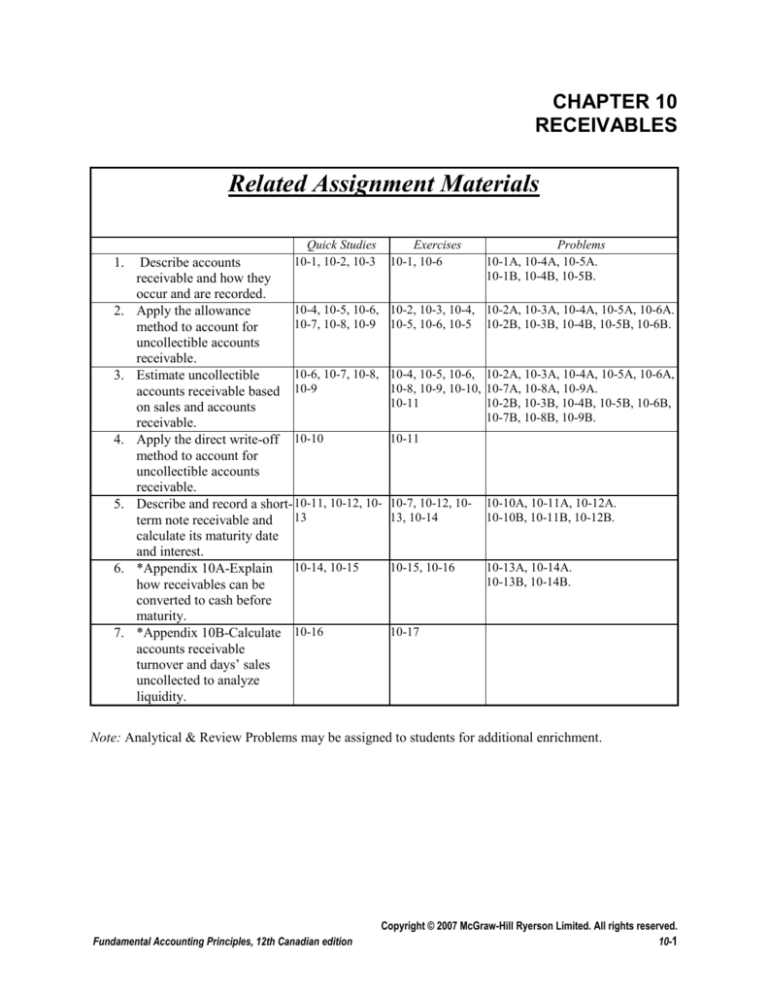

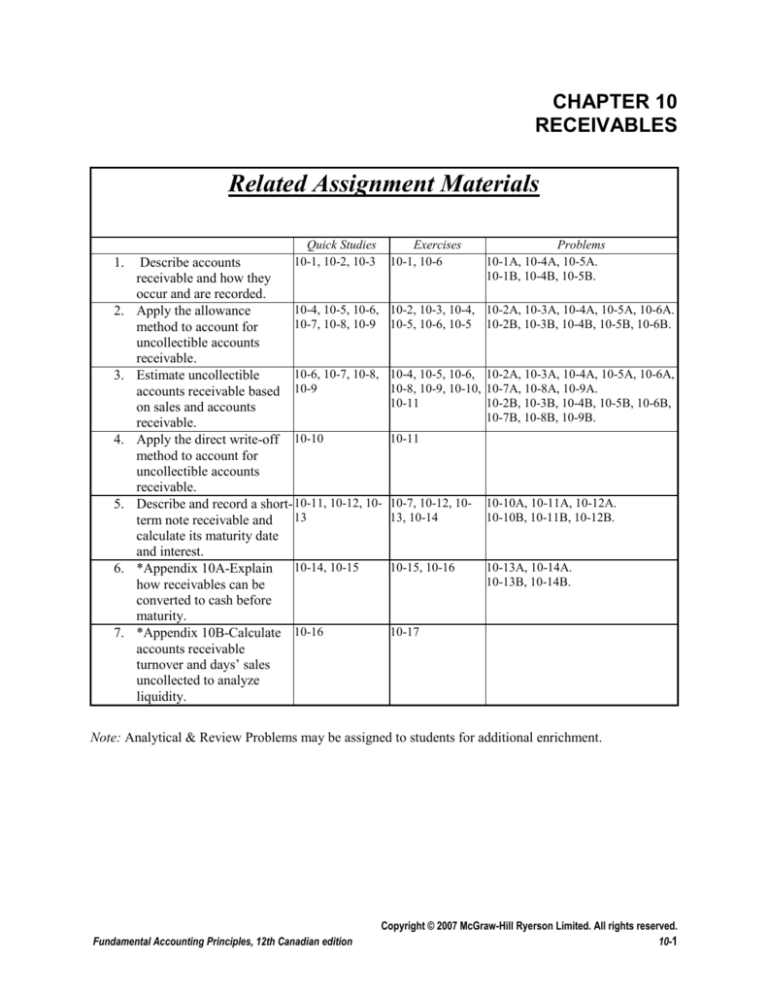

CHAPTER 10

RECEIVABLES

Related Assignment Materials

1.

2.

3.

4.

5.

6.

7.

Quick Studies

10-1, 10-2, 10-3

Describe accounts

receivable and how they

occur and are recorded.

10-4, 10-5, 10-6,

Apply the allowance

10-7, 10-8, 10-9

method to account for

uncollectible accounts

receivable.

10-6, 10-7, 10-8,

Estimate uncollectible

accounts receivable based 10-9

on sales and accounts

receivable.

Apply the direct write-off 10-10

method to account for

uncollectible accounts

receivable.

Describe and record a short- 10-11, 10-12, 1013

term note receivable and

calculate its maturity date

and interest.

10-14, 10-15

*Appendix 10A-Explain

how receivables can be

converted to cash before

maturity.

*Appendix 10B-Calculate 10-16

accounts receivable

turnover and days’ sales

uncollected to analyze

liquidity.

Exercises

10-1, 10-6

Problems

10-1A, 10-4A, 10-5A.

10-1B, 10-4B, 10-5B.

10-2, 10-3, 10-4, 10-2A, 10-3A, 10-4A, 10-5A, 10-6A.

10-5, 10-6, 10-5 10-2B, 10-3B, 10-4B, 10-5B, 10-6B.

10-4, 10-5, 10-6, 10-2A, 10-3A, 10-4A, 10-5A, 10-6A,

10-8, 10-9, 10-10, 10-7A, 10-8A, 10-9A.

10-11

10-2B, 10-3B, 10-4B, 10-5B, 10-6B,

10-7B, 10-8B, 10-9B.

10-11

10-7, 10-12, 1013, 10-14

10-10A, 10-11A, 10-12A.

10-10B, 10-11B, 10-12B.

10-15, 10-16

10-13A, 10-14A.

10-13B, 10-14B.

10-17

Note: Analytical & Review Problems may be assigned to students for additional enrichment.

Fundamental Accounting Principles, 12th Canadian edition

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

10-1

Instructor’s Notes

Chapter Outline

I. Accounts Receivable—an amount due from customers for credit sales. A

separate account receivable is maintained for each customer in a

supplementary Accounts Receivable Ledger. The General Ledger continues to

show a single (total) Accounts Receivable.

A. Recognizing Accounts Receivable:

1. From direct company sales on credit—debit Accounts

Receivable for the full amount of the sale.

2. Non-bank credit cards (such as

Sears of Home Depot) require the retailer to send a copy of

the credit card sales receipts to a credit card company and wait

for payment—debit Accounts Receivable for the full sales

amount. When payment is received, debit Cash for amount

received, debit Credit Card Expense for the amount of the fee

and credit Accounts Receivable for the full amount of the sale.

Cost of Goods Sold is recorded as required.

