Week 2 Introduction to Economic Concepts (cont)

advertisement

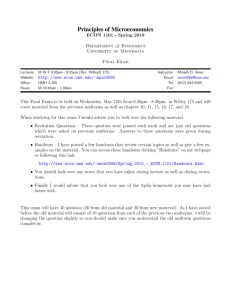

SCHOOL OF ECONOMICS ECON 1101 MICROECONOMICS 1 SESSION 2, 2006 COURSE INFORMATION AND LECTURE SCHEDULE Lecturer in Charge: John Lodewijks Room JG218 Tel: 9385 3386 J.Lodewijks@unsw.edu.au Tutorial Administrator: Ernie Teo Room JG 132 Tel: 9385 1346 E.Teo@unsw.edu.au Microeconomics 1 Website http://vista.elearning.unsw.edu.au CONTENTS PAGE 1. TEACHING STAFF 2 2. INFORMATION ABOUT THE COURSE 2.1 UNITS OF CREDIT AND CLASS HOURS 2.2 LECTURE TIMES AND LOCATIONS 2.3 TUTORIAL GROUP ALLOCATIONS 2.4 RELATIONSHIP OF THIS COURSE TO OTHER COURSES 2.5 APPROACH TO LEARNING AND TEACHING 2 2 3 3 3 3. COURSE AIMS AND OUTCOMES 3.1 COURSE AIMS 3.2 STUDENT LEARNING OUTCOMES 3.3 TEACHING AND LEARNING STRATEGIES 3 4 4 4. STUDENT RESPONSIBILITIES AND CONDUCT 4.1 WORKLOAD 4.2 ATTENDANCE 4.3 GENERAL CONDUCT AND BEHAVIOUR 4.4 KEEPING INFORMED 7 7 7 8 5. ASSESSMENT 5.1 FORMAL REQUIREMENTS 5.2 ASSESSMENT DETAILS 5.3 SPECIAL CONSIDERATION AND SUPPLEMENTARY EXAMS 8 8 29 6. ACADEMIC HONESTY AND PLAGIARISM 29 7. STUDENT RESOURCES 7.1 COURSE WEBSITE 7.2 TEXTBOOK AND READINGS 7.3 PEER ASSISTANCE SUPPORT SCHEME 7.4 OTHER RESOURCES, SUPPORT AND INFORMATION 30 31 32 32 8. CONTINUAL COURSE IMPROVEMENT 33 9. LECTURE SCHEDULE 33 ECON 1101 Page- 1 1. TEACHING STAFF The Lecturer is John Lodewijks (JG RM 218; Ph. 9385 3386, email: J.Lodewijks@unsw.edu.au). He is responsible for the overall direction and content of the course. The Tutorial Administrator is Ernie Teo (JG Rm 132; Ph. 9385 1346, email: E.Teo@unsw.edu.au ). Any questions regarding your allocation to a tutorial group should be directed to Ernie. Information concerning administrative matters may also be obtained from the School of Economics Office on the second floor of the John Goodsell Building (JG 223 Ph. 9385 3335). You should feel free to approach your lecturer about any academic matter. Specific consultation hours will be posted on the course website, in WebCT Vista (http://vista.elearning.unsw.edu.au). The quickest way to contact John is via email: J.Lodewijks@unsw.edu.au. 2. INFORMATION ABOUT THE COURSE 2.1 UNITS OF CREDIT AND CLASS HOURS This course is worth 6 units of credit. There are 2 x 1 hour lectures per week and 1 x 1 hour tutorial class for each student. 2.2 LECTURE TIMES AND LOCATIONS Day Time Location Group A Monday Thursday 1200 – 1300 1300 – 1400 Rex Vowels Webster Th.A Group B Monday 1500 – 1700 Mat. B ECON 1101 Page- 2 2.3 TUTORIAL GROUP ALLOCATIONS Tutorials start in week 2. Students enrol via their MyUNSW site. Once enrolled, moving from one tutorial group to another will not be permitted unless you have compelling reasons. You should consult Ernie about these matters. The Tutorial Program of Topics Readings and Questions is provided in a separate handout. 2.4 RELATIONSHIP OF THIS COURSE TO OTHER COURSES This course is a core requirement for the B.Com and B.Ec. It is a prerequisite for many other courses in the Faculty, including ECON1102 Macroeconomics I and all courses in the School of Economics with a course code number beginning in 2 or 3. Introductory microeconomics provides the foundation for all further study in economics, finance, accounting, organisation and management, marketing and actuarial studies. 2.5 APPROACH TO LEARNING AND TEACHING The philosophy underpinning this course and its Teaching and Learning Strategies (see 3.3 below ) are based on “Guidelines on Learning that Inform Teaching at UNSW”. These guidelines may be viewed at : www.guidelinesonlearning.unsw.edu.au. For students who care about how the world works, microeconomics should be one of the most relevant and exciting courses they study. Yet many students view microeconomics as abstract theory and fail to understand how it relates to actual decisions made by firms, consumers and governments. It is therefore essential that students apply microeconomic logic to practical problems – studying the theory is simply not enough. 3. COURSE AIMS AND OUTCOMES 3.1 COURSE AIMS The aim of this course is to provide an introduction to microeconomic analysis. This means that ECON1101 is an introductory course in the theory of markets with relevant applications to business, social and individual issues. ECON 1101 Page- 3 The course covers the principles and consequences of constrained “rational” choice by individual economic agents in markets. The course also provides introductory analysis of the role of governments in seeking to ensure the efficient and equitable operation of markets. No Previous study of Economics is assumed 3.2 STUDENT LEARNING OUTCOMES On completion of the course, students should be able to: 1. demonstrate an understanding of economic concepts and their appropriate use; 2. construct economic arguments in terms of these concepts; and 3. apply simple economic models to the analysis of relevant economic issues. 4. present logical economic argument in both written and oral form; including the use of economic reasoning to make deductions about market behaviour: and perform simple calculations of costs and benefits The course aims to provide benefits to students in terms of: the ability to use economic principles in ‘rational’ decision-making under a variety of constraints; an understanding of the different market environments in which management, social, and individual business decisions must be made; and an understanding of justifications for, and likely effects of, Government microeconomic policy 3.3 TEACHING AND LEARNING STRATEGIES The Lectures The purpose of lectures is to provide a logical structure for the topics that make up the course; to emphasise the important concepts and methods of each topic, and to provide relevant examples to which the concepts and methods are applied. ECON 1101 Page- 4 The Tutorials The purpose of tutorial meetings is primarily to provide an opportunity for small group discussion of issues to which economic concepts and methods can be applied, and to provide practice and feedback in writing short essays addressing specific questions. (The Discussion Questions). A Tutorial Program of Discussion Questions is provided for tutorial meetings. Students should attempt each set of weekly exercises and later check the solutions on the course website. If time permits, tutorials may also provide an opportunity for assistance with other questions that provide difficulties for students. In Week 10 Tutorials we play the Oligopoly Game. This is an activity that is interesting and challenging, but which also create opportunities for students to have fun, and so can enhance the learning experience. Self-study It is important to note that most learning will be achieved outside of class time. This course has been designed with the expectation that students will prepare for, attend and participate in class as well as review material after classes. It is expected that students will spent an average of seven hours per week in self or group study for this course. Lectures can only provide a structure to assist your study, and tutorials provide an opportunity to follow up and discuss issues. Neither the lecture nor the tutorial will be of any benefit unless you have undertaken the self study required in the course. Electronic Resources & FEEDBACK We will be using the course website, in WebCT Vista (http://vista.elearning.unsw.edu.au), to conduct a number of quizzes and other exercises. Information literacy is a key learning objective and so there is a quiz related to that. Getting speedy and effective feedback on your progress throughout the course is another important feature of this course. Students need to know how they are performing, well before important assessment tasks, and to discover any weaknesses ECON 1101 Page- 5 that require remedy. A number of the on-line quizzes relate to giving students timely feedback. Relating the economic theory to simulated real world markets to make it come alive is another feature of the on-line resources we will use in this course. Students may also access the Study Guide that accompanies the text. We will NOT be using this in lectures or tutorials and the material therein is not examinable. However, some students in the past have found it useful to go through the material in the Study Guide, especially if they are new to the study of Economics. Students also have access to MyEconLab when they purchase the text. The Course ID is: lodewijks49442 Go to http://www.myeconlab.com/mctaggart EconLab helps you to prepare for exams and quizzes, goes over the text chapter materials and assists with the graphs. Suggested weekly study structure Self study/preparation for the lecture Read the relevant chapter(s) of the text and download the lecture overheads from the course website before the lecture. This will give you a general idea of the topic area. Complete any assessment tasks due during the week. Attend the lecture Here the context of the topic in the course and the important elements of the topic are identified. The relevance of the topic should be explained. Self study – Lecture review/tutorial preparation Prepare answers for the Discussion Questions. This will identify the things you need to do to demonstrate your understanding of a topic, and guide your re-reading of specific parts of the text. This will also provide a self-test of your understanding, and identify those parts of the topic with which you have problems. This should be done after the lecture and before the following week’s tutorial. Attend and participate in Tutorials In the week of your assigned Discussion Question (see below) you will be required to present a short (5 - 10 minute) summary of your answer as the basis for discussion by the rest of the class. You are required to submit your answer, written ECON 1101 Page- 6 as a short essay (500 - 1000 words), to your tutor for assessment in the following week’s tutorial. There is an opportunity to do a group presentation (see page 11). In other weeks you should still prepare rough answers to the Discussion Questions so that you can contribute to the discussion. The Discussion Questions are your best preparation for writing essay-type exam answers (see final exam). Seek help if you need it Since the tutorial time is limited, problems may also be addressed by consulting with your tutor or lecturer in their consultation hours, or with the PITSTOP tutors or at the PASS meetings (see below). 