israel's economy - Invest in Israel

advertisement

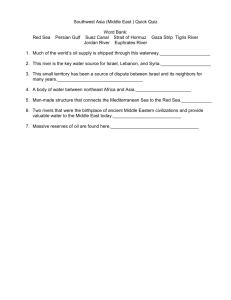

FAQ Index RESILIENCE AMIDST GLOBAL FINANCIAL CRISIS ......................................... 2 How has the Israeli economy been affected by the Global Financial Crisis? ...................... 2 What measures have the Israeli government and Bank of Israel taken to address the effects of the global financial crisis? ............................................................................ 2 How has foreign investment in Israel fared since the onset of the credit crunch? .............. 3 What effect do geopolitical tensions have on the Israeli economy? ................................. 3 INTERNATIONAL COMPANIES INVESTED IN ISRAEL ..................................... 4 Which multinational companies have invested in Israel? ................................................ 4 In which sectors do these companies invest? ............................................................... 4 Which foreign companies have made Mergers and Acquisitions (M&A's) recently? ............. 5 What type of venture capital activity exists in Israel? .................................................... 5 How much foreign capital has been invested in Israel in the past year? ........................... 6 ISRAEL'S ADVANTAGE................................................................................... 6 What is Israel’s greatest natural resource? .................................................................. 6 How does the Israeli business culture impact competitiveness? ...................................... 6 HIGHLY EDUCATED WORKFORCE .................................................................. 6 What is the level of education among the Israeli workforce? .......................................... 6 What characterizes the Israeli workforce? .................................................................... 7 INNOVATIONS IN ISRAEL ............................................................................. 7 Which breakthrough technologies were developed in Israel? .......................................... 7 How does Israeli innovation rank compared to the rest of the world? .............................. 8 What types of incentives are available for investors? .................................................... 8 Who is eligible for investment incentives? ................................................................... 8 Who is eligible for investment grants? ......................................................................... 8 Who is eligible for tax benefits and/or exemptions? ...................................................... 9 What types of grants and tax benefits are available for foreign investors? ....................... 9 What R&D incentives or support programs are available? ............................................ 10 What international economic agreements does Israel enjoy? ....................................... 10 Does Israel have tax treaties with other countries? ..................................................... 10 ISRAEL'S ECONOMY .................................................................................... 11 What was Israel's economic growth in 2008? ............................................................. How did Israeli exports fare in 2008? ........................................................................ What is the inflation rate in Israel? ........................................................................... How is Israel’s economy and credit rated? ................................................................. 11 11 11 12 INVEST IN ISRAEL ...................................................................................... 13 What is Invest in Israel? ......................................................................................... 13 How do I contact an Israel economic representative near me? ..................................... 13 RESILIENCE AMIDST GLOBAL FINANCIAL CRISIS How has the Israeli economy been affected by the Global Financial Crisis? The Israeli economy has been hit less severely by the crisis than other developed countries as a result of responsible macroeconomic policy in recent years. The Israeli economy's favorable fundamental conditions, and in particular the surplus in the current account of the balance of payments, has helped to moderate the effect of the global crisis on economic activity. While the country’s growth rate is predicted to drop into negative territory in 2009, the central bank has said it expects gross domestic product to recover to a rate of 2.7% in 2010, contingent upon an improvement in global trading conditions. What measures have the Israeli government and Bank of Israel taken to address the effects of the global financial crisis? To help safeguard the economy, Israel’s Ministry