ROI FY 2010 - Plymouth State University

advertisement

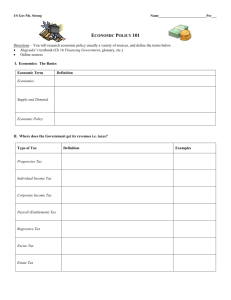

NEW HAMPSHIRE TOURISM RETURN ON INVESTMENT FOR FY 2010 DTTD TOURISM PROMOTION ACTIVITIES Step One Person Trips in New Hampshire for recreational and business travel by in-state and out-of-state people: 34.02 million person trips Step Two Average recreational and business traveler stayed 1.54 days: 34.02 million X 1.54 days = 52.37 million visitor days Step Three Average Visitor Spending per Day was: $77.01 52.37 million days X $77.01 per day = $4.03 billion in traveler spending Step Four Percent of all Traveler Spending that Resulted from DTTD Promotional Activities: 10.13 percent Step Five Estimated Traveler Spending Resulting from DTTD Promotional Activities: 10.13 % X $4.03 billion = $408.5 million in spending Step Six DTTD Promotional Spending: $5,599,853 Step Seven Amount spent by travelers for each DTTD dollar: $408.5 million/$5.60 million = $72.96 Return on Investment Amount of State government taxes, fees and sales as a percent of total traveler spending: 9.57 % $72.96 X 9.57 % = $6.98 Amount of Local government taxes and fees as a percent of total traveler spending: 1.39 % $72.96 X 1.39 % = $1.01 Total State and Local government revenues per DTTD dollar spent: ROI = $7.99: $1.00 EXPLANATION OF THE RETURN ON INVESTMENT INFORMATION The above information for New Hampshire is based on a standard model used by a number of states to estimate government revenues from travelers that result from government spending to attract travelers. Estimated visitor counts and spending shown in this report is for the period of September 1, 2009, to August 31, 2010, while the Division of Travel and Tourism Development (DTTD) budget is for spending through August 31, 2010, out of the agency’s fiscal year (fy) 2010 budget. The information used in this model is based on surveys conducted of travelers in New Hampshire by the Institute for New Hampshire Studies (INHS) during fy 2010 and by the Travel Industry Association of America for fy 2005. In addition, conversion studies of DTTD target markets were conducted by INHS during fy 2009 and monthly travel barometers have been prepared for the past 22 years. Finally, all tourist spending information was benchmarked back to the 2007 US Census of Business and 2008 County Business Patterns for New Hampshire. It is estimated that 18 percent of visitor days and 12 percent of spending were made by state residents during fy 2010, up from last year. Twelve percent of total spending was from business travel during fy 2010, the same as for the previous year. Average spending per visitor day shown in Step Three is estimated at $77.01 for fy 2010. This is down by 6.1 percent from the estimated spending level of $81.97 used to calculate the fy 2009 return on investment of DTTD promotional activities. The ongoing recession has resulted in travelers spending less per trip and per day during fy 2010 than they did during fy 2009. The percent of all traveler spending shown in Step Four is an estimate of those travelers that were either “convinced” or “strongly persuaded” to visit New Hampshire as a result of DTTD promotional activities during fy 2010. Based on the conversion studies and visitor surveys, it is estimated that 8.1 percent of all visitors were convinced or strongly persuaded to visit New Hampshire by DTTD funded promotional activities during fy 2010, no change from the fy 2009 level. Visitor and conversion study surveys show that DTTD target market visitors spend about 25 percent more per day than do other visitors. As a result, it is estimated that 10.13 percent of all visitor spending was a result of DTTD promotional activities during fy 2010. Not included is increased spending by people who decided to lengthen their trip in the state as a result of DTTD promotional activities. Previous surveys have shown that over 35 percent of all visitors to the state make use of DTTD funded information, including the visitnh.gov website before and during visits to the state. State government revenues from tourist spending include not only rooms and meals taxes, but also gasoline taxes, admission fees, licenses, tolls, tobacco taxes, lottery tickets, State liquor store sales and business profits/enterprise taxes. New Hampshire increased its rooms and meals tax from eight to nine percent starting in July 2009 and this tax was also extended to campgrounds during most of fy 2010. Tolls and tobacco tax rates have also increased since fy 2008. Almost 60 percent of rooms and meals taxes collected by the state are due to tourist and business traveler spending, with an estimated 53 percent of all rooms and meals taxes paid by out of state residents and businesses. Step Six shows the portion of the DTTD budget for fy 2010 that was spent on promotional activities. This figure also includes $116,386 in money spent on multiyear printed and electronic media during fy 2010 plus $9,167 in costs from fy 2008 for the ten year plan. An additional $190,540 spent during fy 2010 for the multiyear printed and electronic media will be added into the fy 2011 and future budgets when those return on investment calculations are undertaken. It does cost the State government money to operate the highways, parks and other facilities that visitors use. It is estimated that of the total $6.98 received by State government for each DTTD budget dollar spent during fy 2010, shown in the final part of the table, that the State obtained a gross profit of at least $2.46. This is an increase from the estimate of $2.26 for fy 2009 in gross profit for each DTTD dollar spent and is due entirely to the increase in the tax rate for the rooms and meals tax. The other $4.52 received by the State government repaid State agency spending, including the