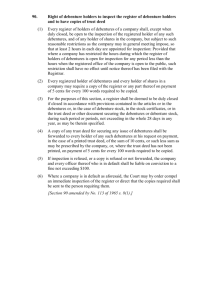

First Leasing Company Of India Limited Secured Redeemable

advertisement

STRICTLY PRIVATE AND CONFIDENTIAL (Not for circulation. For the specific use of the Addressee only) INFORMATION MEMORANDUM FOR PRIVATE PLACEMENT Of SECURED REDEEMABLE NON-CONVERTIBLE DEBENTURES AGGREGATING Rs.10 CRORES Issued by FIRST LEASING COMPANY OF INDIA LIMITED Registered Office 749 Anna Salai, P O Box 2747, Chennai - 600002, Tamil Nadu Telephones: 91-44-2852 1615/0705 HIGHLIGHTS Present issue is rated F1+ (ind) (Highest Safety) by Fitch. First Leasing pioneered the corporate leasing industry in India. Track record of 30 years and excellent brand image on FDs. First Leasing completed an Infrastructure Lease transaction for Rs.75 crores with Ministry of Railways. Resultantly 15.97% of First Leasing’s future receivables are to be met by a “sovereign risk”. The portfolio is truly diversified and there is no unbalanced sectoral exposure. Diversified funds base (Fixed Deposits as a % of total liabilities is a mere 12.68%). First Leasing’s Net NPA of 1.26% is probably the lowest among the top line NBFCs. Capital adequacy of 23.96% is much above the mandatory 12% First Leasing enjoys the confidence of the banking system as a whole and operates credit facilities with major credit grantors, such as State Bank of India, HSBC, UCO Bank, UTI Bank and IDBI Bank. PART – A TERMS AND CONDITIONS OF PRIVATE PLACEMENT Instrument Non Convertible Debentures Style Private Placement Issue Size Rs.10 crores Subscription requested Rs.10 crores Minimum subscription Rs.1 crore Rating F1+ (ind) (Highest Safety) by Fitch Coupon 7.5% p.a. payable monthly Tenor 1 year Purpose of the issue The debentures are being issued to augment short term funds requirements. Security The debentures will be secured by “exclusive first charge” on existing unencumbered and specific lease / hirepurchase assets of the company. Asset cover 1.25 times Date of allotment Security creation will be completed within 45 days from the date of allotment. Interest on application Interest at the coupon rate of 7.5% p.a. will money be paid on the “application money” till allotment. Certificate Debentures will be issued in the “Dematerialised Format” by way of a credit to the investor’s demat account. Trustee UTI Bank Ltd. Listing Yes. The debenture will be listed in The Stock Exchange, Mumbai. Upfront discount Nil Compliance The issue is in full compliance with SEBI’s circular no.SEBI/MRD/SE/AT/36/2003/30 /9 dated September 30, 2003 read in conjunction with SEBI’s clarification no.SEBI/MRD/SE/AT/46/2003 dated December 22, 2003 PART – B INFORMATION ON FIRST LEASING - ISSUER Fundamental strength of First Leasing First Leasing pioneered the corporate leasing industry in India. Our Managing Director, Mr Farouk Irani, as an elder statesman of the industry and the Chairman of Association of Leasing and Financial Services Companies (ALFS) made considerable contribution to the “orderly growth of the Leasing Industry”. Our Managing Director Mr Farouk Irani is the first Indian (also the first Asian) to be invited to address a World Leasing Convention and the only Asian who has the distinction of addressing 7 World Leasing Conventions. First Leasing completed an Infrastructure Lease transaction for Rs.75 crores with Ministry of Railways. Resultantly 15.97% of First Leasing’s future receivables are to be met by a “sovereign risk”. Fitch Ratings India Pvt. Ltd. (the only International Rating Agency operating in India) assigned the “Highest Safety” rating to 2 of our debt programmes. CARE has also assigned the “Highest Safety” rating to 2 of our debt programmes. The portfolio is truly diversified and there is no unbalanced sectoral exposure. There is no concentration in terms of geographical segments or assets or customer groups. No unmanaged or unidentified risks such as Foreign Exchange risks, etc. First Leasing has an impeccable track record of 30 years. First Leasing operated under many “Business cycles” and successfully turned over more than 5 credit portfolios. First Leasing enjoys the full confidence of the Banking System and operates credit limits aggregating Rs.200 crores from 18 banks. First Leasing privately placed debt securities of more than Rs.150 crores with the Banking system. Diversified funds base (Fixed Deposits as a % of total liabilities is a mere 12.68%). First Leasing’s Gross NPA ratio of 4.35% and the Net NPA of 1.26% are probably