Use of Debentures in Secured Credit Transactions

advertisement

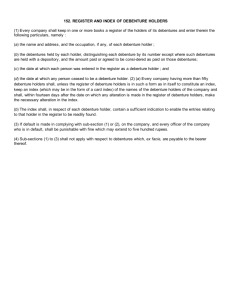

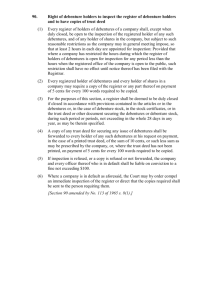

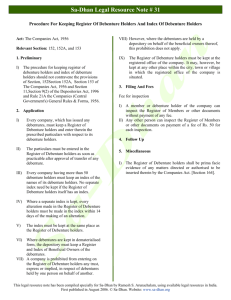

THE USE OF DEBENTURES IN SECURED CREDIT TRANSACTIONS SEMINAR PAPER 14 TOCHUKWU KELLY C. MOGBO: 109061121 17/5/2011 LECTURER - DR. O.`` AMOKAYE AN OVERVIEW Borrowing is an important method of financing the activities of companies in most commercial climes. A company may finance itself not only via issuance of shares but also by incurring debt. These two principal means of financing corporate activities come with their peculiar incidents. This paper however concentrates on debt financing. As with shares, the rights of the debtors against the company are primarily a matter of contract between the company and the lender; the agreements struck between creditor and company can be quite varied. One form of borrowing by a company is by issuing debentures. When the term ‘debenture’ is used in its familiar commercial sense, it means a series of bonds which evidence the fact that the company is liable to pay the amount specified, often times with interest, and generally charge the payment of it upon the property of the company. The term ‘debenture’ is not a creation of modern company lawyers and appears to have been known long before the advent of joint stock companies. Although debentures are basically debt instruments, they differ in some respects from an ordinary debt because of the special treatment which the CAMA accords them. The peculiar incidents of this genus of debt are considered in this paper. Also to be considered are some of the challenges in the use of debentures as a means of obtaining credit. 2 SECTION 1 DEFINITION The evolution of the concept of the debenture through the years has give rise to the ambiguity that attends its view. The answer to the question ‘What is a debenture?’ appears to be quite varied owing to the divergent use of the word. It is possible to use the term ‘debenture’ in at least three different lights – as a debt instrument, and as a class of securities1. The Black’s Law Dictionary2 describes a debenture in the following words: “A debt secured only by the debtor's earning power, not by a lien on any specific asset. 2. An instrument acknowledging such a debt. 3. A bond that is backed only by the general credit and financial reputation of the corporate issuer, not by a lien on corporate assets.” Similarly an early author writing on the subject stated that: “The word ‘debenture’ in its archaic sense was applied to a form given under seal as an acknowledgment for goods supplied to the Royal Household, and as such probably meant a [an acknowledgement of debt]. The term was further applied to drawback certificates issued for repayment, on the exportation of goods, of duty which had already been paid upon them, and this term is still so used by H.M. Customs.....3” Inherent in the above definition is the perception that a debenture is in fact a documentary instrument acknowledging debt and not secured with any charge on the asset of the company. It is pertinent to note that debenture is not looked upon in commercial circle as a security; rather it is considered as a credit transaction, which may be unsecured as seen in the above 1 For the distinction between security and securities, see Roy Goode’s, article ‘Security: A Pragmatic Conceptualist's Response 15 Monash U. L. Rev. 361 (1989); the distinction is further discussed later in this paper. 2 Black’s Law Dictionary 9th ed. 3 Thomas Froude & Eric V.E. White, The Practice Relating to Debentures (1935). 3 definitions, or secured with the asset of the corporation. Hence, the term ‘mortgage debenture’ is defined as “debenture secured by a mortgage on specific property”4. In modern corporate finance, the term ‘debenture’ has acquired a specialized, technical meaning to indicate an acknowledgment of indebtedness given under seal by an incorporated company, containing a charge on assets of the company, and carrying an agreed rate of interest until payment, but the variety of the forms which a debenture may take makes it difficult to find a good general definition in any reported case5. How is the concept of debenture viewed within Nigerian jurisprudence? Section 650 of The Companies and Allied Matters Act6 describes it as: “ a written acknowledgement of indebtedness by the company setting out the terms and conditions for the indebtedness and includes debenture stock, bonds and any other securities of a company whether constituting a charge on the assets of the company or not”. The Nigerian courts have also proffered views on the concept. Perhaps the best known judicial definition of the term ‘debenture’ is as espoused in Intercontractors Nig Ltd v N.P.F.M.B.7 where Karibi-Whyte JSC. postulated that “a debenture consists of a debt owed by the company to another secured by a deed which prescribes the condition of the realization of the debt. 8 It is worthy of note that the inclusionary definition handed down by the Supreme Court in the above case implies the presence of security in a debenture arrangement. However, this writer questions the appropriateness of the description of the security as the deed. Is the deed ipso facto security, or merely a document detailing the rules governing the security arrangement? This writer’s humble view is that if the function of security is “to increase the pool of assets out 4 Webster's Revised Unabridged Dictionary (1913) Thomas Froude, op cit. 6 Cap.C20 LFN 2004 7 (1988) 2 NWLR (Pt 76) page 280 8 This definition has been adopted in a number of cases. See for example U.B.N. v Tropic Foods [1992] 3 NWLR (Pt 228) page 231; NIDB v Olalomi Ind Ltd.