measuring transport benefits using observable demand

advertisement

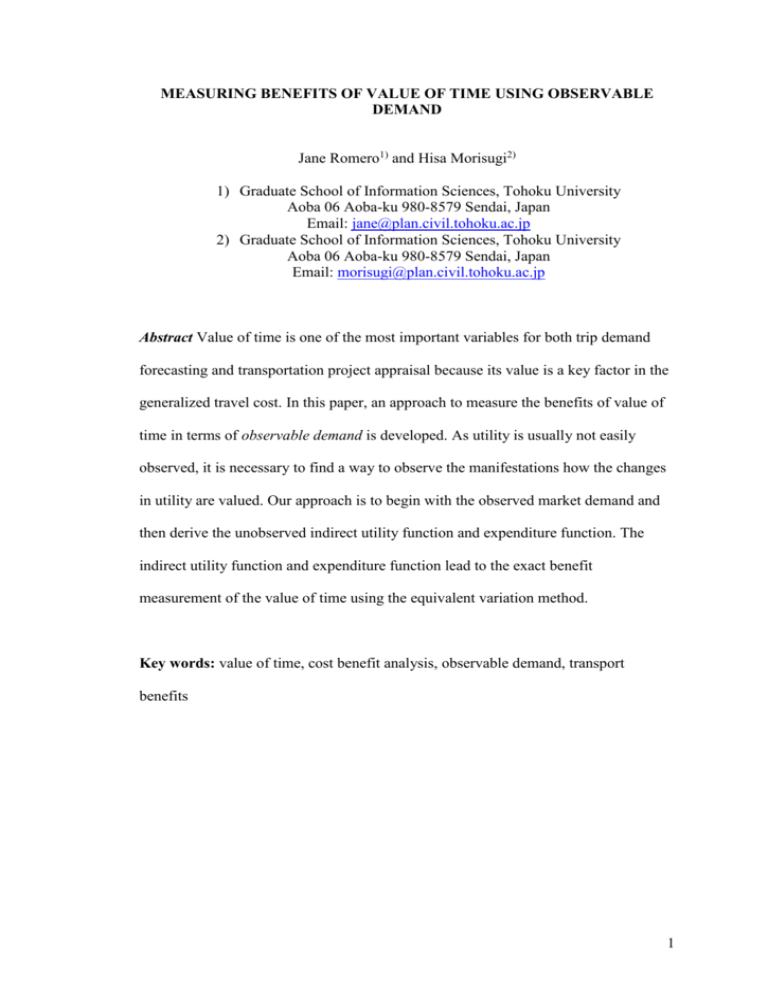

MEASURING BENEFITS OF VALUE OF TIME USING OBSERVABLE DEMAND Jane Romero1) and Hisa Morisugi2) 1) Graduate School of Information Sciences, Tohoku University Aoba 06 Aoba-ku 980-8579 Sendai, Japan Email: jane@plan.civil.tohoku.ac.jp 2) Graduate School of Information Sciences, Tohoku University Aoba 06 Aoba-ku 980-8579 Sendai, Japan Email: morisugi@plan.civil.tohoku.ac.jp Abstract Value of time is one of the most important variables for both trip demand forecasting and transportation project appraisal because its value is a key factor in the generalized travel cost. In this paper, an approach to measure the benefits of value of time in terms of observable demand is developed. As utility is usually not easily observed, it is necessary to find a way to observe the manifestations how the changes in utility are valued. Our approach is to begin with the observed market demand and then derive the unobserved indirect utility function and expenditure function. The indirect utility function and expenditure function lead to the exact benefit measurement of the value of time using the equivalent variation method. Key words: value of time, cost benefit analysis, observable demand, transport benefits 1 1. INTRODUCTION Over the years there has been increasing recognition of the importance of time valuation to the measurement of economic contribution of proposed projects and policies. In transport research, value of time is one of the most important variables for both trip demand forecasting and transportation project appraisal because of its significant contribution in the user benefit and its value is a key factor in the generalized travel cost. Needless to say, measurements of value of time and transport benefits are critical in cost-benefit analysis. Cost-benefit analysis is the name of the game in the field of public finance, and in particular public spending, both in developed and developing countries. Investment in infrastructure is a major indicator that separates the developed from the developing ones. But even in developed countries, because of scarce public funding, social rates of return between alternative projects must be computed and compared among alternatives, and infrastructure, particularly transport infrastructure is the one of the fields of application of these cost-benefit techniques considering how capital intensive is the requirements for funding of transport projects. Although much is left to be desired on the empirical implementation of the theoretical construct behind costbenefit analysis as its mechanistic application may overlook factors such as governance and other behavioral responses that often led to unrealistic evaluations, it is still the litmus test in project feasibility studies and evaluation. This study, in general, aims to improve the process of cost-benefit analysis by introducing a new approach in determining realistic transport benefits ex post through measurement of benefits using observable market demand. 2 Since the early attempts to incorporate time into consumer theory, such as those by Becker (1965), previous approaches primarily relied on the wage rate to provide information about a person’s willingness to trade time with money. In applied economic research, there have been criticisms on the use of the wage rate as the relevant opportunity cost of time. Recent approaches, for example Bockstael et al (1987) and Feather and Shaw (2000) have explicitly recognized that people might not be able to freely choose their work hours, as such have allowed the shadow value of time to deviate from the wage rate. Even with the recent developments that clarified more explicitly the nature of the value of time, there is still no consensus yet on a workable method for estimating the exact value of time. Although the framework of how time should enter the structure of demand has become clear, it remains vague how to determine its value in practice. Basically, in practice, value of time is derived either by the wage rate approach or by mode choice analysis using revealed preference (RP) data or stated preference (SP) data. Both methods neglect the changes induced to the value of time derived from the changes in economic factors such as prices, travel time, travel costs, among others. Other than the current discrete choice models approach, the concept of measuring the value of time in terms of observable demand from market data is yet under explored. Although this concept is already popular in valuing non-market goods in environmental economics, its application in the context of value of time analysis is not yet tapped. There are series of papers by Larson and Shaikh (2001, 2003, 2004) that mentioned the observability of demand in the context of valuing leisure time. However, their analysis only considered VOT as a resource and made no mention of the case of VOT as a commodity. 