4. STUDENT RESPONSIBILITIES AND CONDUCT 4.1 WORKLOAD It is expected that you will spend at least ten hours per week studying this course. This time should be made up of reading, research, working on exercises and problems, and attending classes. In periods where you need to prepare for a Tutorial Presentation or an examination, the workload may be greater. Over-commitment has been a cause of failure for many students. You should take the required workload into account when planning how to balance study with employment and other activities. 4.2 ATTENDANCE Your regular and punctual attendance at lectures and tutorials is expected in this course. University regulations indicate that if students attend less than eighty per cent of scheduled classes they may be refused final assessment. We would appreciate punctual attendance in both lectures and tutorials. 4.3 GENERAL CONDUCT AND BEHAVIOUR IN LECTURES/TUTORIALS You are expected to conduct yourself with consideration and respect for the needs of your fellow students and teaching staff. Conduct which unduly disrupts or interferes with a class, such as using mobile phones, is not acceptable and students may be asked ECON 1101 Page- 7 to leave the class. More information on student conduct is available at: www.my.unsw.edu.au 4.4 KEEPING INFORMED You should take note of all announcements made in lectures, tutorials or on the course web site. In particular you should check “Announcements” on the course elearning site at least once a week. From time to time, the University will send important announcements to your university e-mail address without providing you with a paper copy. You will be deemed to have received this information. So check your student email account regularly. Note that you must ensure that you are correctly enrolled. The last day to discontinue without financial penalty is August 31 and the last day to discontinue without academic penalty is September 15. The final examinations period falls between 10 November and 28 November. October: Tuesday Wednesday Tuesday 3 11 24 Publication of the provisional timetable for the November examinations Last day for students to advise of examination clashes Publication of the Final Timetable for the November examinations 5. ASSESSMENT 5.1 FORMAL REQUIREMENTS In order to pass this course, you must: achieve a composite mark of at least 50; and make a satisfactory attempt at all assessment tasks (see below) 5.2 ASSESSMENT DETAILS The examinable content of the course is defined by the Text references given in the Lecture Schedule, the content of Lectures, the content of the Tutorial Program and the material/quizzes in the course website, in WebCT Vista. ECON 1101 Page- 8 Students learn in different ways and their learning can be better supported by the use of multiple teaching methods, modes of instruction and assessment tasks. There are Eight (8) Assessment Tasks in this course and students need to complete them at a Satisfactory Level. “Satisfactory’ is determined by the Lecturer and varies depending on the particular task. Assessment Task 1 - Information Literacy Quiz Due: Weeks 1-2 of session How: Via the Microeconomics 1 website at http://vista.elearning.unsw.edu.au Grading: Satisfactory/Unsatisfactory Learning Outcomes : Ability to search library databases, retrieve and comprehend information. Effective learning is supported by a climate of inquiry where students feel appropriately challenged and activities are linked to research and scholarship. Assessment Task 2 – Feedback Quiz A Due : Week 4 How: Via the Microeconomics 1 website at http://vista.elearning.unsw.edu.au Grading: Satisfactory/Unsatisfactory Learning Outcomes : Assimilate and understand course materials covering the first 3 weeks of class. Demonstrate an understanding of basic economic concepts and the competitive market model. Identify weaknesses in understanding and undertake remedial activities. Identify and prepare for likely exam questions. Assessment Task 3 - Tutorial Assessment Due : Weeks 3-14 ECON 1101 Page- 9 How: In the first tutorial (week 2), each student will be allocated a Discussion Question. Students are required to present their answer to their set Discussion Question in the relevant tutorial. You will be required to hand-in a written copy of your answer to your tutor in the following tutorial. This will allow you to incorporate any useful comments from the class discussion. The presentation is to be concise and to last 5 - 10 minutes. The written answer is to be between 500 - 1000 words. Students who do not present AND hand-in their discussion question will be given a mark of ZERO for this component of the assessment. While only one student is required to present each allocated Discussion Question, all students should come to tutorials prepared to participate in the class discussion. All students will be expected to contribute to the discussion of any unallocated questions. We do recognize that learning cooperatively with peers may help students to develop interpersonal, professional, and cognitive skills to a higher level. As such, you also have the option of a group presentation. A group is defined as two students. You can then share the work of the presentation and the written answer. However, since there are two of you, the presentation should be at least 10 - 20 minutes and the written answer 1000 - 2000 words. You will each get the same mark. Pick your partners wisely (this has general application) as we will be unsympathetic to cries of “I did all the work and the other bloke bludged!” We will explore this issue more formally when we consider the free-rider problem. Grading: The Tutorial Assessment mark (10% of the total mark) will be awarded on the basis of the submitted written answer to your allocated question and your presentation. Learning objective: The purpose of this assessment is to test knowledge of concepts, their application to practical problems and the ability to present logical economic argument in both written and oral form. Assessment Task 4 - Feedback Quiz B Due : Week 7 ECON 1101 Page-10 How: Via the Microeconomics 1 website at http://vista.elearning.unsw.edu.au Grading: Satisfactory/Unsatisfactory Learning Outcomes : Assimilate and understand course materials covering weeks 4-7 of class. Demonstrate an understanding of supply and demand applications, costs of production and perfect competition.. Identify weaknesses in understanding and undertake remedial activities. Identify and prepare for likely exam questions. Assessment Task 5 – Mid-Session Examination When : Week 8 – Friday, 15 September – 11.30 am – 1.00 pm. Where : At the AJC Randwick Racecourse. Grading : 30% of total mark. Learning Outcomes : The purpose of this assessment is to test knowledge of concepts, the ability to use economic reasoning to make deductions, and to perform simple calculations of costs and benefits. It tests higher-order thinking skills such as analysis, synthesis, and evaluation. The exam will cover materials covered in the first seven weeks of classes – lectures and tutorials - and will consist of multiple-choice questions covering chapters 1-11 of the textbook. Note: There will be NO supplementary exam offered for the Mid-Session Examination. Students who fail to attend the Mid-session Examination will need to apply for Special Consideration. Special Consideration applications must be made within 3 days of the Exam through NewsouthQ in the Chancellery and NOT through the lecturer-in-charge or Course Administrator (you should advise the Lecturer-in-Charge via email that you have made an application). You will need to provide full documentation of the reason for the absence (eg, illness). Employment obligations of any kind are not acceptable reasons for absence from any test/examination. Those students whose request is granted for Special Consideration for the mid-session examination, will have their final mark reweighted according to the weight of the missed piece of assessment. ECON 1101 Page-11 Assessment Task 6 - Interactive Experiments Due : Throughout the session How: Via the Microeconomics 1 website at http://vista.elearning.unsw.edu.au Grading: Satisfactory/Unsatisfactory Learning Objectives : Effective learning is supported when students are actively engaged in the learning process. Assessment Task 7 - Feedback Quiz C Due : Week 12 How: Via the Microeconomics 1 website at http://vista.elearning.unsw.edu.au Grading: Satisfactory/Unsatisfactory Learning Outcomes : Assimilate and understand course materials covering weeks 9-11 of class. Demonstrate an understanding of imperfect competition and some of its consequences, including the income distribution effects. Identify weaknesses in understanding and undertake remedial activities. Identify and prepare for likely exam questions. Assessment Task 8 – Final Exam When : During the final exam period. The School of Economics does not schedule the final exam – so please don’t ask us when it will be – the Examinations Branch of the University schedules the exam during the final exam period. It will be 2 hours long. The final exam will cover the entire course. The format of the examination will be: Part A is 20 MC questions. The MC questions come mainly from the textbook chapters 12-19. 