ASSESSMENT SCHEDULE You should answer ALL the questions

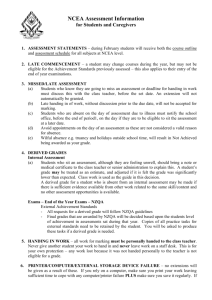

advertisement

ASSESSMENT SCHEDULE You should answer ALL the questions in this booklet. YOU MUST HAND THIS BOOKLET TO THE SUPERVISOR AT THE END OF THE ASSESSMENT. Achievement Criteria Achievement Prepare financial statements following good accounting practice, with some additional information correctly treated. Achievement with Merit Achievement with Excellence Prepare financial statements following good accounting practice, with the majority of additional information correctly treated. Prepare financial statements following good accounting practice, with all or nearly all additional information correctly treated. Prepare accounting entries for Prepare a range of accounting balance sheet day entries for balance sheet day adjustments. adjustments following good accounting practice. Prepare a wide range of accounting entries for balance sheet day adjustments consistently following good accounting practice. Overall Level of Performance (all criteria within a column are met) © NZCETA Practice Assessment 2007 Accounting AS 90224 (2.5) NCEA Level 2/Year 12 Page 1 NZCETA has approval from NZQA to use their materials in the development of this resource Evidence Statement QUESTION ONE Part A – Income Statement Prepare a fully classified Income Statement for Sohan’s Electrical Services after taking into account the additional information. Classify the expenses under the following headings: Electrician’s Expenses; Administrative Expenses; Finance Costs Sohan’s Electrical Services Income Statement for the year ended 31 August 2007 Evidence Revenue Electrical Fees 102 000 Add other income Dividends Received 300 Less Expenses Electrician’s Expenses Advertising Cell phone expenses (Sohan) Electrical supplies used Service Vehicle expenses Depreciation on Service Vehicle 4 000 1 600 4 800 13 000 6 750 Administrative Expenses Bad Debts Office Expenses Office Manager’s Salary Postage and Stationery Doubtful Debts Depreciation on Office Furniture 1 680 14 900 45 000 1 100 900 2200 Finance Costs Interest on Overdraft Total Expenses Profit for the year Code S S 30 150 S SC S S SC 65 780 SC S S S SC SC 770 SC 96 700 5 600 S# S = correct stem, correct classification and correct figure if no C S# = correct calculation (income minus expenses) C = correct number regardless of classification Shaded figures are not marked. F = an item that should not be reported in the Income Statement Judgement Statement for QUESTION ONE Part A Achievement Achievement with Merit Achievement with Excellence 7xS+2xC max 4 F 10 x S + 3 x C max 2 F 13 x S + 5 x C no F © NZCETA Practice Assessment 2007 Accounting AS 90224 (2.5) NCEA Level 2/Year 12 Page 2 NZCETA has approval from NZQA to use their materials in the development of this resource Part B – Balance Sheet and notes extracts Prepare the Current Assets and Non-Current Assets sections of the Balance Sheet and Notes 1 and 2 for Sohan’s Electrical Services after taking into account the additional information. PLEASE NOTE: only notes 1 and 2 need to be prepared. The Property, Plant and Equipment table is not required. Sohan’s Electrical Services Balance Sheet (extract) as at 31 August 2007 Current Assets Accounts Receivable 26 100 SC Non-Current Assets Investments (note 2) Shares in Electrical World Ltd Property, plant and equipment (note 3) Total Carrying Amount 24 000 S 26 050 C Total Assets 76 150 Notes to the Balance Sheet (extract) 1) Accounts Receivable Accounts Receivable less Allowance for Doubtful Debts 29 000 2 900 26 100 C C S# S = correct stem, correct classification and correct figure if no C C = correct number S# = correct calculation (accounts receivable minus allowance for doubtful debts) Shaded figures are not marked. 2) Investments Investments comprise Shares in Electrical World Ltd. S The current fair value of the shares is $ 24000 which is their market value on balance sheet date. S © NZCETA Practice Assessment 2007 Accounting AS 90224 (2.5) NCEA Level 2/Year 12 Page 3 NZCETA has approval from NZQA to use their materials in the development of this resource Part C – Statement of Accounting Policies extract Prepare the following Accounting Policies for Sohan’s Electrical Services. Name and Nature These financial statements are prepared for Sohan’s Electrical Services a sole proprietorship specialising in providing electrical services. S Property, Plant and Equipment Property, Plant and Equipment are stated at cost and (except for land) is depreciated. S GST All amounts are stated exclusive of Goods and Services Tax (GST), S except for receivables and payables which are stated inclusive of GST. C Judgement Statement for QUESTION ONE Part B and Part C Achievement Achievement with Merit Achievement with Excellence 4xS+2xC 5xS+3xC max 2 F 7xS+4xC no F © NZCETA Practice Assessment 2007 Accounting AS 90224 (2.5) NCEA Level 2/Year 12 Page 4 NZCETA has approval from NZQA to use their materials in the development of this