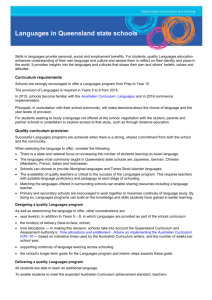

Cover Page

advertisement