the lowest among the top line NBFCs. Very high collection efficiency. Capital adequacy of 23.96% is much above the mandatory 12%. Strong management (pioneer) and cross-functional board. Low leverage of 3.11 times offering excellent financial flexibility High interest cover of 1.93 times We are a Registered NBFC with RBI. We fully comply with all Prudential Norms, including the ALM guidelines. Focused approach, no unrelated diversifications. No walk-in retail exposure. Several world-class organisations found First Leasing an acceptable “counter party” and extended funding and / or associated with First Leasing, after a thorough “Due Diligence”. Organisation US Exim First International Bank (FIB) Commonwealth Development Corporation (CDC) Guinness Flight – U.K. Metlife – U.S. Type of relationship Guarantee ECB Amount $ 20 mio. $ 5 mio. Equity Investment @ a premium of Rs.83.5 per share Joint Venture / collaboration Buy-out of our stake in FIAM GBP 2.5 mio. Track Record and Goodwill Earned We tabulate our financial performance over the last twenty nine years: (Rs / lacs) Year 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2002 2003 Gross Revenue (Rs.) 8.46 19.84 27.11 13.06 47.69 62.72 95.34 133.34 202.76 279.82 388.42 597.02 920.08 1352.19 1800.50 2573.36 3301.57 3698.47 4564.10 5783.61 7617.85 9826.94 11207.61 11772.85 12989.57 14131.11 15590.27 18923.86 13618.01 Profit After Tax (Rs.) Cash Profit (Rs.) 2.35 6.77 8.90 9.37 16.48 22.58 37.43 48.04 71.45 90.04 114.67 139.31 238.01 238.24 $$ 301.10 353.83 457.98 501.77 601.68 763.23 1064.09 1398.84 1400.40 1404.38 1475.34 1858.37 1656.90 1787.90 1910.95 4.23 10.30 14.20 18.67 28.01 40.34 68.47 89.78 130.54 163.77 234.34 324.06 503.99 690.18 1020.93 1449.51 1908.01 2005.35 2168.29 2799.53 3951.75 5094.17 5963.36 6378.77 6951.65 7675.64 7592.79 7842.68 5462.44 Total Asset Footings (Rs.) 64.05 89.21 119.10 164.17 181.44 238.18 305.66 464.51 745.91 1102.50 1797.22 2587.71 4874.99 6128.16 7860.94 11040.92 13189.73 15122.71 20334.49 24734.49 30988.14 33728.78 34996.35 39431.43 45957.63 53816.62 64655.81 71013.55 67526.72 Reserves and Surplus (Rs.) 2.35 4.26 8.68 13.49 24.26 35.25 63.64 101.70 161.44 211.44 298.40 396.58 732.29 822.41 848.90 929.85 903.19 1165.13 1646.26 1964.87 2462.82 3407.33 5045.14 5250.96 6148.64 7419.72 8493.49 9716.65 11174.69 Dividends ( % ) -18.00 18.00 18.00 18.00 19.00 19.00 20.00 20.00 20.00 21.00 21.00 30.00 $ 25.00 # 26.00 26.00 28.00 28.00 30.00 32.00 35.00 35.00 32.00 32.00 25.00 25.00 25.00 @26.67 20.00 Intrinsic Value of each Share (Rs.) 10.94 11.70 13.47 15.40 17.25 18.83 22.70 30.34 40.95 * 31.78 33.47 40.64 ** 29.19 31.63 23.47 24.76 24.32 27.56 27.94 32.46 39.07 ## 33.53 34.63 33.80 37.75 44.26 50.10 55.86 62.73 * After a Bonus Issue of 1:3 and a Public Issue of 5,47,464 Shares. ** After a Rights Issue of 24,80,699 Shares $$ Dividend of 30% in 1986 was in lieu of a Bonus Issue and represented a one-time payment. Accordingly, dividend of 25% in 1987 represented a natural progression over the dividend Declared in earlier years. $$ Includes writes back of Investment Allowance Reserves (utilised) plus Development Rebate. # On an enhanced capital issue of Rs.6.29 Crores versus Rs.3.79 Crores for the previous year. ## After conversion of warrant and CCP of 60,00,000 shares. As recommended by the Board of Directors After private placement of 20,00,000 Equity Shares @ 16 months period (from Dec 2000 to March 2002) PART C CONFIDENTIAL INFORMATION MEMORANDUM This is a confidential information memorandum setting out the terms and conditions pertaining to the issue of Secured Redeemable Non-Convertible Debentures of the face value of Rs. 100/- each to be issued by FLCI. Your participation and subscription is subject to the completion of the Application Form. OBJECTS OF THE PLACEMENT: The proceeds of the placement will be used by FLCI to augment the short-term resources of the company. DEEMED DATE OF ALLOTMENT: The deemed date of allotment of NCD would be the date following the day of subscription. The date would be intimated to the subscriber on confirmation of receipt of subscription by FLCI. INTEREST ON THE DEBENTURES: The debentures will carry interest at the coupon of 7.5% p.a. from the Deemed Date of Allotment (subject to deduction of tax at source at rates prevailing from time to time under the provisions of the Income tax Act, 1961, or any other statutory modification or re-enactment thereof for which a certificate will be