Week

advertisement

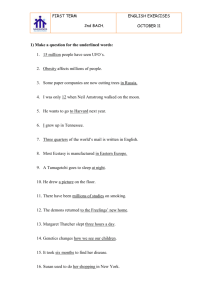

Applied Science University Faculty: Economics and Administrative Sciences Department : Financ Department ( Course Syllabus ) CourseTitle Credit Hours Course No. Financial markets 3 405411 Coordinator Name Lecturer Room No. Dr Imad Z. Ramadan Dr Imad Ramadan 238 Prerequisite E-mail Prof_imad67 @asu.edu.jo Year (semester) 2010-2011(1) Office Hours 9:30 – 11:30 Course Objectives: This course covers the following objectives as follow: 1. Understanding the role and function played by financial markets in the global economy and the importance of money and financial markets in our daily live. 2. Identifying the most important channels of fund fiow, characteristics of financial assets, the role of money markets towerds financial system and different jobs of financial intermediaries and other financial institutions. 3. Understanding roles and functions of money markets, key players of money markets, and how money market loans and securities differ from other financial services. 4. Determining the characteristics of money market instruments and the role of security dealers in money market. 5. Understanding the role played by in the international money market, nature and characteristice of commercial papers, federal agencies and their effect on other sectors of the economt. 6. Learning the characteristics of common and preferred corporate stock, how stock market operate, the difference between organized market and over the counter market. Course Description: A survey of the sources and uses of funds in financial markets from the standpoint of both investors and users. The course examines short, intermediate and long-term sources of financing business operations and the structure of market interest rates for various financing instruments. Markets examined include those for money market instruments, stocks and bonds, stock options, T-Bill futures, Ginnie Mae futures, Eurodollars and Eurobonds. The various applications of interest rate theory, Federal Reserve Operations, U.S. Treasury Operations and international financing to financial markets are studied. Intended Learning Outcomes : After studying this course the student should be able to: 1. Understsnd the function performed and the roles played by the system of financial markets and financial institiutions in the global economy and in our daily lives. 2. discover how important the money and capital markets and the whole financial system are to increasing our standard of living, generating new jobs, and building our savings to meet tomorrow's financial needs. 3. discover the most important channels through which funds flow from lenders to borrowers and back again within the global system of money and capital markets. 4. discover the nature and characteristics of financial assets-how they are created and destroyed by decision markers within the financial system. 5. explore the critical roles played by money within the financial ayatem and the linkages between money and inflation in the prices of goods and services. 6. examine the important jobs carried out by financial intermediaries in lending and borrowing and in creating and destroying financial assets. 1 Course Contents : Reference (chapter) Topic Details Week 1+2 Function and role of the financial system in the Global Economy: 3+4 Financial Assets, Money, Financial Transactions, and financial Institutions: 5+6 Introduction to money markets: Chapter 1: Peter Rose (2006) , " Money and Capital Markets", Chapter 2: Peter Rose (2006) , " Money and Capital Markets", Chapter 10: Peter Rose (2006) , " Money and Capital Markets", Chapter 11 : Peter Rose (2006) , " Money and Capital Markets", Chapter 12 : Peter Rose (2006) , " Money and Capital Markets", Chapter 22: Peter Rose (2006) , " Money and Capital Markets", 7 + 8 + 9 Money market instrument: 10 + 11 + Money market instrument: 12 13 +14 15 16 Corporate stock: Practical Applications: Amman Stock Exchange Final Exam Grade Distribution : Assessment - First Exam - Second Exam - Assignments ( Reports /Quizzes/ Seminar / Tutorials ….) - Final Examination Grade 20% 20% 10% 50% Date * Make-up exams will be offered for valid reasons. It may be different from regular exams in content and format. Main Reference: Peter Rose (2008) , " Money and Capital Markets", 9th Ed, McGraw – Hill. Other References: . بيروت- دار المنهل اللبناني، )3002( ، " قضايا نقدية ومالية: "البورصات واألسواق المالية، مالك وسام- Monear .Hindy "Capital Markets and Securities", The Arabic Academy for Banking and financial sciences Jordan , Amman, 2004. Saunders, Anthony,(2001) “Financial Markets & Institutions” a modern Perspective, McGraw-Hill. Batra, G. S. , (2002), " Financial Services and Markets", Deep and Deep Puplication. Mish Kin, and Frederic S.(2000), " Financial markets and Institutions", Addison-Wesley. 2