Analysing the Capabilities of the Organisation

advertisement

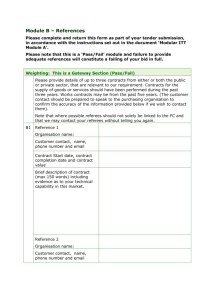

MA in Management – Strategic Analysis Module Analysing the Capabilities of the Organisation A. INTRODUCTION TO SESSION Whilst it is clear that the external environment in which an organisation operates will have a significant impact upon its performance, this is hardly the whole story. Even a superficial glance across a range of organisation’s involved in the same area of activity will reveal differences in performance, whatever the measure used. It is clear that what organisations do, as well as how well they do it, will have a significant impact upon their success or failure. In recent years, the study of strategy as focused increasingly upon the capabilities of the organisation to use the resources available to it in order to build success. As a result, a range of frameworks and techniques has been developed in order to understand and analyse the strategic capabilities of organisations. These frameworks and techniques are explored below. Your Objectives By the end of this session you should be able to: Understand how the resources and competences available to or created by an organisation can contribute to strategic capability. Undertake a resource audit of an organisation. Use value chain analysis to outline the activities an organisation performs and the ways in which it links them together in order to create competences. Understand the potential sources of cost efficiency and value added that could underpin and sustain the strategic capabilities of the organisation. Use relevant frameworks to identify and analyse the core competences and strategic capabilities of an organisation. B. THE NEED FOR CAPABILITIES ANALYSIS Organisations have different strengths and weaknesses, which means that they have different abilities to deal with the threats and opportunities presented by the external environment. In an increasingly unpredictable world it is also important to understand how well equipped an organisation is to cope with the changes that this implies. Internal analysis of an organisation aims to identify and understand the strategic capabilities it possesses that will lead it to deal successfully with the challenges it faces, currently and into the future, by meeting the needs and requirements of its customers and users, better than other providers. d:\533575375.doc As this is a relatively new area of academic investigation, the terminology used by different authors tends to vary, so it is important to be on your guard as you read articles and books about the subject. The overall approach taken here is to see strategic capability as resulting from the resources the organisation owns or to which it can gain access, the way in which it performs and links together activities to create competences that use these resources, so creating products and services valued by users. In “Exploring Corporate Strategy”, Gerry Johnson and Kevin Scholes split these resources and competences between those that are similar to those possessed by other providers and those that are better or difficult to imitate. This is shown in Figure 4:1. Same as competitors or easy to imitate Better than competitors or difficult to imitate Resources Necessary Resources Unique Resources Competences Threshold Competences Core Competences Figure 4:1 – A Typology of Resources and Competences Necessary resources and threshold competences are needed by organisations simply to compete in an industry or provide a service. However, as success depends upon performing better than your competitors, sustainable competitive advantage is the result of possessing unique resources and /or core competences that set an organisation apart from others and allow it to deliver a superior product or service to users. Given the stress upon the difficulty of imitation, core competences are seen as particularly valuable as they are based on how the organisation works and tend by their nature to be hidden and unique. Mahen Tampoe defined core competence as ‘a technical or management subsystem which integrates diverse technologies, processes, resources and know-how to deliver products and services which confer sustainable and unique competitive advantage and added value to an organisation’. The focus of capability analysis is upon the identification of those factors that will allow an organisation to outperform its competitors. This is achieved by: Assessing the resources of the organisation through a resource audit. Identifying the key activities and linkages between activities across the organisation through value chain analysis. Understanding the bases of competitive advantage that underpin potential unique resources and core competences. Identifying and analysing the core competences and strategic capabilities of the organisation. d:\533575375.doc C. AUDITING THE RESOURCES OF THE ORGANISATION The resources available to the organisation can be critical to strategic success. If an organisation does not have the quantity of resources necessary, or they are not of sufficient quality, then it is unlikely that the organisation’s strategy will be realised. Further, as argued above, necessary resources are also available to competitors so offer no more than the opportunity to participate, whilst unique resources may contribute to competitive advantage. The resources of the organisation go beyond a simplistic list of the factors of production, land, labour and capital, to include the skills possessed within the organisation and resources created by previous activities. In auditing the resources of an organisation it is also important to consider not only those resources it owns but also those to which it has access. In broad terms, resources can be split into four types: Physical - the buildings, machinery, facilities and equipment used by the organisation. Any audit of these resources also needs to consider factors like their age, condition, technological sophistication, capacity and location. Human - the people involved within the organisation. Any audit needs to extend beyond a headcount to consider factors like education levels, skills mix, skill levels, age profiles and adaptability. Financial – not just available cash, but the ability of the organisation to raise capital, management of working capital (stocks, debtors and creditors) and external financial standing. Intangible – these include patents, brand names and reputation. They are often more difficult to identify or copy, but as a result potentially more valuable in creating competitive advantage. Consequently, it is worth looking in more detail at this area. Intangible resources like brand names and reputation are frequently the most important assets that an organisation can possess because, by their very