of Finance and central bank have implemented special initiatives including an acceleration program, a pension safety net and a monetary program to help increase liquidity, create new jobs, protect private savings and promote continuous growth in Israel. The pension safety net, which is designed to compensate some market losses by pension funds for savers near retirement age, aims to protect a savings whose total worth is estimated at about 100 billion shekels (~$ 25b), as of November 2008. The acceleration program is a package of economic measures designed to boost activity in the economy through the allocation of funds to infrastructure, research & development, the credit sector and the labor market. In addition, the program addresses the market failure created in the credit sector, using existing funds and creating new credit funds with an emphasis on small and medium-size businesses that have fewer resources available to deal with the credit crunch. All the said activities are expected to increase the supply of credit for these businesses by some 2.5 billion shekels (~$625 million). To help the economy deal with the effects of the global crisis in the interim, the Bank of Israel in late February lowered the key lending rate by three-quarters of a point to a new record-low of 0.75%. Since October, 2008, the central bank has slashed lending rates by a cumulative 3.50% in seven consecutive rate reductions. The rate cuts, meant to support the economy by lowering the cost of credit, thus contributing to financial stability and partially offseting the downward pressure on prices, were in 2 line with what central banks globally have done with their interest rates. As the Israeli market is heavily dependent on revenues from exports, the expansionary monetary policy has also served to stabilize the shekel relative to many of the globally weaker currencies to assist the competitiveness of Israeli products internationally. To help underpin the economy, the Bank of Israel has also increased the level of foreign exchange reserves since March 2008 by purchasing about $100 million per business day. As of January 2009 the central bank had bought a total of approximately $10 billion, increasing their reserves to about $37 billion. The central bank believes that the appropriate level of the reserves lies between $40 billion and $44 billion, and plans to continue the program pending an adjustment in market conditions. How has foreign investment in Israel fared since the onset of the credit crunch? Foreign investors see their investment in Israel as long-term profitable assets and continue to express their confidence in the Israeli economy year after year. This trust is shown by the establishment of research and development centers, the founding of manufacturing plants, mergers and acquisitions and other types of collaboration. Foreign direct investment in Israel reached about $10 billion in 2008, the second highest figure since 2006, when Berkshire Hathaway's $4 billion acquisition of Iscar Ltd. boosted FDI to $14 billion. What effect do geopolitical tensions have on the Israeli economy? Throughout the years, security events that have occurred in Israel may have lead to uncertainty in the short-run, but in the long-run the strength of the Israeli economy continues to inspire a steady inflow of foreign direct investments. Israel's reputation as a leader of technological innovation is well established internationally and continues to gain ground. The country's macro-economic fundamentals and strict fiscal policy serve as a robust buffer against foreign financial pressures, and ensure the economy's quick recovery. Multinational corporations have been active in Israel for decades and their motivation to invest in the local economy has been unshaken by security issues. 3 Some examples of major foreign investors in Israel are: INTEL first invested in Israel in 1974 and then again in 1985, 2004 and 5002. In 2008 Intel opened a new semiconductor production plant in Kiryat Gat, the third such facility in the country. Microsoft has operated in Israel since 1989, and after a number of years opened an R&D center in Israel. The software giant opened an additional R&D center in Herzliya in 2008. SAP made its initial investment in Israel in 1998, employing 40 people and has increased its investments in Israel a number of times in the past years. Today, 1,000 employees are working in SAP plants across the country. Unilever has operated in Israel since 1986, and has continued to increase its investment in Israel ever since. Motorola initially invested in Israel in 1964, and since then has made several acquisitions in Israel – in 1986, 1996 and 1997. Motorola- Israel is the firm's first wholly owned subsidiary outside of the United States. INTERNATIONAL COMPANIES INVESTED IN ISRAEL Which multinational companies have