3 Larson and Shaikh (2001) modified Becker’s full price approach to introduce the twoconstraints model for recreation choice wherein time is a binding constraint. With this approach, it is possible to extend it to evaluate the general case of person trips and carry out exact welfare measurement that is consistent to the utility theoretic model. They first mentioned the observability of VOT as a resource and applied it to derive recreation demand. However, there is no approach yet wherein the components of VOT can be specifically derived based on actual observable demand. Moreover, measurement of transport benefits in terms of observable demand is a novel approach that has not been introduced to the value of time research yet. Further thorough analysis of this approach will be of use to establish the theoretical basis for future empirical applications. Basically, this study attempts to fill the research gaps mentioned above vis-à-vis in the definition and welfare measurement of the value of time and transport benefits. Generally, as the title implies, it aims to measure the value of time and its components using observable demand measure the time savings benefits in terms of observable demand De Serpa (1971) concluded that the value of saving time consists of value of time as a resource (i.e., value of reassignment of time to other activities) and value of time as a commodity (i.e., value of time allocated to a certain activity). Jara-Diaz (2003) proposed the third component that value of time changes in the consumption pattern. Although there have been a number of previous studies measuring the value of time, few studies were concerned with measuring its actual components primarily because 4 the components are viewed as largely theoretical constructs. The components of the value of time also vary in different ways which adds to the confusion on how to analyze it. For example, value of time as a resource is more familiar as it is synonymous to time savings that can be re-assigned to do other activity. However, there is still an effect in the value of time as commodity although there is no time savings when there is an improvement in the traveling conditions. Therefore, measuring the components of the value of time separately leads to better understanding of the factors that affects it which also contributes to better estimation reliability. This paper will only focus on the case of the value of time as a resource for nonbusiness person trips. The discussion is highly on the theoretical framework on how to measure the value of time as a resource using observable demand. The application of the theory is still a work in progress. The paper will be organized as follows. After the introduction is the discussion on the non-business person trips. Specifically, it will measure the value of time as a resource in terms of observable Marshallian demand. After expressing the value of time in terms of observable demand, what follows is the measurement of time savings benefits by equivalent variation approach. Finally, the paper ends with the conclusion. 2. NON-BUSINESS PERSON TRIPS Value of time is one of the most important variables for both trip demand forecasting and transportation project appraisal because its value is a key factor in the generalized travel cost. The value of time for household is defined as the change in travel fee 5 corresponding to the change in travel time with the utility level kept constant, i.e., the willingness to pay for marginal change in travel time. Value of time for firms is defined as the same with the profit kept constant. Mathematically, it is defined as VOT dp dt u or const. (1) where p is transport cost, t is necessary transport time, u is utility and π is profit. The subjective value of time is the marginal rate of substitution between travel time and travel cost under constant utility or profit level. It is commonly referred to as