nature they are often difficult to identify and particularly difficult to copy by a competitor. Work by Richard Hall, here at the University of Durham, has identified a range of intangible resources that can be important to the organisation. In his classification, he draws a distinction between intangible assets, the things that “belong” to the company, and intangible resources, that are the “doing” abilities of the organisation and the people within it. Whilst this is an example of how language can vary in this area, it is a helpful distinction because it highlights the range of resources that need to be considered and how they exist or are created. The “capabilities” mentioned within the framework also imply a more limited definition than overall “strategic capability”, though “cultural capabilities” could be considered as crossing the divide between resources and competences outlined above. Despite these variations, Hall’s framework is helpful within a resource audit because it encourages consideration of all potential intangible resources and indicates ways in which these potentially vital contributors to competitive advantage can be protected into the future. His classification is outlined in Figure 4:2. d:\533575375.doc Intangible Assets which are legally Intangible Assets which are not legally protected protected Trade Marks Patents Copyright Registered Designs Contracts and licences Trade Secrets Information in the public domain Reputation Organisational and personal networks These are the result of Regulatory Capabilities These are the result of Positional Capabilities Intangible Resources Functional skills Intangible Resources Cultural capabilities Employee know-how Supplier know-how Distributor know-how Servicer’s know-how e.g. advertising agencies These can be looked upon as Functional Capabilities Perception of quality standards Perception of customer service Ability to manage change Ability to innovate Team-working ability These can be looked upon as Cultural Capabilities Figure 4:2 - Intangible Assets and Resources d:\533575375.doc SAA 1 Using the frameworks outlined above, identify and classify the resources likely to be available to an institution like the University of Durham. Main Resources Physical Human Financial Intangible - Intangible assets (legally protected) - Intangible assets (not legally protected) - Intangible resources (functional skills) - Intangible resources (cultural capabilities) d:\533575375.doc Necessary or Unique? D. IDENTIFYING COMPETENCES – THE IMPORTANCE OF ACTIVITIES AND LINKAGES Whilst the resources available to an organisation are important, the ways in which these resources are utilised by the organisation are also critical to strategic success. Michael Porter outlined the concept of the value system and the value chain as a means of understanding how an organisation could create competitive advantage through the activities it performs and the linkages between activities. The value chain is a way of describing an organisation in terms of all the activities it performs using the resources available to it in order to create products and services valued by its customers or users. An organisation’s value chain is embedded in a broader value system that provides inputs into the organisation and helps transfer outputs to the ultimate consumer. Figure 4:3 illustrates the value system for an industry, showing how an organisation’s value chain is connected by a series of linkages to its suppliers, distribution channels, eventually reaching the final customer. Figure 4.5 The value system Supplier value chains Channel value chains Customer value chains Organisation's value chain Source: Adapted from M. E. Porter, Competitive Advantage, Free Press, 1985. Used with permission of The Free Press, a division of Macmillan, Inc Copyright 1985 Michael E. Porter Figure 4:3 – The Value System Suppliers have value chains that create and deliver the purchased inputs used in an organisation’s chain. Suppliers not only deliver a product but also can influence an organisation’s performance in many other ways e.g. through quality control, meeting delivery dates and price. In addition, many products pass through distribution channels on their way to the buyer. The value chains of these channel organisations perform additional activities that affect the buyer (e.g. a dealer network in the case of automobiles), as well as influence the organisation’s own activities. Gaining and sustaining competitive advantage depends on understanding an organisation’s value chain activities and the linkages between these activities. But it also depends upon understanding the relationships between the organisation and the value chains of its suppliers and buyers. Finally, the organisation needs to understand how it fits into the overall value system and this involves consideration of competitive scope. d:\533575375.doc Competitive Scope The value chains of organisations in an industry differ. The difference reflects their histories, strategies, and success at implementation. An organisation’s value chain may differ in scope from that of its rivals, representing a potential source of competitive advantage. Competitive scope describes the range over which an organisation competes. There are at least four dimensions to this range: • Segment scope - the range of products or services produced to serve different groups of buyers. • Vertical scope - the extent to which activities are performed in-house instead of by other organisations. This involves considering the extent of vertical integration. • Geographical scope - the range of regions, countries or groups of countries across which an organisation chooses to compete with a co-ordinated strategy. • Industry scope - the range of related industries in which the organisation competes with a co-ordinated strategy in order to gain scope economies. A broad scope can allow a firm to exploit the benefits of performing more activities internally. It may also allow the firm to exploit interrelationships between the value chains that serve different segments, geographic areas or related industries. A firm may exploit the benefit of broader scope internally or it may form alliances with other firms to do so. Alliances with other firms are agreements that fall short of outright merger, such as joint ventures, licenses, and supply agreements. They involve co-ordinating or sharing value chains with partners, so broadening scope of the firm. For example, a shared sales force may sell the products of two organisations or there may be joint production. A narrow scope allows the tailoring of the value chain to serve a particular target segment or geographic area of industry to achieve lower cost or to serve the target in a unique way (e.g. niche marketing). The success of a narrow