[2002] 5 NWLR (Pt761) page 532 5 4 of which the creditor may satisfy his claim”9, then it is not the deed, but an asset which usually is the subject matter of the deed that can truly be referred to as the security. The difficulty in defining the term ‘debenture’ notwithstanding, L.C. Gower surmises that“there is no doubt that where a company creates a series of securities, acknowledging the indebtedness of the company, offers them to the public and introduces them to trading on a public market, then there exists a debenture.10” This perspective of debenture as a series or class of securities receives closer scrutiny in the succeeding paragraph. THE CONCEPT OF SECURITIES AND SECURITY INTEREST AS RELATES TO DEBENTURE The broad-range view on security is that the criterion to be applied to determine whether a transaction is a security, after its incidents have been determined, is its ability to fulfil the function of security. This generous ascription to security is best encapsulated in David Allan declaration: “Anything that performs the function of security must be a security”11. A pertinent question would therefore arise in the light of the definition of ‘debenture’ ascribed in the section 650 of CAMA earlier quoted, on the nature of security interest created by a debenture12. The concept of unsecured debentures necessarily flags off an enquiry as to the nature of interest conferred on the parties of a debenture transaction. Simply put does an unsecured debenture confer any security interest on the holder of such debenture note, and what is the nature and incident of such interest? 9 David E. Allan ‘Security: Some Mysteries, Myths, and Monstrosities’ (1989)15 Monash U.L Review, page 345. L.C. Gower ‘Principles of Modern Company Law’ 8th ed., page 1140 11 David E. Allan op cit. 12 Going by S.650, CAMA “a written acknowledgement of indebtedness by the company setting out the terms and conditions for the indebtedness” is classified as a debenture “whether constituting a charge on the assets of the company or not “(Emphasis supplied). 10 5 Professor Sir Roy Goode13 states that security interest is “a right given to one party in the assets of another party to secure payment or performance by that other party or by a third party” and postulates that it arises from a transaction intended as a security, and is created by grant or declaration of trust not by reservation. The inescapable implication of this definition is that for a security interest to exist in a credit transaction, there must exist an asset to which the security interest attaches. It would therefore appear from Goode’s perspective that a unsecured debenture14 does not confer any security interest on the debenture holder. On the raison d’etre of security interest, Woode15 has this to say: “A security interest is primarily a protection against the insolvency of the debtor, since normally if the debtor remains solvent the creditor has no need for the priority property right.” If this is taken as true, then it must be surmised that the debenture as an instrument does not conceive of any class of inherent security interest; the nature of interest attaching to each debenture transaction will thus be molded by the general rules governing secured credit transactions16. Another implication of CAMA’s definition of debenture is that it can be classified as a securities17 transaction. The learned writer, Fidelis Oditah18 acknowledges that securities could be used in at 13 R.Goode, Commercial Law (Harmondsworth, Penguin Books/allen Lane, 1982) page 733. Also referred to as ‘naked debenture’ 15 Wood, P., Comparative Law of Security Interest and Finance, Sweet & Maxwell(2007), page 25. 16 As we shall see in the latter part of this paper, there is but one major exception – relating to the applicability of the rule against excluding the right to redeem. 17 As may be gleaned from previous papers on the subject, the term “securities” is a common word in legal phraseology. Although, one may be inclined to regard it as the plural form of security, such a conclusion will be misleading. “Securities” is a very different terminology from “security”. To help our understanding of this matter, Goode argues that the term “security” should not be confused with the term “securities”. He states that “securities” is the term used for investment instruments such as shares and bonds. While there are relationships between the concepts, securities refer to property of a type and not to a legal transaction over property. It is therefore possible to have taken or given a security over certain securities. See generally, Goode R. M., Legal Problems of Credit and Security, Sweet and Maxwell, p.1 (2003) 18 F. Oditah’s contribution to the book “Contemporary Issues in Nigerian Law” page 125 14 6 least two wholly different senses. In one sense it may mean shares, stock, debenture and other financial assets usually traded on organized securities market. In the classical sense, the debenture is usually issued in units to members of the public, or a specific class of creditors19. These debt notes may be transferrable and infact traded. It is in this sense that debenture is looked upon as a form of securities. It is very likely in this sense that the Investment and Securities Act20 views