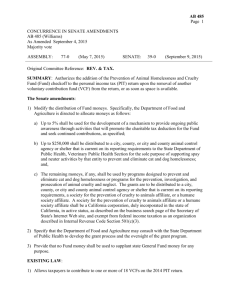

Assembly Revenue and Taxation

advertisement

AB 1399 Page 1 Date of Hearing: January 11, 2016 ASSEMBLY COMMITTEE ON REVENUE AND TAXATION Philip Ting, Chair AB 1399 (Baker) – As Amended January 4, 2016 SUSPENSE Majority vote. Fiscal committee. SUBJECT: Income taxes: voluntary contributions: California Domestic Violence Fund SUMMARY: Authorizes the addition of the California Domestic Violence Fund (Fund) checkoff to the personal income tax (PIT) return upon the removal of another voluntary contribution fund (VCF) from the return, or as soon as space is available. Specifically, this bill: 1) Establishes the Fund in the State Treasury. 2) Provides that all money transferred to the Fund, upon appropriation by the Legislature, shall be allocated to the: a) Franchise Tax Board (FTB) and the State Controller for reimbursement of all costs incurred in administering the VCF; and, b) Office of Emergency Services (OES) for the distribution of grants to domestic violence programs in California that are in active status, as reflected on the Business Search of the Secretary of State’s Internet Web site, and that are exempt from federal income taxation as an organization described in the Internal Revenue Code (IRC) Section 501(c)(3). 3) Provide that the OES shall award grants and be responsible for overseeing the grant program. 4) Provides that a domestic violence program and the OES shall not use grant moneys awarded or funds for administrative purposes and costs. 5) Provides for the Fund provisions' automatic sunset on January 1 of the fifth taxable year following the Fund's first appearance on the PIT return. 6) Requires the Fund to meet a minimum contribution threshold of $250,000 indexed for inflation. EXISTING LAW: 1) Allows taxpayers to contribute to one or more of 18 VCFs. AB 1399 Page 2 2) Provides a specific sunset date for each VCF, except for the California Seniors Special Fund and the State Parks Protection Fund. 3) Requires each VCF to meet an annual minimum contribution amount to remain in effect, except for the California Firefighters' Memorial Fund, the California Peace Officer Memorial Foundation Fund, and the California Seniors Special Fund. FISCAL EFFECT: Unknown COMMENTS: 1) The author has provided the following statement in support of this bill: AB 1399 will increase available resources to victims of domestic violence by providing additional resources through a donations option on California tax returns to the California Domestic Violence Fund. Specifically, this bill will allow an individual to designate on the tax return that a contribution in excess of the tax liability be made to the California Domestic Violence Fund. The cause for unmet critical needs are reduced government funding (37%,) cuts from private funding (25%,) lack of staff (23%,) and a reduction in individual donations (13%.) By providing additional opportunities for donations to domestic violence programs, we can better provide a safe haven for families. 2) Arguments in Support. According to Safe Alternatives to Violent Environments, “Domestic violence programs rely on a wide range of funding sources to support their programs, including government grants, foundations, corporate donations, and individual donations. Allowing individuals to easily donate to the California Domestic Violence Fund through their individual tax filing will encourage Californians to support these essential programs and fund lifesaving services.” 3) So many causes, so little space. There are countless worthy causes that would benefit from the inclusion of a VCF on the state's income tax returns. At the same time, space on the returns is limited. Thus, it could be argued that the current system for adding VCFs to the form is subjective and essentially rewards organizations that can convince the Legislature to include their fund on the form. 4) VCF policy. This Committee's VCF policy provides that "[a]ll proponents seeking authorization for a new or reauthorized checkoff shall provide information justifying their expectation that the checkoff will meet its minimum contribution requirement." The author’s office has been clear about the need to fund domestic violence shelters but has provided no explanation as to why this fund will generate the required $250,000 minimum contribution requirement. 5) Administering the Fund. OES maintains a very large grant program, including a victims services program that provides grants for domestic violence. This bill, however, provides that OES shall distribute grants to domestic violence programs that are in active status as reflected on the Secretary of State’s Internet Web site. It is unclear if the domestic violence programs maintained on the Secretary of State’s Web site would be different than those currently maintained by OES. In order to provide greater guidance and in order to reduce AB 1399 Page 3 administrative costs, the Committee may wish to amend this bill so that the grants are distributed to domestic violence programs that are part of one of OESs grant programs. 6) Funding the Administration of the Fund. This bill allows the FTB and the State Controller’s office to be reimbursed for costs incurred in administering the VCF but does not do the same for OES. Therefore, any additional staff, if needed, will have to come out of the OES’ existing budget. It is believed that cost will be absorbable bit OES has not confirmed this as yet. REGISTERED SUPPORT / OPPOSITION: Support Alliance for Community Transformations California Partnership to End Domestic Violence Center for Community Solutions Center for Domestic Peace Contra Costa County, Office of District Attorney Contra Costa County, Board of Supervisors Safe Alternatives to Violent Environments Opposition None on File Analysis Prepared by: Carlos Anguiano / REV. & TAX. / (916) 319-2098