scope rests on differences among product varieties, buyers, or geographic regions within an industry and the differences in resources and competences of the organisation that allows it to perform better than its rivals in this area. Illustration CHANGING TIMES AT MARKS AND SPENCER With a history extending back into the Victorian era, the name of Marks and Spencer had been synonymous with product quality and customer service on most UK High streets for more than three decades. Yet, from late 1998 the company suffered from a series of boardroom problems and uncomplimentary stories in the press, along with declining performance. Unlike most of its competitors in both clothing and food retailing, Marks and Spencer sold products only under its own St. Michael brand. Customers valued the high standard of product quality of the clothing, food and household products on offer and were prepared to pay a small premium compared to similar competitor ranges. The wide range of products available, the service provided by store staff and accessibility of the stores, along with the “no questions asked” returned goods policy meant that a broad cross-section of the UK public rated Marks and Spencer’s customer service highly. d:\533575375.doc In addition to the decisions taken about the scope of their operations, Marks and Spencer’s approach was the result of a complex set of activities and relationships which, in part, is captured by the value chain illustrated below: [see J & S pp 455-456] Marks and Spencer’s Value Chain in the mid-1990s. Source: G Johnson & K Scholes, Exploring Corporate Strategy, Prentice Hall, 1999 Marks and Spencer’s strategic capabilities extended beyond their own retail value chain to the management of relationships with their suppliers. Their cultivation of, mainly UK-based, suppliers to ensure adequate performance in terms of quality and delivery was built up over many years. Sometimes higher margins were imposed on suppliers to ensure that quality and delivery were up to standard. However, this record of success came to an end as problems started to emerge late in 1998. The six-monthly results up to September revealed the first decline in operating profits in over 30 years. The struggle to replace their Chairman and Chief Executive, Sir Richard Greenbury, also generated stories that moved from the business pages to the front pages of the national press. Problems with previous acquisitions made in Canada and the USA, coupled with continued poor retailing results in the UK, meant that the picture turned from bad to worse during 1999 and 2000. Despite major changes in senior personnel, including the appointment of a Belgian Chairman in Luc Vandevelde, the cutting of long term links with suppliers like William Baird, the introduction of “concept” stores in some of their main locations and a major advertising campaign, the poor performance continued into 2001. Many analysts claimed that Marks and Spencer’s clothing ranges lay at the heart of the problem. The tastes of British consumers had changed during the late 1990s, with preferences moving towards cheaper clothing sold by the new discount stores like Matalan, or moving towards “designer” labels at the other end of the scale. Marks and Spencer was no longer seen as providing the prices, styles or quality demanded by shoppers. The question being asked by these analysts was could Marks and Spencer change even further to meet these new competitive conditions? E. VALUE CHAIN ANALYSIS The value chain provides a systematic basis for analysing the activities an organisation performs and the linkages between these activities. Through these activities the organisation creates value. The organisation gains competitive advantage through reducing costs or increasing value more efficiently or more effectively than its rivals do. Value chain analysis involves disaggregating the organisation into the specific activities it performs in creating the products or services valued by customers or users. The linkages between activities within and external to the organisation’s value chain also need to be identified. Once both these tasks have been undertaken, attention can be focused upon those activities and linkages that are critical to the creation of core competences. Analysing Value Chain Activities Every organisation is a collection of activities that are performed to design, produce, market, deliver and support its products and services. All these activities can be represented generically though the value chain depicted in Figure 4:4. The particular structure of an d:\533575375.doc organisation’s value chain and the way it performs individual activities are a reflection of its history, its strategy, its approach to implementing its strategy and the underlying economics of the activities themselves. Figure 4.4 The value chain Firm infrastructure Margin Human resource management Support activities Technology development Procurement Inbound Operations Outbound logistics logistics Marketing and sales Service Margin Primary activities Source: M.E Porter, Competitive Advantage, Free Press, 1985. Used with permission ofThe Free Press, a division of Macmillan, Inc. Copyright 1985 Michael E. Porter. Figure 4:4 – The Value Chain Value activities can be divided into two broad types: • Primary Activities - the activities involved in the physical creation of the product and its sale and transfer to the buyer as well as after sale assistance. The five primary activities are divided into inbound logistics, operations, outbound logistics, marketing and sales, and service. • Support Activities - primary activities are supported by purchased inputs, technology, human resources and various organisation-wide functions. The dotted lines in Figure 4:4 reflect the fact that procurement, technology development and human resource management can be associated with specific primary activities as well as support the entire chain. Firm infrastructure in particular supports the entire chain. Primary Activities According to Porter each primary activity is divisible into a number of distinct activities: • Inbound Logistics - including receiving, storing and disseminating inputs to the product or service. Materials handling, warehousing, inventory control, vehicle scheduling and returns to suppliers are all part of inbound logistics. • Operations - operations transform inputs into the final product form. In a manufacturing company they could include machining, packaging, assembly, maintenance and testing. In a service organisation like an architect’s practice, operations activities would focus upon the creation of plans for a new building and include site surveying, project evaluation and the generation of plans and specifications using CAD packages. d:\533575375.doc • Outbound Logistics - collecting, storing and physically distributing products and services to buyers are included here. This could involve warehousing of the final product, materials handling, delivery vehicle operation, and order processing. In a service business like hairdressing, operations and outbound logistics activities are intrinsically merged in the creation of a new hairstyle for the customer sitting in the salon. • Marketing and Sales – activities like advertising, promotion, sales force management, producing quotations, managing distribution channels and pricing are included in marketing and sales. • Services - providing service to enhance or maintain the value of the product or service after sale. This might include installation, repair, training, parts supply, and product adjustment. Support Activities Support activities can be divided into four categories. As with primary activities, each support category is divisible into a number of distinct activities: • Procurement - refers to the activity of purchasing inputs to be used within the organisation’s value chain. It can be divided into selecting new suppliers, purchasing inputs and monitoring of supplier performance. Purchased inputs include raw materials, supplies and other consumable items, as well as assets such as machinery, laboratory equipment, office equipment, and buildings. Purchased inputs are present in both primary and support activities and tend to be spread throughout an organisation. Whilst the purchasing department may buy raw materials, plant managers may be responsible for new machinery, office managers for temporary secretarial support and the chief executive would be responsible for engaging strategy consultants. • Technology Development - is concerned with investment in the updating and improvement of both the organisation’s products and its processes. It may include component design, features design, field-testing, and process engineering. Every activity is likely to use technology, either in the form of technical know-how or procedures, or in the form of process equipment. Technology tends to be associated with operations but this is too narrow a view; information technology is a key element of logistics, sales, procurement and human resources in many companies. Technology development is not solely linked to end products or services; communications technology will be applied throughout the organisation via e-mail systems and Intranets. • Human Resource Management - includes recruiting, hiring, training, development and compensation of all types of personnel. Human resource management supports both individual primary and support activities (e.g. staff recruitment throughout an organisation) and the entire value chain (e.g. labour negotiations). Human resource management affects competitive advantage in any firm, by determining the skills and motivation of employees and the cost of hiring and training. In some industries it holds the key to competitive advantage. • Firm Infrastructure - consists of a number of activities including general management, planning, finance, accounting, legal, government affairs and quality management. Infrastructure, unlike other support activities, usually supports the entire chain and not individual activities. Depending on whether a firm is diversified or not, firm infrastructure may be self-contained or divided between a business unit and the parent corporation. Firm infrastructure is sometimes viewed only as “overhead”, but it can be a powerful d:\533575375.doc source of competitive advantage. In utility companies such as telecommunications or gas, for example, negotiating and maintaining ongoing relations with regulatory bodies can be among the most important activities for sustaining competitive advantage. Direct, Indirect and Quality Assurance Activities Sometimes, organisations concentrate on direct value chain activities and neglect indirect ones such as quality assurance and after-sales service. Every organisation has direct, indirect and quality assurance value activities. All three types are present in both primary activities and support activities. For example, in the technology development activity, actual laboratory teams are direct activities, while research administration is an indirect activity. What is the distinction between direct, indirect and quality assurance activities? • Direct Activities - are directly involved in creating value for the buyer, such as assembly, parts machining, sales force operation, advertising, product design and recruiting. • Indirect Activities - make it possible to perform direct activities on a continuing basis, such as maintenance, scheduling, operation of facilities, sales force administration, research administration and vendor record keeping. • Quality Assurance Activities - ensure the quality of other activities, such as monitoring, inspecting, testing, reviewing, checking, adjusting and re-working. The role of indirect and quality assurance activities is often not well understood. In many industries, indirect activities represent a large and rapidly growing proportion of cost and can play a significant role in the differentiation of the product or service. Similarly, quality assurance activities apply across the value chain and to ignore them can lead to problems. The Relative Importance of Value Chain Activities Companies rarely create core competences as a result of one value chain activity. Indeed, were the company to rely on such an activity it would be at risk of losing its competitive advantage as its competitors would find it relatively easy to replicate the activity within their own value chains. The key is to identify those activities that seem to contribute most to the creation of value within the product or service. Originally, value chain analysis emerged from the move to introduce activity-based costing systems in large organisations, often at the suggestion of management consultants. Whilst few of these costing systems have survived, the value chain concept has proved more durable and detailed analysis is often still possible in practice, as Alan Shepherd’s article, “Understanding and using value chain analysis”, indicates. Even without access to great detail, such as when undertaking a case study analysis, critical activities can be identified by asking which activities contribute most to the distinctive nature of the products or services created by the organisation? This is likely to focus attention on those activities performed differently to competitors or those activities different to those of competitors. The importance of particular activities will also vary according to the industry in which the organisation is located. For a distributor, inbound and outbound logistics are the most critical. For a restaurant or retailer, outbound logistics