ARC_PA_2008_State_Strategy

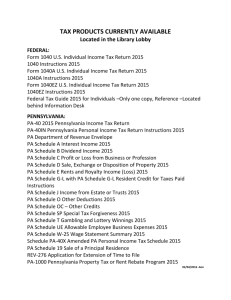

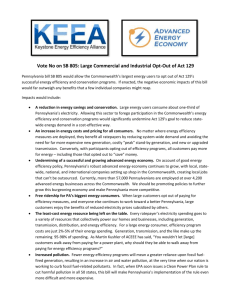

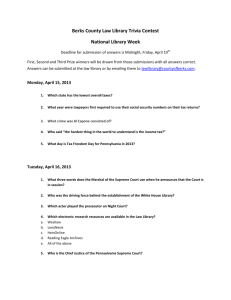

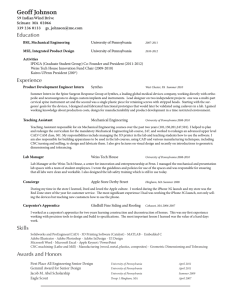

advertisement