About Capital Gains Tax - is it all doom and gloom?

advertisement

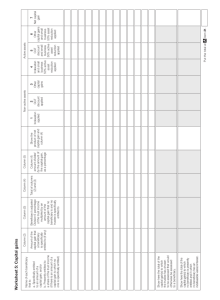

ABOUT GAINS TAX – IS IT ALL DOOM AND GLOOM? The subject of Capital Gains Tax (CGT) has been around for several years now, during which time it has left many people in a state of wondering as to just how this tax will effect their everyday lives. There has been much debate about the viability, the ability of SARS to implement and manage this new tax, and whether the cost of the collection effort will justify the net result. Nevertheless, the bottom line is that SARS have been mandated by the government of the day to implement and collect this new form of tax from citizens of the country and it is a job they fully intend to carry out. So it’s in your interest to get to grips with a few basics of this new tax!! Why introduce CGT ? It is SARS’ view that there are many taxpayers who are currently able to evade paying tax by converting portions of their earnings into capital gains and not paying anything on the gains they enjoy. In comparison there are those taxpayers who invest in various forms of savings and investment schemes etc. most of who do pay tax on the interest they earn on these investments. CGT is aimed at bringing in more tax from taxpayers who have been able to avoid paying tax through the conversion of what would normally be taxable earnings into non-tax bearing capital assets. Who is liable for CGT ? Tax residents of South Africa are subject to CGT when they dispose of any of their “CGT-able” assets (worldwide assets included). Non-residents are only liable when they dispose of their South African based assets (i.e. immovable property). This applies when the immovable asset is held directly by the non-resident, however there are instances where CGT is due on immovable assets even if not held directly by the non-resident. CGT is also due on assets of a permanent establishment owned by a non-resident when they are disposed of. When is CGT applicable ? CGT only applies when there is a disposal (or a deemed disposal !) of capital assets on or after 1 October 2001. Bear in mind that a partial disposal also attracts CGT but on an apportioned basis. How is a Capital Gain or a Capital Loss Calculated ? Simply put, the base cost is the actual amount spent on acquiring the asset and CGT is calculated on the difference between what the asset cost you and how much profit/loss you made when you disposed of it. There are a few considerations when calculating the base cost as there are some specific exclusions, deferrals and loss limitations. The base cost includes such items as the actual cost of acquiring the asset, creation costs, costs of valuation, incidental costs on acquiring or disposing of the asset. So, by way of example: Cost of Property Building Cost : : R R 250 000 500 000 Plans/Valuations : R 50 000 Total Cost : R 800 000 Sale Price : R 1 000 000 Profit : R 200 000 In the above example, the first R10 000 (or R50 000 if in the year of a person’s death) of the R200 000 would be exempt from CGT so therefore R190 000 would be the amount on which CGT would be applicable. This applies to a natural person or a special trust that has been excluded from CGT. If the above property was the primary residence of the owner then the first R 1 000 000 profit would be exempt. What are the effective tax rates for CGT? Inclusion Statutory Effective Type of Taxpayer Individuals/Special Trusts Trusts Retirement Funds Life Assurance Rate % 25 50 n/a Rate % 0-40 40 0 Rate % 0-10.5 20 n/a Individual policyholder fund Company Policyholder fund Corporate fund Untaxed policyholder fund Companies Small business corporations Employment companies Permanent establishments (branches) Tax holiday companies 25 50 50 0 50 50 50 50 50 30 30 30 0 30 15-30 35 35 0 7.5 15 15 0 15 7.5-15 17.5 17.5 0 Assets owned on the commencement date – what’s the ruling? Only the portion of the capital gain (i.e. the profit) arising on or after 1 October 2001 is subject to CGT. The taxpayer must elect which method should be used in determining the base cost of assets. Taxpayers may choose any one of the following methods: Market value as at 1 October 2001, or A time-based apportionment, or 20% of disposal proceeds. Market value can only be used if a valuation is done before 1 October 2003, and there are specific rules, which apply to assets where market value exceeds R10 million (R1 million for intangibles). Individuals – assets which are exempt: Primary residence – the house you ordinarily live in. The first R1 million gain is exempt from CGT provided it is personally owned and is not held by a company, close corporation or trust. (The property may be transferred to you free of stamp and transfer duty if you owned the company or CC on 5 April 2001 and you arrange transfer before 30 September 2002 and registration takes place by 31 March 2003). Assets – personal use: Personal use assets (such as furniture, motor vehicles, jewellery and collectibles including art and stamp collections) are not subject to CGT. The following however, are subject to CGT: private use aircraft exceeding 450 kilograms, boats larger than 10 metres and precious metal coins e.g. Kruggerrands. The disposal of a non-exempt personal use assets gives rise to a gain, which is subject to CGT but no deduction is granted if a loss arises. Disposal of “small business assets” on retirement (55 years or older): A lifetime exemption of R500 000 applies to the disposal of small business assets provided these are valued at not more than R5 million. This also applies to indirect holdings via companies or close corporations or partnerships but is subject to specific rules. Record keeping: The onus is on the taxpayer to prove base costs and it is essential that relevant documentation be retained. Valuations of assets held on 1 October 2001 must be forwarded to the South African Revenue Service (SARS) with the first tax return submitted after 1 October 2003 or with the tax return in which the gain is reported, as appropriate. Planning: If possible try and complete the disposal transaction before 1 October 2001. Where practical (and legal) consolidate the potentially affected assets into one entity to be able to off-set capital gains and losses against each other Flatten group structures where possible to prevent the cascading effect of CGT in a chain of companies. Ensure that the records of base cost include all qualifying costs.