issued by the company). PAYMENT OF INTEREST: The interest will be payable monthly to the registered Debenture holders recorded in the books of the Company, and in case of joint holders, to the one whose name stands first in the register of Debenture holders. In the event of the Company not receiving any notice of transfer along with the original debenture certificates at least thirty days before the respective due date of payment of interest, the transferee(s) for the Debentures shall not have any claim against the Company in respect of interest so paid to the registered Debenture holder(s). Wherever the signature(s) of such transferor(s) in the intimation sent to the Company is/are not in accordance with the specimen signature(s) of such transferor(s) available on the records of the Company, all payments of remaining interest on such Debenture(s) will be in abeyance by the Company till such time as the Company is satisfied in this regard. The Company shall pay no penal interest for such period, when the interest is kept in abeyance. TAX DEDUCTION AT SOURCE: Tax as applicable under the Income Tax Act, 1961, or any other statutory modification or re-enactment thereof will be deducted at source. Tax exemption certificate/ document, under Section 193 of the income Tax Act, 1961, if any, must be lodged at the office of the Company, at least 30 days before the interest payment becoming due. REDEMPTION: The Company will redeem the debentures at par the end of 365 days from the deemed date of allotment. RIGHT TO ACCEPT OR REJECT APPLICATIONS: The Company is entitled at its sole and absolute discretion, to accept or reject any application, in part or in full, without assigning any reason. The application forms, which are not complete in all respects, are liable to be rejected. The rejected applicants will be intimated along with the refund warrants within 15 days of closure of the subscription list. Interest on application money will be paid at the rate of 7.5%p.a. from the date of realisation of cheque(s)/demand draft(s) till the date of refund. LETTER OF ALLOTMENT AND DEBENTURE CERTIFICATE: The company will make allotment to the investors in due course after verification of the Application Form, the accompanying documents and on realisation of the application money. The Company will execute and send Letter of allotment /Debenture Certificates evidencing the title of the Debentures in favour of the allottees, not later than 30 days from the date of allotment. In the event of the Company issuing Letter of Allotment, the same shall be exchanged for Debenture Certificates, to be issued within three months, or within such further period as may be permissible, after completion of all formalities. The company is also agreeable to issue the debentures in a dematerialized form. DENOMINATION OF THE DEBENTURE CERTIFICATES: The Company will normally issue a consolidated debenture certificate for the debentures allotted to the investors. The applicant may request the Company to issue the certificate in market lots by specifying the same in the Application Form. If the applicant does not specify/incorrectly specifies the denomination required by him, the Company will issue one consolidated certificate. Under no circumstances will any of the certificates be split into denominations of less than 1000 debentures of face value Rs. 100/- each. SURRENDER / DEBENTURES REPURCHASE AND REISSUE / RESALE OF The Company shall have the right to accept surrender or to repurchase the Debentures in full or part(s) thereof at any time or prior to the date(s) of redemption from the secondary markets and reissue/resell them from time to time, in accordance with the provisions of section 121, of the Companies Act, 1956. Upon reissue/resale of any Debentures, the new holders of the debentures shall have and always deemed to have had the same rights and priorities/privileges, as if the Debentures had never been repurchased/redeemed. The Debentures so reissued or sold shall be covered and secured by the original mortgage deed/trust deed to be executed by the Company. Where the Company has repurchased any Debentures comprised in this issue, then the Company shall have and be deemed always to have had the power to resell/reissue the Debentures, as the case may be, either by reissuing the same Debentures or by issuing other Debentures in their place. HOW TO APPLY: Applications for the Debentures must be made in the prescribed form, and must be