debenture when the Act defines it to mean: “(a)debentures, stocks or bonds issued or proposed to be issued by a government; (b) debentures, stocks, shares, bonds or notes issued or proposed to be issued by a body corporate; (c) any right or option in respect of any such debentures, stocks, shares, bonds notes…” As used in the foregoing provision, the term ‘securities’ will include shares, debentures, debenture stock, bonds, notes (other than promissory notes) and perhaps units under a unit trust scheme21. A formal approach to security is used to connote a proprietary interest over an asset22. The principal reason for security is to enhance the certitude of repayment of the loan advanced, although security may be capable of performing other functions. This is achieved by 19 ‘Debenture Stock’ is described as “borrowed money consolidiated into one mass for the sake of convenience”. See Charlesworth and Cairn Company Law 13th ed page 560 20 Cap I15, LFN 2004, Section 315 21 The CAMA recognizes debenture in the sense of securities when it defines securities in the same section 650 as follows: “In this PART, that is, PART A of this Act, unless the context otherwise requires, - ‘securities’ include shares, debentures, debenture stock, bonds, notes (other than promissory notes) and units under a unit trust scheme”. 22 See Bristol Airport v Powdrill Browne where Wilkinson V-C postulated that “Security is created where a person (‘the creditor’) to whom an obligation is owed by another (the debtor’) by statute or contract, in addition to the personal promise of the debtor to discharge the obligation, obtains right exercisable against some property in which the debtor has an interest in order to enforce the discharge of the debtor’s obligation to the creditor.” 7 giving the secured creditor a right of obligation property, which includes the right of pursuit and the right of preference or priority.23 While it is true that many of the definitions adopted above describe the debenture in terms of a debt transaction without security, and although we have identified the possibility of a debenture being issued without security, in reality this seldom happens. The predominant practice is for debenture issued by companies to be secured with an asset belonging to the company. The legal right over asset pledged as security enables a secured creditor to enforce his security without having to go through the sometimes tumultuous journey of a court action. Even where the secured creditor requires the intervention of the court in order to enforce his security, the procedure is cheaper and less time consuming as he can proceed against the property directly in court. This is unlike an unsecured creditor who has no property right in the assets of the debtor and who can only enforce his claim by obtaining a judgment for a debt before proceeding to levy execution.24 The right of preference or priority is the secured creditor’s right to appropriate a specific property, which is the subject matter of the security interest, in satisfaction of his claim in the face of competing claims of third parties. This right is available whether or not the debtor is in liquidation since the secured creditor may exercise his right to dispose of the property in satisfaction of the outstanding debt. LEGAL NATURE OF A DEBENTURE Viewed from the perspective of our earlier definition of a debenture is an instrument acknowledging indebtedness, there is a spin-off of a number of legal incidents. 23 24 F. Oditah’s contribution to the book “Contemporary Issues in Nigerian Law” (op. cit) page 126 ibid 8 We have said elsewhere in this paper that a debenture does not enjoy special treatment in the law of secured credit transaction. However, one notable exception to this assertion is that the equitable rule which invalidates restrictions on a mortgagor’s right to redeem does not apply to debentures, with the consequence that a debenture may be perpetual or irredeemable as we shall see shortly. While legal rules apply strictly to the bindingness of the loan contract envisaged under a debenture arrangement, it is doubtful that the principles of equity apply stricto sensu. For instance, unlike the traditional case in legal mortgage of under conventional loan contracts, the equitable rule which invalidates restrictions on a mortgagor’s right to redeem does not apply to debentures25. This line of thought was followed by the court in Knightsbridge Estates ltd v Byrne26. The case concerned an ordinary mortgage on houses, shops and a block of flats by a company to secure a loan of 310,000 pounds from an insurance company. The loan was to be repayable by 80 half-yearly installments spread over 40 years but became immediately repayable if the mortgagor should sell the equity of redemption. The company was forbidden from selling any of the properties free from the mortgage or from granting leases for more than three year without the consent of the mortgagee. Five years later, the company wished to pay off the mortgage in full and argued that the term making the mortgage irredeemable for 40 years was void as a clog on the equity of redemption. The question was whether the mortgage was a debenture under the relevant statute at the time. The House of Lords held that it was, and further that a debenture was not subject to the rule against the clogging of the equity of redemption. The possibility of excluding application of the equity of redemption for debentures is to allow companies to issue