the monetary appraisal of value of time or the willingness to pay for savings in travel time. To express the value of time in terms of observable demand for non-business person trip, the indirect utility function and expenditure function are derived based on the given demand. This is different from the more common approach of starting from a specified utility function like trans-log then estimating the unknown parameters from the derived market functions. However, the analysis on how to choose the appropriate demand function for the given demand will not be discussed here. In other words, it is assumed that market demand is observable, and that the preference is not observed. Instead, the focus is on the next step, on the indirect utility function and expenditure function, on how to express the value of time in terms of observable demand. The process applied here is an extension of the Larson and Shaikh’s (2001) approach, which they introduced to measure recreation demand. With the extension, it is then possible to estimate the general case of an endogenous value of time jointly with 6 observable behavior in a utility-consistent framework, which utilizes full price – full income specification subject to two binding constraints (i.e., income and time constraints) on demand parameters. This approach, with the indirect utility function and expenditure function, lead to exact welfare measurement derived consistently from observable demand for person trips. 2.1 Value of time as a resource 2.1.1 Modeling individual behavior First, to formulate the VOT, think of an individual on a non-business trip, which is, either commuting or shopping. Let u z, x, l be the individual’s preference function. The utility of an individual is assumed to be a function of the demand for commodity goods z whose price is normalized to 1, transport service demand x and leisure time l. This formulation assumes neutrality in time t where disutility induced by the trip duration such as fatigue, inconvenience and discomfort are not included in the analysis. Also, assume that working time is fixed then referring to (2) and (3), the individual maximizes utility subject to income y and total available time T. The indirect utility function, V 1, p, t , T , y , is given by V 1, p, t ,T , y max uz, x, l (2) z , x,l s.t. z px y, tx l T (3) 7 The utility function is assumed to be differentiable and quasi-concave in x , and the constraints are differentiable and linear in x and in both money and time prices and money and time budgets. Graphically, the utility maximization problem subject to the income constraint and budget constraint is shown as, Figure 1 Graph of individual choice maximization The individual’s choice is represented by plane a-b, which is better illustrated in Figure 2. Figure 2 Graph of individual’s choice The Lagrangian function of (2) and (3) is represented by V 1, p, t ,T , y max uz, x, l y z px T l tx (4) z, x,l The Lagrange multipliers and represent the shadow values of money and time, respectively. Intuitively, is the marginal utility of income and is the marginal utility of time. By applying envelope theorem to (4), the following are derived: 8 Vy 1, p, t , T , y , (5a) VT 1, p, t , T , y , (5b) V p 1, p, t , T , y x1, p, t , T , y , (5c) Vt 1, p, t , T , y x1, p, t , T , y (5d) where Vy ,VT ,V p ,Vt are partial derivatives wrt the subscript Using the envelope results, the Marshallian demand x1, p, t ,T , y can be recovered through two separate versions of Roy’s identity, 2.1.2 V p Vy x (6a) Vt VT x (6b) VOT as a resource expressed by observable Marshallian demand Value of time is defined as the marginal substitution rate for utility between price p and duration time t . Recalling (1) and applying Roy’s identities above, the value of time can be expressed as VOT V VT x VT dp t dt v const. V p V y x V y (7) where notation with subscripts indicate partial derivatives wrt the subscript 9 To express (7) in terms of observable demand, the approach is to take the derivative of (5a) and (5b) with respect to t and p to express the VOT in terms of x, V pt V y x Vty x V y xt VT x y x V y xt VTy x 2 VT x y x V y xt t (8) (9) T Vtp VT x p V pT x VT x p V y x x VT x p V yT x 2 V y xT x VT x p Note that (8) and (9) are equal, so equating the two equations, it can derive VT x p xxy Vy xt xT x (10) Therefore, it follows from (10) that VOT as a resource can be expressed in terms of observable demand x as V x xxT VOT