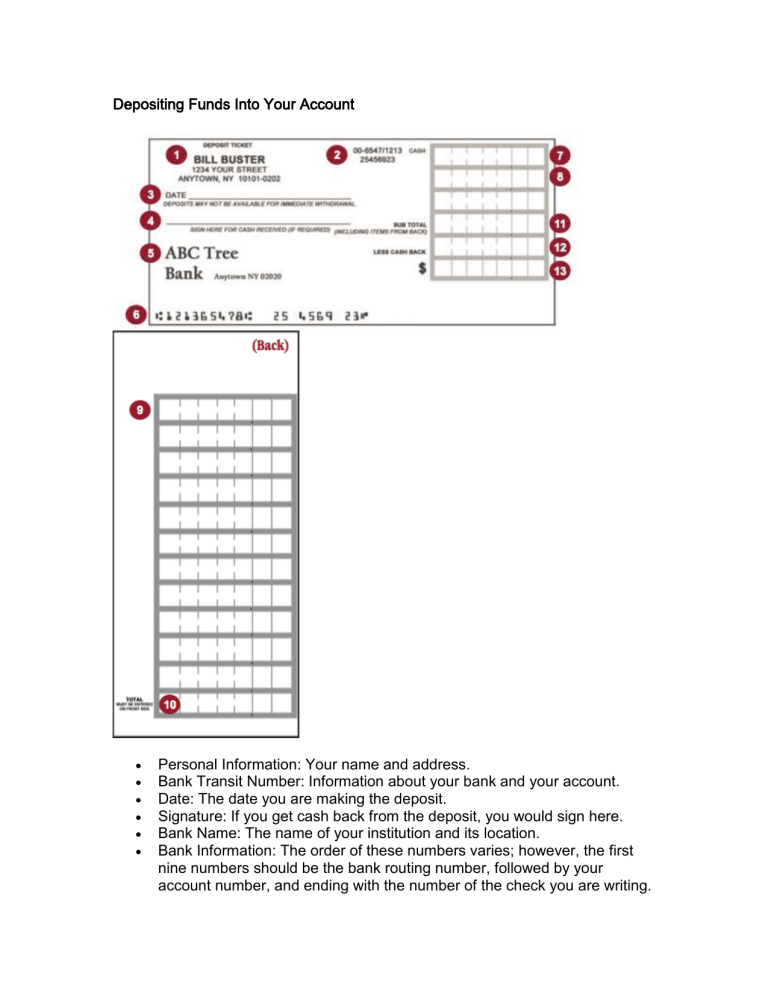

Depositing Funds Into Your Account

Depositing Funds Into Your Account

Personal Information: Your name and address.

Bank Transit Number: Information about your bank and your account.

Date: The date you are making the deposit.

Signature: If you get cash back from the deposit, you would sign here.

Bank Name: The name of your institution and its location.

Bank Information: The order of these numbers varies; however, the first nine numbers should be the bank routing number, followed by your account number, and ending with the number of the check you are writing.

1

2

3

4

5

They are printed in special magnetic ink for the bank clearinghouses to read.

Cash: The amount of cash you are depositing.

Check Entry Area: Your would write down each check you are depositing.

Put each check on its own line.

Additional Check Entry: The bank of the deposit slip should have additional spaces for checks if you run out of room on the front. Put each check on its own line.

Additional Check Entry Total: Add up the checks listed on the back of the slip ONLY and write the dollar amount here.

Subtotal: Add up all of the cash and check and put the total dollar amount here.

Less Cash Back: If you want to deposit part of your money, and get part of your money in cash, you would write the dollar amount of cash you want here.

Net Deposit: Subtract any cash back you received from your deposit, and write the remaining amount here. This is your net deposit.

6

7

8

9

10

11

12 next »->

Checking Accounts

We have seen how to use a register for a single entry, now let us review how to use the register for ongoing transactions.

This is your beginning balance: $600.00

You sent check number 1001 on April 4 for your Car Payment. The amount of this transaction was $430.00. To come up with your new balance, you would subtract the $430.00 payment from your beginning balance of $600.00 (600-430 = 170).

Your new balance would be $170.00.

On April 5 you made a Withdrawal. The amount of this transaction was

$100.00. You used an ATM and there was a fee of $1.00. To come up with your new balance, you would subtract the $100.00 withdrawal and the

$1.00 fee from your balance from the previous line, which is $170.00 (170

- 100 - 1 = 69).

Your new balance would be $69.00.

On April 7, you made a Deposit. The amount of this transaction was

$756.94. To come up with your new balance, you add the $756.94 deposit to your balance from the previous line, which is $69.00 (69 + 756.94 =

825.94).

Your new balance would be $825.94.

On April 10 you went to the Supermarket. The amount of this transaction was $58.73. You used your Debit Card. To come up with your new

balance, you would subtract the $58.73 debit card transaction from your balance from the previous line, which is $825.94 (825.94 - 58.73 =

767.21).

Your new balance would be $767.21.

You sent check number 1002 on April 11 for your ABC Bank Credit Card payment. The amount of this transaction was $125.00. To come up with your new balance, you would subtract the $125.00 payment from your balance from the previous line, which is $767.21 (767.21 - 125 = 642.21).

Your new balance would be $642.21