double-entry accounting system. 3. A journal entry in which more than two accounts are involved is known as a combined journal entry. 4. Assume assets total $24,000, liabilities total $5,000, and owner's equity is $19,000. If assets increase by $3,000 and equity decreases by $1,000, then liabilities must increase by $4,000. 5. Under credit terms of 2/10, n/60, the credit period is 60 days and the discount period is 10 days. 6. An analysis that explains the difference between the balance of a checking account shown in the depositor's records and the balance reported on the bank statement is called a bank reconciliation. 7. An exclusive right granted by the federal government or by international agreement to publish and sell a musical, literary, or artistic work for a period of years is called a copyright. 8. Recording sales discounts and sales returns and allowances separately form sales gives useful information to managers for internal monitoring and decision making. 9. A revenue expenditure benefits only the current period and should be charged to expenses of the current period. A capital expenditure has a benefit that extends beyond the end of the current period and should be charged to an asset. 10. A firm can have a positive current ratio and a negative acid-test ratio. Part III: Multiple Choices (10*2.5= 25 points) 1. Rebecca Shoe Chains sold a batch of shoes to a retailer for $1,000. The retailer sold these shoes to you for $1,250. It cost Rebecca $800 to make the shoe. It cost the retailer $1,050 total to buy and sell the shoe. Which answer below is not correct? a) Rebecca will make $200 on the transaction b) The retailer will make $200 on the transaction c) They both will have the same revenue on the sale d) They both will have the same net profit on the sale 2. Silicon Batteries Co., a maker and seller of solar power for computers, determined that its chief executive officer should attend a workshop on solar energy to be held on the beach at Mimi Island. The workshop cost $10,000, including air fare, meals, and lodging. The firm charged the cost of the trip with a local travel agency. Recording the transaction requires a) an asset to be debited, a liability to be credited b) a liability to be debited, an asset to be credited c) an expense to be debited, a liability to be credited d) an asset to be debited, revenue to be credited 3. James Linch deposited $6,000 in a bank account he established for a pet store that he is going to own and operate as Linch’s Pets Co. Recording the deposit will a) increase an asset, increase a liability b) decrease an asset, decrease a liability c) increase an asset, increase owner's equity d) decrease an asset, decrease owner's equity 4. Total assets less total liabilities are known as a) owner's equity or net assets b) net income or net loss c) total expenses d) total revenue 5. When preparing the work sheets for the Tony & Brothers Co., you find out that the subtotals of the Income Statement columns of the work sheet are $6,200 and $4,900, respectively. If the subtotal of the Balance Sheet Debit column is $19,000, then you figure out that the subtotal of the Balance Sheet Credit column should be a) $20,300 b) $1,300 c) $17,700 d) $14,400 6. The bookkeeper recorded a check at $450 for store supplies. The check was recorded by the bank at its correct amount of $540. The bank reconciliation will require a(an) a) addition per book balance of cash b) deduction per book balance of cash c) addition per bank statement balance d) deduction per bank statement balance 7. Nina Company issues ten-year bonds with a par value of $100,000, 8% annual interest, were sold for $106,000 on September 30, when the market rate of interest was 7%. The issuer uses straight-line amortization of premium. The December 31, year-end adjusting entry for accrued interest will include a: a) debit to Interest Payable for $2,000 b) credit to Interest Payable for $1,850 c) debit to Premium on Bonds Payable for $150 d) debit to Bond Interest Expense of $1,850 8. Mishita Heavy Machine Company purchased a tractor by issuing a 5-year non-interest-bearing note for $100,000 when the market rate of interest was 10%. The note's fair value when issued using a 10% rate is $62,090. When the note was issued, the tractor was recorded at a value of: a) $100,000 b) $62,090 c) $90,000 d) $37,910 9. On the accounting books of Black Swan Company, you find out that its net sales are $360,000, the cost of goods sold is $180,000, operating expenses are $120,000. and the ending balance of the Accounts Receivable account is $20,000. You know that the merchandise turnover ratio was 12.75. Now you calculate and obtain the profit margin of Black Swan as: a) 16.67% b) 20.0% c) 40.0% d) 33.3% 10. Which of the following ratios would not be considered a measurement of short-term liquidity? a) debt ratio b) days' sales uncollected c) current ratio d) acid-test ratio Part IV: Exercises & Problems (10+10+20 = 40 points) 1. The cost of goods sold was $240,000. Beginning and ending merchandising inventory balances were $20,000 and $30,000, respectively. What was the merchandise inventory turnover? 2. An asset having a four-year service life and a salvage value of $5,000 was acquired for $45,000 cash on January 2 of Year One. What will be the amortization expense for Year 2, ending December 31? 3. The Bagar Mining Company acquired an iron ore deposit for $2,000,000. The company's geologist estimated the deposit to contain 1,500,000 tons of iron ore. At the end of the first year, 60,000 tons had been extracted. Prepare the end-of-year journal entry to record the depletion of the iron ore.