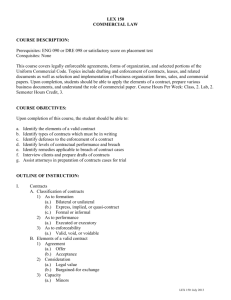

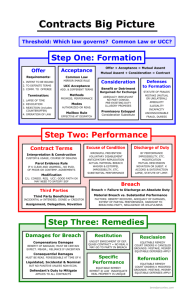

Contracts

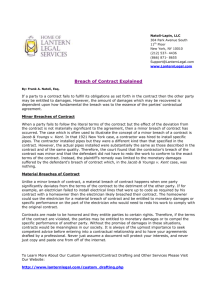

advertisement