may be largely non-existent and operations are the vital category. In a bank, marketing and sales activities, coupled with d:\533575375.doc technology development may well be vital in the development of successful financial “products”. In any organisation, however, all the categories of primary and support activities will be present to some degree and play some role in creating threshold and core competences. The following illustration highlights how one company attempted to create core competences through a combination of activities. Illustration CREATING CORE COMPETENCES AT BRASSERIES KRONENBOURG In the mid-1990s, Brasseries Kronenbourg was the main company within Kronenbourg SA, the beer division of the French food and packaging group, Danone. Along with Heineken and Carlsberg, Kronenbourg SA was one of the three largest brewers in Europe. Brasseries Kronenbourg, formed from the merger of Kronenbourg and Kanterbraü in the 1970s, aimed to become one of the most productive brewers in the world. Production facilities, along with human resources, finance and administration functions, were combined by the mid-1980s. There then followed a restructuring programme that reduced staffing by 570 jobs, mainly through voluntary redundancies. At the same time a major investment programme created larger, more efficient breweries capable of serving larger geographical areas, up to 1,000km2 for mass market brands. The distribution system in France was also developed through the acquisition of 60 warehouses via its subsidiary, Elidis. By merging the sales forces of Kronenbourg and Kanterbräu, the company brought together a unified product range of 28 brands. As product image and brand name are critical in this market, the company made key investments in this area. The company strengthened its links with its customers, particularly the retail chains, by introducing a merchandising system called “Pluton”, that improved the presentation of beers, adapting it to each retail chain, region and season. Kronenbourg also developed and launched a series of beers, to meet the needs of emerging customer segments, including: Tourtel Brune (1989); Tourtel Ambrée (1990) and Tourtel 100% malt (1994). Working with the packaging division of Danone Group it also developed new packaging for its products, winning awards for one bottle and developing a label that changed colour once the bottle was at the right temperature for its Kronenbourg 1664 brand. From 1993, the Loi Evin restricted beer advertising, so the company concentrated on the promotion of its products in cafés and the sponsorship of the Paris Saint Germain and Strasbourg football teams. As well as developing in its home market, Kronenbourg also sought to develop its international presence through a range of acquisitions and licensing agreements. For example it entered into a production agreement with Courage in the UK, as well as entering into agreement with local breweries in Italy, Belgium, Spain and Greece. Its strategy was to develop Kronenbourg 1664 and Tourtel as international brands brewed in each local market alongside the strongest brands of its partner. Source: based on R Calori & P Monin, “Brasseries Kronenbourg” in G Johnson & K Scholes, Exploring Corporate Strategy, Prentice Hall, 1999. d:\533575375.doc SAA 2 Use the value chain framework below to plot the main activities undertaken by Brasseries Kronenbourg in the illustration, Creating Core Competences at Brasseries Kronenbourg. d:\533575375.doc Identifying Value Chain Linkages A key aspect of organisations is the interdependence or linkages between their various activities. Whilst value activities can be viewed as the building blocks of core competences, linkages are vital to the overall building process in two ways: • Co-ordination of linked activities such as procurement and assembly can reduce the need for resource inputs. For example, Just-in-Time manufacturing methods reduce total inventory requirements within assembly operations. • Integration of activities can create the opportunity to lower the total cost of the linked activities or increases the value added. In copier manufacturing, for example, the quality of purchased parts is linked to the adjustment of copiers after assembly. Canon found it could virtually eliminate the need for adjustment in its personal copier line by purchasing higher precision parts. Managing the linkages across the value system is therefore a key management task. Three kinds of linkages can be considered: • Linkages within the value chain. It is easy to see that the value chain is a set of interdependent activities. The efficiency with which one activity is performed determines the cost of other linked activities and the cost of the product or service as a whole. Some of the most common linkages are those between: • • • • Operations and maintenance. Quality assurance and other activities (e.g. inspection and after-sales service). Activities which must be co-ordinated (e.g. inbound logistics and operations). Activities that are alternative ways of achieving the same results (e.g. advertising and direct sales). Identifying linkages requires us to ask the question: “What are all the other activities elsewhere in the organisation that have or might have an impact on the cost or effectiveness of performing this activity?” When activities in the value chain are linked, changing the way one of them is performed can reduce the total cost of both. Deliberately raising costs of one activity may not only lower the cost of another but may also lower the total cost. For example, using better quality sub-assemblies may reduce total manufacturing costs if final assembly is made easier. Similarly, linking together activities may create opportunities to add value to the products and services offered by an organisation. For example, the creation of “One-Stop Shops” for business advice services can allow a more tailored package of support to be created for clients. • Linkages between the business units of the same organisation. Within the same company different kinds of businesses might concentrate on different products or markets and thus need to be managed differently. Many organisations are made up of separate business units, each with its own value chain. d:\533575375.doc However, there may be opportunities to link particular activities to the advantage of the business units concerned. For example, a major clothing retailer might have several different store concepts appealing to different types of customer, but all can share the same logistics and distribution system so reducing costs. • Linkages between the value chains of different organisations. Vertical linkages reflect interdependencies between a company’s activities and the value chains of suppliers and distributors and can be a key source