GPT 2012 Budget Vote Speech - Gauteng Provincial Treasury

advertisement

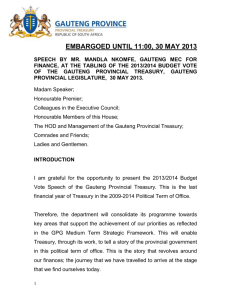

SPEECH BY MR. MANDLA NKOMFE, GAUTENG MEC FOR FINANCE, AT THE TABLING OF THE 2012/2013 BUDGET VOTE OF THE GAUTENG PROVINCIAL TREASURY, GAUTENG PROVINCIAL LEGISLATURE, 12 JUNE 2012. Madam Speaker; Honourable Premier; Colleagues in the Executive Council; Honourable Members of this House; The HOD and Management of the Gauteng Provincial Treasury; Comrades and Friends; Ladies and Gentlemen. INTRODUCTION Madam Speaker, I am heartened to present the 2012/2013 Budget Vote Speech of the Gauteng Provincial Treasury. As Members of this House are aware, Gauteng Provincial Treasury became a stand-alone department in April. This development is consistent with Section 17 of the PFMA, and it is meant to ensure that the Gauteng Provincial Treasury is adequately capacitated to perform its duties accordingly. 1 REVIEW OF THE 2011/2012 FINANCIAL YEAR In reviewing the previous financial year, I will briefly outline some of the milestones recorded by the Gauteng Provincial Treasury in the process of implementing its mandate. Madam Speaker, our responsibility is to ensure that we maintain a targeted and balanced approach in the allocation of both financial and non-financial resources to areas that support the achievement of our priorities as reflected in the GPG Medium Term Strategic Framework. We are also required to monitor that resources allocated are used for their intended purpose, as required by the regulatory framework. Therefore, our overall strategy in the year under review was focused on improving the finances of the provincial government. This included the important aspect of addressing accruals that are a serious burden to the fiscus. I am pleased to report that many milestones were recorded in this area. This was made possible by improving efficiencies in the process of procuring goods and services, and strengthening financial controls. Specifically we implemented the following measures: 2 o Ring-fencing conditional grants and infrastructure funds to ensure that suppliers are paid on time; o Work towards ensuring that the age analysis of accruals is 30 days in a given month; o Ensuring that departments operate within the agreed cash forecasts and/or allocations; o Reducing substantially the unauthorised expenditure. In addition to this, we successfully implemented resolutions taken at the Premier’s Budget Committee and at the Finance Lekgotla to address financial challenges experienced by the Gauteng Department of Health. We are also working with the National Government mainly the Department of Health and National Treasury to resolve the financial challenges in the Provincial Department of Health. Furthermore, we worked closely with the Department of Infrastructure Development to enhance infrastructure expenditure. In this regard we developed a joint program to accelerate infrastructure spending to achieve infrastructure service delivery in the province. Our effort saw the opening of Berth Gxowa hospital, and expediting the completion of Zola Hospital.There is remarkable improvement on infrastructure delivery in the province, and we are working towards completely turning the conrner for the better.. Madam Speaker, GPT is committed to ensuring that local government works better. In the year under review, we continued with efforts to strengthen intergovernmental relations with particular interest to municipal financial management. 3 Through the quarterly Municipal Finance Indaba Forums, we conducted vigorous one-on-one engagement with key stakeholders in the municipal finance space to ensure coordination and support. The body of knowledge accumulated through these intergovernmental engagements has assisted us to gain in-depth understanding of the financial management practices in local government. This has enabled us to improve the quality of our assessment of the monthly budget statements to a point where they have become more diagnostic in nature. These reports now allow for early warning and intervention in municipalities experiencing financial constraints. Furthermore, the Debt Management Committee established in the 2009/10 financial year continued to receive great support from both municipalities and provincial departments as a key platform to resolving outstanding government debt owed to municipalities for rates, taxes and services charges. To date, a total amount of over R1.5 billion has been transferred to municipalities from various departments within the province and this platform has provided a wealth of knowledge of local government sphere which will provide the basis to unlock possible blockages in the intergovernmental transfer system. 