resource QUESTION TWO Samantha Smith owns a children’s clothing store that she has run for a number of years. The store is called Pink and Blue. Pink and Blue Cash Flow Statement for the month ended 30 September 2007 Evidence Receipts (Cash) Sales 23 000 (Cash from) Accounts Receivable/Customers 100 Total Receipts Payments Wages Electricity Rent (Cash paid to) Accounts Payable/Suppliers Interest (on Loan) Code S SC 23100 S S SC SC S 14 000 250 1 000 1 300 250 Total Payments Net increase (decrease) in cash Opening bank balance Closing bank balance 16 800 6 300 1 200 7 500 C* S C# S = correct stem, correct classification and correct figure if no C C = correct number S# = correct calculation (accounts receivable minus allowance for doubtful debts) Shaded figures are not marked. Judgement Statement for QUESTION TWO Achievement Achievement with Merit Achievement with Excellence 4xS+2xC 5xS+3xC max 1 F 7xS+4xC no F © NZCETA Practice Assessment 2007 Accounting AS 90224 (2.5) NCEA Level 2/Year 12 Page 5 NZCETA has approval from NZQA to use their materials in the development of this resource QUESTION THREE Ihakara’s Golf Centre sells golf accessories and equipment. Ihakara’s Golf Centre Trial Balance as at 31 March 2007 (extract) Accumulated Depreciation – 3 400 Office Equipment 26 000 Capital Advertising Cost of Sales Insurance 5 200 Land 150 000 400 GST 980 34 000 Interest Received Shop Wages 78 000 Rent Received 100 000 21 000 Dividends Received Office Equipment Term Deposit (7% pa) 6 000 Sales 6 500 13 500 150 000 Additional information: Shop Wages due $500 Interest is due to Ihakara’s Golf Centre on the Term Deposit The insurance is paid every six months. On 1 November 2006 $2700 including GST was paid for the six months beginning 1 November 2006. Ihakara rents out one of his unused sheds for $500 excluding GST a fortnight. On balance day his tenants had prepaid a fortnight. Depreciate the office equipment, 10% diminishing value. The net profit for the period was $42 000 (after taking into account the additional information above) Part A – General Journal Entries Prepare the General Journal Entries to record the following balance day adjustments, closing entries and reversing entries. You must include dates but narrations are not required. Remember: do not abbreviate account names. a) Record the interest due on the Term Deposit Date 31/3/07 b) Debit 500 Credit SS# 500 Record the insurance that has been prepaid Date 31/3/07 c) Particulars Accrued Income Interest Received Particulars Prepayments Insurance Debit 400 Credit SS# 400 Record the rent that Ihakara’s tenants have prepaid Date 31/3/07 Particulars Rent Received Income (Revenue) Received in Advance Debit 500 Credit SS# 500 © NZCETA Practice Assessment 2007 Accounting AS 90224 (2.5) NCEA Level 2/Year 12 Page 6 NZCETA has approval from NZQA to use their materials in the development of this resource d) Record the depreciation on the Office Equipment Date 31/3/07 e) Date 1/4/07 Debit 2 800 Credit SS# 2 800 Close off the Net Profit on balance day Date 31/3/07 f) Particulars Depreciation on Office Equipment Accumulated Depreciation on Office Equipment Particulars Income Summary Capital Debit 42 000 Credit S 42 000 Record the reversal of the balance day adjustment for the Shop Wages due Particulars Accrued Expenses Shop Wages Debit 500 Credit S 500 Part B – General Ledger entries Complete the General Ledger accounts below to show the relevant transactions for balance sheet day and the first day of the next period, using the additional information provided. Include dates and do not abbreviate account names. DEPRECIATION – OFFICE EQUIPMENT Date Particulars Accumulated Depreciation on Office 31/3/07 Equipment Income Summary INTEREST RECEIVED Date Particulars 31/3/07 Balance Accrued Income Income Summary 1/4/07 Accrued Income Debit Credit 2800 2800 Debit Credit 500 7000 500 Balance 2800 dr SS 0 S Balance 6500 cr 7000 cr 0 500 dr In the journals, to award S, S# the journal entry must be correct, ie. the correct stems, correct figure in the correct column and there must be a debit entry that equals the credit entry S = complete entry correct SS# = first S – correct stems and any number the same in both debit and credit columns the S# - correct number Sf = allow follow through Judgement Statement for QUESTION THREE Achievement Achievement with Merit Achievement with Excellence 8S 11 S correct dates mostly followed 15 S correctly and consistently applied dates Overall Judgement Statement © NZCETA Practice Assessment 2007 Accounting AS 90224 (2.5) NCEA Level 2/Year 12 Page 7 NZCETA has approval from NZQA to use their materials in the development of this resource S SS Sf Sf Question Criterion Achievement Achievement with Merit Achievement with Excellence One and Two First 2xA 2 x M and 1 x A 2 x E and 1 x M Three Second A M E © NZCETA Practice Assessment 2007 Accounting AS 90224 (2.5) NCEA Level 2/Year 12 Page 8 NZCETA has approval from NZQA to use their materials in the development of this resource