v const. T t V y x p xxy (11) Analyzing (11), value of time under the assumption of constant utility can be measured from observable changes in the Marshallian demand x where xt is the change in demand with respect to change in time, x p is the change in demand with respect to change in transport cost, xT is the change in demand with respect to change in total available time and x y is the change in demand with respect to change in income. The denominator in (11) is the price substitution effect while the numerator is the time substitution effect. Looking at it, it shows that VOT is observable just by examining 10 only the price and time substitution effects of transport demand. Also, it shows at the same time that VOT is a function of p, t , T , y and other individual characteristics. 3. MEASUREMENT OF TIME SAVINGS BENEFITS USING OBSERVABLE DEMAND The dual approach to the problem is to consider the associated minimization problem, which defines the expenditure function e 1, p, t , T , u min h0 ph s.t. (12) h0 ,h th h2 T , uh0 , h, h2 u (13) where hi i 0,2 represents the demand for commodity goods z and leisure l respectively, h is the compensated transport demand, t is transport time, T is total available time and u is given level of utility. The expenditure function may be expressed as the minimization of the Lagrange function, e L h0 ph T th h2 u uh0 , h, h2 (14) Then the following are derived from the envelope theorem applied to (14): ep h (15a) 11 et h eT h (15b) eT (15c) 3.1 Compensated VOT and Time-extended Slutsky Equations The compensated VOT is defined as the marginal substitution rate for expenditure function between price p and time t , which is equal to the marginal value of available time T . The compensated VOT in terms of the expenditure function is given as, compensated VOT dp e e h t T eT dt e const. ep h u const. (16) where eT can be interpreted as the compensated value of time Now, to express the compensated VOT in terms of the compensated demand h, take the derivative of the e p h with respect to t and et h eT h with respect to p, which results to e pt ht (17a) etp eT h p e pT h eT h p hT h eT h p (17b) Then equating (17a) and (17b), the compensated VOT is equal to 12 ht hhT hp (18) Note that the compensated VOT, i.e. (18), is not equal to the Marshallian VOT given V x xxT by (11), which is VOT v const. T t . V y x p xxy This compensated VOT can be expressed by the compensated demand function. The compensating demand function is always equal to the usual demand function at income equal to e1, p, t , T , u , which can be expressed as, h1, p, t, T , u x1, p, t, T , e1, p, t, T , u (19) Taking the derivative of (19) with respect to p, t and T, and recall that when u is at V 1, p, t ,T , y then it follows that e1, p, t,T , v1, p, t,T , y,V y and accordingly, it can be derived that xe x y , h x and VOT eT , then it can be shown that h p x p xxy (20a) ht xt VOT xxy (20b) hT xT VOT x y (20c) 13 From (20b) and (20c), this relationship can be derived showing how ht can be expressed in terms of hT , ht xhT xt xxT ht xt xxT xhT (20d) Notice that (20a)-(20d) show the relationships between the observable uncompensated Marshallian demand and the unobservable Hicksian demand, that is, the changes in compensated demand h with respect to travel cost h p , travel time ht and total available time hT can be expressed in terms of the changes in observable Marshallian demand x. These expressions lead to evaluating the compensated demand in terms of observable demand. These relationships of the uncompensated demand to observable demand have not been expressed this way before. These formulations will be more beneficial in the succeeding texts where transport benefits will be derived based on observable demand. Following the same logic, the compensating VOT is always equal to the usual Marshallian VOT at income equal to e1, p, t , T , u , which can be expressed as, 1, p, t,T , u VOT 1, p, t,T , e1, p, t,T , u . Accordingly, the compensated VOT can be expressed in terms of observable VOT, which take the form similar to a Slutsky equation as follows: p VOT p xVOT y (21a) 14 t VOT t VOT xVOT y (21b) T VOT T VOT VOT y (21c) It is also necessary to calculate the combined compensated demand and VOT. With h 1, p, t,T , u xVOT 1, p, t,T , e1, p, t,T , u , the derivatives of hp with respect to p and t can be derived as, h p xVOT p x xVOT y (22a) h t xVOT t xVOT xVOT y (22b) h T xVOT T VOT xVOT y (28c) These extended Slutsky formulations of the compensated VOT in terms of observable VOT will come in handy in the measurement of welfare changes as it is only the Marshallian VOT that is observable and yet the compensated VOT is the vital component that needs to be measured. Finally, at A 1, p A , t A , T A , y A , comparing the Marshallian VOT to the Hicksian h hhT . V x xxT VOT, recall (11), VOT v const. T t , and (18), t V y x p xxy hp Referring to (20a), where h p x p xxy , then we could say that the denominators of the Marshallian VOT and HIcksian VOT are equal. 