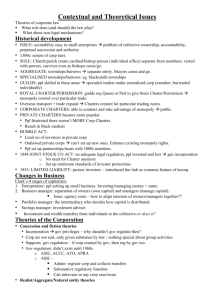

Corporations - Penn APALSA

advertisement