of competitive advantage. The delivery of chocolate in liquid form instead of moulded bars can reduce a confectioner’s processing costs for example. Often linkages with suppliers provide opportunities for cost reduction on both sides. The delivery of liquid chocolate can reduce the supplier’s cost as well, since it eliminates the cost of moulding bars and packaging them. A similar analysis applies to linkages with distributors. For example, the location of a channel’s warehouse and its material handling technology can influence a company’s logistical and packaging costs. Similarly, sales or promotional activities by distributors may reduce a company’s sales cost or increase opportunities to add value to the product through increased service support. d:\533575375.doc SAA 3 Refer back to your analysis of value chain activities at Brasseries Kronenbourg conducted in SAA 2. Identify any linkages that exist between the activities and between this value chain and those of other parts of the Danone Group and other organisations. Linkages between value chain activities within Brasseries Kronenbourg Linkages between Brasseries Kronenbourg and other parts of Danone Linkages between Brasseries Kronenbourg and other organisations d:\533575375.doc Adapting the Value Chain Whilst the value chain is a very useful tool for strategic analysis, the generic framework needs to be adapted to suit the different conditions of individual organisations. Certainly, it is easier to apply the framework to a manufacturing company than a service-based organisation, where inbound and outbound logistics are often integrated into operations activities. A number of changes have also been suggested to the generic framework. Information technology is now an integral part of the activities of almost all organisations irrespective of the products and services they provide and thus a key activity across their value chains. Even stripping away much of the hype about e-commerce, IT and communications technology are transforming the ways in which organisations operate, whether a car manufacturer with electronic procurement systems or a university providing distance learning courses via CD-ROM and an Intranet. It has also been argued that people management and knowledge management are integral to the value chain, particularly in knowledge-based businesses. Increasing academic attention upon core competence has led to suggestions for further revisions to the framework. In their book, “Strategic Management”, Hugh Macmillan and Mahen Tampoe propose a revised value chain to reflect many of these points. Their revision of the value chain is displayed in Figure 4:5. F. THE BASES OF COMPETITIVE ADVANTAGE As was argued above, the underlying assumption of strategic capability analysis is that sustainable competitive advantage results from an organisation having access to unique d:\533575375.doc resources and core competences. These factors are important because they allow the organisation to lower costs or increase revenues more than its competitors. Together, the unique resources and the activities and linkages that create core competences contribute to competitive advantage by allowing the organisation to exploit sources of cost efficiency or value added not available to other organisations or difficult for them to imitate. Therefore, it is important to understand and recognise these potential bases of competitive advantage. Economies of Scale When unit costs fall as the scale of output increases, the phenomenon is described as economies of scale. When such economies of scale exist, large volumes of output can be produced at lower unit costs (average costs) of production than small volumes of output. This can provide an organisation with an advantage over its competitors, as is shown in Figure 4:6. In Figure 4:6, the curve marked AC is an average cost curve for the industry as a whole, illustrating economies and diseconomies of scale for organisations with different output capacities. Note that beyond a certain volume of output, average costs may rise due to the problems of managing large operations - these are diseconomies of scale. The curves AC1 and AC2 represent the costs of output of separate organisations with different capacity levels. Even if the organisation with a smaller capacity operates at maximum efficiency, at the lowest point on the curve AC1, it is unable to match the lower costs achievable by the organisation with capacity that is exploiting economies of scale. d:\533575375.doc The essential point about economies of scale is that there are some costs that do not increase as output is increased (e.g. in manufacturing once plant and machinery are set up). Output can be increased (up to a point) without further additions, and hence average costs of production may fall. Economies of scale arise for a number of reasons. Large-scale output levels often allow firms to utilise more efficient, capital-intensive methods, for example, computer-controlled assembly lines, flexible manufacturing systems (FMS) and robotics. Methods of production that involve very high set-up, or fixed costs are uneconomic for small-scale production but large-scale production enables them to be spread over more units of output. Scale economies can be attained anywhere in the value chain, where there are costs which do not increase proportionally with output. These are often referred to as “indivisibilities” (an example is overheads) and can occur in any of the functional areas. For example, the film footage used for Coca-Cola advertisements is produced in one location, and then dubbed in several languages for distribution all over the world. Economies of scale do not exist in all industries. Where they do exist, however, they tend to result in an increase in concentration - that is, an increase in the market share of the largest firms, as has been the case in steel manufacturing, bulk chemicals and automobiles. Economies of Scope In addition to economies of scale from producing a single product, there is also the possibility that cost savings can result from the simultaneous production of several different products in a single enterprise. Such costs savings are referred to as economies of scope. They occur when the joint costs of two or more products or services are less than the costs of producing them separately. Scope economies are important strategically because they enable a diversified firm to share investments and costs over a diversified product range. Competitors not possessing such diversity cannot do this, and so a cost advantage may be established. Sharing can occur in markets, products or segments. A diversified firm can share equipment, brand names, cash, distribution outlets and expertise, information and organisational strengths across different markets