B. Valuing Accounts Receivable—There are two methods used to

account for receivables that customers do not pay:

1. Allowance method—at the end of each accounting period,

bad debts expense is estimated and recorded.

a) Entry: debit Bad Debt Expense, credit a contraasset account called the Allowance for Doubtful

Accounts.

b) Method satisfies matching principle—expense is

charged in period of related sale.

c) Accounts Receivable are reported at their

estimated realizable value (A/Rec less the allowance

account).

d) Entry to write-off an uncollectible: debit

Allowance for Doubtful Accounts, credit Accounts

Receivable.

e) Writing off an uncollectible does not change the

estimated realizable value of Accounts Receivable.

2. Direct Write-off Method - This method does not satisfy

GAAP. Journal entry is a debit to Bad Debts Expense and a

credit to the customer account. The entry would be reversed

in the event that a collection is made.

Note: The write-off entry varies by method. When a written-off

account is recovered, first reinstate the account by reversing the

original write-off entry and second, record collection on reinstated

account

.

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

10-2

Fundamental Accounting Principles, 12th Canadian edition

Instructor’s Notes

Chapter Outline

C. Estimating Bad Debts Expense—two methods:

a) Percent of sales method (uses income statement

relationships)—bad debts expense is calculated as a

percentage of credit sales. ). Stress here that an

income statement account t (sales or net credit sales)

is being used in order to get the desired balance in

another income statement account (bad debts

expense).

2. Accounts Receivable methods (uses balance sheet

relationships)—desired credit balance in Allowance for

Doubtful Accounts is calculated:

a) As a percentage of outstanding receivables

(simplified approach). Stress here that a balance sheet

account t (accounts receivable) is being used in order

to get the desired balance in another balance sheet

account (allowance for doubtful accounts).

b) By aging of accounts receivable. Same

relationship is used, accounts receivable balance leads

us to the desired balance in allowance account.

D. Direct write-off method—accounts for bad debts from an

uncollectible account receivable at the time it is determined to be

uncollectible.

1. Entry to write-off an uncollectible: debit Bad Debt

Expense, credit Accounts Receivable.

2. This method violates matching principle—frequently

results in expense being charged in period different from

revenue.

3. Materiality principle permits use of this method when bad

debts expenses are very small in relation to other financial

statement items such as sales and net income.

II.

Short –Term Notes Receivable—(promissory note) is a written

promise to pay a specified amount of money (principal) either on demand or at

a definite future date. Usually interest bearing.

Promissory notes are notes payable to the maker of the note and notes

receivable to the payee of the note. Notes receivable are generally preferred

by creditors over accounts receivable.

Calculations required:

1. Maturity date

2. Interest ( Principal of note X Interest Rate X Term of

note/365 days)

B. Receipt of a note—debit Notes Receivable for principal or face

amount of note. Credit will vary; depends on reason note is received.

C. End-of-period interest adjustment—record accrued interest by

debiting Interest Receivable and crediting Interest Earned.

D. Honouring note or receipt of note payments—debit Cash for

Fundamental Accounting Principles, 12th Canadian edition

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

10-3

Instructor’s Notes

Chapter Outline

maturity value (face + interest), credit Note Receivable for face

amount and credit Interest Earned for the interest amount.

F. Dishonoured note—debit Accounts Receivable for maturity value,

credit Note Receivable for face amount and credit Interest Earned

for the interest amount. If account receivable remains uncollected,

will be written-off.

Note: Interest is earned and realized even though collectibility is in question.

(If deemed uncollectible, the receivable and interest earned would be written

off to Allowance for Doubtful Accounts.)

III.

Appendix 10A Converting Receivables to Cash before Maturity—

reasons for this include the need for cash or a desire to not be involved in

collection activities.

A. Selling Accounts Receivable—buyer, called a factor, charges the

seller a factoring fee and then collects the receivables as they come

due.

B. Pledging Accounts Receivable as security for a loan

1. Borrower retains ownership of the receivables.

2. If borrower defaults the lender will be paid from receipts

of collections on accounts receivable.

