GASB 62 Highlights

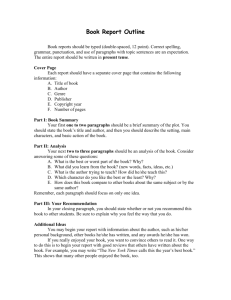

advertisement

Capitalization of Interest Cost Revenue Recognition for Exchange Transactions Statement of Net Assets Classification 29 Paragraphs 30–44 apply only when a government is preparing a classified statement of net assets for accounting and financial reporting purposes. Paragraphs 34–43 also apply to disclosures made about maturities of obligations reported in both classified and unclassified statements of net assets. Current Assets Classification and Disclosure of Allowances Current Liabilities Classification of Short-Term Obligations Expected to Be Refinanced Special and Extraordinary Items Adjustment of Amounts Reported in Prior Periods Comparative Financial Statements Related Parties 54 Paragraphs 54–57 provide guidance on disclosures of transactions between related parties. 26 Examples of related party transactions include transactions (a) between a government and its related organizations, joint ventures, and jointly governed organizations; (b) between a government and its elected and appointed officials, management, or members of their immediate families; and (c) between a government and trusts for the benefit of employees, such as pension and other postemployment benefit trusts that are managed by or under the trusteeship of the government's management. Transactions between related parties commonly occur in the normal course of operations. Some examples of common types of transactions with related parties are sales, purchases, and transfers of realty and personal property; services received or furnished, for example, accounting, management, engineering, and legal services; use of capital assets by lease or otherwise; borrowings and lendings; guarantees; and reimbursements based on allocations of common costs. Transactions between related parties are considered to be related party transactions even though they may not be given accounting recognition. For example, a government may receive services from a related party without charge and not record receipt of the services. Disclosures 55 Financial statements should include disclosures of related party transactions, other than compensation arrangements, expense/expenditure allowances, and other similar items in the ordinary course of operations. The disclosures should include: 27 a. The nature of the relationship(s) involved b. A description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which financial statements are presented, and such other information deemed necessary to gain an understanding of the effects of the transactions on the financial statements c. The dollar amounts of transactions for each of the periods for which financial statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period d. Amounts due from or to related parties as of the date of each statement of net assets 28 presented and, if not otherwise apparent, the terms and manner of settlement. 56 Transactions involving related parties cannot be presumed to be carried out on an arm'slength basis, as the requisite conditions of competitive, free-market dealings may not exist. Representations about transactions with related parties, if made, should not imply that the related party transactions were consummated on terms equivalent to those that prevail in arm's-length transactions unless such representations can be substantiated. Glossary 57 This paragraph contains definitions of certain terms as they are used in paragraphs 54–56; the terms may have different meanings in other contexts. Immediate Family(ies) Family members whom an elected or appointed official or a member of management might influence or by whom they might be influenced because of the family relationship. Management Persons who are responsible for achieving the objectives of the government and who have the authority to establish policies and make decisions by which those objectives are to be pursued. Management normally includes the chief executive officer (for example, city manager), directors or secretaries in charge of principal government departments or functions (such as service provision administration or finance), and other persons who perform similar policymaking functions. Persons without formal titles also may be members of management. Related Parties A government's related organizations, joint ventures, and jointly governed organizations, as defined in Statement No. 14, The Financial Reporting Entity, as amended; elected and appointed officials of the government; its management; members of the immediate families of elected or appointed officials of the government and its management; and other parties with which the government may deal if one party can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests. Another party also is a related party if it can significantly influence the management or operating policies of the transacting parties (for example, through imposition of will as discussed in Statement 14, as amended) or if it has an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests. Prior-Period Adjustments Accounting Changes and Error Corrections Reporting a Change in Accounting Estimate Reporting a Correction of an Error in Previously Issued Financial Statements Disclosure of Accounting Policies Contingencies 96 For the purpose of applying paragraphs 96–113, a contingency is defined as an existing condition, situation, or set of circumstances involving uncertainty as to possible gain (referred to as a gain contingency) or loss 37 (referred to as a loss contingency) to a government that will ultimately be resolved when one or more future events occur or fail to occur. Resolution of the uncertainty may confirm the acquisition of an asset or the reduction of a liability or the loss or impairment of an asset or the incurrence of a liability. 