Answers to Frequently Asked Tax Time Questions

advertisement

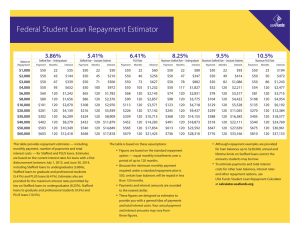

Making the Most of Student Loans Money Management – November 2008 This is the time of year when many high school seniors are finalizing their decisions about which colleges they will apply to. That means that it’s time for their parents to give serious consideration to how they are going to pay for that college education. The Missouri Society of CPAs provides some smart financing ideas to follow. MORE THAN JUST TUITION When you are trying to determine how much money you’ll need for college, consider not only tuition and room and board but also books, supplies, personal expenses and transportation costs. Recent graduates left college with an average of $19,646 in student loan obligations, according to a study by the Project on Student Debt. That’s a lot of debt for a young person starting his or her career, so only borrow the minimum amount that you will need to cover your costs. Help your child resist the temptation to take on more student loans to pay for vacations or other items that are unnecessary. SET A LIMIT How much is too much when it comes to student loans? CPAs recommend that the student loan payments that you make after college should equal no more than 10% of your monthly income. So, if you expect to earn $3,000 a month once you graduate, for example, your monthly loan payment should be no more than $300 per month. When you apply for a student loan, ask the lender to provide the expected monthly loan payment amount, based on the interest rate and the loan term. Estimating the student’s post-college income will be a little harder, but it is possible to come up with a reasonable estimate. Start by talking to friends or family who are new grads with jobs in the field in which your student is interested. You can also check with local employment agencies or online job search sites to find out what new hires are earning in your student’s desired field. This probing will give you a sense of whether your student will be in a good position to handle the loans after graduation. UNDERSTAND YOUR FINANCING OPTIONS There are many options available to you to help finance college education. Your first step should be to check out whether you qualify for government-sponsored loans, which generally have the most attractive interest rates or payment options. There are three different types of government-sponsored loans. Stafford and Perkins loans are taken out in the student’s name. Another option is the federal PLUS loan which allows parents to borrow up to the total cost of the college education, even if their children already have Stafford or Perkins loans. Be aware, though, that the interest rate for the PLUS program is higher than for Stafford or Perkins loans. So, determine first whether a Stafford or Perkins loan will cover your needs. Not only are the rates lower, but your child also may be able to deduct his or her interest payments on these loans, and a future employer may be willing to pay off some of the student’s college debt. You can find out more about the specifics of each loan program online at www.federalstudentaid.ed.gov. YOUR CPA CAN HELP Your CPA can answer your questions on education loans and on the best choices for you and your family. Turn to your local CPA with questions about any financial issues facing you and your family. To find a CPA near you, visit http://www.mocpa.org/public/referral/findcpa.aspx.