here

advertisement

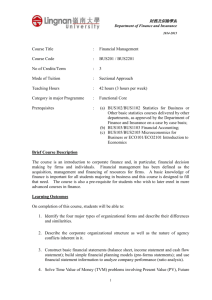

FINANCE MBI

Session 1/2

Time Value of Money

( chapter 4 )

Bonds

( chapter 5 )

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

1

VALUATION OF CASH FLOWS

1.

2.

3.

4.

5.

6.

7.

Future value

Present value

Perpetuity value

Annuity values

Inflation

Discrete interest rates

Continuous rate of return

-----------------------------------------------You start with € 1000 at t = 0

Annual interest rate

6%

After 1 year this is:

1000 (1 + 0,06) = 1060

After t years

1000 (1 0,06)

t

Assumption: no intermediate cash

withdrawals.

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

2

So in the next period you also earn interest

on previous interest payments

This is called Compound Interest. Applying

compound interest generates Future Values.

Example

We have arranged a loan

amount € 4 mln (principal)

to be paid back after 6 years

interest rate 7 % annually

no intermediate payments of interest

Final payment will be:

4,000.000* (1 0.07)6

= € 6.002,921

Side comment: Do you think a bank

would like such an arrangement?

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

3

Future Value and Present Value factors

can be found in:

Tables

A.1

A.2

(p. 684)

(p. 686)

Better: just calculate it yourself

Present value

= a future cash flow calculated backwards

to get a value today ( at t = 0 ).

Example:

Worth today

A cash flow

as:

Annual interest rate 6 %

Future cash flow € 1000

Timing one year hence

1000

(1 0.06)

CF

t

= € 943.40

will be valued today

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

4

CFt

PV = (1 r ) t

Note: r will be presented in a decimal

notation. So 6 % interest per period is

r = 0.06 and t the number of periods in the

formula.

In 2013 we expect to have a cash flow of

€ 3 mln. Today (6 years earlier) this will be

valued with 6 % interest rate as:

3

PV = (1 0.06) 6 = € 2.114,882

1

The expression (1 r) t

is called the

discount factor for interest rate r and time t.

book: example 4.3 (page 80)

We have an IOU zero coupon bond

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

5

Suppose r = 8.53 %,

25 years

It pays $ 1000 after 25 years. Today´s

value will be, rounded to the dollar:

1000

PV = (1.0853) 25 = $ 129

The other way around:

Assume you pay today $ 150 in stead.

After 25 years you will receive $ 1000.

What is the implied interest rate?

1000

150 = (1 r ) 25

(1 r ) 25 = 6.6667

(1 + r) = (6.6667)

1

25

or 6.66670.04

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

6

hence 1 + r = 1.0788…

Annual interest rate is 7.88 %

For a series of cash flows we have a similar

approach:

CF2

CFt

CF1

PV = 1 r + (1 r ) 2 + … + (1 r ) t

A perpetual bond (or perpetuity) is a loan

with a principal that never will be paid back.

Interest payments will continue forever.

Assume the annual interest payment

equals € 80

What is a fair price for this bond?

Just suppose the bond is traded on the

market for € 900 (So this is the present

value!)

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

7

The return on investment in such a case will

be

r

80

900

0.0889

So, the market is happy with a (permanent)

interest rate of 8.89%.

Now let´s think the market rate of return

changes to 10%

We then get:

PV

80

0.10

€ 800

This implies that the market price for the

bond will decrease with

€ 900 € 800 = € 100 (loss)

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

8

General conclusion:

Changes is the rate of return, required in a

financial market, directly influences the

value of the assets in that market:

Required rate up: value down, and

Required rate down: value up.

(… but of course, the market interest rate is

NOT the only factor that determines value )

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

9

ANNUITIES.

You negotiate today a loan with a principal

A.

There will be t annual payments C, starting

one year hence.

After t years everything wil be payed back,

including all interest due. This implies that

the following must be valid:

C

C

C

A

...

2

1 r (1 r )

(1 r ) t

just work with the formula….

C

(1 r ) A C

1 r

C

...

(1 r ) (t 1)

tric: Take line 2 minus line 1

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

10

C

C

(1 r ) A C

...

1 r

(1 r ) t 1

A

C

C

C

...

t 1

1 r

(1 r )

(1 r )t

The difference will be:

C

rAC

(1 r )t

1

r A C 1

t

(

1

r

)

1

1

A C

t

r r (1 r )

A: total amount borrowed, present value.

C: annual payment

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

11

What you read between the brackets is

sometimes called the annuity present value

factor.

This relates the annual payments to the

current value of the principal.

( It is a bit of mathematics, but you can read the formula as:

the present value of a perpetuity C minus the present value

of a perpetuity C, starting at t+1 )

Example

Let us assume that you borrow € 4 mln to be

paid back in 6 equal annual payments.

