Q - WordPress.com

advertisement

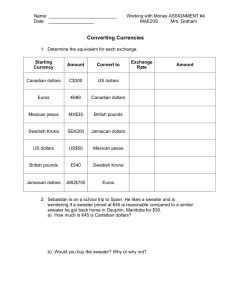

Q.03- Two British pound (₤) put options are available with exercise prices of $1.60 and $1.62. The premiums associated with these options are $.03 and $.04 per unit, respectively. A. Describe how a bull spread can be constructed using these put options. What is the difference between using put options versus call options to construct a bull spread? b. Complete the following worksheet. c. At option expiration, the spot rate of the pound is $1.60. What is the bull spreader’s total gain or loss? d. At option expiration, the spot rate of the pound is $1.58. What is the bear spreader’s total gain or loss? ANSWER: a. Using put options to construct a bull spread involves exactly the same actions as constructing a bull spread using call options. The bull spreader would buy the $1.60 put option and write the $1.62 put option. The difference between using call and put options to construct a bull spread is that using put options results in a credit spread. Q.4-The current spot rate of the Singapore dollar (S$) is $.50. The following option information is available: Call option premium on Singapore dollar (S$) = $.015 Put option premium on Singapore dollar (S$) = $.009 Call and put option strike price = $.55 One option contract represents S$70,000 Construct a contingency graph for a short straddle using these options. ANSWER: The plotted points should create an upside down V shape that cuts through the horizontal (break-even) axis at $.526 and $.574. The peak of the upside down V shape occurs at $.55 and reflects a net profit of $.024. Q.08. the following information is available You have $500,000 to invest The current spot rate of the Moroccan dirham is $.110. The 60-day forward rate of the Moroccan dirham is $.108. The 60-day interest rate in the U.S. is 1 percent. The 60-day interest rate in Morocco is 2 percent. a. What is the yield to a U.S. investor who conducts covered interest arbitrage? Did covered interest arbitrage work for the investor in this case? b. Would covered interest arbitrage be possible for a Moroccan investor in this case? ANSWER: A. Covered interest arbitrage would involve the following steps: 1. Convert dollars to Moroccan dirham: $500,000/$.11 = MD4, 545,454.55 2. Deposit the dirham in a Moroccan bank for 60 days. You will have MD4, 545,454.55 × (1.02) = MD4, 636,363.64 in 60 days. 3. In 60 days, convert the dirham back to dollars at the forward rate and receive MD4, 636,363.64 × $.108 = $500,727.27 The yield to the U.S. investor is $500,727.27/$500,000 – 1 = .15%. Covered interest arbitrage did not work for the investor in this case. The lower Moroccan forward rate more than offsets the higher interest rate in Morocco. B. Yes, covered interest arbitrage would be possible for a Moroccan investor. The investor would convert dirham to dollars, invest the dollars at a 1 percent interest rate in the U.S., and sell the dollars forward 60 days. Even though the Moroccan investor would earn an interest rate that is 1 percent lower in the U.S., the forward rate discount of the dirham more than offsets that differential. Q.10. the following exchange rates and one-year interest rates exist. (book Example) Bid Quote Ask Quote Euro spot Euro one-year forward Interest rate on dollars Interest rate on euros Bid Quote $1.12 1.12 Deposit Rate 6.0% 6.5% Ask Quote $1.13 1.1 Loan Rate 9.0% 9.5% You have $100,000 to invest for one year. Would you benefit from engaging in covered interest arbitrage? 1. Convert $100,000 to euros (ask quote): $100,000/$1.13 =€88,496 2. Calculate accumulated euros over one year at 6.5 percent: €88,496 X 1.065 =€94,248 3. Sell euros for dollars at the forward rate (bid quote): €94,248 X $1.12 = $105,558 4. Determine the yield earned from covered interest arbitrage: ($105,558 - $100,000)/$100,000=.05558, or 5.558% Q.09. (Part. A) You just came back from Canada, where the Canadian dollar was worth $.70. You still have C$200 from your trip and could exchange them for dollars at the airport, but the airport foreign exchange desk will only buy them for $.60. Next week, you will be going to Mexico and will need pesos. The airport foreign exchange desk will sell you pesos for $.10 per peso. You met a tourist at the airport who is from Mexico and is on his way to Canada. He is willing to buy your C$200 for 1,300 pesos. Should you accept the offer or cash the Canadian dollars in at the airport? Explain ANSWER: (Ye Answer Key wala hai) In D0n0 Methods se Jo Ap ko Acha lagye wo likhna,.Ap Exchange with the tourist. If you exchange the C$ for pesos at the foreign exchange desk, the cross-rate is $.60/$10 = 6. Thus, the C$200 would be exchanged for 1,200 pesos (computed as 200 × 6). If you exchange Canadian dollars for pesos with the tourist, you will receive 1,300 pesos. OR Solution: Rate of tourist: 1 Canadian $ = 1300 / 200 = 6.50 Rate of Airport: 1 Canadian $ = 0.06 / 0.10 = 6.00 Profit per unit = 6.50 – 6.00 = 0.50 Profit = 200 × 0.50 Profit of Peso = 100 Q.09 (Part. B) Assume you have $1,000 and plan to travel from the United States to the United Kingdom. Assume further that the bank’s bid rate for the British pound is $1.52 and it’s asked rate is $1.60. Before leaving on your trip, you go to this bank to exchanged dollars for pounds. Now suppose that because of an emergency you cannot take the trip, and reconvert the pounds back to U.S. dollars, if the exchange rate has not changed what number of dollars you will lose? Solution: Convert $ 100 into £: = 1000 / 1.60 = £ 625 Convert £ 625 into $: = 625 × 1.52 = $ 950 Loss on exchange of currency = 1000 – 950 = $ 50 Ans.