perpetual and irredeemable debentures. The CAMA supports this practice and states that 25 26 Boyle & Birds “Company Law” 6th ed., page 331 [1940] A.C. 613 9 “a company may issue perpetual debentures and a condition contained in any debentures, or in any deed for securing any debentures, shall not be invalid by reason only that the debentures are made irredeemable or redeemable on the happening of a contingency, however remote, or on the expiration of any period however long, any rule of equity to the contrary notwithstanding.”27 There is the argument in some quarters that a debenture is very much akin to a bill of sale. On the issue, the learned author, J Omotola28 stated: “a debenture generally is not such an instrument that qualifies as a bill of sale even where it is secured by a fixed or floating charge notwithstanding that such a charge creates a right over personal chattels.” Indeed Section 17 of the Bills of Sale Act 1882 expressly excludes debentures from its operation so that it is not required either that the instrument comply with the statutory form as prescribed by the Act or registered in accordance with its provisions. On the issuance and transfer of debentures, the Investment and Securities Act prescribes that all debentures29 shall be registered with t at the Securities and Exchange Commission. The Act prohibits the issuance, transfer, offer or sale of any class of debentures to the public without prior registration of same with the Commission30. Given that statutory description of debenture is usually classed alongside shares. It is pertinent to inquire if the debenture shares the same characteristics as shares. In the case of Borland’s Trustees v Steel Brothers & Co. Ltd31, the court offered a description of the legal nature of shares and stated: “A share is the interest of a shareholder in the company measured by a sum of money, for the purpose of liability in the first place and the interest in the 27 Section 171 J Omotola, “the Law of Secured Credit” (Evans Brothers Nigeria Publishers Limited) page 296 29 The section actually says ‘securities’; however securities has elsewhere in Section 315 been defined to include debentures. 30 Section54(6) criminalizes the issuance transfer sale or offer for subscription of Debenture notes without prior registration. The offence is punishable with a term of imprisonment of three years with fine. 31 (1901) 1CH299 28 10 second, but also consisting of a series of mutual covenants entered into by all the shareholders inter se . . . a share is not a sum of money, but is an interest measured by a sum of money and made up of various rights contained in the contract including the right to a sum of money of a more or less amount.” In contrast with a shareholder, the debenture holder is in law not a member of the company having rights in it, but a creditor having rights against it. In reality, however, the difference between the debenture and the share may not be that clear-cut because the debt instrument may confer on the holder certain contractual rights akin to those of a shareholder. e.g. to appoint a director, share profits (whether or not available for dividend), attend and vote at general meetings. Covenants in the debt instrument may also give the debenture holders considerable influence over the way in which the company is managed. Moreover, where the debenture is secured by a floating charge on all the undertaking the assets of the company, the holder will have a legal or equitable interest in the company’s business, albeit of a different kind from that of the shareholders32. The line of distinction between the shareholder and debenture holder shrivels even further when considering preference shares which may confer the shareholder much the same rights as a debenture holder, including the right to a fixed rate of profit. The main difference between the two in such a case may then be that the dividend on a preference share is not payable unless profits are available for distribution, whereas the debt-holder’s interest entitlement is not subject to this constraint; and that the debenture-holder will rank before the preference holder in a winding up33. For example, Gower34 argues that although “the accounting rules operated operate with a binary divide between debt and equity, . . . the practice leads to the creation of securities whose classification in accordance with this divide is problematic.” In support of this 32 L.C. Gower, op cit. page 1139 There are continued arguments, which cannot be multiplied in a short treatise like this about the distinctions and similarities between the debenture-holder and shareholder. 34 L.C. Gower op cit. 33 11 argument, the learned author points to the so-called hybrid securities e.g. convertible debenture which could be converted to equity. It is however this writer’s humble opinion that implicit in the option to convert from one form of securities to another is the understanding that until so converted, the debenture is not seen in the same light as a share in the eyes of the law. Upon compliance with registration requirement relating to debentures the securities may be transferrable. A contract with a company to take up and pay for debentures is specifically enforceable. This seems to reflect an analysis to the effect that, in the case of a public offer of debentures, a change in market conditions would deprive the company of the alternative upon which the general contractual rule is based, i.e. that the company could raise