original $1.00 spent for the DTTD promotional budget. In comparison with fy 2009, travelers who came to the state during fy 2010 spent less at State and local parks and ski areas, for ATV and snowmobile licenses, for Fish and Game licenses, at private recreational sites, at retail stores, at toll booths, at State Liquor Stores, for lottery tickets, for car rentals and for air travel. These visitors spent slightly more at restaurants, for lodging and for gasoline. The state attracted slightly more visitors during fy 2010 in comparison with fy 2009, but they spent less money per trip due to the ongoing recession. Total spending by all visitors was down by 4.9 percent between fy 2009 and fy 2010, while spending by visitors attracted by DTTD promotional activities decreased by 1.0 percent. The summer of 2010 had much better than average weather and attracted near record levels of visitors. Spring 2010 was also higher than the previous year and appears to have marked a turning point for the number of visitors and visitor spending. In contrast, the fall of 2009 and the winter of 2009-10 seasons appeared to have been still stuck in the recession and also had worse weather than usual. It is estimated that total state revenues for the September 1, 2009, to August 31, 2010, period that resulted from DTTD promotional activities decreased by 6.0 percent below the level of the previous year, from $41.8 million to $39.1 million, while DTTD spending increased by 6.2 percent for fy 2010 from the fy 2009 level. It is estimated that the State received $2.50 in Rooms and Meals Taxes (including taxes from vehicle rentals to tourists) for each dollar spent by the DTTD in fy 2010, up by 13.6 percent from $2.20 for fy 2009, with this increase almost entirely due to the change in the tax rate from eight to nine percent. The estimate of local government revenues should be viewed as conservative. These revenues consist of property taxes on commercial property used by tourists plus airport landing fees, parking revenues and municipal and county park and ski area revenues. They do not include property taxes or user fees on second home properties. Local government revenues decreased from an estimated $5.65 million in fy 2009 to $5.61 million during fy 2010, a decrease of 0.7 percent, due primarily to fewer air travelers at the Boston-Manchester Regional Airport. The total return on investment decreased from $9.00 in state and local government revenues for each DTTD promotional dollar spent during fy 2009 to $7.99 in state and local government revenues for each DTTD promotional dollar spent during fy 2010. This was a decrease of 11.2 percent from the previous year and was the result of both the 6.2 percent increase in DTTD spending and a 5.0 percent decrease in visitor spending on state and local government services and goods, especially at State and local parks and ski areas, and at State Liquor Stores, for Fish and Game licenses and at the Boston-Manchester Regional Airport. Also, there were lower state revenues from indirect taxes such as the business profits/enterprise and tobacco taxes due to lower visitor spending overall. The total estimated direct spending by tourists and travelers of $4.0 billion for fy 2010 is about 6.7 percent of the estimated Gross Domestic Product of $60.0 billion for New Hampshire for this same period. This tourism spending supported an estimated 60,500 jobs, or 7.2 percent of all employment in the state. The DTTD promotional spending of $5.60 million resulted in tourists and travelers spending an estimated $408.5 million, or 0.68 percent of Gross Domestic Product, which resulted in about 6,125 jobs, or 0.73 percent of all employment in the state. If the DTTD budget were reduced by $500,000 for fy 2011 from the fy 2010 budget level, a decrease of 8.9 percent, it is estimated that tourist and traveler spending would drop by $36,743,000, or about 0.9 percent. State government revenues would drop by an estimated $3,516,000, and of this amount, the rooms and meals taxes collected would drop by $1,245,000. Local government revenues would decrease by an estimated $511,000, not including any decrease in state government money that would be forwarded to local government out of the reduced rooms and meals and other state taxes and fees. Finally, there would be an estimated 550 fewer jobs due to the possible $500,000 DTTD budget cut that would result in fewer visits and lower visitor spending. These projected losses should be viewed as slightly conservative for it currently appears that average spending per visitor day will be higher during fy 2011 than it was for fy 2010 as the state slowly emerges from the recession. Historically, the rooms and meals tax has been the second most important source of state government revenues after the business profits/enterprise tax. Slightly over half of all rooms and meals taxes are paid by nonresidents of the state. Since 1970, New Hampshire has always ranked between seventh and ninth of the 50 states in the share of tourism spending as a percentage of its gross domestic product. In terms of jobs supported by revenues brought into the state from elsewhere, only the value of manufacturing products that leave the state exceeds the impact of dollars spent within the state by tourists and business travelers who come here from outside the state on a vacation or business trip. The New Hampshire Division of Travel and Tourism Development is an economic development agency whose promotional spending results in state and local tax revenues, including revenues at other state agencies, and supports significant revenue income and employment levels in the private sector. This report was prepared by: Laurence E. Goss, Ph.D. Institute for New Hampshire Studies Plymouth State University REVISED: January 6, 2011