20 MC questions worth 1 mark each = 20%. ECON 1101 Page-12 Part B has four short answer/essay type questions. STUDENTS DO ONLY TWO OF THESE QUESTIONS. Each of the 4 questions has parts (a,b,c,d) and each of these parts is worth 5 marks. These 4 questions are very similar to the 25 Discussion Questions covered in tutorials. Indeed, a number of the questions have parts that have been taken from the Discussion Questions. Other parts have been taken primarily, but not exclusively, from chapters 12-19. Two questions X 20% each = 40% SO PART A AND PART B COMBINED IS 60%. Grading : 60% of total mark. Learning Objectives : The purpose of the final exam is to assess knowledge of economic concepts and their appropriate use, to test the ability to use economic reasoning to make deductions, and to test the ability to perform simple calculations of costs and benefits. It is important to note that a satisfactory performance in the Final Examination is required to pass this course. THE UNIVERSITY OF NEW SOUTH WALES SCHOOL OF ECONOMICS ECON 1101 MICROECONOMICS I Mid-Session Exam April 2006 (1) Time Allowed – 75 minutes (this includes any reading time). (2) This exam has 30 multiple-choice Questions. Each multiple choice question is worth one mark. ECON 1101 Page-13 (3) You should attempt all Questions. Select the best answer from the alternatives provided. Any ambiguous responses (e.g. double answers) will count as being incorrect. No marks will be deducted for an incorrect response. (4) Answer must be written in pencil on the Computer Answer Sheet. Write your name and Student ID number in the spaces provided. (5) THIS IS A CLOSED BOOK EXAMINATION. No examination aids are permitted. All mobile phones must be turned off. 1. RailCorp once asked the State Government for permission to increase its rail ticket prices by 20 per cent. RailCorp argued that declining revenues made this rate increase essential. Opponents of the rate increase contended that RailCorp’s revenues would fall because of the fare increase. It can be concluded that: (a) (b) (c) (d) 2. Both groups believed that demand was elastic but for different reasons Both groups believed that demand was inelastic but for different reasons RailCorp believed that the demand for passenger service was inelastic and opponents of the rate increase believed it was elastic RailCorp believed that the demand for passenger service was elastic and opponents of the rate increase believed it was inelastic A recent heatwave in Tasmania has done extensive damage to the apple crops. As a result, Victorian apple products are commanding high prices. Which of the following statements best explains the situation? (a) The demand for Tasmanian apples has been reduced, causing their price to fall and therefore increasing the demand for the substitute Victorian apples. (b) The demand for Tasmanian apples has been reduced by the heatwave, causing a greater demand for the Victorian apples and an increase in their price. (c) The supply of Tasmanian apples has decreased, causing their price to increase and the demand for the substitute Victorian apples to also increase. (d) The supply of Tasmanian apples has decreased, causing the supply of the Victorian apples to increase and their price to rise. 3. Which of the following would cause a rightward shift in the demand for petrol? 1. A large fall in the price of public transport 2. A large decrease in the price of cars 3. A large reduction in the costs of producing petrol (a) 1 only. ECON 1101 Page-14 (b) 2 only. (c) 1 and 2 only. (d) 2 and 3 only. 4. Consider a downward-sloping, straight-line demand curve. If the marginal revenue associated with a given decline in price is negative, it can be concluded that: (a) the product is an inferior good (b) this price decline will increase the firm’s profits (c) the elasticity coefficient of demand is greater than one (d) the demand for the product is inelastic in this price range. 5. Which of the following would not cause the demand curve for beer to shift to the right? (a) A decrease in the price of beer (b) An increase in the price of wine (c) An increase in income for beer buyers (d) A published study that links beer consumption with a longer life span. 6. Wheat is a normal good. If the market for wheat is competitive, and if improved technology in wheat farming increases the supply of wheat at each price while at the same time bakeries suddenly increase their demand for wheat, one can predict that: (a) (b) (c) (d) 7. Equilibrium quantity will increase Equilibrium price and quantity will both increase Equilibrium price will increase while equilibrium quantity will decrease Equilibrium price will decrease while equilibrium quantity will increase Tammy is a full time student but also runs an internet dating company. She rents internet access for a fixed fee of $500 and employs her sister to do all the work at a wage of $20 per hour. Assuming that she operates in a perfectly competitive industry, she should decide to cease operations (shut down) if: (a) She cannot make positive profits (b) Price falls below average total costs (c) Total revenue does not cover her sister’s wages (d) Total revenue does not cover her sister’s wages plus $500. ECON 1101 Page-15 8. If the government imposes a price ceiling on rentable accommodation, this will (a) Shift the supply of rentable housing to the right (b) Lead to a surplus of rentable accommodation (c) Lead to a shortage of rentable accommodation (d) Shift the demand for rentable housing to the left 9. If sirloin steak and T-bone steak are substitutes for each other, when the price of only T-bone steak rises: (a) (b) (c) (d) 10. Consider the market for motor cars. If a dealer cuts prices 20 percent and finds that she sells 10 percent more cars, then: (a) (b) (c) (d) 11. Demand for cars is elastic and total revenue will rise Demand for cars is elastic and total revenue will fall Demand for cars is inelastic and total revenue will rise Demand for cars is inelastic and total revenue will fall. It is argued that the perfectly competitive industry is an efficient allocator of resources because in long run equilibrium, among other things, it forces firms to (a) (b) (c) (d) 12. T-bone steaks become relatively less expensive than sirloin steaks The income elasticity of demand for either product is negative The cross-price elasticity between these two products is positive The price elasticity of demand for sirloin steaks is inelastic Use a technology that yields the lowest possible ATC curve. Operate on the lowest point of their ATC curves. Sell to consumers at a price equal to the minimum ATC. All of the above. If the market demand for a product produced by a perfectly competitive industry increases, the demand curve facing the individual firm will (a) (b) (c) (d) Become more elastic Become less elastic Shift upward Shift downward ECON 1101 Page-16 13. If the price elasticity of demand for domestic Australian travel is –0.7 and the cross price elasticity of demand for international air travel with respect to domestic air travel prices is –0.1 then: (a) domestic and foreign air travel are substitutes and a fall in domestic air fares will raise domestic airlines’ revenue (b) domestic and foreign air travel are substitutes and a rise in domestic air fares will raise domestic airlines’ revenue (c) domestic and foreign air travel are complements and a fall in domestic air fares will lower domestic airlines’ revenues (d) although both kinds of air travel are normal goods a fall in the price of domestic air travel will lower the demand for international air travel by Australians 14. Ticket scalping is selling a ticket for a sporting or entertainment event at a price above the price printed on the ticket. Scalping occurs because: (a) (b) (c) (d) 15. Which market structure best approximates the Australian markets for telecommunication services, letter postal services and fast foods respectively: (a) (b) (c) (d) 16. Oligopoly, monopoly and monopolistic competition Monopoly, perfect competition and monopoly Oligopoly, monopoly and perfect competition Perfect competition, oligopoly and monopsony When a firm is producing zero output its Total Costs are $25. When the firm is producing 5 units of output its Total Costs are $60. What is the Total Variable Cost of producing 5 units of output? (a) (b) (c) (d) 17. the demand for tickets is highly inelastic the printed price on the ticket is below the equilibrium price some fans are willing to pay almost any amount to obtain a ticket the supply of tickets is fixed at the capacity of the stadium or auditorium Cannot be determined from the information given. $35 $60 $7 Tax incidence depends on demand and supply elasticities. Which of the following statements is correct? ECON 1101 Page-17 (a) The greater the demand elasticity the smaller the deadweight loss and the higher the tax incidence on consumers. (b) The lower the demand elasticity the smaller the deadweight loss and the lower the tax incidence on producers. (c) The lower the supply elasticity the larger the deadweight loss and the higher the tax incidence on consumers. (d) The greater the supply elasticity the smaller the deadweight loss and the higher the tax incidence on producers. 