money from another borrower. However, in the absence of a public offer, CAMA does not specify the issuing process. Unlike with shares, there is no rule in the Act that, even for public companies the authorization of the shareholders or the existing debenture-holders is required for an issue of debentures, though this matter may well be one of the matters regulated in the trust deed of the existing debenture-holders. In some ways this is surprising, since a large increase in the company’s debt could have a significant impact on the prospects of the debenture-holders. Nor does the Act create pre-emption rights on an issue of debentures. Again, since debt does not count as legal capital, the rule relating to issuance at a discount, or capital maintenance rules do not apply to debentures. One could also be faced with problems similar to those in relation o shares, regarding equitable and legal ownership of debentures and the priority of competing transferees. But the great difference here is the lesser role played by registration. Like with members a company is obliged to maintain a register of debenture-holders35. Howbeit, the Act says nothing about the register being evidence of ownership, and it is not clear what role, if any, it plays in converting an equitable interest to a legal one. On general principles relating to assignments of choses-in35 Section 193(1) 12 action, a transfer of a debenture should be an equitable assignment only, until it becomes a legal assignment when the company receives notice of it. In principle, therefore, the legal interest should pass from transferor to transferee when the company is given notice of it, and that date, rather than the later date of actual registration, should be the relevant one in determining its priority over earlier unnotified transfers. TYPES OF DEBENTURES: Naked Debenture: This is in keeping with the traditional view of debenture as an instrument of borrowing which does not attach any charge on the assets of the company has given way. As seen previously, the CAMA stipulates clearly that debentures may be unsecured with the assets of the company36. Secured Debenture: Debentures may be secured by a fixed charge on certain of the company’s property or a floating charge over the whole or a specified part of the company’s undertaking and assets, or by both a fixed charge on certain property and a floating charge37. A charge securing debentures shall become enforceable on the occurrence of the events specified in the debentures or the deed securing the same. Pepertual Debenture: A company may issue perpetual debentures and a condition contained in any debentures, or in any deed for securing any debentures, shall not be invalid by reason only that the debentures are made irredeemable or redeemable on the happening of a contingency, however remote, or on the expiration of any period however long, any rule of equity to the contrary notwithstanding.38 36 Section 173 Section 173(1) &(2) 38 Section 171 37 13 Convertible Debenture: Debentures may be issued upon the terms that in lieu of redemption or repayment, they may at the option of the holder or the company, be converted into shares39. Debentures may either be secured by a charge over the company property or may be unsecured by any charge. CREATION OF DEBENTURES “A company may borrow money for the purpose of its business or objects and may mortgage or charge its undertaking, property or uncalled capital or any part thereof and issue debenture, debenture stock, and other securities whether outright or as security for any debt, liability or obligation of the company or of a third party.”40 Debenture is usually created by an instrument. Usually the instrument consists of the terms of the debenture particularly, the principal and the coupon rate41. The company must confirm from its Articles of Association to ascertain that borrowing is not ultra vires the company. This is important because a borrowing which is outside the object of the company is ultra vires and void. Where the directors borrow money on debenture in excess of the amount authorized by the Articles, the debenture is void and the security unenforceable unless the lender can rely on the provision of Section 69(a) of CAMA which is similar to the common law rule in Royal British Bank v Turquand42. Thereafter, pursuant to a board 39 Section 172 Section 166 41 i.e. interest payable on each debenture note 42 (1856)119 E.R. p.886. Section 69(a) provides that “anyone having dealings with a company or with someone deriving title under the company shall be entitled to make the following assumptions and the company and those deriving title under it shall be stopped from denying the truth that the company’s memorandum and articles have been duly complied with.” It is relevant to note that the provisions of CAMA however protects creditors against the harshness of the consequences of ultra vires transaction. For instance, Section 39(3) provides that no act of a company shall be invalid by reason of the fact that such act, conveyance or transfer was not done or made for the furtherance of any of the authorized business of the company or that the company was otherwise exceeding its powers. 