FBE 464 - USC Marshall

advertisement

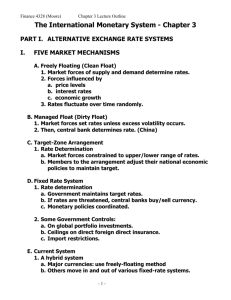

FBE 464 – International Finance Spring 2006 Professor Vincenzo Quadrini Tuesday-Thursday 4:00-5:50, Classroom ACC 310 Office hours Tuesday-Thursday 12:45-1:45, Office HOH 601A, Tel. 740-6521, e-mail: quadrini@usc.edu Web address: http://www-rcf.usc.edu/~quadrini/FBE464/FBE464.html TA: Yuri Marynets, e-mail: marynets@usc.edu This course provides a systematic understanding of critical aspects of international finance. It examines how international financial markets operate and the forces driving toward the globalization of these markets. Central to the analysis is the role of money in an international context and the role of exchange rates as relative prices of national currencies. The course develops some key principles of international financial investment and examines how the foreign exchange market can be used to hedge and speculate in financial markets. It also studies the role of government policies toward the foreign exchange market, including the choice between fixed and floating exchange rates, and the use of exchange controls to create impediments to excess currency exchanges volatility. These concepts will be integrated to study macroeconomic policies in open economies. Course Materials and Requirements Required textbook: Thomas Pugel, International Economics, twelfth edition, Irwin McGraw-Hill, 2004. Parts III and IV. I strongly suggest that you read (perhaps quickly) the readings indicated in the list of topics before the class meets. In the class session I will usually cover the concepts and issues that are most challenging, reinforcing and extending what is in the required reading. I suggest that after the class session you review the assigned reading to solidify your understanding. It is important that you develop the ability to use and apply the concepts and tools developed in the course. The best way to do this is by practicing actively. Questions and problems in the textbooks are one source of practice items. In addition, several problem sets will be distributed. The problem sets must be handed in by the due dates as specified below. Copies of the basic slides used in the class will be made available on the web site. The web address is: http://www-rcf.usc.edu/~quadrini/FBE464/FBE464.html Course Requirements and Grading The course grade will be based on the following weighted items: 1. First mid-term examination (February 14) 2. Second mid-term examination (March 30) 3. Final examination (May 4, 4:30-6:30PM) 4. One group assignment (March 7) 5. Series of five problem sets (2% each) 6. Class attendance, participation and presentation 25% 25% 25% 10% 10% 5% It is highly recommended to keep up with current developments in the international environment, both for class purposes and for your own benefit. You can do this by reading the relevant articles in newspapers (e.g., Financial Times, Wall Street Journal, New York Times) or weekly magazine (e.g., the Economist). To encourage the readings of news and the applications of theory to the real world, students are encouraged to make inclass presentations of issues recently covered in the news that are related to the topics of the course. We will use the last 15 minutes of class for these presentations. The presentation can be done in groups of 3 or 4 students. The groups can be the same as the ones formed for the group assignment. Students who decide not to present will loose 3 percentage points in participation. Topical Organization PART I: FOREIGN EXCHANGE AND INTERNATIONAL FINANCIAL MARKETS 1. Introduction: international linkages and globalization (Jan. 10) Required reading: Pugel, Chapter 1 2. Payments among nations (Jan. 12) Balance of payment. Current account. Capital account. Foreign reserves. Required reading: Pugel, Chapter 15. Practice Questions and Problems: 1-10. 3. The foreign exchange market (Jan. 17) The basic currency trading. Demand and supply for foreign exchange. Floating and fixed exchange rates. Arbitrage in the spot exchange market. Required reading: Pugel, Chapter 16. Practice Questions and Problems: 1-10. 3. Forward exchange and international financial investment (Jan. 19, 24, 26) Hedging the risk using the foreign exchange market. Speculating using the foreign exchange market. Other currency contracts: futures, options and swaps. International investment with and without cover. Covered interest arbitrage and covered interest parity. Does the interest rate parity hold? Required reading: Pugel, Chapter 17. Practice Questions and Problems: 1-10. 4. What determine exchange rates? (Jan. 31) Exchange rates in the short and long run. Purchasing Power Parity (PPP): absolute and relative PPP. Exchange rate overshooting. Required reading: Pugel, Chapter 18. Practice Questions and Problems: 1-14. 5. Government policies towards the foreign exchange market (Feb. 2, 7) Defending a fixed exchange rate. Market interventions by the central bank. Exchange controls. Some historical experience: Gold Standard, Bretton Woods and recent days. Required reading: Pugel, Chapter 19. Practice Questions and Problems: 1-12. 6. Review in preparation for the exam (Feb. 9) 7. First midterm exam (Feb 14) PART II: INTERNATIONAL LENDING AND MACRO POLICIES IN OPEN ECONOMIES 1. International lending and financial crisis (Feb. 16, 21) Gains and losses from international lending. Lending to developing countries. Financial crisis and their causes. Resolving financial crisis and preventing them. Required reading: Pugel, Chapter 20. Practice Questions and Problems: 1-10. 2. Macro policies in open economies (Feb. 23, 28, Mar. 2, 7, 9) The basic open economy macro model. Fixed versus flexible exchange rates. Fiscal and monetary policy with fixed and flexible exchange rates. Required reading: Handout from the instructor and selected parts of Pugel, Chapters 21, 22, 23, 24. 3. Monetary integration (Mar. 21, 23) Dollarization and monetary unions. The monetary integration of Europe. - From the Bretton Woods System to the “Snake in the Tunnel” - The European Monetary System - The Maastricht Treaty and the European Monetary Union - The role of the EURO as an international currency. Required reading: Presentation slides. 4. Review in preparation for the exam (March 28) 5. Second midterm exam (March 30) PART III: OTHER INTERNATIONAL TOPICS 1. Multinationals and migration (Apr. 4, 6) Foreign direct investment (FDI). Multinational enterprises. Taxation of multinational enterprises’ profits. Policies toward FDI. Migration and the labor market. Policies toward immigration. Required reading: Pugel, Chapter 14. Practice Questions and Problems: 1-17. 2. International portfolio investment and diversification (Apr. 11, 13, 18, 20) Investment in foreign stocks. Risk and return from investing in foreign stocks. Capital Asset Pricing Model (CAPM) applied to international portfolio investment. International diversification puzzle. Required reading: Handout from the instructor. 3. Other topics in international finance (April 25) 4. Review in preparation for the exam (Apr. 27) 5. Final exam (May 4, 4:30-6:30PM)