4 THE 2012/2013 BUDGET VOTE: Madam Speaker; let me now turn to the programmes and projects that we will be implanting in this financial year. I need to point out that our total allocated budget of the Gauteng Provincial Treasury for this financial year is four hundred and twenty eight million, nine hundred and thirty four thousand rand (R428, 934.000). We plan to use these resources to provide strategic and operational support to departments and municipalities in the province in order to facilitate the achievement of inclusive economic growth. In line with the announcements that we made when we presented the 2012/2013 Provincial Budget, improving Supply Chain Management processes in the province is one of the most important areas that GPT will focus on, not only in this financial year, but over the medium term period. The department is currently engaging with the State Security Agency to vet all SCM officials in the province. Our belief is that this will assist in reducing deviations from normal procurement processes, and thus avoid irregular and unauthorised expenditure. This intervention forms part of our efforts to root out fraud and corruption, which manifest itself primarily in procurement processes. This move is in line with the Gauteng Anti-Corruption Strategic Framework which identifies fighting corruption as one of the key priorities of this term of government. 5 Madam Speaker; as per the mandate of the Gauteng Provincial Treasury we will ensure prudent municipal financial management. In line with this, the focus will be on ensuring proper interface between the Municipal Finance Indaba and the Premier’s Coordinating Forum. We will strengthen the system of intergovernmental fiscal relations with specific reference to the interface between planning, budgeting and transferring of funds and as well as resolving debt owed between organs of state. In addition we will provide technical support in the implementation of Generally Recognised Accounting Practice (GRAP) standards, while strengthening the capacity of audit committees to respond to Operation Clean Audit 2014. As we have said before, Fiscal constrains force governments to choose carefully between competing needs. Difficult decisions are required to ensure that scarce resources are directed towards financing our priorities and more effective service delivery, while ensuring that debt levels are sustainable. As the Gauteng Provincial Treasury, we are committed towards ensuring financial stability of the province, while facilitating service delivery in a tight fiscal environment. 6 Therefore we will implement strategies that will result in prudent financial management across the province. Furthermore, we will improve the implementation of the Outcomes Based Budgeting approach to respond to the prevailing environment and ensure effective resourcing of outcomes, priorities and projects of the province There will be continuous review and improvement of the provincial budget process to strengthen its effectiveness in driving the provincial planning and budgeting process, monitoring and evaluation of public spending on service delivery. Furthermore, Gauteng Provincial Treasury plans to increase the capacity for managing the provincial performance monitoring and reporting. This initiative aims to improve the quality of performance information in order to realise the target and outputs of the province. In respect to GPG Audit Committees, the Gauteng Provincial Treasury will continue to ensure that GPG Audit Committees operate effectively and are value adding partners to the Province by ensuring they are fully capacitated with non-executive members with relevant skills and expertise. The Department will also ensure that the Audit Committee operates under approved and comprehensive GPG Audit Committee Charter. In 2012/13, the provincial Treasury will embark on a number of interventions to improve infrastructure delivery in the province. These include, amongst many others, targeted capacity building around project management 7 Madam speaker, fiscal discipline remains a key focus for the provincial treasury. Aspects of the contract management will be looked at thoroughly this year. We are fully aware that this will be no easy task. However, I am confident that we have the necessary skills, knowledge and experience to carry out our mandate. Our employees are committed to their work; and they are driven by the desire to facilitate service delivery to our people. CONCLUSION In conclusion, Madam Speaker, let me thank the HOD Nomfundo Tshabalala, the management and staff of Gauteng Provincial Treasury for their dedication to the work that they do. Indeed without their devotion, the accomplishments that GPT has achieved to date would not have been possible. Many thanks to you all, you are indeed our most valuable asset. I therefore present Budget Vote 13 – the Gauteng Provincial Treasury to the House. Thank You 8