3. The pledge should be disclosed in financial statement

footnotes.

C. Discounting Notes Receivable—selling collection rights to bank

or financial institution.

1. With recourse—if the original maker of note defaults, the

original payee must pay.

a) A company that discounts the note with recourse

has a contingent liability (an obligation to make a

future payment if and only if an uncertain future event

actually occurs) if maker defaults.

2. Without recourse there is no contingent liability. Bank

assumes the risk of a bad debt loss.

D. Full-Disclosure—is principle that requires that financial

statements (including notes) report all relevant information about the

operations and financial position of a company.

IV.

Appendix 10 B Using the Information

The longer receivables are outstanding, the less likely the collection will be.

Monitoring receivables is critical to timely collection.

A. Accounts receivable turnover measures both quality and liquidity

of receivables. Calculated as:

Net sales/Average accounts receivable

Days sales uncollected indicates how much time is likely to

pass before we receive cash receipts from credit sales equal to

the current amount of accounts receivable. Calculated as:

(Accounts Receivable/Net Sales) X 365

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

10-4

Fundamental Accounting Principles, 12th Canadian edition

Alternate Demo Problem Chapter Ten

At the end of the year, the M. I. Wright Company showed the following

selected account balances:

Sales (all on credit) ............................................................................$300,000

Accounts Receivable ......................................................................... 800,000

Allowance for Doubtful Accounts.....................................................

38,000

Required:

1.

Assume the company estimates that 1% of all credit sales will not be

collected.

A. Prepare the proper journal entry to recognize the expense

involved.

B. Present the balances in Accounts Receivable and Allowance for

Doubtful Accounts as they would appear on the Balance Sheet. Also

show the net realizable Accounts Receivable.

2.

Assume the company estimates that 5% of its accounts receivable

will never be collected.

A. Prepare the proper journal entry to recognize the expense

involved.

B. Present the balances in Accounts Receivable and Allowance for

Doubtful Accounts as they would appear on the Balance Sheet. Also

show the net realizable Accounts Receivable.

3.

Under assumptions 1 and 2 above, give the proper journal entries for

the following events.

June 3

John Shifty, who owes us $500, informs us that

he is broke and cannot pay. We believe him.

Nov. 9

We learn that John Shifty has won the lottery and he

pays his account balance.

Fundamental Accounting Principles, 12th Canadian edition

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

10-5

Solution: Alternate Demo Problem Chapter Ten

1A.

Bad Debts Expense ..........................................

Allowance for Doubtful Accounts..............

($ 300,000 X 1 %)

1B.

Accounts Receivable .......................................$800,000

Less: Allowance for Doubtful Accounts ........ 41,000

Estimated Realizable A/R ................................$759,000

2A.

Bad Debts Expense ..........................................

Allowance for Doubtful Accounts..............

($ 800,000 X 5 % less $38,000)

3,000

3,000

2,000

2,000

2B.

Accounts Receivable .......................................$800,000

Less: Allowance for Doubtful Accounts ........ 40,000

Estimated Realizable A/R ...............................$760,000

3.

Both assumptions 1 and 2 above represent the allowance method of

accounting for uncollectibles. The only difference is in the approach

to estimating uncollectibles. Therefore the entries to write-off and

show subsequent reinstatement would be the same in 1 and 2.

June 3

Nov. 9

Nov. 9

Allowance for Doubtful Accounts.............

Accounts Receivable/John Shifty........

500

Accounts Receivable/John Shifty.............

Allowance for Doubtful Accounts........

500

Cash .............................................................

Accounts Receivable/John Shifty........

500

500

500

500

Note: There would be a closing entry for the Bad Debts Expense since it is

an expense account just like any other expense account. There would be

no closing entry for the Allowance for Doubtful Accounts since it is not a

temporary account. It is a contra-asset account, contra to Accounts

Receivable.

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

10-6

Fundamental Accounting Principles, 12th Canadian edition