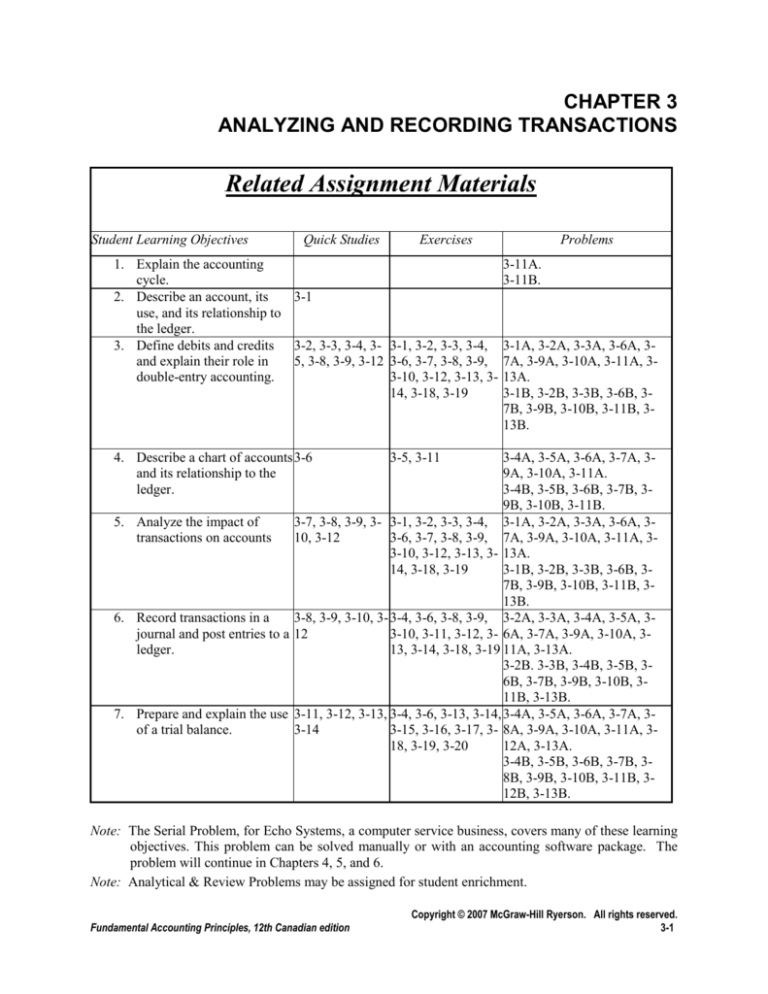

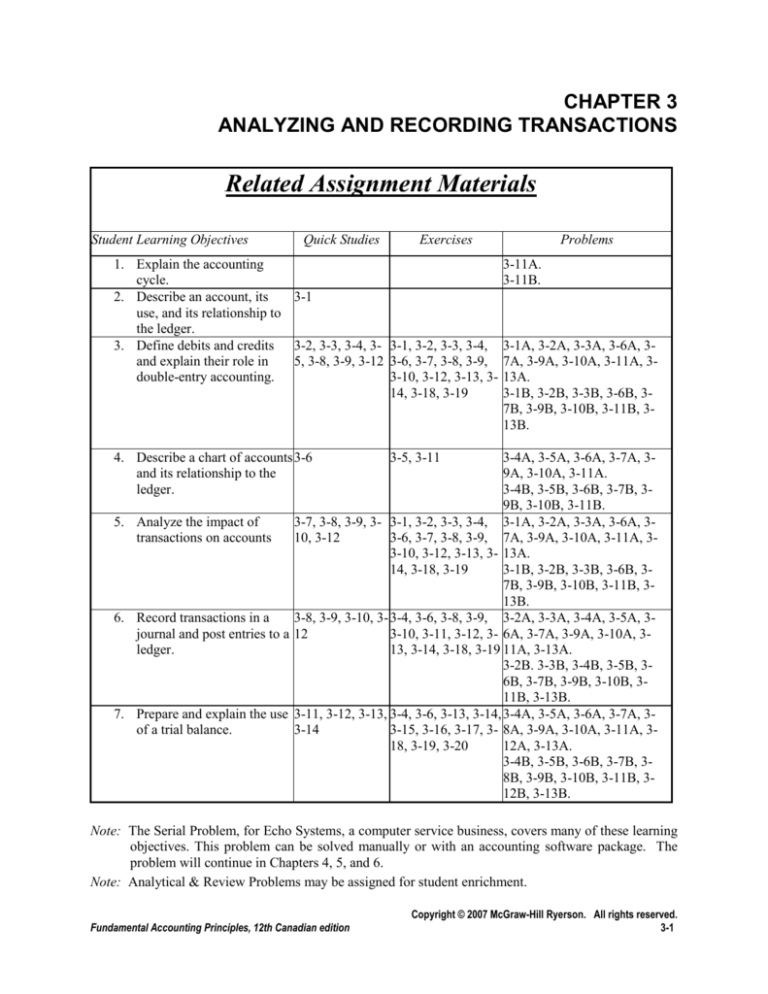

CHAPTER 3

ANALYZING AND RECORDING TRANSACTIONS

Related Assignment Materials

Student Learning Objectives

Quick Studies

Exercises

1. Explain the accounting

cycle.

2. Describe an account, its

3-1

use, and its relationship to

the ledger.

3. Define debits and credits 3-2, 3-3, 3-4, 3- 3-1, 3-2, 3-3, 3-4,

and explain their role in

5, 3-8, 3-9, 3-12 3-6, 3-7, 3-8, 3-9,

double-entry accounting.

3-10, 3-12, 3-13, 314, 3-18, 3-19

4. Describe a chart of accounts 3-6

and its relationship to the

ledger.

Problems

3-11A.

3-11B.

3-1A, 3-2A, 3-3A, 3-6A, 37A, 3-9A, 3-10A, 3-11A, 313A.

3-1B, 3-2B, 3-3B, 3-6B, 37B, 3-9B, 3-10B, 3-11B, 313B.

3-5, 3-11

3-4A, 3-5A, 3-6A, 3-7A, 39A, 3-10A, 3-11A.

3-4B, 3-5B, 3-6B, 3-7B, 39B, 3-10B, 3-11B.

5. Analyze the impact of

3-7, 3-8, 3-9, 3- 3-1, 3-2, 3-3, 3-4, 3-1A, 3-2A, 3-3A, 3-6A, 3transactions on accounts

10, 3-12

