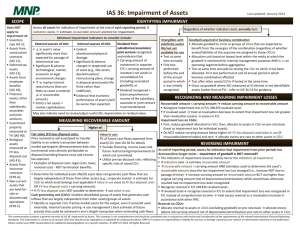

IFRS 9 Financial Instruments

advertisement