Prof.S.V.MURULIDHAR, M.Com.MBA.,M.Phil.,MHRD.,PGDCA

advertisement

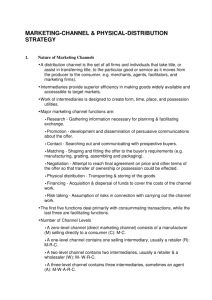

Prof.S.V.MURULIDHAR, M.Com.MBA.,M.Phil.,MHRD.,PGDCA.PGDMM.,(PhD) Dept.of Studies in Commerce & Management Post Graduate Centre Govt. First Grade College, Ranebennur Email:muruli1976@gmail.com Website: www.murulicommerce.jimdo.com Unit IV: Marketing Channels, Structure and Functions, Channel Design, Selecting and Motivating Channel Members, Evaluating Channel, Member Performance. Unit IV - CHANNEL MANAGEMENT Channel Management & Relationships • Designing a Distribution Channel. • Types of Intermediaries • Functions of Intermediaries • Identification & Selection of Channel Partners. • Appointment & Training of Channel Partners. • Evaluating & Motivating Channel Partners. • Causes of Channel Conflict. • Resolution of Channel Conflict. Designing a Distribution Channel • Specifying the role of distribution channel. • Selecting type of distribution channel. • Determining the intensity of distribution channel. • Choosing specific channel members. Specifying the role of distribution channel • Channel strategy to be proportional to a Co.’s marketing objectives, and roles assigned to the rest of the marketing mix. • Co to decide whether distribution will be used defensively or offensively. • Defensive approach – Distribution as good as a competitor. • Offensive approach – Gain competitive advantage by having better distribution. Planning the distribution Channel • To decide on: Channel structure Channel tiers Channel Structure • Direct, Indirect. • Vertical, Horizontal. • Multi-channel • Direct: Producer Consumer • Indirect: Producer Intermediary Consumer 1 Vertical Marketing Systems (VMS) - Corporate VMS : A firm at one level of channel owns firm at the next or subsequent levels. High degree of control for Producer. - Administered VMS : Dominant brand owners are able to secure strong trade support from intermediaries. - Contractual VMS : Producer exercises control through contractual terms – exclusive dealers. • Horizontal Marketing Systems (HMS) – 2 or more unrelated Cos. join together, so as to have pooled resources to exploit an emerging marketing opportunity. This system takes place when a Co. lacks financial resources or marketing know how and is afraid to take risks on its own. • Multi-channel Marketing Systems (MMS) – MMS occurs when a Co. uses different channels to reach same/different market segments, to ensure availability of right product at right time. • Selecting type of Channel Decision based on: Market considerations. Product considerations. Company considerations. Middlemen considerations. Factors affecting choice of distribution channels • Market considerations: • • • • • • • • • Type of market – Different distribution channels are used to reach different types of markets. No. of potential customers - No. of customers low, direct distribution possible Geographic concentration of the market – Direct distribution practical when there is high concentration of customers in few geographical areas. High market concentration – Direct distribution channel : low cost of serving market. Low market concentration – Indirect distribution channel : high cost of reaching directly. Customer service level: 3 sub-factors – delivery time, lot size, product availability. More the need for customer service : lower deliver time, lower lot size, lower product availability – Indirect distribution channel more desirable. Direct distribution economical when either size or total volume of business is large. Product considerations: • • Unit value – Direct distribution possible when unit value is high. Perishability – Low shelf life products have to be sold through short distribution channels. 2 • Technical nature of product – Highly technical products require direct distribution. Company considerations: • • Desire for channel control – Producers wanting more control over their products’ distribution establish direct distribution. Ability of Management – Marketing experience and ability influences channel decisions . Inexperienced Companies would appoint Marketing Agent. Company considerations: • • • • Financial resources – Financially strong Co. would go in for direct distribution. Financially weak Co.s appoint middlemen. Availability of Working Capital: High – Direct distribution channel. Low – Indirect distribution channel. Services provided by seller – Highly promoted products would have wider retail coverage. Middlemen considerations: • • • Services provided by middlemen – Middlemen must provide the service which the producers are unable to provide. Availability of desired middlemen - The middlemen desired by a Producer