3-6, 3-7, 3-8, 3-9, 7A, 3-9A, 3-10A, 3-11A, 33-10, 3-12, 3-13, 3- 13A.

14, 3-18, 3-19

3-1B, 3-2B, 3-3B, 3-6B, 37B, 3-9B, 3-10B, 3-11B, 313B.

6. Record transactions in a

3-8, 3-9, 3-10, 3- 3-4, 3-6, 3-8, 3-9, 3-2A, 3-3A, 3-4A, 3-5A, 3journal and post entries to a 12

3-10, 3-11, 3-12, 3- 6A, 3-7A, 3-9A, 3-10A, 3ledger.

13, 3-14, 3-18, 3-19 11A, 3-13A.

3-2B. 3-3B, 3-4B, 3-5B, 36B, 3-7B, 3-9B, 3-10B, 311B, 3-13B.

7. Prepare and explain the use 3-11, 3-12, 3-13, 3-4, 3-6, 3-13, 3-14, 3-4A, 3-5A, 3-6A, 3-7A, 3of a trial balance.

3-14

3-15, 3-16, 3-17, 3- 8A, 3-9A, 3-10A, 3-11A, 318, 3-19, 3-20

12A, 3-13A.

3-4B, 3-5B, 3-6B, 3-7B, 38B, 3-9B, 3-10B, 3-11B, 312B, 3-13B.

Note: The Serial Problem, for Echo Systems, a computer service business, covers many of these learning

objectives. This problem can be solved manually or with an accounting software package. The

problem will continue in Chapters 4, 5, and 6.

Note: Analytical & Review Problems may be assigned for student enrichment.