15 Looking at the numerator of ht hhT hp and referring to (20b) and (20c), which are ht xt VOT xxy and hT xT VOT x y respectively, then from (20b) and (20c), this equation can be derived relating ht xt xxT xhT . Substituting that formulation of ht to the numerator of ht hhT , given that hp x h , then it V x xxT becomes equal to the numerator of VOT v const. T t . Therefore, with V y x p xxy the derived Slutsky equations, it is possible to relate the observable Marshalian VOT to the compensated Hicksian VOT. 3.2 Estimation of time savings benefits using observable demand The indirect utility function and the expenditure function provide the theoretical structure for welfare estimation. The theoretical method is to use information available about the expenditure function or its accompanying Hicksian demand curves for market goods to obtain compensating or equivalent variation measures of a change in a nonmarket good. The compensating variation, CV, is the amount of money that must be given to the loser, or taken from the gainer, in order to keep the individual on the initial reference curve. In conventional references with price change and no time constraint, it is expressed by CV e p B ,V A e p A ,V A where the term e p A ,V A is the total expenditure level in the initial situation, denoted by m A and e p B ,V A is the 16 expenditure function for p B ,V A . On the other hand, the equivalent variation, EV, is the amount that the individual would be prepared to pay, in the new situation, to avoid the price change, that is, EV e p B ,V B e p A ,V A , where the term e p B ,V B is the total expenditure after the price change, denoted by m B . In the partial equilibrium context, only the prices change, so m A m B . Applying the concept of equivalent variation to the value of time problem, it is not only the price change that needs to be evaluated. As the definition of value of time implies, it is the willingness to pay for savings in travel time so the changes that we will consider to measure the exact welfare changes between the before (A) and after (B) scenarios are time change t A t B , price change p A pB , income change y A yB and change in utility v A v1, p A , t A , T , y A v B v1, p B , t B , T , y B . It is possible that these changes may occur individually or simultaneously depending on the given circumstances or the need of evaluation but to measure the exact welfare changes, we will consider a whollistic approach including all the changes. Two expressions of equivalent variation, EV, will be considered. It will be evaluated with respect to the Marshallian demand with adjustment of the marginal ratio of income, e y x , and with respect to the compensated demand, h . 3.2.1 Exact welfare measurement formula wrt e y x First, looking at the reference point A, EV can be expressed as 17 e1, p A , t A , T ,V B e1, p A , t A , T ,V A EV e A,V B y A e A,V B e A,V A (29a) Another way of expressing EV is by eA,V B eB,V B y B y A e1, p A , t A , T ,V B e1, p B , t B , T ,V B y B y A EV e A,V B y A e A,V B y B y B y A (29b) Now, to evaluate EV in terms of Marshallian demand and applying Roy’s identity where V p Vy x, Vt VT x, VOT VT Vy , EV e A,V B eA,V A VB Aev dV V eV V p dp eV Vt dt eV Vy dy A B eV Vy x dp eV Vy VT (29c) V y x dt eV V y dy A B e y A,V xdp xVOTdt dy A B Looking at (29c), it is necessary to express the term ey A,V in terms of demand x. Evaluating ey A,V , it can be shown that, e y A,V ev A,V V y 1, p, t , T , y V y 1, p, t , T , y V y 1, p A , t A , T , y (29d) 18 So e y may be called as the marginal utility ratio of income. Note that e A,V A, y y , so e y A,V A, y y at any y , therefore e yy 0 . 