invested in Israel? Many major multi-nationals have chosen to run core activities in Israel including: HP, Microsoft, Intel, IBM, Siemens, GE, SAP, Philips, TimeWarner, Sony, Cisco, Google, EBay, Analog Devices, Computer Associates, Berkshire-Hathaway, Applied Materials, Sun Microsystems, 3Com, Motorola, Pfizer, J&J and more. In which sectors do these companies invest? Sectors that multinationals invest in include telecommunications, information technologies, semiconductors, medical devices, pharmaceuticals, biotechnology and optics. Israel’s high tech industry in particular is extremely profitable and attractive to foreign multinationals. Israel's water and cleantech technologies sectors have become recognized worldwide due to the country's first-hand, proven knowledge in these fields and the global increase in demand for efficient water and clean energy technologies. 4 Which foreign companies have made Mergers and Acquisitions (M&A's) recently? 2008 witnessed some major international Mergers & Acquisitions: Johnson & Johnson acquired Omrix for $438 million, Saint Jude Medical bought Mediguide for $300 million, Plastro Irrigation Systems was bought by John Deere and Scopus Video was purchased by Harmonic Inc. Despite the global economic crisis, the total sum of FDI in Israel was slightly higher in 2008 than in 2007- at $9.7billion. Furthermore, 2006 saw a record number of Mergers & Acquisitions; As, a total of 76 Israeli companies were acquired. Warren Buffet's Berkshire-Hathaway made its first international investment when the company made its monumental acquisition of Israeli Iscar for $4 billion, HP acquired Mercury for $4.5 billion and SanDisk acquired MSystems for $1.5 billion. Other examples of multinational companies that have acquired Israeli companies include: Microsoft, Motorola, Intel, HP, Siemens, Samsung, IBM, GE, Phillips, Lucent, AOL, J&J, Applied Materials, Sun Microsystems, EMC, Boston Scientific, eBay, HP, Kodak, Cisco and Xerox. What type of venture capital activity exists in Israel? With some 80 VC management companies operating in Israel, total capital raised reaching over $10 billion and investments made in more than 1000 Israeli start-ups, Israel’s venture capital industry thrives as in no other country. The Israeli VC industry is second in the world, directly following the U.S. Israeli VC's typically invest in communications, computer software, IT, semiconductors, life sciences (including medical devices and biotechnology) and homeland security. In 2008, 483 Israeli high-tech companies raised $2.08 billion from local and foreign venture investors,18% above the $1.76 billion raised in 2007 and 28% above the 2006 level ($1.62 billion). 5 How much foreign capital has been invested in Israel in the past year? In light of the growth of the high-tech industry, foreign investment has increased dramatically since the 1990’s. Foreign direct investments grew from $600 million in 1993 to about $14.3 billion in 2006 and $10 billion in 2007 and 2008. Venture capital investments since 1993 have exceeded $11 billion, with $2.08 billion raised in 2008 alone. ISRAEL'S ADVANTAGE What is Israel’s greatest natural resource? Israel's greatest natural resource is its skilled workforce - highly motivated, resourceful and independent - they enable Israel to stay ahead of the competition. How does the Israeli business culture impact competitiveness? Israel’s workforce is particularly competitive because of the informal but effective get-down-to-business culture, exceptional ingenuity and entrepreneurial spirit. The combination of culture, skill and initiative creates a flexible, working system that allows for great adaptability while producing breakthrough technologies and quick time-to-market solutions. HIGHLY EDUCATED WORKFORCE What is the level of education among the Israeli workforce? Israel enjoys the highest ratio in the world of university degrees and academic publications to population and boasts the world’s greatest per capita number of engineers, scientists and doctors. 6 What characterizes the Israeli workforce? The highly skilled, motivated, and entrepreneurial workforce represents a multilingual population with cultural, historic and business ties to almost every other nation in the world. INNOVATIONS IN ISRAEL Which breakthrough technologies were developed in Israel? Israel has a long history of market-making innovations and breakthroughs in all sectors, including: Israel’s M-Systems was the first to offer Disk-on-Key and Disk-on-Chip flash memory products, and changed the way people store and handle information. The Philips Brilliance CT Scanner, developed in Israel, takes a comprehensive picture of a patient in seconds instead of minutes, in the emergency room where every second counts. IP Telephony was invented by the two Israelis who founded VocalTec. ZIP compression technology was developed by two professors at the Technion, Israel's institute of technology. Israel's Given Imaging developed the first ingestible video camera to view the small intestine from the inside, and help doctors diagnose cancer and digestive disorders. The technology for the AOL Instant Messenger ICQ was developed in 1996 by four young Israelis. Israel's Comverse invented voice-mail. Revolutionizing present day agricultural techniques, Israel’s Netafim developed modern drip-irrigation technology and Israeli companies continue to lead this field with innovative breakthroughs. 