18. A perfectly competitive firm produces 1000 units of output. The price it charges is $100 per unit, the average total cost is $100 and the average variable cost is $80. If the production level is in equilibrium then the marginal cost must be equal to: (a) (b) (c) (d) 19. When marginal cost is less than average total cost, then: (a) (b) (c) (d) 20. $20 $80 $100 Cannot be determined from the information given as we are not told the value of marginal revenue. Average cost must be increasing with output Average cost must be decreasing with output. Marginal revenue must be less than total revenue Marginal cost does not equal marginal benefit Suppose that in the economy there are only two goods, A and B. Suppose further that the economy is on its production possibility frontier with the output combination of 40 units of good A and 50 units of good B. Which of the following output combinations could also be a point on the frontier: (a) (b) (c) (d) 40 units of A and 47 units of B 60 units of A and 47 units of B 45 units of A and 55 units of B 40 units of A and 55 units of B Use the accompanying diagram to answer questions 21 to 25. The diagram shows a market in which the demand and supply were originally those represented by the curves D and S. A per-unit tax was then imposed on this market, and the post-tax situation is represented by Stx. ECON 1101 Page-18 Stx M Price S I E C A H G J K O D Q F F 21. The distance that represents the per unit amount of the tax is: (a) (b) (c) (d) 22. OA and OB OG and OF OE and OF OE and OB The amount of tax revenue raised by this tax is equal to the area (a) (b) (c) (d) 24. HJ EG OA IH After the tax is imposed, the equilibrium price paid by buyers and the equilibrium quantity sold are given respectively by (a) (b) (c) (d) 23. B EGJCI AGJH EGJI EAHI After the tax is imposed, consumer surplus and producer surplus are represented, respectively, by the areas: (a) ECON 1101 MAC and KAC Page-19 (b) (c) (d) 25. The deadweight loss due to the tax is represented by the area: (a) (b) (c) (d) 26. AVC rises, ATC rises, MC rises, output falls, and profits fall. AVC rises, ATC rises, output is unchanged, and profits fall. AFC rises, ATC rises, output is unchanged, and profits are unchanged. AFC rises, ATC rises, MC rises, output falls, and profits fall. Ceteris paribus, the price elasticity of demand for a product tends to be greater (a) (b) (c) (d) 29. $20 $50 $100 $200 Consider a typical firm in a perfectly competitive manufacturing industry in the short run. What will happen to the firm’s cost curves, its output, and its profits, if the price of coal, which is burned to drive the firm’s machinery, increases? (a) (b) (c) (d) 28. IJC IHC HJC EACI If the average variable cost of producing 5 units of a good is $100, and if the average total cost of producing 5 units of the good is $200, what is the average fixed cost of producing 10 units of the good? (a) (b) (c) (d) 27. MGJI and KGJ MEI and KGJ EAHI and GAHJ the more of a necessity it is the more substitutes there are for it the less important it is in our budget the lower the price If an economy is operating inside its production possibilities frontier for goods X and Y, then: (a) (b) (c) (d) ECON 1101 the economy’s available resources are being used efficiently production can be increased only if the frontier is shifted outward the production of X can only be increased if the production of Y is reduced an additional amount of X can be produced at no opportunity cost. Page-20 30. If the supply of product X is perfectly elastic, an increase in the demand for it will: (a) (b) (c) (d) increase equilibrium price but reduce equilibrium quantity increase equilibrium quantity but equilibrium price will be unchanged increase both equilibrium price and equilibrium quantity increase equilibrium price but equilibrium quantity will be unchanged. The University of New South Wales School of Economics ECON 1101 MICROECONOMICS I Final Examination June 2006 Time Allowed: Two (2) Hours This paper is worth 60% of the total course mark This exam is comprised of Two Parts. Part A – 20 multiple-choice questions – worth 1 mark each. Answer all questions. Answer this Part on the Computer Answer Sheet. Part B – Four short-answer/essay type questions. Only answer Two (2) of these questions in the Answer books provided. Answer each question in a separate book. Indicate the question number in the space provided on the cover of the answer book. Each question is worth 20 marks. ECON 1101 Page-21 This paper may be retained by the candidate. No examination aids are allowed. Answers must be written in ink. Except where they are expressly required, pencils may be used only for drawing, sketching or graphical work. Part A – 20 Multiple Choice Questions You should attempt all Questions. Select the best answer from the alternatives provided. Any double answers will count as being incorrect. No marks will be deducted for an incorrect response. Answer must be written in pencil on the Computer Answer Sheet. Write your name and Student ID number in the spaces provided. 1. The ‘free rider problem’ of public goods refers to: (a) (b) (c) (d) 2. individuals’ refusals to pay taxes the inelasticity of individuals’ demands for public goods individuals’ attempts to hide their preferences for public goods and to avoid paying for them individuals’ overuse of public goods Which of the following correctly describes an external benefit resulting from an individual’s purchase of preventive medical services such as influenza or measles inoculations? (a) By purchasing an inoculation an individual reduces the likelihood that his family or other contacts will catch the particular contagious illness (b) Purchase of preventive medical services benefits doctors by providing additional income (c) An individual saves money by preventing illness through inoculations instead of having to pay to have the illness treated (d) By reducing the number of sick days, inoculations allow the individual more work days, and thus more income ECON 1101 Page-22 3. Economists argue that oligopoly may be the market structure most conducive to technological change and innovation because: (a) oligopolists must create new production methods in order to maintain prices equal to marginal cost (b) oligopolistic collusion allows existing firms to prevent the entry of new firms into the industry (c) oligopolists face competitive pressures from rival firms combined with the opportunity for economic profits (d) money is not wasted on advertising since there are few firms and each is well known 4. Collusion among oligopolists is difficult in practice because: (a) laws make explicit price fixing agreements legal (b) individual firms have an incentive to cheat and undercut the other firms (c) as demand and cost conditions change, it is easy to renegotiate agreements (d) all of the above 5. Firms in a monopolistically competitive market earn zero economic profits in the long run because: (a) (b) (c) (d) 6. they have identical cost curves they sell a homogenous product they charge an identical price there are no barriers to entry and exit in the market In order to maximize short-run profits, a monopolist should produce the output at which: (a) marginal cost equals marginal revenue, but marginal revenue is less than price (b) marginal cost equals marginal revenue, but marginal revenue equals price (c) marginal cost equals marginal revenue, but marginal cost equals average cost (d) marginal cost equals average revenue, but total cost equals total revenue ECON 1101 Page-23 7. In country A the area between the line of income equality and the Lorenz curve is greater than in country B. Therefore: (a) (b) (c) (d) 8. Emission taxes have an advantage over taxes on production in that: (a) (b) (c) (d) 9. the MC curve intersects the AVC curve the MC curve intersects the ATC curve the MC curve intersects the MR curve the MC curve intersects the AR curve. In the long run, a firm will leave the industry when: (a) (b) (c) (d) 11. they do not raise the firm’s prices while taxes on production do they change the firm’s output while taxes on production do not the firm can increase the amount of pollution associated with a given amount of production the firm has an incentive to use technology to change the amount of pollution associated with its production If a monopoly were regulated so that a socially efficient solution prevails, production would be set at the point where: (a) (b) (c) (d) 10. the average income in country A is higher than in country B the average income in country B is higher than in country A incomes are more equally distributed in country A incomes are more equally distributed in country B marginal revenue exceeds marginal cost marginal cost exceeds marginal revenue total revenue exceeds total cost average cost rises above price If a profit-maximizing monopolist (who does not practice price discrimination) has positive short-run marginal costs at his profit maximizing level of output, then demand at that level of output has a price elasticity: ECON 1101 Page-24 (a) (b) (c) (d) 12. At any point above the midpoint of a linear demand curve: (a) (b) (c) (d) 13. (c) (d) the higher wages are offset by labour productivity rises employers pass on the wage rises in higher prices and the demand for their products is elastic labour costs are a relatively small percentage of the final production costs the possibilities for substituting capital for labour are low for technical reasons A firm’s demand for labour curve: (a) (b) (c) (d) 16. price exceeds marginal cost price is equal to average total cost marginal cost equals marginal revenue price equals minimum average total cost Suppose textile and clothing workers succeed in raising wages in their industry. The loss of employment will be greater if: (a) (b) 15. total revenue decreases as price decreases marginal reveue is negative the price elasticity of demand is less than one