97 Not all uncertainties inherent in the accounting process give rise to contingencies as that term is used in paragraphs 96–113. Estimates are required in financial statements for many ongoing and recurring activities of a government. The mere fact that an estimate is involved does not, in and of itself, constitute the type of uncertainty referred to in the definition in paragraph 96. For example, the fact that estimates are used to allocate the known cost of a depreciable asset over the period of use by a government does not make depreciation a contingency; the eventual expiration of the utility of the asset is not uncertain. Thus, depreciation of assets is not a contingency as defined in paragraph 96, nor are such matters as recurring repairs, maintenance, and overhauls, which interrelate with depreciation. Also, amounts owed for services received, such as advertising and utilities, are not contingencies even though the accrued amounts may have been estimated; there is nothing uncertain about the fact that those obligations have been incurred. 98 Risks of loss from the following kinds of events are included within the scope of paragraphs 96–113: a. Collectibility of receivables b. Guarantees of indebtedness of others c. Agreements to repurchase receivables (or to repurchase the related property) that have been sold d. Claims for delays or inadequate specifications on contracts. 99 Risks of loss from the following kinds of events are not included within the scope of paragraphs 96–113: a. Torts b. Theft of, damage to, or destruction of assets c. Business interruption d. Errors or omissions e. Job-related illnesses or injuries to employees f. Acts of God g. Pollution remediation obligations. 38 Probability Classifications for Loss Contingencies 100 When a loss contingency exists, the likelihood that the future event or events will confirm the loss or impairment of an asset or the incurrence of a liability can range from probable to remote. Paragraphs 96–113 use the terms probable, reasonably possible, and remote to identify three areas within that range, as follows: a. Probable. The future event or events are likely to occur. b. Reasonably possible. The chance of the future event or events occurring is more than remote but less than likely. c. Remote. The chance of the future event or events occurring is slight. Accrual of Loss Contingencies 101 The conditions for accrual of loss contingencies in paragraph 102 do not amend any other present requirement in a pronouncement to accrue a particular type of loss or expense/expenditure. 102 An estimated loss from a loss contingency (as defined in paragraph 96) should be accrued if both of the following conditions are met: a. Information available prior to issuance of the financial statements indicates that it is probable that an asset had been impaired or a liability had been incurred at the date of the financial statements. It is implicit in this condition that it should be probable that one or more future events will occur confirming the fact of the loss. b. The amount of loss can be reasonably estimated. 103 The purpose of the two conditions in paragraph 102 is to require accrual of losses when they are reasonably estimable and relate to the current or a prior period. Condition (b) in paragraph 102, that the amount of loss can be reasonably estimated, does not delay accrual of a loss until only a single amount can be reasonably estimated. To the contrary, when condition (a) in paragraph 102 is met, that is, it is probable that an asset had been impaired or a liability had been incurred, and information available indicates that the estimated amount of loss is within a range of amounts, it follows that some amount of loss has occurred and can be reasonably estimated. 104 When condition (a) in paragraph 102 is met with respect to a particular loss contingency and the reasonable estimate of the loss is a range, condition (b) in paragraph 102 is met and an amount should be accrued for the loss. When some amount within the range appears at the time to be a better estimate than any other amount within the range, that amount should be accrued. When no amount within the range is a better estimate than any other amount, however, the minimum amount in the range should be accrued. 39 In addition, paragraph 106 may require disclosure of the nature and, in some circumstances, the amount accrued, and paragraph 107 requires disclosure of the nature of the contingency and the additional exposure to loss if there is at least a reasonable possibility of loss in excess of the amount accrued. 105 As an example, assume that at December 31, 20XX, a government has an investment of $1,000,000 in the securities of an entity that has declared bankruptcy, and there is no quoted market price for the securities. Condition (a) in paragraph 102 has been met because information available indicates that the value of the investment has been impaired, and a reasonable estimate of loss is a range between $300,000 and $600,000. No amount of loss in that range appears at the time to be a better estimate of loss than any other amount. Paragraphs 96–113 require accrual of the $300,000 loss at December 31, 20XX, disclosure of the nature of the contingency and the exposure to an additional amount of loss of up to $300,000, and possibly disclosure of the amount of the accrual. Disclosure of Loss Contingencies 106 Disclosure of the nature of an accrual 40 made pursuant to the provisions of paragraph 102, and in some circumstances the amount accrued, may be necessary for the financial statements not to be misleading. 107 If no accrual is made for a loss contingency because one or both of the conditions in paragraph 102 are not met, or if an exposure to loss exists in excess of the amount accrued pursuant to the provisions of paragraph 102, disclosure of the contingency should be made when there is at least a reasonable possibility that a loss or an additional loss may have been incurred. 