may not be available, so alternate channels would have to be considered. Attitude of middlemen towards Producer’s policies – If middlemen are unwilling to join a producer’s channel because of disagreement on policies, then the producer has fewer options. Selecting type of Channel Tiers of distribution channel: • Zero Tier: Producer Consumer. • One Tier: Producer Retailer Consumer. • 2 Tier: Producer Distributor Retailer Consumer. • 3 Tier: Prod Super Dist/Con.Agt Distr Ret Cons. • 4 Tier: Prod Mktg Agt S.D/C.A Dist Ret Cons. Tiers of distribution channel: • More widely dispersed the customers – Greater the tiers. • Zero tier & 1 tier – Specialised products, technologically advanced products, industrial products, consumer durables, branded garments. • 2 Tier – Consumer durables, branded FMCG. • 3 & 4 tier – Smaller/unbranded FMCG. Intensity of Distribution • Intensive – Distribution through every reasonable outlet in the market. • Selective - Distribution through multiple, but not all outlets. Lies midway between extensive and exclusive distribution. 3 • Exclusive – Distribution through a single outlet in the market. Types of Intermediaries • Marketing Agent. • C&F Agent/Consignee Agent/ Super Distributor. • Distributor/Stockist. • Wholesaler/Semi-wholesaler. • Retailer – General Merchant, Chemists & Druggist, Grocer, Dept. Store, Exclusive Outlet, Cooperative Stores, Food Products Store, Pan Bidi Shop. Functions of intermediaries • Physical possession function: Hold and distribute stocks. • Retail function: Buy in large quantities and sell in small quantities. Cover local market in absence of Producer’s salesmen. Supply retail orders booked by Co. salesman. • Promotion function: Help in carrying out local promotion activities. • Information function: Provide feedback information on Producer’s and competitive products and activities. • Financing function: Could buy on advance or COD terms from Producers and sell on credit to retailers. Marketing Agent • Provides full function sales and local promotion support to Producer. Stocks received could be purchased or on “stock transfer” basis. If stocks purchased, then income is on basis of commission on sales, otherwise could be on cost plus basis. Producer does not employ own sales force. C & F Agent • Acts on behalf of the Producer. Holds Producer’s stock. Basically provides warehousing and stock delivery facility in state where he is based. Distributes stock to market level distributors. Receives income on cost plus basis Is appointed to avoid payment of L.S.T. Producer deploys own sales force. Consignee Agent/ Super Distributor 4 • Functionally both are same. Super Distributor buys stock on “C” Form by paying full CST. Consignee Agent buys stock on “F” Form. Both hold stocks bought from Producer and distribute it to area level distributors • Income from commission on sales. • Identification of Channel Partners Purchases stock from CA/SD/C&FA or directly from Co. In turn distributes stocks to area level retailers. Income from commission on sales. Identification of Channel Partners Prospecting for Agents/Distributors • Advertisements – Newspapers/T.V/Cable. • Word of mouth publicity through retail trade • References from retail trade. • References from sales staff of other Companies. • References from friends and acquaintances. • Reference from tertiary sources – Banks, Suppliers, etc. Selection of Channel Partners Criteria of selection for Agents/Distributors • Management strength • Financial standing:– Whether overtrading. Terms of business with other Cos. Terms of business with retail trade • Infrastructure:– Office set up: location, space, computers, telephone/fax, etc. Godown: Space, location, security, etc. Delivery vehicles: mechanised – 3,4 wheelers, manual. • No. of years in business, Reputation/goodwill. Criteria of selection for Agents/Distributors • Manpower Office staff, numbers and expertise. Salesmen, number and expertise. • Market coverage and relations. • Other businesses, turnover. • Reputation of other Agencies handled. • Willingness to work. 5 Appointment of Intermediaries • Prospective appointees contacted by Co. salesman who does initial appraisal and also discusses Co. terms and conditions. Fills up Appraisal Form. • If initial appraisal is positive, and prospective appointee also agrees with terms, then a second appraisal is carried out by a superior officer. • Both sides agreeing, an Appointment letter is then issued by the Co. Training of Intermediaries • Channel members have to be trained at the start and also from time to time regarding: Company policies and products. Latest marketing strategies adopted by Co. and also competitors. Changes in