the price elasticity of demand is greater than one Which of the following is not characteristic of long-run equilibrium under monopolistic competition? (a) (b) (c) (d) 14. equal to zero less than one equal to one greater than one is the same as its marginal revenue product curve will shift leftward when the price of the firm’s output increases shows how much labour the firm hires at different tax rates all of the above Game theory is applicable to modelling oligopoly behaviour because: ECON 1101 Page-25 (a) (b) (c) (d) 17. If in the consumption and production of chemical fertilizer the marginal social costs exceeds marginal private costs then this means there exists a: (a) (b) (c) (d) 18. (d) it improves the economy’s physical capital stock it generates positive externalities it raises productivity less than the private benefits the individual receives all of the above Patents create: (a) (b) (c) (d) 20. public good positive externality negative externality free rider Subsidizing education can be justified on the grounds that: (a) (b) (c) 19. oligopolists ignore rival firms oligopolists are price takers oligopolists use strategic behaviour oligopolists can only be profitable if they collude a competitive situation in an industry less profitable inventions some protection of intellectual property rights disincentives to patent-awarded researchers Who was the economist that highlighted the importance of property rights in economics? (a) (b) (c) (d) ECON 1101 Ronald Coase Robert Conlon Ray Charles The Veronicas Page-26 Part B Answer only Two (2) of the following questions. Question 1. Over the period 1996-2004 Telstra achieved an average rate of return on its capital of 15 per cent a year. As a result of its extensive existing copper wire network and the forthcoming $3 billion higher-speed fibre-optic network, Telstra has some of the characteristics of a natural monopoly. This then raises the issue of the appropriate access costs that Telstra should charge to its competitors for access to these networks. a. (5 marks) Draw a graph of this natural monopoly situation. b. (5 marks) Illustrate Telstra’s unregulated profit maximizing access charge and discuss the economic efficiency of this outcome. c. (5 marks) Telstra has agreed in principle to a regulated cost-based access pricing scheme. Illustrate two possible cost-based access pricing schemes and discuss their relative merits. d. (5 marks) There are reports that a consortium of Telstra’s competitors may combine to finance a rival fibre-optic network. What are the efficiency implications of this possible development? Question 2. In 2001 average full-time weekly earnings of women were about 85 per cent of those of men. a. ( 5 marks) Illustrate two labour markets – one for males and one for females – and discuss how this wage differential may result. b. ( 5 marks) Would a minimum wage for women equal to the male wage alleviate this gender inequality? Illustrate and explain your answer. c. ( 5 marks) There may be skill differentials between males and females. Historically women have acquired less human capital than men. Use graphs to show how this might explain some of the wage gap. ECON 1101 Page-27 d. ( 5 marks) Would a tax on male workers – equivalent to the 15 per cent wage gap – payable to the government be an efficient way to remove the gender gap. Illustrate and explain your answer. Question 3. Only 0.2 per cent of Sydney-siders use a ferry on an average work day. The average total cost of a ferry journey is $6.87 but passengers only pay $2.90 of this. The total cost of providing 14 million ferry trips a year is $100 million and only $42 million of this cost is covered by passengers. The remaining amount is paid by NSW taxpayers. a. ( 5 marks) Are ferry services ‘public goods’? Explain. b. ( 5 marks) Assume that ferry services generate externalities. How do we determine the optimal quantity of ferry rides? c. ( 5 marks) There is a wide discrepancy in the incomes of ferry users. What opportunities are there for price discrimination in the provision of ferry services? Would perfect price discrimination lead to an efficient outcome? Explain your answers. d. ( 5 marks) Given that the fleet of Sydney ferries are ageing and that they constantly need repair, at what point should ferry operations cease in the short-run? Question 4. In 2000 the poorest 20 per cent of Australian households received less than 4 per cent of total gross income. But the richest 20 per cent of families received 49 per cent of total gross income. a. ( 5 marks) Explain at least two sources of income inequality. b. ( 5 marks) In what way does our income tax system attempt to redistribute income? Explain the tradeoff between equity and efficiency in this redistribution of income. c. ( 5 marks) Discuss at least one tax reform proposal that might improve income inequality. d. ( 5 marks) A major contributor to air pollution is the car. Would a significant increase in petrol taxes be an efficient and equitable way to deal with this problem? Explain your answer. ECON 1101 Page-28 5.3 SPECIAL CONSIDERATION AND SUPPLEMENTARY EXAMINATIONS A supplementary final examination may be offered to students who failed to attend the final examination for medical reasons, or whose performance during the final examination has been severely affected by illness, or other extraordinary circumstances that can be documented by the student. Supplementary examinations are not offered as a matter of course. The following conditions must be fulfilled before such an application to sit for a supplementary final examination will be considered: (i) the student's performance during the session (based on the student’s tutorial assessment mark and midsession exam mark) must be deemed to be at a satisfactory level by the lecturer-in-charge, and (ii) the student has applied for special consideration which is made through NewsouthQ within 3 days of the final examination, and the application is supported with full documentation. Notes: If a supplementary examination is granted, the format of that examination will be similar to that of the final examination. Students who are granted a supplementary examination will be advised of the date of the supplementary exam as soon as possible, and students have the responsibility to make themselves available to sit for the supplementary exam on the date specified. 6. ACADEMIC HONESTY AND PLAGIARISM The University regards plagiarism as a form of academic misconduct, and has very strict rules regarding plagiarism. For full information regarding policies, penalties and information to help you avoid plagiarism see: http://www.lc.unsw.edu.au/plagiarism/ Plagiarism is the presentation of the thoughts or work of another as one’s own.* Examples include: direct duplication of the thoughts or work of another, including by copying work, or knowingly permitting it to be copied. This includes copying material, ideas or concepts from a book, article, report or other written document (whether published or unpublished), composition, artwork, design, drawing, circuitry, computer program or software, web site, Internet, other electronic resource, or another person’s assignment without appropriate acknowledgement; paraphrasing another person’s work with very minor changes keeping the meaning, form and/or progression of ideas of the original; ECON 1101 Page-29 piecing together sections of the work of others into a new whole; presenting an assessment item as independent work when it has been produced in whole or part in collusion with other people, for example, another student or a tutor; and, claiming credit for a proportion a work contributed to a group assessment item that is greater than that actually contributed.† Submitting an assessment item that has already been submitted for academic credit elsewhere may also be considered plagiarism. The inclusion of the thoughts or work of another with attribution appropriate to the academic discipline does not amount to plagiarism. Students are reminded of their Rights and Responsibilities in respect of plagiarism, as set out in the University Undergraduate and Postgraduate Handbooks, and are encouraged to seek advice from academic staff whenever necessary to ensure they avoid plagiarism in all its forms. The Learning Centre website is the central University online resource for staff and student information on plagiarism and academic honesty. It can be located at: www.lc.unsw.edu.au/plagiarism The Learning Centre also provides substantial educational written materials, workshops, and tutorials to aid students, for example, in: correct referencing practices; paraphrasing, summarising, essay writing, and time management; appropriate use of, and attribution for, a range of materials including text, images, formulae and concepts. Individual assistance is available on request from The Learning Centre. Students are also reminded that careful time management is an important part of study and one of the identified causes of plagiarism is poor time management. Students should allow sufficient time for research, drafting, and the proper referencing of sources in preparing all assessment items. * Based on that proposed to the University of Newcastle by the St James Ethics Centre. Used with kind permission from the University of Newcastle † Adapted with kind permission from the University of Melbourne. 7. STUDENT RESOURCES 7.1 COURSE WEBSITE The Microeconomics1 website may be found at: http://vista.elearning.unsw.edu.au Students should consult this website at least once a week as it contains important information about the course. It will be assumed that all students have seen any notice ECON 1101 Page-30 posted on the course website. There is usually an active discussion forum on the website with students posting and answering messages and queries. 