Fundamental Accounting Principles, 12th Canadian edition

Copyright © 2007 McGraw-Hill Ryerson. All rights reserved.

3-1

Instructor’s Notes

Chapter Outline

I.

II.

III.

The Accounting Cycle

The steps followed in preparing financial statements. Emphasize that

this is a process which is consistently followed.

Accounts

A. An account is a detailed record of increases and decreases in a

specific asset, liability, equity, revenue or expense item.

B. There should be a separate account for each item on the income

statement and balance sheet. The major types of accounts are:

1. Asset accounts, including Cash, Accounts Receivable, Notes

Receivable, Prepaid Expenses, Supplies, Equipment,

Buildings, and Land.

Examples: Cash (on hand and in bank), Receivables, Prepaid

Expenses, (insurance, rent, taxes office supplies, store

supplies) Equipment, Buildings, Land.

Note: Ask students to describe some transactions that would

involve Accounts Receivable.

2. Liability accounts

Payables, Accounts Payable, Notes Payable, Mortgage

Payable.

Unearned Revenue Unearned Rent, Unearned Subscriptions,

Unearned Professional Fees.

Note: The realization principle and how it relates to revenue

versus unearned revenues and expense versus prepaid

expense can be reviewed.

3. Equity Accounts, including Owner Capital, Owner

Withdrawals, and a separate account for each type of Revenue

and Expense found in the business entity.

The chart of accounts is a list of all the accounts.

Analyzing Transactions

A T-account is helpful learning tool that represents an account in the

ledger. It shows the effects of transactions and events on specific

accounts.

1. The left side of an account is called the debit side. A debit is

an entry on the left side of an account.

2. The right side of an account is called the credit side. A credit

is an entry on the right side of an account.

3. An account balance is the difference between the increases

and decreases recorded in account.

4. The account balance is the difference between the increases

(including the beginning balance) and decreases recorded in

an account

1. Assets are on the left side of the equation therefore the left or

Copyright © 2007 McGraw-Hill Ryerson. All rights reserved.

3-2

Fundamental Accounting Principles, 12th Canadian edition

Instructor’s Notes

Chapter Outline

debit side is the normal balance for assets. Liabilities and

equities are on the right side therefore the right or the credit

side is the normal balance for liabilities and equity.

2. Withdrawals, revenues, and expenses really are changes in

owner’s equity but it is necessary to set-up temporary accounts

for each of these items to accumulate data for statements.

Withdrawals and expense accounts really represent decreases

in owner’s equity therefore they are assigned debit balances.

Revenue accounts really represent increases in owner’s equity

therefore they are assigned credit balances.

C. Double-entry accounting is an accounting system that records the

effects of transactions and other events in at least two accounts

with equal debts and credits. The total amount debited must equal

the total amount credited. Therefore, the sum of the debit account

balances in the ledger must equal the sum of the credit account

balances. (Note: It is extremely important for students to practice

analyzing each of the basic transactions into debits and credits.)

Note: It is crucial that students understand basic debit-credit

theory. After introducing the Rules, illustrative

transactions can be presented by:

Analyzing the transaction

Determining the types of accounts affected (asset, liability,

owner's equity, revenue, expense)

Determining which accounts increase and/or decrease

Converting the increase/decrease to debit/credit.

Note: The words to debit and to credit should not be confused

with to increase and to decrease.

IV. Recording and Posting Transactions

A. To help avoid errors, accounting systems first record transactions

in a journal. The process of recording the transactions in a journal

is called journalizing.

B. A General Journal is the most flexible type of journal because it

can be used to record any type of transaction. A journal entry that

affects more than two accounts is called a compound journal entry.

Each journal entry must contain equal debits and credits.

A general journal entry will include:

1.

Date of the transaction

2.

Titles of affected accounts

3.

Dollar amount of each debit and credit

4.

Explanation

C. Posting is the process of copying journal entry information from

the journal to the accounts in the ledger. Actual accounting

systems use balance column accounts rather than T-accounts in the

Fundamental Accounting Principles, 12th Canadian edition

Copyright © 2007 McGraw-Hill Ryerson. All rights reserved.