3.2.2 Exact welfare measurement formula wrt h Another way of expressing EV is in terms of compensated demand h by applying Sheppard’s lemma e p h, et h such as, e p dp et dt y B y A B A h1, p, t , T ,V B dp h1, p, t , T ,V B 1, p, t , T ,V B dt y B y A EV e 1, p A , t A , T ,V B e 1, p B , t B , T ,V B y B y A (30) B A In order to calculate and express (29a) and (30) in terms of consumer’s surplus with respect to the Marshallian and compensated demand functions x, h and to multiply by marginal utility ratio of income e y x the first case. 3.2.3 Linear approximation for the marginal utility ratio of income, e y x By linear approximation of the demand function, that is, second-order approximation of EV, (29a) can be re-written as 19 EV e A,V B e A,V A e y A,V xdp xVOTdt dy A B 1 A A 1 e y x e yB x B p A p B e yA x AVOT A e yB x BVOT B t A t B 2 2 1 A e y e yB y B y A 2 (31) since e yA 1 , it needs to express only e yB e y A, v B in terms of observable demand. So e yB is linearly approximated and to be expressed in terms of observable demand, A A pB p A e ytA t B t A e yy yB y A e yB e yA e yp (32) A where e yy 0, A A A e yp e py eVA A,V V p e y A,V x A x yA y y A A A e yt etyA eV Vt A y eV VT x y xVOT y Simplifying, it becomes, e yB 1 x yA pB p A xVOT A y t B t A (33) From (33), it shows that e yB can be approximately expressed in terms of observable demand as defined in (11). 20 The above formula, (31), is the well-known trapezoidal formula for area with modification of x B by e yB x B where e yB is an addition by income effect. This is not similar to Willig’s consumer’s surplus approach wherein fixed income is a valid assumption. However, if the income effect e yB is negligible, the modified demand function could be equal to the Marshallian demand function. 3.2.4 Graphical illustration of the changes in p, t , y Referring to (29a), the following figures illustrate the changes in p, t , y . The first, second and third terms can be expressed by the consumer’s surplus due to price, time and income change equal to the shaded area with respect to the adjusted demand function, adjusted time values demand function and adjusted marginal ratio of income function. Figure 3 Change in p Figure 4 Change in t Figure 5 Change in y From Figure 4, also note that the generalized cost (full price) approach is misleading unless the project does not result to a change in VOT. 3.2.5 Linear approximation for compensated demand, h 21 From (30), it can be shown that by linear approximation for h , EV e 1, p A , t A , T ,V B e 1, p B , t B , T ,V B y B y A hdp hdt y B yA B A y B y A 1 1 h A,V B h B p B p A h A,V B A,V B h B B t B t A 2 2 (34) B B,V B VOT B where h B h B,V B x B Referring to the equation above, terms h A,V B and h A,V B A,V can be linearly approximated around h B and h , respectively. B h A,V B h B,V B h pB p A pB htB t A t B (35a) h A,V B A,V B h B B h Bp p A p B h tB t A t B (35b) Substituting Slutsky equations for h p , ht , h p and h t , B B B A B B A B B B h A,V B x B x B p x x y p p xt VOT x x y t t h A,V B x BVOT B xVOT Bp x B xVOT By p A p B (36a) B xVOT tB x BVOT xVOT y t A t B (36b) 22 Thus h A,V B and h A,V B can be expressed by observable demand and observable Marshallian VOT as defined in (11). Note also the application of the extended Slutsky equations in the derivations of (36a) and (36b). 3.2.6 Relationship between e y x and h The difference between the two methods become clear by looking only at the price change indicated as the first term in (31) and (34) as illustrated in Figure 6. Figure 6 Relationship between e y x and h Equation (31) is the expression of EV= trapezoid p A AEp B while (34) is the expression of EV= trapezoid p A DBp B . Time change can be expressed graphically the same except by expressing demand in terms of xVOT or h . The trapezoid bounded by p A AEp B derived from the modified demand function is equal to the trapezoid bounded by p A DBp B from the compensated Hicksian demand. To measure the welfare change, referring to Figure 6, it is necessary to establish the Hicksian demand line DB or the modified demand line AE. However, the compensated Hicksian demand nor the modified demand cannot be observed in the market whereas only the Marshallian demand indicated by line AB is observable. So basically, the approach discussed can be summarized as the approach on how lines 23 DB and AE can be calculated in terms of line AB, which is in terms of the observable Marshallian demand. 