40 14 resolution of the company, authorizing the issuance of the debenture, the company proceeds to issue same. Apart from the company’s register, companies that issue debentures have a statutory obligation to maintain a register of all debenture-holders43. Similarly, where an asset is subject to charge as security for the debenture, such a charge must be duly registered44. The registration is done at the Corporate Affairs Commission (CAC) within 90 days after the creation of the charge or debenture. Where the particulars of a charge are not registered, the charge shall be void as against the company’s liquidator or creditors. For a loan from one person or a few persons, a simple debenture deed is used. However, for a loan for a large number of persons or to the public at large, this must be done via issue of debenture stock under a Debenture Trust Deed entered into between the company and a trustee appointed for the debenture holders45. The company issues debenture notes to targeted members of the public. Where the borrowing is to be secured by a charge on the assets of the company, the company offering debentures to the public for subscription is mandated to execute a Debenture Trust Deed in respect. The Debenture Trust Deed enables many debenture holders to hold security by having legal interest vested in the trustees in trust for the beneficiary debenture holders and the trustees can retain custody of title deeds in the case of legal mortgages46. Section 168 of the CAMA provides minimum requirements for the content of every Debenture which includes: a. The principal amount borrowed; 43 Section 193 Section 191 45 Section 198 46 See generally J Omotola “The Law of Secured Credit” 9Evans Brothers Nigeria Publishers Limited)pages 294 -295 44 15 b. The maximum discount which may be allowed on the issue or re-issue of the debentures, and the maximum premium at which the debentures may be made redeemable; c. The rate of and the date on which the interest on the debentures issued shall be paid and the manner in which payment shall be made; d. The date on which the principal amount shall be repaid or the manner in which redemption shall be effected, whether by the payment of installments or principal or otherwise; e. In the case of convertible debentures, the date and terms on which the debenture may be converted into shares and the amounts which may be credited as paid up on those shares, and the dates and terms on which the holders may exercise any rights to subscribe for shares in respect of the debentures held by them; f. The charges securing the debenture and the conditions subject to which the debenture shall take effect. Interestingly, although the CAMA allows for naked debenture, it makes it mandatory that all debentures be supported with a trust deed that must state “the charges securing the debenture”47. We submit that there is therefore need for legal reform to correct this ambiguity. The Trustee The Debenture Trustee is an intermediary between the issuer of debentures and the holders of debentures. Whether or not a debenture is secured by a charge over the assets of the company, it may be secured by a trust deed appointing a trustee for the debenture holders 48. Accordingly 47 Section 168 (f) quoted above. In further exacerbation of this contradiction, Section 184(c)& (d) reinforces the provisions of Section 168 making the inclusion of details of the asset charge, whether or not the debenture trust deed is required under section 183. 48 Fidelis Oditah , ‘Issues and Problems in Corporate Debt Financing in Nigeria’ Contemporary issues in Nigeria Law page 103 16 the main responsibility of debenture trustee is to protect the interest of holders of debentures including creation of adequate security by the company issuing the debentures and to redress their grievances. He may also take such steps as he deems fit to protect the debenture holders and the assets used as security. He may do either of the following: 1. ensure on a continuous basis that the assets of the company issuing debentures and each of the guarantors are sufficient to discharge the principal amount and the interest at all times; 2. to satisfy himself that the prospectus or the letter of offer does not contain any matter which is inconsistent with the terms of debentures or with the trust deed; 3. to ensure that the company does not commit any breach of covenants and provisions of the trust deed; 4. to take such reasonable steps to remedy any breach of the covenants of the trust deed or the terms of issue of the debentures; 5. to take steps to call a meeting of holders of debentures as and when such meeting is required to be held. The trustee of a debenture trust deed is required in law to hold all contracts, stipulations and undertakings given to him and all mortgages, charges and securities vested in him in connection with the debentures covered by the deed exclusively for the benefit of the debenture holders concerned. The trustee is further mandated to exercise due diligence in respect of the enforcement of those contracts, stipulations, undertakings, mortgages, charges and securities and the fulfillment of his functions generally49. Needless to say, that the aforesaid responsibilities are intended to protect the interest of the debenture holders. One of the 49 Section 176(1) 17 aforesaid requirements relate to adequacy of security so that in the event of failure of issuer of security to redeem the debentures, (which is an event of default) the Debenture Trustee should enforce the security and pay off the debenture holders by disposing off the secured assets. 