7.2 TEXTBOOK AND READINGS The textbook for this course is: McTaggart, D., Findlay, C., and Parkin, M., (2006) Microeconomics, Updated Fourth Edition with MyEconLab, Addison-Wesley, Sydney (hereafter referred to as McTaggart). The publishers provide a range of support material for the textbook. Information on accessing this support material is provided in the introduction to the text. While the support material may provide useful additional assistance to your study of the subject matter, the support material is not required reading. Students must make their own judgement as to whether accessing and using the support material is worthwhile. Other useful readings: The library holds a wide range of alternative textbooks covering microeconomic principles. While the text set for this course is sufficient reading, if you wish to supplement this with additional readings, you may consult these alternative books. Some useful texts are: Krugman, P. and R. Wells (2005) Microeconomics, Worth, New York Frank, Robert H. and Ben S. Bernanke 2nd Ed. (2004), Principles of Microeconomics, McGraw-Hill Irwin. (SQ338.5/197) Baumol, W.J., Blinder, A.S., Gunther, A.W. and Hicks, J.R.L., (latest ed.), Economics: Principles and Policy , Australian Edition, Harcourt Brace Jovanovich, Sydney. (S330/485F) Jackson J., McIver, R., McConnell, C. and Brue S. (latest ed.), Microeconomics, McGraw-Hill International Book Co., Tokyo. (S338.5/155). Samuelson, P & W.D. Nordhaus (2005) Microeconomics, 18th ed. McGraw Hill, Sydney. Stiglitz, J.E., (latest ed.), Principles of Microeconomics, Norton, New York. (S338.5/148) ECON 1101 Page-31 7.3 PEER ASSISTANCE SUPPORT SCHEME (PASS) The School of Economics pioneered the PASS Scheme in this Faculty back in 1996. It is a support scheme where second, and sometimes third year, students assist first year students with their study skills. It has been extraordinarily successful and past students have found it exceedingly valuable in their exam preparations. The PASS leaders have recently completed ECON1101 at a high level of performance and can share their experiences, tell you the study tricks and prepare you for exams. PITSTOP is another student-friendly initiative from the School. If you can not find your tutor, go to the PitStop drop-in centre and there will be someone there to help you personally. 7.4 OTHER RESOURCES, SUPPORT AND INFORMATION The University and the Faculty provide a wide range of support services for students, including: Learning and study support; Counselling support; Library training and support services; Disability support services; The Education Development Unit of the Faculty of Commerce and Economics can be contacted on edu@unsw.edu.au, tel: 9385 5584 or http://education.fce.unsw.edu.au. It is in Room 2039 of the QUAD and open most days from 10am. It opens on Mondays at 1.00 pm. The UNSW Learning Centre is located in the Library. Contact tel: 9385 3890 or www.lc.unsw.edu.au. The UNSW Counselling service can be contacted on 9385 5418. The Equity and Diversity Unit can be contacted at 9385 4734 or at www.equity.unsw.edu.au. In addition, it is important that all students are familiar with policies and procedures in relation to such issues as: Examination procedures and advice concerning illness or misadventure; Special Consideration including Supplementary Examinations; Occupational Health and Safety policies and expectations. ECON 1101 Page-32 8. CONTINUAL COURSE IMPROVEMENT Each year feedback is sought from students and other stakeholders about the courses offered in the School and continual improvements are made based on this feedback. UNSW's Course and Teaching Evaluation and Improvement (CATEI) Process (http://www.ltu.unsw.edu.au/ref4-5-1 catei_process.cfm) is one of the ways in which student evaluative feedback is gathered. We take student feedback and evaluations very seriously and formally respond to the comments students make at the University level. 9. LECTURE SCHEDULE Week 1 (Week Starting 24/7) Introduction to Economic Concepts Week 2 Introduction to Economic Concepts (cont) Markets, Trade and Efficiency McTaggart Ch. 2 (cont.), 3 (31/7) Opportunity Cost, Efficiency, Production Possibilities Curve McTaggart Chs 1, 2 Week 3 (7/8) The Competitive Market Model Demand, Supply, Market Equilibrium McTaggart Ch. 4, 5 Week 4 (14/8) Elasticity Price elasticity Income elasticity, cross-elasticity Elasticity and Total Revenue McTaggart Chs. 5, 6 Week 5 (21/8) Applications of the Competitive Model Consumer & Producer Surplus, Floor and Ceiling Prices, Tax Incidence Trade, Tariffs & Subsidies McTaggart Chs 6,7, 8 Week 6 (28/8) The Theory of the Firm: The Costs of Production Production and Costs Short run and long run costs McTaggart Chs 9, 10 ECON 1101 Page-33 Week 7 (4/9) Perfect Competition Short run profit maximisation, long run equilibrium McTaggart Ch. 11 Week 8 (11/9) No Lectures or Tutorials this week Mid-session Test Friday 15/9 Week 9 (18/9) Market Models: Monopoly Monopoly and Efficiency Price discrimination Regulation of Monopoly McTaggart Ch. 12 MIDSESSION BREAK Week 10 No Lectures this Week as Monday October 2 is a public holiday. (2/10) Week 11 (9/10) Market Models: Oligopoly and Monopolistic Competition Monopolistic competition: short run & long run Game Theory Cartels Non price Competition McTaggart Ch. 13 Week 12 (16/10) Resource and Labour Markets; Income Distribution Derived Demand Monopsony Lorenz Curves McTaggart Chs 14,15 Week 13 (23/10) Market Failure Public Choice, Public Goods Taxes Income Inequality & Redistribution McTaggart Chs 16, 17 Week 14 (30/10) Market Failure (continued) Externalities and Information Regulation & ACCC McTaggart Chs 18, 19 ECON 1101 Page-34 SCHOOL OF ECONOMICS ECON 1101 MICROECONOMICS 1 SESSION 2, 2006 TUTORIAL PROGRAM Microeconomics 1 Website http://vista.elearning.unsw.edu.au ECON 1101 Page-35 TUTORIAL PROGRAM In the first tutorial (week 2), each student will be allocated a Discussion Question. Students are required to present their answer to their set Discussion Question in the relevant tutorial. You will be required to hand-in a written copy of your answer to your tutor in the following tutorial. This will allow you to incorporate any useful comments from the class discussion. The presentation is to be concise and to last 5 - 10 minutes. The written answer is to be between 500 - 1000 words. Students who do not present AND hand-in their discussion question will be given a mark of ZERO for this component of the assessment. While only one student is required to present each allocated Discussion Question, all students should come to tutorials prepared to participate in the class discussion. All students will be expected to contribute to the discussion of any unallocated questions. We do recognize that learning cooperatively with peers may help students to develop interpersonal, professional, and cognitive skills to a higher level. As such, you also have the option of a group presentation. A group is defined as two students. You can then share the work of the presentation and the written answer. However, since there are two of you, the presentation should be at least 10 - 20 minutes and the written answer 1000 - 2000 words. You will each get the same mark. Grading: The Tutorial Assessment mark (10% of the total mark) will be awarded on the basis of the submitted written answer to your allocated question and your presentation. Students attach the Cover Sheet to their written answer. Learning objective: The purpose of this assessment is to test knowledge of concepts, their application to practical problems and the ability to present logical economic argument in both written and oral form. ECON 1101 Page-36 SCHEDULE OF TOPICS WEEK 2 (Week Starting 31/7) In this tutorial, allocation of Discussion Questions will be made, and your tutor will explain the requirements for presentations. WEEK 3 (7/8) Discussion Question 1 (The following Discussion Question comes from the Supplementary Chapter immediately before Chapter 1 in the text. This question can be used to raise a whole host of issues that we cover in greater detail throughout the course). Over the period 1996-2004 Telstra achieved an average rate of return on its capital of 15 percent a year. How has Telstra managed to be so profitable? Discussion Question 2 (This also comes from the Supplementary Chapter). Are Australia’s water resources being managed efficiently? If not, what should be done? ECON 1101 Page-37 WEEK 4 (14/8) Discussion Question 3 John Quiggin in an article titled ‘Top Tax Rate, low priority’ published in The Australian Financial Review (24 February 2005) claimed reductions in the top marginal rate of income tax are a low priority on any serious agenda for tax reform. Use income and substitution effects to explain Quiggin’s argument. Would it be more desirable to cut taxes at lower income levels? Discussion Question 4 Assume the market for rental accommodation can be represented in the competitive market model. Represent the model diagrammatically. Use your model to explain why rent control may fail to improve the welfare of lowincome renters. What alternative policies to assist these people can you suggest? In your answer use your model to represent and explain the effect of: (a) An increase in the number of people seeking rental accommodation due to an increase in migration. (b) A government decision to increase the quantity of public housing available. (c) A change in the tax legislation to allow deductibility for mortgage interest payments against income for owner occupiers. (d) The imposition of a legislated maximum