4 CONCLUSIONS This study develops an approach for welfare measurement of the value of time based on observable demand. While the current practice derives the value of time assuming specified utility and demand functions, analysis thru observable demand is possible and is consistent with utility-theoretic model. It is an important finding as this approach expresses the VOT in terms of Marshallian observable demand and even capable to analyze the components of the value of time. It has been known that the use of compensated demand curves lead to appropriate welfare measures. However, as Hausman (1981) commented, ‘While this result has been known for a long time by economic theorists, applied economists have only a limited awareness of its application’. True enough, its application to the benefit measurement of the value of time has not been shown, how VOT can be derived and its benefits be measured from observable demand. This study showed that the indirect utility function and expenditure function provide the appropriate compensated demand curve and thus the appropriate welfare function. VOT as a resource assumes utility neutrality in travel time. For the exact welfare measurement of VOT, two approaches by equivalent variation considering time change, price change, income change and utility change are demonstrated. These two methods resulted from the transformation of the compensated demand and VOT in 24 terms of Marshallian demand and VOT by applying the extended Slutsky equations. The first method is by expressing the marginal utility ratio of income in terms of Marshallian demand and VOT while the second method is by expressing the compensated demand and VOT in terms of Marshallian demand and VOT. REFERENCES Becker, G. (1965) ‘A theory of the allocation of time’, Econ. J., 75, 493-517. Brockstael , N.E., Strand, I.E. and W.M. Hanemann (1987) ‘Time and recreation demand model’, American Journal of Agricultural Economics, 69, 293-302. Cornes, R. (1992). Duality and Modern Economics (New York: Cambridge University Press). De Donnea, F.X. (1971) ‘Consumer behavior: transport mode choice and value of time (some micro-economic models)’, Regional Science and Urban Economics, 1, 355-382. De Serpa, A.C. (1971) ‘A theory of the economics of time’, The Economic Journal, Vol. 81 (324), pp.828-846. Gonzales, R.M. (1997) ‘Value of time: a theoretical review’, Transport Reviews, 17(3), 245-266. 25 Hanemann, M.W. (1991) ‘Willingness to pay and willingness to accept: how much can they differ?’, The American Economic Review, 81(3), 635-647. Hausman, J.A. (1981) ‘Exact consumer’s surplus and deadweight loss’, The American Economic Review, 71(4), 662-676. Heckman, J.J. (1974) ‘Shadow prices, market wages, and labor supply’, Econometrica, 42(4), 679-94. Jara-Diaz, S.R. (2003) ‘On the goods-activities technical relations in the time allocation theory, Trans, 30(3), 245-260 Larson, D.M. (1992) ‘Further results on willingness to pay for nonmarket goods’, Journal of Environmental Economics and Management, 23, 101-122. Larson, D.M. and S. Shaikh (2001) ‘Empirical specification requirements for twoconstraint models of recreation demand’, American Journal of Agricultural Economics, 83(2), 428-40. Larson, D.M. and S. Shaikh (2004) ‘Recreation demand choices and revealed values of leisure time’, Economic Inquiry, 42(2), 264-278. 26 McConnell, K.E. and I.E. Strand (1981) ‘Measuring the cost of time in recreation demand analysis: an application to sportfishing’, American Journal of Agricultural Economics, 63(1), 153-156. Neary, J.P. and K.W.S. Roberts (1980) ‘The theory of household behavior under rationing’, European Economic Review, 13, 25-42. Shaikh S. and D.M. Larson (2003) ‘A two-constraint almost ideal demand model of recreation and donations’, The Review of Economics and Statistics, 85(4), 953-961. Smith, V.K., W.H. Desvousges and M.P. McGivney (1983) ‘The opportunity cost of travel time in recreation demand models’, Land Economics, 59(3), 259-77. 27 LIST OF FIGURES Figure 1 Graph of individual choice maximization Figure 2 Graph of individual’s choice Figure 3 Change in p Figure 4 Change in t Figure 5 Change in y Figure 6 Relationship between e y x and h where: AB: Marshallian demand function, x AC,DB: Hicksian demand at v A and v B , h AE= e yA A, v x : modified demand function 28 b z u z , x, l preference function l tx l T A a t p z px y x 29 u z , x, l b zy A pT z y t z y px z px y a T t l0 x x, l such that x0 l T 30 p e y x1, p, t , T , y pA pB ey x 31 t e y xVOT 1, p, t ,T , y tA tB e y x VOT 32 e y 1, p, t , T , y 33 p x pA A D h ey x pB C xA h pB ,u A h p A,u B B xB E x, h 34