3-3

Instructor’s Notes

Chapter Outline

VI.

ledger. A balance column account has debit and credit columns for

recording entries and a third column for showing the balance of

the account after each entry is posted. It is possible for accounts to

have abnormal balances.

The posting process is commonly done using a computer program. .

The Trial Balance

A. A trial balance is a summary of the ledger that lists the accounts

and their balances. The total debit balances should equal the total

credit balances.

B. One purpose for preparing a trial balance is to test for the equality

of the debit and credit account balances. Another reason is to

simplify the task of preparing the financial statements.

C. When a trial balance does not balance (the columns are not equal),

an error has occurred in one of the following steps:

1. Preparing the journal entries

2. Posting the journal entries to the ledger.

3. Calculating account balances.

4. Copying account balances to the trial balance.

5. Totaling the trial balance columns.

Any errors must be located and corrected before preparing the

financial statements.

Note: Correcting errors

1. Errors must be corrected. Do not erase journal entries or

postings in accounts. This may indicate an effort to conceal

something.

2. Errors discovered before posting or incorrect amount posted—

correct by ruling a single line through the incorrect data and

writing in the correct data.

3. Incorrect account posted—records a correcting journal entry,

which requires a complete explanation.

Note: Formatting conventions:

1. Commas to indicate thousands of dollars and decimal points to

separate dollars and cents are not necessary except on unruled

paper.

2. Dollar signs are not used in journals and ledgers but are

required on financial reports—before the first amount in each

column of figures and before the first amount appearing after a

ruled line that indicates an addition or subtraction.

Copyright © 2007 McGraw-Hill Ryerson. All rights reserved.

3-4

Fundamental Accounting Principles, 12th Canadian edition

VISUAL #3-1

THREE PARTS OF AN ACCOUNT

(1) ACCOUNT TITLE

Left Side

Right Side

Called

Called

(2) DEBIT

(3) CREDIT

Rules for using accounts

Accounts are assigned balance sides (Debit or Credit)

To increase any account, use the balance side

To decrease any account, use the side opposite the balance

Finding account balances

If total debits = total credits, the account balance is zero.

If total debits are greater than total credits, the account has a debit

balance equal to the difference of the two totals.

If total credits are greater than total debits, the account has a

credit balance equal to the difference of the two totals.

Fundamental Accounting Principles, 12th Canadian edition

Copyright © 2007 McGraw-Hill Ryerson. All rights reserved.

3-5

VISUAL #3-2

REAL ACCOUNTS

ALL ACCOUNTS ARE ASSIGNED BALANCE SIDES

BALANCE SIDES FOR ASSETS, LIABILITIES, AND

EQUITY ACCOUNTS ARE ASSIGNED BASED ON

SIDE OF EQUATION THEY ARE ON.

ASSETS

=

LIAB + OWNER’S

EQUITY

are on the

left side of the equation

therefore they are

are on the

right side of the equation

therefore they are

ASSIGNED LEFT SIDE

BALANCE

ASSIGNED RIGHT SIDE

BALANCE

DEBIT BALANCE

CREDIT BALANCE

All Asset Accts

Normal

Debit

Credit

Balance

+ side

- side

All Liability Accts

Normal

Debit Credit

Balance

- side + side

All Equity Accts

Normal

Debit

Credit

Balance

- side

+ side

*In a sole proprietorship, there is only one owner’s equity account, which is

called capital. For that reason, the terms equity and capital are often used

interchangeably. When corporations are discussed in detail, you will learn

many (shareholder’s) equity accounts. Owner’s equity is an account

classification like assets. Owner’s name, capital, is the account title.

Copyright © 2007 McGraw-Hill Ryerson. All rights reserved.

3-6

Fundamental Accounting Principles, 12th Canadian edition

VISUAL #3-3

TEMPORARY ACCOUNTS

Temporary accounts are established to facilitate efficient accumulation of

data for statements. Temporary accounts are established for withdrawals,

each revenue and each expense. Temporary accounts are assigned balances

based on how they affect equity.