7 How does Israeli innovation rank compared to the rest of the world? According to the WEF 2008-2009 Competitiveness Report, Israel has the 5th highest number of patents pending in the world and ranks 6th in technological innovation. Israel also ranks 3rd in quality of scientific research institutions. What types of incentives are available for investors? The State of Israel encourages local and foreign investment by offering a wide range of investor incentives and benefits in industry, tourism and real estate according to the Law for the Encouragement of Capital Investment. Eligible companies can benefit from investment grants of up to 24 percent of tangible fixed assets, reduced tax rates, tax exemptions and other tax related benefits. Hi-tech companies can benefit from government R&D funding as well. Who is eligible for investment incentives? Companies meeting the required criteria will be granted Approved or Beneficiary Enterprise status and will be eligible for investment incentives. Certain basic criteria must be met which include: registration of the company in Israel, international competitiveness and minimal designated investment. Who is eligible for investment grants? Investment grants are only available to companies choosing to locate their plants in Priority Areas A or B. Grants are calculated as a percentage of the original cost of land development and investment in buildings, in machinery and equipment. This cost includes installation and related expenses. Grant rates are 24% in Priority Area A and 10% in Priority Area B. Companies choosing this incentive path should approach the Israel Investment Center to process their request. In addition tax benefits are also part of this path as per the tax benefits table. 8 Who is eligible for tax benefits and/or exemptions? Investors who choose to forgo the investment grants are eligible for the tax benefit option. This option is administered directly by the Tax Authority and no prior approval is required. As long as the company meets the basic requirements (see section 2.2)where is this section?, the benefits are granted automatically.( For Foreign Investors - see next section) 1. Alternative tax path – Tax exemption for 10 years in Priority Area A. However if a dividend is paid out, the dividend tax rate is 15% - and corporate tax will also be levied. In Priority Area B - Tax exemption for 6 years, 25% in the 7th (final) year. In the Center of the Country - Tax exemption for 2 years and 25% for the next 5 years. 2. Priority Area path - Tax rate of 11.5% for 10 years. Dividend tax rate - 15%. 3. Strategic Investment path – Large multi-national companies investing over US$130 million in a given project in Priority Area A, will be exempt from corporate and dividend tax for 10 years. What types of grants and tax benefits are available for foreign investors? Foreign investors receive preferential treatment. To qualify the foreign investor must invest a sum of at least US$1.1 million and control at least 25% of the company. The benefit period for a foreign owned company is 10 years (compared to 7 years for a local investor). 1. Grant path - Grant rates are 24% in Priority Area A and 10% in Priority Area B; In addition, the tax rate is 10% and the benefit period as stated above is for a 10 year period. 2. Alternative tax path – Tax exemption for 10 years in Priority Area A. However if a dividend is paid out, the dividend tax rate is 15% - and corporate tax will also be levied. In Priority Area B - Tax exemption for first 6 years, 10 % for another 4 years. In the Center of the Country (non-priority area) tax exemption for 2 years and 10% for the next 8 years. 3. Priority Area path – Tax rate of 11.5% for 10 years. Dividend tax rate of 4%. If dividend is paid out, the total tax rate becomes 15%. 