bem146notesfall03 - Division of the Humanities and Social

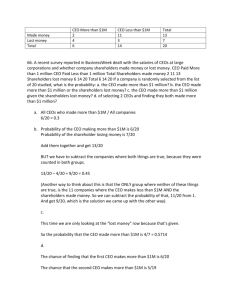

advertisement