rent (“rent control”). (e) The granting of a government subsidy to the construction of rental accommodation. (f) The provision of a government subsidy to renters. (g) A change in the tax legislation to remove the allowance of “negative gearing” for the taxation of landlords’ income. ECON 1101 Page-38 WEEK 5 (21/8) Discussion Question 5 The Urban Transit Authority receives the following two pieces of expert advice: i. “You should cut rail fares in order to encourage greater use. Raising fares will mean fewer customers and lower revenue.” ii. “You cannot afford to cut fares as this will reduce your revenues” (a) What do each of these pieces of advice assume about the elasticity of demand for rail use? (b) How might an economist seek to resolve the conflict of opinion? (c) What factors determine the elasticity of demand for rail use? (d) Are cross-elasticity and income-elasticity issues important in this context too? How? Discussion Question 6 Use the competitive market model with a downward sloping demand for labour curve and an upward sloping supply of labour curve, to show that a legislated minimum wage set above the market equilibrium level results in unemployment. Show that the amount of unemployment is greater, the greater is the elasticity of demand for labour. What determines the elasticity of demand for a particular category of labour. What categories of labour have the highest elasticity of demand and therefore suffer the highest loss of employment from Minimum Wage Legislation? (Note: Gary Becker says that it is simple – raise the minimum wage and you put people out of work. However, David Card and Alan Krueger find that some studies show there is a positive effect of the minimum wage on employment and that most studies show no effect at all. You will have to do a few more economics courses to explain these anomalies!) ECON 1101 Page-39 WEEK 6 (28/8) Discussion Question 7 Use the Supply and Demand model to illustrate the effects on competitive market equilibrium, of the imposition of a per unit indirect tax on a particular commodity. Explain the factors that determine the amounts by which the equilibrium price and quantity of the commodity will change as a result of the imposition of the tax. Use your model and your knowledge of economic theory to consider the following questions: (a) Suppose an indirect tax is levied on an across the board basis, at an equal proportionate rate on all goods and services. Will the tax result in an equal proportionate increase in the market prices of all goods and services? (b) Will the imposition of an equal across the board tax be neutral in its effect on the pattern of consumption demand? Does such a tax affect consumers equally? (c) Suppose the government decides to limit the imposition of indirect taxes to particular commodities. If indirect taxation is levied on particular commodities, to what type of commodities might it be applied? What criteria might government use in applying indirect taxation? Discussion Question 8 Consider the following case: The demand curve for cars in Australia is ‘normal’, downward sloping, and the supply curve for locally manufactured cars is ‘normal’, upward-sloping. The supply curve for imported cars is perfectly elastic and their price is $10,000 (excluding any tariffs that may be imposed). Australian consumers consider local cars and imported cars to be perfect substitutes. There is a tariff protecting the local car manufacturers. Importers of cars must pay a tariff of $5000 per car. With this tariff, imports comprise about 20 per cent of total ECON 1101 Page-40 Australian market sales of 500,000 units each year. If the tariff were $10,000 per car there would be no imports at all. The government decides to abolish the tariff on imports. Show and describe in detail (using graphs where appropriate) who are the gainers and who are the losers when the tariff is abolished. What is the overall effect on economic welfare? WEEK 7 (4/9) Discussion Question 9 The number of automatic teller machines (ATMs) overtook the number of bank branches in Australia a decade or so ago. Several banks have programs for cutting the number of their branches. Over-the-counter banking using human tellers is being replaced by new delivery channels. i. What is the difference, from a cost point of view, between human tellers and ATM machines? Compare the average variable costs and average fixed costs per transaction for each system. ii. Draw the SRAC curve for banking services delivered by teller transactions and that for ATM transactions. iii. Use the figure in part (ii) to explain why you think ATMs have become so common. iv. Suppose the government put a tax on the banks for each ATM machine but didn’t impose a similar tax for human teller transactions. How would the tax affect a bank’s costs and cost curves? Would it change the number of ATMs and the number of tellers that banks hire? Discussion Question 10 An article titled “Air War Savages Virgin Blue” was published in The Australian Financial Review on the 20 January 2005. It reported on Virgin Blue’s declining profit expectations in the light of its vigorous price war with Qantas and Jet Star. Another concern was Virgin’s 60 per cent increase in capacity, as it has increased its fleet of ECON 1101 Page-41 planes aggressively, and now finds itself filling only 73 per cent of its seats, compared to more than 80 per cent a year ago. There is also speculation about predatory pricing against Virgin. Finally, all the domestic airlines have also been hit by rising global oil prices and moves by airports to increase landing fees and charges. Use economic analysis to explain how these developments have affected Virgin Blue. Use graphs where appropriate. WEEK 8 NO TUTORIALS THIS WEEK MID-SESSION EXAM ON FRIDAY 15/9 WEEK 9 (18/9) Discussion Question 11 Pricing Problem Information: Warner Bros. owns The Fugitive and Free Willy. After the release of the two movies, the Company is ready to sell the two DVDs to the mass market. Warner Bros. unit costs for the DVDs are $5 and the stores that sell the DVDs charge a markup of $9. Assume the market is as follows: 100 people would pay $20 for The Fugitive but had no interest in Free Willy 100 people had just the opposite preference 100 people said they would buy both movies at $20 each 100 people said they liked both movies but that $20 was too expensive, but would buy both at a lower price of $17.50 ECON 1101 Page-42 a. Warner Bros. is considering two possible prices - $20 or $17.50 – which price should it charge? Why? b. Would the company make more money if it charged $20 for each DVD but gave purchasers of either DVD a coupon for $5 off the purchase of the other DVD? c. Why does the studio come out ahead if it cuts the price of both DVDs together by $5 but losses if it cuts the price of each DVD separately by $2.50? d. Would the discount package work if the two DVDs were Star Wars and The Empire Strikes Back? e. What problem would the company face if people starting selling the coupons i.e. a market for coupons emerged? Discussion Question 12 The Australian Medical Association (AMA) once called for an immediate 20% cut in medical student intakes to halt what they alleged was a growing oversupply of doctors. “It is a tragic waste of human and economic resources to spend six years training men and women for jobs that will not be needed” said the AMA President. a. Do you agree with the AMA? Why or why not? b. Are professional association’s attitudes to pricing, entry, marketing and competition likely to be always in the public interest? Why? c. How do the characteristics of this market deviate from the perfectly competitive situation? ECON 1101 Page-43 WEEK 10 (3/10) Note: Those with tutorials on Monday will have to attend any tutorial later in the week. DURING THIS WEEK WE PLAY THE OLIGOPOLY GAME NO PREPARATION NEEDED – COME AND HAVE SOME FUN! WEEK 11 (9/10) Discussion Question 13 Explain the concept of “price discrimination” as it relates to the monopoly model. What conditions are necessary for price discrimination to be profitable. What criteria should a monopolist use in practicing price discrimination to maximise profits. Explain why each of the following is, or is not, an example of price discrimination: (i) Pensioners are granted concessional prices for theatre tickets. (ii) Male under 25 drivers are charged higher car insurance rates than other drivers. (iii) An equipment hire stores charges $20 for the first day’s hire, and $10 per day for each additional day. (iv) Petrol prices for motorists are significantly higher in rural areas than in the city. (v) Some Australian wine sells at a lower price in London than in Australia. ECON 1101 Page-44 Discussion Question 14 The Australian government is considering (i) allowing Singapore airlines to compete against Qantas on the trans-Pacific route. The trans-Pacific route is highly profitable for Qantas and it is claimed that Qantas charges 17 per cent more per kilometer traveled on this route than on other routes it services. Another possibility (ii) is a Singapore Airlines – Qantas merger. Examine the microeconomic arguments behind these two possibilities. WEEK 12 (16/10) Discussion Question 15 Suppose Netscape and Microsoft each develop their own versions of an internet browser that is not only much more efficient and powerful for the user, but also allows advertisers to better target potential customers. Each firm must decide whether to sell the browser (for say $30) or give it away free. Giving the browser away free means more people will use it and will bring in increased advertising revenue. However, selling the browser will generate substantial sales revenue. Since the browsers