Interest rate = 7 % per year.

Let us try to find the annuity factor

1

1

1

1

t

6

r r (1 r )

0.07 0.07(1.07)

14.2857 - 9.5192 = 4.7665

hence A = C x 4.7665…

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

12

A

4

C

€ 839,183

4.7665 4.7665

So: the loan of 4 million will be fully

reimbursed, including interest due, by 6

equal annual payments of 839,183 each,

starting one year hence.

Alternatively, the value of a series of cash

flows could be determined at the end of that

series, at time t.

( mathematically: multiply the annuity-present-value-factor with the

compound interest factor for t periods and simplify.)

The resulting future value factor of an

annuity is

( 1 + r )t - 1

r

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

13

Example.

A – piteous – participant of the “ Legio

Lease investment scheme “ joined in

January 1998, agreeing to pay Dfl 200

monthly for a period of 5 years. Normally

he/she could earn 0.5 % ( half-a percent ! )

per month in a savings account. On January

1st, 2003 his/her Legio investment turned out

to be worthless. Determine his/her loss at

that day.

The proper future value factor is:

{(1.005)60 – 1} / 0.005 = 69.77……

The loss, measured at the start of 2003, is:

200 * 69.77… = Dfl. 13,954

What a shame!

( In practice more has been lost by these participants, as the market value of

their investment in stock at the time of selling off was lower than their debt to the

lease-banker, thus ending negatively as well! )

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

14

Notice that an annuity series actually could

start immediately in stead of at the end of the

first period.

If this is the case, it is indicated as an

Immediate Annuity or Annuity due,

compared with the ordinary or regular

annuity.

Computational rule:

Given a annuity of n cash flows and an

interest rate of r, multiply the annuity future

value factor and the annuity present value

factor with ( 1 + r ) in order to obtain the

factors for an annuity due.

Question:

Can you intuitively explain, why the PV and

FV of an annuity due is higher than these of

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

15

an ordinary annuity of an equal size and

time ?

Application: value of bonds.

For the debt financing it is common to make

a distinction between two categories:

- Long term

- Short term

(arbitrary: 1 year will determine the

distinction between long and short)

For the long term we focus on bonds.

Characteristics:

* Nominal value (par value or face value)

* Coupon payments

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

16

NL: Coupons once a year

USA: semi-annual coupons

* There is an end date at which the

borrower will pay back the principal.

(Maturity date)

We focus on publicly traded bonds.

Issued by:

National government

Local goverment

Utility companies

Corporations

Others

How are they traded?

We start with the issue of the bonds to

the general public. This is usually

organised by banks

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

17

Later the secundairy market

Sometimes OTC-issues

What determines the value of a bond ?

Prices will depend on the market interest

rate and default risk.

At issue the interest rate usually will be

market conform.

Example:

A 6% bond issue is announced. If the market

rate is slightly under 6%, e.g. 5,9%, the loan

will be issued at a price above 100%.

Since the coupon rate remains constant, the

value of the loan will move up and down,

inversely related to the market interest rate.

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

18

Example:

Outstanding a 6% bond with an annual

coupon. Remaining time to maturity 3 years.

Cash flows 60, 60, 1060.

Suppose the market rate today is 4%.

60

60

1060

PV

2

1.04 (1.04) (1.04)3

PV = 57.69 + 55.47 + 942.34 =1055.50

So, today we have to pay 55.50 more than

the final repayment after three years!

The 4% is called YIELD-TO-MATURITY

(YtM). This yield equals the current market

price to the expected cash flows over time.

We also have Current Yield, that is the short

term return, that can be calculated taking the

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

19

coupon payment relative to the market price

of the bond.

Coupon payment

CurrentYield

Bond price

In the example we would get:

60

return

0.0568 5.68%

1055.50

This gives us a confusing picture since the

price of the bond will go down….(at a

market rate of 4%).

Total return = Coupon + Capital gains

What will be the bond price one year later?

Assume the market interest rate does not

change:

60 1060

PV

57.69 980.03 1037.72

2

1.04 (1.04)

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

20

Hence the Capital gain will be:

1037.72 – 1055.50 = – 17.78 ! A loss.

Just check:

Coupon + Cap. Gain = 60 – 17.78 = 42.22

????

We invested 1055.50.

42.22

0.04 4%

1055.50

Exactly right!

An interesting issue is the sensitivity of

bond prices to changes of the market interest

rate. Long term maturities tend to show a

higher sensitivity.

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

21

Next week more on the characteristics of an

interest rate and its relationship with

inflation.

MBI-5 2007-2008. Financial Management, part finance. Lecture 1/2. 09-06/11-2007.

22