41 The disclosure should indicate the nature of the contingency and should give an estimate of the possible loss or range of loss or state that such an estimate cannot be made. Disclosure is not required of a loss contingency involving an unasserted claim or assessment when there has been no manifestation by a potential claimant of an awareness of a possible claim or assessment unless it is considered probable that a claim will be asserted and there is a reasonable possibility that the outcome will be unfavorable. 108 After the date of a government's financial statements but before those financial statements are issued, information may become available indicating that an asset was impaired or a liability was incurred after the date of the financial statements or that there is at least a reasonable possibility that an asset was impaired or a liability was incurred after that date. The information may relate to a loss contingency that existed at the date of the financial statements. On the other hand, the information may relate to a loss contingency that did not exist at the date of the financial statements. Disclosure of those kinds of losses or loss contingencies may be necessary, however, to keep the financial statements from being misleading. If disclosure is deemed necessary, the financial statements should indicate the nature of the loss or loss contingency and give an estimate of the amount or range of loss or possible loss or state that such an estimate cannot be made. Occasionally, in the case of a loss arising after the date of the financial statements in which the amount of asset impairment or liability incurrence can be reasonably estimated, disclosure may best be made by supplementing the historical financial statements with pro forma financial data giving effect to the loss as if it had occurred at the date of the financial statements. It may be desirable to present pro forma statements, usually a statement of net assets 42 only, in columnar form on the face of the historical financial statements. 109 Certain loss contingencies should be disclosed in financial statements even though the possibility of loss may be remote. The common characteristic of those contingencies is a guarantee, normally with a right to proceed against an outside party in the event that the guarantor is called upon to satisfy the guarantee. Examples include guarantees of indebtedness of others and guarantees to repurchase receivables (or, in some cases, to repurchase the related property) that have been sold or otherwise assigned. Those loss contingencies, and others that in substance have the same characteristic, should be disclosed. The disclosure should include the nature and amount of the guarantee. Consideration should be given to disclosing, if estimable, the value of any recovery that could be expected to result, such as from the guarantor's right to proceed against an outside party. 110 The term guarantees of indebtedness of others in paragraph 109 includes indirect guarantees of indebtedness of others. An indirect guarantee of the indebtedness of another arises under an agreement that obligates a government to transfer resources to another entity upon the occurrence of specified events, under conditions whereby (a) the resources are legally available to creditors of the second entity and (b) those creditors may enforce the second entity's claims against the government under the agreement. Examples of indirect guarantees include agreements to advance resources if a second entity's revenues, coverage of debt service, or net assets/fund balance fall below a specified minimum. 43 General or Unspecified Operations Risks 111 General or unspecified operations risks do not meet the conditions for accrual in paragraph 102, and no accrual for loss should be made. No disclosure about these risks is required by paragraphs 96–113. Gain Contingencies 112 Contingencies that might result in gains usually are not reflected in the accounts since to do so might be to recognize revenue prior to its realization. Adequate disclosure should be made of contingencies that might result in gains, but care should be exercised to avoid misleading implications as to the likelihood of realization. Other Disclosures 113 Unused letters of credit, long-term leases, assets pledged as security for loans, and commitments, such as an obligation to reduce debts, should be disclosed in notes to financial statements, and paragraphs 96–113 do not alter the present disclosure requirements with respect to those items. Construction-Type Contracts—Long-Term Extinguishments of Debt Foreign Currency Transactions Note Exchanged for Cash [if someone can’t settle a current liab right away] Note Exchanged for Property, Goods, or Services Amortization of Discount and Premium 185 With respect to a note, which, by the provisions of paragraphs 173–187 requires the imputation of interest, the difference between the present value and the face amount should be treated as discount or premium and amortized as interest expense or revenue over the life of the note in such a way as to result in a constant rate of interest when applied to the amount outstanding at the beginning of any given period. This is the interest method. 186 The objective of the interest method is to arrive at a periodic interest cost (including amortization) that will represent a level effective rate on the sum of the face amount of the debt and (plus or minus) the unamortized premium or discount and expense at the beginning of each period. The difference between the periodic interest cost so calculated and the nominal interest on the outstanding amount of the debt is the amount of periodic amortization. Inventory Investments in Common Stock Leases [largest section] Nonmonetary Transactions