(Equity Account)

Owner’s Name, Capital

Debit

Credit Balance

- side

+ side

Effect on equity? OE or OE

OE = Dr

OE = Cr

OE = Dr

Temporary Accounts

Owner, Withdrawals*

Revenues

Expenses

All Withdrawal Accts

Normal

Debit

Credit

Balance

+ side

- side

All Revenue Accts

Normal

Debit

Credit

Balance

- side

+ side

All Expense Accts

Normal

Debit

Credit

Balance

+ side

- side

Note:

Transactions during the period always increase the balances of these

temporary accounts since the transaction represent additional withdrawals,

revenues, and expenses. We will later learn how to move these amounts

back to the real account they affect CAPITAL. At the end of the

accounting period, transferring withdrawals, revenues and expenses back to

capital is the main use for the decrease side of the temporary accounts.

*The “owner’s name, withdrawals” is the account title and the classification

of account is a contra-equity.

Fundamental Accounting Principles, 12th Canadian edition

Copyright © 2007 McGraw-Hill Ryerson. All rights reserved.

3-7

VISUAL #3-4

USING ACCOUNTS - SUMMARY

Real Accounts

All Asset Accts

Debit +

Balance

All Liability Accts

Credit +

Balance

All Equity Accts

Credit +

Balance

RULE REVIEW

Temporary Accounts

Transaction analysis rules

Each transaction affects at least 2

accounts.

Each transaction must have equal

debits and credits

General account use rules

To increase any account, use balance

side.

To decrease any account, use side

opposite the balance

All Withdrawal

Accounts

Debit +

Balance

All Revenue Accounts

Credit +

Balance

All Expense Accounts

Debit +

Balance

Copyright © 2007 McGraw-Hill Ryerson. All rights reserved.

3-8

Fundamental Accounting Principles, 12th Canadian edition

Alternate Demo Problem Chapter Three

Wigor Company was organized by Bill Wiggins.

transactions were completed in 2011.

The following

a. Bill Wiggins paid in $30,000 to start the business.

b. Equipment for use in the business was purchased for $9,000.

Two-thirds of the price was paid in cash; the rest was due in a

year.

c. Service fees earned were $60,000; $6,000 of this was on credit.

d. Operating expenses incurred were $35,000; $4,000 was on

credit.

e. Half the money owed to Wigor Co. was collected.

f. Two thousand dollars owed by Wigor Co. was paid off.

g. Wiggins bought a car for $12,000 for his personal use, half

paid for now from his personal savings and half to be paid in a

year.

Required:

1.

Provide journal entries for each of the events.

2.

Prepare a trial balance at the end of the year for the Wigor

Company.

Fundamental Accounting Principles, 12th Canadian edition

Copyright © 2007 McGraw-Hill Ryerson. All rights reserved.

3-9

Solution: Alternate Demo Problem Three

1.

a.

b.

c.

d.

e.

f.

g.

Cash..................................................

Bill Wiggins, Capital ...................

Dr.

30,000

Cr.

30,000

Equipment ........................................

Cash ............................................

Accounts Payable ......................

9,000

Cash..................................................

Accounts Receivable.......................

Service Fee Earned ....................

54,000

6,000

Operating Expenses ........................

Cash ............................................

Accounts Payable ......................

35,000

Cash..................................................

Accounts Receivable .................

3,000

Accounts Payable ............................

Cash ............................................

2,000

6,000

3,000

60,000

31,000

4,000

3,000

2,000

No entry because this is a personal

transactions

Copyright © 2007 McGraw-Hill Ryerson. All rights reserved.

3-10

Fundamental Accounting Principles, 12th Canadian edition

WIGOR COMPANY

Trial Balance

December 31, 2011

Dr.

Cash ....................................................................

Accounts receivable ..........................................

Equipment ..........................................................

Accounts payable ..............................................

Bill Wiggins, capital ...........................................

Service fees earned ...........................................

Operating expenses...........................................

Totals ..................................................................

Fundamental Accounting Principles, 12th Canadian edition

11

Cr.

$48,000

3,000

9,000

35,000

$95,000

$ 5,000

30,000

60,000

______

$95,000

Copyright © 2007 McGraw-Hill Ryerson. All rights reserved.

3-