9 4. Strategic Investment path – Large multi-national companies investing over US$130 million in a given project in Priority Area A, will be exempt from corporate and dividend tax for 10 years. What R&D incentives or support programs are available? The Office of the Chief Scientist (OCS) of the Ministry of Industry, Trade and Labor is responsible for implementing the government policy of encouraging and supporting industrial research and development in Israel. The OCS provides a variety of support programs. The main one is The Law for the Encouragement of Industrial R&D which offers conditional grants of 20%- 50% of approved programs. Additional international funds ? and domestic programs including technological incubators are also available. What international economic agreements does Israel enjoy? Israel has an extensive network of international agreements with countries throughout North America, Europe and Asia that facilitate international business including: Free Trade Agreements that cover close to 80% of Israel's foreign trade R&D programs to promote industrial cooperation that provide up to 50% of costs for joint projects Treaties for the avoidance of double taxation Does Israel have tax treaties with other countries? Israel has entered into treaties for the avoidance of double taxation with about 40 countries around the world, including the US, most EU countries, China and more. 10 ISRAEL'S ECONOMY What was Israel's economic growth in 2008? The Israeli economy has grown on average 5% annually since 2005 and continued to grow steadily in 2008. Gross domestic product grew 4.1% to about $168 billion at current prices, representing a continuation of the sustainable growth seen over the last few years. Nevertheless, growth in the second half of the year was markedly slower due to the effects of the global financial crisis and is not expected to pick up until 2010, depending on trading conditions worldwide. In purchasing-power-parity (PPP) terms, Israel's GDP per capita, which has averaged $30,000 for the past couple of years, has been on par with members of the Organization for Economic Cooperation and Development (OECD). In fact, over the past 20 years, the country – with a population of only 7 million – has ranked as one of the world's five fastest growing emerging markets. How did Israeli exports fare in 2008? For many years, Israel's economic growth has been fueled by a steady increase in exports and foreign investment. In 2008, however, the raging credit crisis weighed down Israeli exports causing a slowdown in the growth pattern. Exports are estimated to have risen 3.6 % in 2008, following an 8.6% rise in 2007, and a 6.1% rise in 2006. Exports continued to be mostly carried by the high-tech sector, which makes up about 43% all industrial exports. What is the inflation rate in Israel? In 2008 the consumer price index (CPI) grew by 3.8% following a 3.4% increase in 2007 and compared to close to 0% in 2006. In recent years Israel has joined the ranks of economies with the lowest inflation rates in the industrialized world. Responsible fiscal and monetary policies have accompanied reforms that have liberalized the economy, accelerated the process of privatization and made the economy more competitive The forecast for 2009 is an inflation rate of 0.6%, which is below the target range of 11 1-3%. To help moderate the downward pressure on prices, the central bank continues to pursue an expansionary monetary policy. How is Israel’s economy and credit rated? Leading international rating agencies continue to express confidence in the Israeli economy, amid the global financial crisis. Fitch maintained its foreign currency Issuer Default Rating (IDR) for Israel at A with a stable outlook, and its local currency IDR at a stable A+. International rating company Standard & Poor's kept its A/A-1 rating with a stable outlook on Israel's long/short term foreign currency debt and AA-/A1+, stable, on its long/short term local debt. S&P said "the rating affirmation reflects the government's commitment to continued fiscal discipline and the resilience of the Israeli economy after five years of strong GDP growth at over 5%, notwithstanding a tense political and fiscal environment". Moody’s, in its January Israel report, also kept its relatively high A1 rating with a stable outlook that it had awarded Israel last April. The following charts summarize Israel's rating by the leading international agencies: 12 INVEST IN ISRAEL What is Invest in Israel? Invest in Israel is the investment promotion center of Israel’s Ministry of Industry, Trade and Labor, Foreign Trade Administration. The center serves as the marketing agency for foreign investments in Israel and as a full-service “one-stop shop” for foreign based companies and individuals who are interested in investigating direct investment and joint venture opportunities in Israel. Invest in Israel provides service, support and information to potential and current investors. Invest in Israel works closely with potential and current investors before, during and after investment, and serves as a resource for investment related information about Israel. How do I contact an Israel economic representative near me? Contact the Israel Economic representative in your area or the Invest in Israel offices in Jerusalem. 13