or products. Similarly, external relations with customers, governments, distributors, financial institutions can be shared. The Experience Curve The experience curve relates the cost per unit output to the cumulative volume of output since the production process was first started. Costs per unit tend to decline as the cumulative volume of output rises. As the production process is repeated, the organisation learns from experience, and is able to adjust production processes in accordance with this acquired knowledge, so reducing costs. This is usually amplified by the economies of scale available to these organisations. Some analysts argue that certain industries show considerable experience effects where only the largest of competitors, with the greatest market shares and associated volumes of output, can survive. Any new competitor starts with no experience gained from production, putting it at a considerable cost disadvantage to the more experienced competitors. d:\533575375.doc Empirical studies of these industries indicate that unit costs tend to decline at a relatively stable percentage each time cumulative volume is doubled. Figure 4:7 shows an example of an experience curve, where costs decline by 85% every time cumulative volume doubles. Figure 4:7 – The Experience Curve Whilst experience effects can provide a considerable source of advantage in some industries, not all industries exhibit the phenomenon. Further, if the technology shifts rapidly, then existing advantages may be lost and new entrants can restructure the industry. This certainly happened with consumer electronics in the 1970s and 1980s where Japanese companies overtook the existing players. Creating Value Added through Differentiation Reducing costs are important to most organisations but for many, competitive advantage is based on adding value to their products and services for which customers are willing to pay more. This is best achieved if the customer perceives the product or service to be different from others on offer - this is achieved through differentiation. As with cost efficiency, the creation of value added depends upon the resources available to the organisation and the activities and linkages within the value chain. There are many ways of differentiating the products and services of an organisation, with the most difficult to imitate involving all aspects of the value chain rather than just one activity. The illustration used earlier Changing Times at Marks & Spencer showed how the company had built its reputation upon consistent product quality and high levels of customer service. The analysis of their value chain during the mid-1990s depicts the complexity of activities involved in achieving this differentiation. Whilst this value chain would be difficult to imitate, perhaps the recent problems experienced by the company are a result of failing to d:\533575375.doc understand changing customer requirements and new competitors creating different value chains more attuned to these shopping trends. Other sources of differentiation might include design quality, brand names, up-to-the-minute fashions, short delivery times, after-sales service, individual customisation of the product, added features or services, engineering quality, the list goes on. The key is that all these potential sources of advantage need to be viewed from the perspective of the customer or user - it is that which they value that matters. SAA 4 Refer back to the illustration Creating Core Competences at Brasseries Kronenbourg and your analyses in SAA 2 and SAA 3. Identify examples of the potential bases of competitive advantage that might underpin Brasseries Kronenbourg’s core competences. Economies of Scale Economies of Scope Experience Effects Value Added through Differentiation d:\533575375.doc G. IDENTIFYING CORE COMPETENCES AND STRATEGIC CAPABILITIES The definition of core competences discussed above highlighted that they are hidden, unique and extend across the organisation. Consequently, overall strategic capabilities built on unique resources and core competences are difficult to identify. Whilst the analyses outlined above can dissect the resources and activities of the organisation, offering great insight into how it goes about its business, there is still a risk that the central message remains opaque, obscured by the mass of detail. A further range of frameworks and techniques have been developed that can help make things more visible. Activity Mapping In his article “What is Strategy?”, the ubiquitous Michael Porter illustrated how an activitysystem map can highlight the core competences of an organisation, linking it them to a cluster of other activities that support these higher-order themes. An example of the activitysystem map for the Swedish furniture retailer Ikea is shown in Figure 4:8. High-traffic store layout Self-transport by customers Explanatory catalogues, informative displays and labels Limited customer service Self-selection by customers Most items in inventory Limited sales staffing Ease of transport and assembly Ample inventory on site Self-assembly by customers Increased likelihood of future purchase “Knock-down” kit packaging Wide variety with ease of manufacturing More impulse buying Suburban locations with ample parking Modular furniture design Year-round stocking Low manufacturing cost In-house design focused on cost of manufacture 100% sourcing from long-term suppliers Source: M E Porter, “What is Strategy?”, Harvard Business Review Nov-Dec 1996 Figure 4:8 – An Activity-System Map for Ikea Whilst Porter goes into little detail on how to construct the map, it can still be useful in displaying the relationship between core competences and other activities once identified using other approaches. Porter argues that they can also help focus attention upon how well each activity contributes to core competences, by helping to identify weaknesses, gaps and redundant activities. d:\533575375.doc Steps to Identify Core Competences In “Exploring Corporate Strategy”, Gerry Johnson and Kevan Scholes outline a series of steps and questions that can help identify core competences: Identify successful business units within corporations – this is important in multibusiness organisations that may be operating in many different markets. Identify the bases of perceived value from the perspective of customers – these are labelled the primary reasons for success. It is important here to identify those reasons where the organisation performs better than its competitors. Unpack the bases for success by asking managers why the business is successful in creating each of the primary reasons. These are the secondary reasons for success and are likely to include activities where the organisation is no better than its competitors but others