Dimensional Fund Advisors, 2002

advertisement

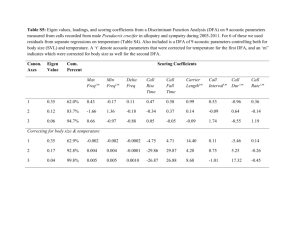

Dimensional Fund Advisors Case In addition to reading the case, you should also read, “The cross-Section of Expected Stock Returns” by Eugene Fama and Kenneth French; published in The Journal of Finance Volume 47 No. 2. March 1992 p. 427-465. In the paper, don’t get bogged down with the methodology, but concentrate more on what the authors were trying to test and what they found out. After you have read the paper and the case, please present an overview of both the case and the paper to the class as well as your group’s thoughts. Please answer the following questions in your presentation: 1. Discuss DFA as a fund and as a business. How does it add value for investors? What are the pros and cons of their somewhat passive approach? How is DFA different from most other investment companies? 2. What are the Fama-French findings? Do they make sense? Should we expect small stocks to outperform large stocks in the future? Value stocks to outperform growth stocks? What did Fama and French discover about the CAPM and beta? How do you reconcile the empirical findings with the CAPM theory? 3. Reproduce Table I Panel A and Table 5 from the Fama-French paper and show them on the overhead during your presentation. Clearly explain to the rest of the class what these two tables show (This is important!). 4. Discuss DFA’s trading strategy. How does it work, and what are the costs and benefits? Can DFA keep this competitive advantage in the future? Why don’t competitors emulate DFA’s approach? 5. What should be the firm’s strategy going forward? Does the company need to modify its basic strategy if it wants to grow assets and/or profits? 6. What is the relationship between the Fama-French paper and the DFA case? 7. Whould you hire DFA to invest your money? Why or why not? 8. This case was written in 2003. Go to the DFA website and let us know how they are doing now.