the environment. Training Methods • If just one or two distributors are being appointed at the time, then the training is provided by senior Company personnel at the place of business. • If more are being appointed at the same time, then a separate training session is organised by the Company. Training sessions: • Provide a platform to the parties involved to communicate and understand each others point of view. • A forum where a manufacturer can understand the needs of the dealers and gather information about the market. • Makes the intermediary feel valued. • Combined with a holiday package are used as reward motivators by the Cos. Evaluating Channel Members • Evaluation is an on-going exercise. • Constant evaluation and fine tuning required to keep abreast of changes in market place, nature of competition, etc. 6 • Producers should also evaluate coherence between product and channels, as requirements may change over period of time. Evaluation Criteria: Achievement of targeted sales and growth generated. Adherence to payment norms. Maintenance of average inventory levels. Treatment of damaged and returned goods Co-operation in promotional and training programmes. Channel member relationship life cycle: Birth – Exciting stage. Members work together getting to know each other, but if things are not working out, they should get out immediately. • Growth – Dictates hard work for both parties. Energy should be directed towards solving problems. • Maturity – Watch for trouble, as the only way to go is down. Parties required communicating as it is the key to efficiency. • Death – Too many problems kill efficiency. So get out fast. Motivating Channel Members • Motivation is a continuous activity. • A Producer has to exert power to motivate the members to take into consideration a macro perspective and work together. • Power is the ability of Producer or a channel member to get another channel member to do what otherwise they would not have done. • Power is an essential ingredient required to motivate and direct efforts of non-identical organisations and individuals. • A Producer uses power to elicit cooperation: coercive, reward. legitimate, expert and referent. • However, ultimate motivator is the creation of an atmosphere of mutual trust that understands the mutual goals of network partnerships. • 2 types of motivation: • Monetary – Reward motivator (positive reinforcement). • Non-monetary • Coercion (negative reinforcement). • Expert knowledge. • Identification basis • • • • • • 7 • Legitimate power motivator Monetary motivators: • Reward motivator – Based on channel member’s belief that the other party has an ability to give something of value to him. This reward will be available to him only if he adheres to the wishes of the other party. Known as positive reinforcement as reward is used to motivate the individual to repeat the behaviour. Reward motivators: • Granting larger margins. • Higher promotional activities/allowances. • Functional discount schemes. • Easier payment terms. • Faster settlement of claims. • Granting exclusive territories or large individual accounts. • Sales force compensation/incentive schemes. • Lower inventory holding norms. Non monetary motivators: • Coercive power – Refers to power of one intermediary over another, when a member expects punishment for his failure to comply with the wishes of the former party. Opposite of reward motivators. Should be adopted only when all other tools fail to bring about the desired changes in the channel member, as it can act as a demotivator. Main tools are: Reduction in margins. Withdrawal of rewards previously granted. Slowing down of supplies. Tougher operational norms. • Expert knowledge – When a channel member perceives Producer to have some specialised knowledge, it results in Producer having control over the intermediary. Expert knowledge provides the Producer with knowledge leverage to manipulate behaviour of the intermediary. Tools include: Managerial counselling. Sales training for employees. Sales promotion counsel. Advice on sources of items not stocked by intermediaries. 8 • Identification basis – Whenever dealer prides himself with dealing with a certain Producer, this results in referent power for the Producer. This can be used as a motivator by those Producers who have earned a high degree of customer loyalty. • Legitimate power motivator – When a Producer uses its agreements to modulate the behaviour of a channel partner, it is called legitimate power. It is usually used as a referent power – avoiding a channel member from behaving in a manner which could be detrimental to the goodwill of the Producer. ********************************** 9