18 SECTION 2 ENFORCEMENT AND PROTECTION OF RIGHTS OF THE DEBENTURE HOLDER Enforcement right is a subset of the right of property. The right of preference and pursuit is the right to take a specific property, which is the subject of the security interest, without having recourse to the court of law and to follow the property into whatever new thing it assumes. It also includes the right to follow the property into the hands of any person who receives it. Although, in some cases, the possibility of tracing the property might be limited by special common law or equitable rules designed to protect recipients of such property such as a plea by a bona fide purchaser for value without notice of the security interest.50 An uncontroversial feature of security interest is that it confers an interest in property that is defeasible or destructible upon the payment of the debt or performance of the obligation which was secured.51 In the enforcement of security the law places very few obligations on the secured creditor, such as the obligation to register the security where it is a charge,52 avoidance, avoidance of fraudulent preferences,53 and statutory limitations which are imposed on floating charge. Apart from these, the law does not impose on a creditor enforcing his security any duty of care as to timing of enforcement even where it is calculated to spite the debtor, provided that in exercising any power of sale he does so with reasonable care. 50 F. Oditah op. cit page 126 Elis Ferran, “Principles of Corporate Finance Law” (Oxford University Press) page357 52 Section 197 CAMA 53 Ibid. sections 495 and 496 51 19 The CAMA provides that a contract with a company to take up and pay for any debentures of the company may be enforced by an order for specific performance.54 The Debenture Trust Deed is perhaps the most important document to the debenture holder in exercising and enforcing the rights accruing by virtue of the debenture. A trust deed organizes debenture holders, where they are a sizeable number55 and would usually provide for meetings of debenture holders to discuss matters affecting the interests of the holders, enabling resolutions to be passed at such meeting with the prescribed majority, binding on all debenture holders of that class. Ordinarily a majority rule applies and debenture-holders resolution can bind dissentient minorities. However, this power to bind minorities must be exercised bona fide56. A debenture holder has a right of action against the company, and in appropriate cases, the trustee. This is a personal right and not necessarily to be brought as a class action. In summary the remedies of the debenture holder include: 1. Power of Sale: Most debenture deeds will usually provide for this power. The power of sale will be exerciseable without resort to the courts. It is clear from Section 123 of the Property and Conveyancing Law that even in the absence of the express power, the holder has an implied power of sale. 2. Foreclosure: This is however only available to holders of a secured debenture. The remedy of foreclosure is only available by the sanction of the court, vide a class action. 3. Receivership: This remedy applies to both fixed and floating charges. In the case of a floating charge, the court may , notwithstanding that the charge has not become 54 Section 170 As in the case of a public issue 56 See British America Nickel Corp Ltd v MJ O’Brien Ltd [1927] A.C. 396 55 20 enforceable, appoint a receiver or manager if the court is satisfied that the security of the debenture holder is in jeopardy57. 4. Winding up: The debenture holder, whether secured or not can bring an action for winding up under Section 408 (d)58. Unsecured Debenture: Because security puts its holder in an advantageous position in the event of insolvency, it may enable the company to borrow from a wider pool of lenders. It is for this reason that secured debentures are vastly popular. However, unsecured debentures are operable for companies with sufficient credit-worthiness, and a long-standing reputation of meeting obligations. The unsecured debenture usually comes with higher interests to trade off the obvious risk of being left out in the cold in the event of a downturn in the company’s fortunes.59 However, the unsecured debenture-holder has available to him the traditional right of action to sue for his debt and may even apply for the winding up of the company under Section 408(d). Forms of Security Interest in Debenture: a. Legal Mortgage In most secured debenture arrangements, a legal mortgage will occur where the mortgagor transfers the share to the mortgagee and the name of the mortgagee is entered in the register as the holder of the securities. The legal interest in the mortgaged property is usually held by the 57 See section 180 (2) for situations where the court will infer that the security is in jeopardy. This section provides that the failure of the company to pay its debt is a ground for compulsory winding up of the defaulting company. 