completed in block letters in English. Either a demand draft or cheque, drawn or made payable in favour of “First Leasing Company Of India Limited” and crossed Account Payee only must accompany application Forms. RIGHTS OF ALL DEBENTUREHOLDERS: The Debentureholders will not be entitled to any rights and privileges of shareholders other than those available to them under statutory requirements. The Debentures shall not confer upon the holders the right to receive notice, or to attend and vote at the general meetings of shareholders of the Company. The principal amount and interest, if any, on the Debentures will be paid to the holder only, or in the case of joint holders, to the one whose name stands first. The Debentures shall be issued to the allottee(s) of such debentures by the Company and also in the Trustee Agreement/trust Deed. MODIFICATIONS OF RIGHTS: The rights, privileges, terms and conditions attached to the Debentures may be varied, modified or abrogated with a written consent of those Debenture holders, who hold atleast three fourth of the outstanding amount of the Debentures or with the sanction accorded pursuant to a resolution passed at a meeting of the Debenture holders, provided that nothing in such consent or resolution modifies or varies the terms and conditions of the Debentures, if the same are not acceptable to the Company. NOTICES: The notice to the Debenture holders required to be given by the Company or the trustees shall be deemed to have been given if sent by courier to the sole/first registered holder of the Debentures, as the case may be. All notices to be given by the Debenture holders shall be sent by registered post or by hand delivery to the Company or to such persons at such address as may be notified by the Company from time to time. FINANCIAL PERFORMANCE OF THE COMPANY: The Financial Highlights of the Company are as under: Fig. In Rs. Crs. Financial Year Total Income Financing Charges Depreciation Profit Before Tax Profit After Tax Dividend (%) Equity Share Capital Reserves & Surplus Networth Total Borrowings Total Assets Debt Equity Ratio (Times) Book Value (Rs) 6 months ended September 30, 2003 57.72 24.83 14.16 11.17 12 months ended 31.3.2003 (audited) 136.18 58.57 33.10 21.52 16 months Ended 31.3.2002 (audited) 189.23 83.71 55.88 22.54 Year Ended 30.11.2000 10.31 -21.18 19.11 20.00 21.18 17.88 26.67 21.18 *16.56 25 21.18 122.06 111.75 97.16 84.93 143.24 420.23 690.35 2.93 132.93 413.43 675.27 3.11 118.35 472.19 710.13 3.98 106.11 414.4 645.75 3.90 62.85 62.73 55.86 50.10 (audited) 155.90 59.41 55.10 20.82 * First Leasing registered a Net Profit of Rs.1656.90 lacs for fiscal 2000. The Return on Networth is an impressive 15.61%. The Net Profit of Rs.18.56 crores posted by the company for fiscal 1999 included an one time non-recurring, nonoperating revenue of Rs.3.5 crores representing the capital gain on sale of First Leasing’s equity stake in First India Asset Management Ltd (FIAM). After adjusting this one time non-recurring, non-operating revenue of Rs.3.5 crores, the Adjusted PAT for fiscal 1999 computes at Rs.15.08 crores and the reported Net Profit of Rs.16.56 crores for fiscal 2000 represents an improvement of Rs.148 lacs over the previous year’s Adjusted PAT. Financial Highlights & Key Ratios 31-Mar-03 Audited 31-Mar-02 * 30-Nov-00 30-Nov-99 30-Nov-98 Audited Financial Highlights Audited Audited Audited Rs / crores Gross Income 136.18 141.92 155.90 141.31 129.89 Operating Profit 113.20 121.60 135.35 126.92 115.27 PAT 19.10 13.40 16.56 18.58 14.75 Equity 21.18 21.18 21.18 21.18 21.17 132.92 118.34 106.12 95.38 82.66 Operating Profit Margin (%) 83.13 85.68 86.82 89.82 88.74 PAT Margin 14.03 9.44 10.62 13.15 11.36 90.18 63.28 78.19 87.72 69.67 14.37 11.33 15.60 19.48 17.84 Net Worth Key Ratios (%) Return on Equity (%) Return on Net Worth (%) Current Ratio (Times) 1.74 1.70 1.71 2.33 2.38 Debt Equity (Times) 3.11 3.99 3.90 3.74 3.72 Interest Coverage (Times) 1.93 1.94 2.28 2.53 2.52 (Rs) 9.02 6.33 7.82 8.77 6.97 EPS * Figures are annualised Financial Highlights & Key Ratios for 6 months ended Sep. 30, 2003 Rs / crores 6 months 30.9.03 (unaudited) Financial Highlights 57.72 Gross Income 50.17 Operating Profit 10.31 PAT 21.18 Equity 143.24 Net Worth Key Ratios Operating Profit Margin (%) PAT Margin Return on Equity Return on Net Worth (%) (%) (%) Debt Equity (Times) Interest Coverage (Times) EPS * Figures are annualised (Rs) 86.92 17.86 *97.35 *14.39 2.93 2.02 *9.73