are almost perfect substitutes, if one firm gives theirs away free, the other firm will sell none if they charge a price, thus making a loss equal to their development costs. Assume the development costs are $2b for each firm. The estimated outcomes for each firm are as follows: If Microsoft and Netscape both charge $30, they share the market and each makes $3b in sales revenue and $4b in advertising revenue. If Microsoft and Netscape both give the browser away free they share the larger market and each makes $5b in advertising revenue ECON 1101 Page-45 If one firm gives the browser away free, while the other tries to charge a price, the former makes $10b in advertising revenue and the latter makes zero revenue. (a) Construct the pay-off matrix showing each firm’s profit under different strategies. (b) Assuming the situation can be modelled as a single competitive game, is there a Nash equilibrium? What is it? (c) Does this situation provide any incentive for collusion by the two firms? (d) How does your analysis change if development costs are assumed to be $6b? Discussion Question 16 (Hint: Set up two labour markets – one for females and one for males) The average wage for working women is less than the average wage of working men. Attempts by the government to get rid of this average wage differential usually takes the form of one of two general approaches: (i) an equal pay law or (ii) affirmative action on employment. Using graphs, show the likely affects of these two policies. How applicable, in this context, is the supply and demand framework? WEEK 13 (23/10) Discussion Question 17 “Australians should be paying more for their water, electricity and roads. But it could be worse. Smart pricing - such as by raising prices only for high water users, for electricity consumed at peak times and for driving on roads when they are congested - means we could avoid many of the increases. Getting the demand and supply sides of the equation right is the reform challenge of this decade”. Mike Steketee, ‘Get ready to pay more’, The Australian, 26 March 2005. ECON 1101 Page-46 Using the microeconomic concepts and tools developed so far this session, explain the economic analysis behind this statement. Discussion Question 18 One leading tax expert, Associate Professor Neil Warren, has claimed that the current government has abrogated its responsibility “to implement a transparent and simple tax system, one that minimizes economic distortion and is both horizontally equitable and vertically equitable. The fundamental problem with tax policy is that it is all about tax cuts and not about good tax reform”. Analyze this statement. WEEK 14 (30/10) Discussion Question 19 Two firms, Atomic Chemicals and Bob’s Seafood, are located next to each other on a river. Atomic chemicals freely dumps waste from its chemical plant into the river, which reduces the number of fish in the river and hence the number caught by Bob’s Seafood. (a) Is there market failure involved here? What sort? Explain. (b) The government plans to pass a law preventing Atomic Chemicals from dumping any waste into the river. Would such a regulation lead to an efficient allocation of resources? Explain your answer. (c) Discuss the use of taxes and subsidies as alternative weapons to deal with this situation. In your answer, outline the advantages and disadvantages of each method. Use diagrams, where possible, to support your answer. ECON 1101 Page-47 Discussion Question 20 “The tax system could be improved were we able to shift some of the tax burden off good things we want to encourage and onto bad things we'd actually like to discourage. What bad things? Well, activities or commodities whose production and consumption generates adverse spillover effects ("negative externalities") on the wider community. These activities are always under-priced because their price doesn't include the cost to third-parties of the spillover effects. And because they're under-priced, people end up producing and consuming more of them than is in society's interests. So you'd make the world a better place if you raised the price of these commodities by slapping an extra tax on them. This would tend to discourage their consumption and production - which is just what we'd like to do”. Ross Gittins, ‘Let's have some 'bad' ideas about tax reform’, Sydney Morning Herald, April 18, 2005. Analyze this quotation in the context of explaining how the presence of public goods and externalities prevent a competitive market from achieving an efficient allocation of resources. Explain and illustrate how these market failures might be corrected. Focus especially on the use of taxation and subsidies. SUPPLEMENTARY QUESTIONS (We have scheduled 2 discussion questions per week but if the number of student presentations is greater than the number of discussion questions you can use any of the following five questions and the tutor can slot them in to the appropriate week). Discussion Question 21 For the Australian manufacturing sector the effective rate of protection fell from around 35% in 1970 to less than 5% in 2001. These policies have increased the competitiveness of Australian industry. ECON 1101 Page-48 a. Explain how competitiveness is increased when domestic firms have easier access to cheaper intermediate inputs and capital imports. Some of these imported inputs may have given local firms access to the latest technology. b. Explain how local manufacturers have faced increased competitive pressures with the greater availability of cheaper imported finished products. c. Explain why those manufacturing sectors that experienced rapid import growth also had an even more rapid growth of manufactured exports. Where appropriate use graphs to illustrate your answers. Discussion Question 22 Three families jointly own the only pizza shop in town. The Lee family wants to sell as many pizzas as possible without losing money. The O’Brien family wants to make the largest possible profits. The Yang family wants the shop to bring in as much revenue as possible. i. Using a single diagram, depicting the demand curve for pizzas by town residents and the cost curves of the pizza shop, illustrate and explain the price-quantity combination favoured by each of the partner families. ii. Suppose the local government decided to impose price regulations on the pizza shop. Outline the quantity produced and the deadweight loss under: a. average cost pricing b. marginal cost pricing c. profit maximisation Discussion Question 23 The Australian Financial Review of 1 April 2005 reported that the ACCC had launched an investigation into price-fixing allegations and anti-competitive behaviour in the $2.2 billion cardboard-box market. The ACCC had uncovered communication between the ECON 1101 Page-49 two leading companies that controlled 90 per cent of the market, indicating possible cartel behaviour – market sharing and price-fixing. a. Explain why it may be in the interests of these two leading firms to engage in anti-competitive behaviour. b. Use graphs to analyze the effects of this behaviour on the efficiency of this market. c. What are the potential benefits if the ACCC finds, and is able to stop, anticompetitive behaviour? Discussion Question 24 In Britain during World War 2 the government imposed a price ceiling on bread to hold down its market price. Explain why this resulted in upward pressure on the price of bread. If the upward price continued (and given continued enforcement of the ceiling) what consequence(s) would you anticipate happening? The government then decided to enforce a law in which all bread sold had to be one day old. Would you expect this to achieve the desired result? How? Use graphs to illustrate your answers. Discussion Question 25 Analyze and compare the effects of subsidies and quotas in protecting the Australian garment industry against competition from imports. In particular, consider the effects on price, domestic production and consumption of garments, and economic efficiency. What government assistance, if any, do you think is appropriate for this industry? ECON 1101 Page-50 SCHOOL OF ECONOMICS DISCUSSION QUESTION, COVER SHEET AND MARKING GUIDE ECON1101: MICROECONOMICS 1 Student Name: SESSION 2, 2006 Student Number: _______________ Tutorial Group (Number, Time and Place): _________ Tutor: _________ Discussion Question Number: I declare that this assessment item is my own work, except where acknowledged, and has not been submitted for academic credit elsewhere, and acknowledge that the assessor of this item may, for the purpose of assessing this item: Reproduce this assessment item and provide a copy to another member of the University; and/or, Communicate a copy of this assessment item to a plagiarism checking service (which may then retain a copy of the assessment item on its database for the purpose of future plagiarism checking). I certify that I have read and understood the University Rules in respect of Student Academic Misconduct. Signed: ………………………………………… Date: ………………… CRITERIA Excellent Very Good Satisfactory Unsatisfactory ORAL PRESENTATION Organisation: well organised, evidence of planning Content: identification of key issues Quality: explanation and application of relevant economic theories or analysis Discussion: responded to class questions Delivery: confidence, clarity, used overheads/whiteboard Time frame: kept within time limit WRITTEN PRESENTATION Structure: clear and well organised Discussion of background information Explanation and application of relevant economic theories Overall: was the question answered? ECON 1101 Page-51 Length: kept within word limit Additional Comments: Mark /10 Signed (Tutor) ……………………………… ECON 1101 Page-52