59 James J White “Efficiency Justifications for Personal Property Security” Vanderbilt Law Review, (April 1984) Vol 37 58 21 trustee on behalf of the debenture holders. Hence as between the debenture holder and the company, there exists only an equitable interest. b. Equitable Mortgage An equitable mortgage is established through the transfer of ownership to the mortgagee or pursuant to an agreement for the transfer of ownership. It should be noted that an equitable mortgage or an assignment of same to a third party is a vulnerable form of security as the company is not under an obligation to register the mortgagee or the assignee and an equitable mortgage will usually be subjected to a prior equitable mortgage.60 c. Charge A Debenture may be expressed to be secured with “fixed and floating charge on the assets of a company”. A fixed charge is usually created in the same way as other mortgages i.e. the transfer of proprietary interest of the company in the fixed assets as security for a loan subject to cesser on redemption61. A debenture secured by a fixed charge takes the form of a mortgage legal or equitable, with attendant rights and obligations of the parties as in the ordinary mortgage involving the individual62. In Siebe Gorman & Co. v. Barclays Bank Ltd63, a charge on “all books debts and other debts, from time to time due or owing to the company” was held to be a fixed charge because the debenture not only prohibited the plaintiff’s consent but it also imposed controls on receipts by requiring these to be paid into a blocked account. The agreement creating a charge may stipulate that the intermediary the charge would be transferrable to third parties who would then exercise all the rights incidental to such a charge. . 60 Goode on legal problems of credit and security (op cit) page 253 Re New Bullas Trading (1994) 1 BCLC Also 62 I.O Smith “Nigerian Law of Secured Credit” Lagos Ecowatch, (2001) page 299 63 (1979) 2 lloyd’s Report p.12 61 22 The court in Union Bank of Nigeria v Tropic Foods64 recognized that interest conferred by a floating charge is ambulatory and continues to float until the occurrence of the crystallizing event. Also, the same principle applicable to an equitable mortgage applies equally to a charge as a charge is essentially equitable in nature. It will appear that the only difference is in the mode of creation. DEBENTURES HELD AS SECURITIES We have previously seen that debentures are characterized by both the CAMA and the Investment and Securities Act as securities. The latter legislation empowers the Securities and Exchange Commission to regulate the Nigerian Stock Exchange. However, the Nigerian Stock Exchange is yet to be fully developed and only supports the equities market, with virtually no activity in the debt market aside from government bonds. This thus hampers the view of debentures as tradable instruments. Unlike the more developed climes from which the idea of debenture as securities was borrowed, debenture holders in Nigeria are yet unable to freely transfer their interest to third parties on the floor of the exchange. This is in spite of the fact that CAMA declares debentures to be freely transferrable65. Although the newly compiled SEC Rules released in 2011 makes provision for the derivatives and bond markets, it is this writer’s opinion that the Nigerian financial market is not yet sufficiently mature to rise to the trade platform of these securities66. It is must be understood that the Nigerian Stock Exchange is primarily driven by speculation as against hard facts drawn from company’s performance. However, in contradistinction to shares 64 [1992] 3 NWLR (Pt 228) page 23 Section 189(1) 66 The reasons for this are in the writer’s view, mainly extralegal. For the strongest financial markets the world over, the most actively traded securities are equities. The growth in the equities market would usually inspire investor confidence in trading on debt securities. 65 23 which are traded on account of their speculative nature, debentures usually do not lend themselves to speculation since they usually have fixed coupon rates. In other words, debenture stock generally have fixed and predictable income. Thus, they tend to be largely unattractive to the speculating public. However where the debentures eventually become trading securities67, the securities could also be mortgaged and participate in all the advantages the shares enjoy by reason of their transferability. CONCLUSION The purview of this seminar paper has been to show that debentures are a veritable means of creating security interests and underpin credit transactions for companies. We have also shown that due to the proprietary nature of debentures, the debenture-holder has a bundle of rights against the company until the redemption of the debenture. We have also brought to the fore the legal incidents arising from the use of debentures as security in a secured credit transaction. It is suggested that there is a need for statutory intervention to supplement the existing rules of common law governing this aspect of law. Such laws should be made with a view to enhancing 67 For now, they remain merely tradeable. 24 the use of securities in a secured credit transaction. Also, this will make the law in this area certain and further encourage the use of shares as security interest. This is more so in view of the growing interest in the capital market and the ease at which securities can be transferred on the floor of the stock exchange. In addition to the foregoing, it is recommended that our laws relating to the financial market should be enhanced and strengthened in order to encourage trading in debenture securities. But more important is government intervention at a macro-economic level to bolster investor confidence in trading in securities. Additionally investors should be educated on the advantages of having debenture stock. This will foster wider participation in the capital market and encourage the participants to purchase debentures on the market. This in turn will enhance the attractiveness of debentures as security interest in a secured credit transaction. 25