the swap market

advertisement

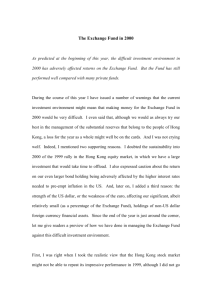

THE SWAP MARKET The swap market in Hong Kong plays an important role in channelling funds. It is also a highly efficient indicator of confidence in the linked exchange rate. Readers who are familiar with the foreign exchange and money markets, and have been monitoring developments there, will have noticed that the so-called “swap” prices have recently changed quite a lot. For swaps of up to one-year duration, the prices have been trading near zero, and fluctuating within a narrow range from a 5 to 75-pip premium. At the height of the financial turmoil at the end of August 1998, the one-year swap, for example, was traded at a premium of 6,800 pips; the three-month swap was at a premium of around 1,900 pips. (See chart) Notwithstanding the technical complexities surrounding the dynamics of the swap market, the trends in this market do contain meaningful underlying messages that I think should be of interest to the general public. Allow me to be somewhat didactic this week in offering a layperson’s guide on the swap market. Let me first explain what a swap is. It is an arrangement whereby one currency is exchanged for another currency for a defined period. This is to facilitate whoever is in possession of one of the two currencies, and has a temporary need for the other currency, to manage the exchange risk by crystallising it upfront to avoid the uncertainties of subsequent exchange rate movements. Thus if you hold US dollars and you have a temporary need for Hong Kong dollars for, say, three months, and you want to be protected against unexpected exchange rate movements, you can do a three-month swap. It is like borrowing Hong Kong dollars for three months on the security of US dollars. But what actually happens is that you sell your US dollars now at the market exchange rate, and at the same time enter into a contract to buy them back in three months’ time at an exchange rate adjusted by the three-month swap price. The swap price is expressed in terms of the differential in the exchange rates of the Hong Kong dollar against the US dollar when the swap is made (spot) and when the swap is reversed (forward), with one cent being 100 swap pips. It can be at a premium or a discount. The price of the swap bears a fairly mechanical relationship to the interest rate differential between the two currencies, although the money raised through the swap is not necessarily held as deposits earning interest. If the three-month interest rate for the Hong Kong dollar is higher than that for the US dollar, then whoever, through the swap, is temporarily holding Hong Kong dollars for three months will earn a higher return than the counterparty temporarily holding US dollars. This will be reflected in the swap price in the form of a premium, meaning that, in three months’ time, you will need more Hong Kong dollars to buy back the US dollars that you have just sold. Similarly, a swap price showing a discount would reflect Hong Kong dollar interest rates being below those of the US dollar. And a price around zero means that Hong Kong dollar interest rates are about the same as US dollar interest rates. The swap price may seem, to the layperson, to be a rather convoluted way for the market to be making comparisons between the interest rates for the two currencies. But, for market participants, it is a highly efficient indicator that brings together the forces of the inter-related wholesale deposit and foreign exchange markets involving the two currencies. Traditionally, the swap market is where licensed banks with no Hong Kong dollar deposit base gain access to Hong Kong dollar funding without having to be overly dependent upon the Hong Kong dollar interbank market. It is also a popular mechanism for licensed banks with a substantial Hong Kong dollar deposit base to put excess Hong Kong dollar liquidity to use without incurring too much credit risk arising from otherwise lending funds directly in the interbank market. Over time, the swap market has gained considerable sophistication and complexity, with market plays developed for different swap periods to take advantage of opportunities for profit, or market anomalies, as perceived by market participants. It has become a very efficient market with a high degree of liquidity. And with the Hong Kong dollar linked to the US dollar, the swap prices of different swap periods have become reliable indicators of the flow of funds into and out of the Hong Kong dollar, and also of the level of confidence in our currency. As a rule of thumb, the closer the swap price is to zero and the longer this phenomenon is manifested in the maturity period of the swaps, the higher is confidence in the linked exchange rate system. A premium in the swap price indicates the market perception of the possibility of outflow from the Hong Kong dollar, and a discount indicates the market perception of the possibility of inflow, although no light is thrown on the rationale behind them. But small deviations of, say, up to 100 pips for a three-month swap are not really very significant, as sentiment in the relative attractiveness of financial and other investments in Hong Kong and the US shifts in response to new information continuously made available. In any case, the current movement in the exchange rate applicable to Convertibility Undertaking for the clearing balance of the banking system of one pip a day back to 7.80 should have produced a 90-pip premium in three months’ time. The fact that the three-month swap price has instead been down to a discount of about up to 50 pips in recent weeks is perhaps an indication of some inflow. However, too large a premium or discount should create arbitrage activities that limit further deviation. The recent behaviour of the swap market suggests that confidence in the linked exchange rate is the highest we have seen. It also suggests some inflow as the performance of the economy and of financial markets improves, providing higher rates of investment return in Hong Kong. Joseph Yam 20 April 2000 HK$ Swap points (Aug 1998 - Mar 2000) 7500 6500 Swap points started to ease after the introduction of the seven technical measures 5500 pips 4500 Financial trouble of GITIC and subsequent credit downgrade of China enterprises 3500 3 Month Tension across Taiwan Straits and rumours of RMB devaluation 12 Month 2500 1500 500 -500 08/98 10/98 12/98 02/99 04/99 06/99 08/99 10/99 12/99 02/00