where they again have an advantage. Unpack the secondary reasons for success by asking what operational activities contribute to these successes. Although difficult, this stage can reveal extensive explanations of why things work well in practice – sometimes by people breaking the rules or exploiting slack in the system. Look for patterns of explanation by linking factors within and between the levels. This can be achieved graphically, as shown below in Figure 4:9. Note that only two primary reasons for success, good service and reliable delivery, are explored in detail. In practice, all the primary reasons would be explored. Source: G Johnson & K Scholes, Exploring Corporate Strategy, Prentice Hall, 1999 Figure 4:9 – Identifying Core Competences in a Consumer Goods Business d:\533575375.doc Core Competence Analysis In “Getting to know your organisation’s competences”, Mahen Tampoe highlights an approach based on the composition of goods and services. His definition of core competence was outlined earlier, though the model in his article suggests an interpretation that is closer to the more encompassing definition of strategic capability. First he highlights a model showing how core competence uses the resources available to the organisation to create the goods and services bought by the customer. This is outlined in Figure 4:10. Product or service (as chosen by the customer) Different products, parts, sub-assemblies Rules or processbased provision, of knowledge and functionality Knowledge-based, person-specific professional service Core Competence Basic technologies, bodies of knowledge, corporate or individual learning, relationship culture, strategic assets, parts, processes, raw materials, supply chain management Source: based on M Tampoe, “Getting to know your organisation’s core competences”, in V Ambrosini et al., Exploring Techniques of Analysis and Evaluation in Strategic Management, Prentice Hall, 1998 Figure 4:10 – A Core Competence Model of the Composition of Goods and Services Tampoe argues that this bottom-up model can be used to identify the core competences of an organisation, but that a top-down approach is often of more use as an analytical method. This means starting with the final product or service and then breaking it down, through a series of stages, to arrive at the organisation’s core competences. This approach is highlighted in Figure 4:11. d:\533575375.doc T h e p r o d u c t o r s e r v ic e b o u g h t b y t h e c u s t o m e r T e c h nic a l s u b s y s te m s D is as s e m b le in t o c o r e p ro d u c t s , s u b a s s e m b lie s A dm in is tr a tiv e / in s t itu t ion a l s u b s y s te m s Ide n tif y k n ow led g e em b ed de d in r u les o r pr o ce s s e s Ide n tif y k n ow led g e in ind ivi d u a ls an d g ro u ps D ist r ibu t io n , m ar k e tin g , w a r e h o u s in g , sa le s , fin a nc e, e t c. , p ro ce s s es B as ic te c h no lo gie s , bo d ie s o f k no w le d ge , c or po ra te s t ra te gic a s s et s , p a rts , p r oc es s e s , ra w m ate r ial s o r in d iv id ua l S tr a te g ic a s s e t s P a te n ts , tr a d e m a r k s , c op y r ig h t , lic e n c e s , w a y le av e s lea r n in g, re la tio ns hip Raw m a t e ria ls , u n iq u e s u p p ly c u ltu r e, C O R E C O M P E T E N C E o r E N A B L IN G C U L T U R E Source: based on M Tampoe, “Getting to know your organisation’s core competences”, in V Ambrosini et al., Exploring Techniques of Analysis and Evaluation in Strategic Management, Prentice Hall, 1998 Figure 4:11 – A Framework for Unravelling Core Competence In his article, Tampoe suggests that this breakdown can be achieved using the following steps: Analyse the revenue stream to identify products and services that make a significant contribution to the organisation’s success. Taking each product and service: Disassemble them to identify core products and services, then disassemble these to identify the basic technologies, people skills, processes and strategic assets used. Dissect services to identify core processes or unique talents that confer unique value to the service. Relate products or services to the technical, administrative or institutional subsystems of the organisation. Analyse the sub-systems to find basic technologies, people skills, processes and strategic assets that combine to create the market strength of the core products or services. This is a core competence. Test core competences by asking: Do they provide potential access to a wide variety of markets? Do they make a significant contribution to the perceived customer benefits of the end products and services? Are they difficult for competitors to imitate? d:\533575375.doc H. SUMMARY We have focused upon the ways in which an organisation can create strategic capability based on the resources available to it and the competences it possesses to make use of these resources. The importance of unique resources and core competences that are better than those of competitors and difficult to imitate in the creation of sustainable competitive advantage was stressed. The resources available to the organisation can take various forms, but can generally be classified into physical, human, financial and intangible resources. Frequently, the most important resources of the organisation are the intangible assets and resources that, by their very nature, are difficult to copy by competitors. To understand how an organisation uses the resources available to it, the concept of the value chain and the value system was introduced. The value chain shows how the organisation can be understood as a series of activities and linkages that create value in the goods and services it produces. The value chain is also embedded in a larger value system that opens up a series of decisions about the scope of the organisation. In value chain analysis, the activities within organisation are divided into the primary activities (inbound logistics; operations; outbound logistics; marketing and sales; service) and support activities (firm infrastructure; human resource management; technology development; procurement). The linkages between value chain activities and linkages with other value chains, both within the wider organisation and with other organisations, can also be identified and assessed. We then saw how the bases of competitive advantage can contribute to the organisation’s ability to lower cost or add revenue better than its competitors. These bases include economies of scale, economies of scope, experience curve effects and differentiation. Finally, a range of frameworks to help assess core competences and strategic capabilities were identified. These include activity mapping, Johnson and Scholes’ steps to identify core competences and Tampoe’s core competence analysis. d:\533575375.doc